Navigating the complexities of student loan repayment can feel overwhelming, especially when understanding how interest accrues. This guide clarifies the often-confusing difference between monthly and yearly interest calculations on student loans. We’ll explore how interest rates, repayment plans, and additional payments impact your overall loan cost, empowering you to make informed financial decisions.

We will delve into the mechanics of simple and compound interest, providing practical examples and calculations to illustrate how these methods affect your total interest burden. We’ll also examine the various repayment plans available and their implications for your monthly payments and long-term costs. Understanding these factors will enable you to develop a strategic repayment plan tailored to your financial situation and goals.

Understanding Interest Calculation Methods

Understanding how interest is calculated on your student loans is crucial for effective financial planning. This section will clarify the differences between simple and compound interest and provide practical examples to help you grasp these concepts. Knowing how interest accrues will allow you to better budget and manage your loan repayment.

There are two primary methods for calculating interest: simple interest and compound interest. Simple interest is calculated only on the principal amount of the loan, while compound interest is calculated on the principal amount plus any accumulated interest. Most student loans utilize compound interest, leading to significantly higher total interest payments over the loan’s lifespan.

Simple Interest Calculation

Simple interest is calculated only on the original principal amount borrowed. The formula for calculating simple interest is: Interest = Principal x Rate x Time. Where ‘Principal’ is the initial loan amount, ‘Rate’ is the annual interest rate (expressed as a decimal), and ‘Time’ is the loan term in years.

Compound Interest Calculation

Compound interest, in contrast, is calculated on the principal amount plus any accumulated interest. This means that interest earned in one period is added to the principal, and subsequent interest calculations are based on this larger amount. This snowball effect leads to significantly faster growth of the total amount owed. The calculation is more complex and typically involves monthly calculations.

Monthly Interest Accrual on a $10,000 Loan

Let’s illustrate monthly interest accrual on a $10,000 loan with a 5% annual interest rate. First, we need to determine the monthly interest rate: 5% annual rate / 12 months = 0.4167% monthly rate (approximately).

Now, let’s calculate the interest accrued in the first month:

Month 1: $10,000 x 0.004167 = $41.67 interest

The balance at the end of month 1 is $10,041.67. The interest for the second month is calculated on this new balance, and so on. This compounding effect accelerates the growth of the loan balance.

Total Interest Paid Over 10 Years

Calculating the total interest paid over a 10-year loan term requires a more complex calculation, often best handled with a loan amortization schedule (a table showing the breakdown of each payment). However, we can approximate the total interest by understanding the compounding nature of the interest. A more precise calculation would require using a financial calculator or spreadsheet software to account for the monthly compounding. Using a loan calculator, a $10,000 loan at 5% annual interest compounded monthly over 10 years would result in approximately $2,875 in total interest paid.

Comparison of Total Interest Paid at Varying Interest Rates

The following table compares the total interest paid for a $10,000 loan over 10 years with varying interest rates. Note that these are approximations and may vary slightly depending on the specific loan calculation method.

| Loan Amount | Interest Rate | Loan Term (Years) | Total Interest Paid (Approximate) |

|---|---|---|---|

| $10,000 | 4% | 10 | $2,186 |

| $10,000 | 5% | 10 | $2,875 |

| $10,000 | 6% | 10 | $3,587 |

Impact of Loan Repayment Plans

Choosing the right student loan repayment plan significantly impacts your monthly budget and the total amount you pay back over the life of your loan. Understanding the differences between available plans is crucial for making informed financial decisions and minimizing long-term costs. Different plans offer varying levels of flexibility in monthly payments, but this flexibility often comes with a trade-off in the total interest paid.

Different repayment plans affect both your monthly payment amount and the total interest paid over the life of the loan. A standard repayment plan, for example, typically involves fixed monthly payments over a 10-year period. Graduated repayment plans offer lower initial payments that gradually increase over time, while extended repayment plans stretch payments over a longer period (often up to 25 years). Income-driven repayment plans, on the other hand, tie your monthly payment to your income and family size.

Comparison of Repayment Plan Characteristics

The choice of repayment plan significantly influences both short-term cash flow and long-term interest costs. A standard repayment plan, with its fixed monthly payments and shorter repayment period, generally results in the lowest total interest paid. However, the fixed payments might be higher than what some borrowers can comfortably afford initially. Graduated plans offer more manageable initial payments, but the increasing payments and longer repayment period lead to higher total interest paid. Extended plans offer the lowest monthly payments but incur the highest total interest due to their extended repayment period. Income-driven repayment plans offer payment flexibility based on income but often lead to higher overall interest payments and longer repayment periods.

Pros and Cons of Different Repayment Plans

Understanding the advantages and disadvantages of each plan is vital for making an informed decision.

- Standard Repayment Plan:

- Pros: Lowest total interest paid, predictable payments, shorter repayment period.

- Cons: Potentially high initial monthly payments, may not be suitable for everyone’s budget.

- Graduated Repayment Plan:

- Pros: Lower initial payments, manageable in early career stages.

- Cons: Payments increase over time, potentially becoming unaffordable later, higher total interest paid than standard plan.

- Extended Repayment Plan:

- Pros: Lowest monthly payments.

- Cons: Highest total interest paid, significantly longer repayment period.

- Income-Driven Repayment Plans (IDR):

- Pros: Monthly payments adjusted based on income, potentially affordable payments during periods of lower income.

- Cons: Higher total interest paid, longer repayment period, potential for loan forgiveness (but with tax implications).

Impact of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans, such as ICR, PAYE, REPAYE, and IBR, offer monthly payments based on your discretionary income and family size. While this provides short-term affordability, it often results in a longer repayment period and significantly higher total interest paid over the loan’s lifetime. For example, a borrower with a $50,000 loan might see their monthly payment reduced considerably under an IDR plan compared to a standard plan, but the total interest paid could increase by tens of thousands of dollars over the 20 or 25-year repayment period. The potential for loan forgiveness after 20 or 25 years is a significant factor to consider, but it’s crucial to understand the tax implications of any forgiven amount.

Factors Affecting Monthly Interest

Understanding the factors that influence your monthly student loan interest payments is crucial for effective repayment planning. Several key variables interact to determine the amount you pay each month, ultimately impacting the total cost of your loan. This section will explore these factors and their implications.

The primary determinants of your monthly student loan interest are the interest rate, the outstanding loan balance, and the type of repayment plan you’ve chosen. These factors work together to calculate your monthly interest payment, and understanding their interplay is essential for managing your debt effectively.

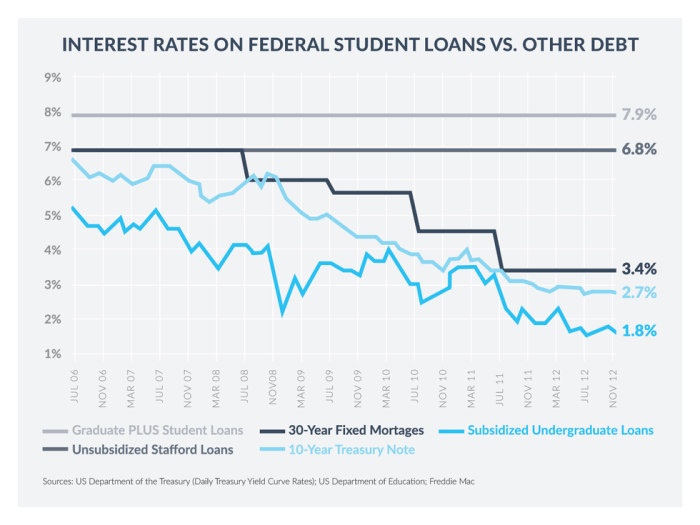

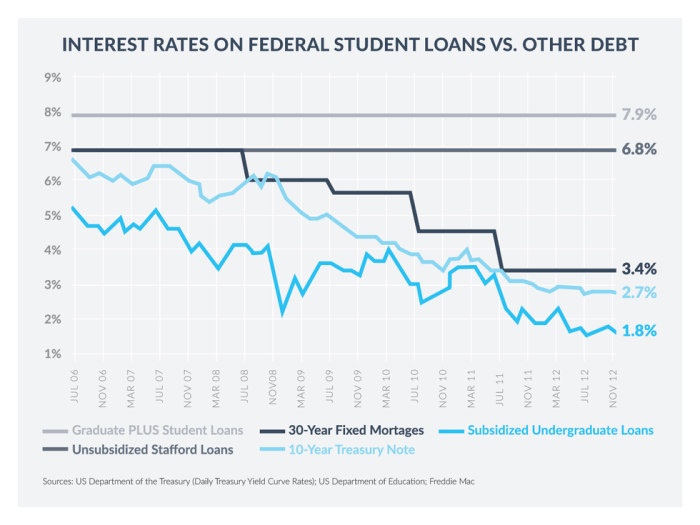

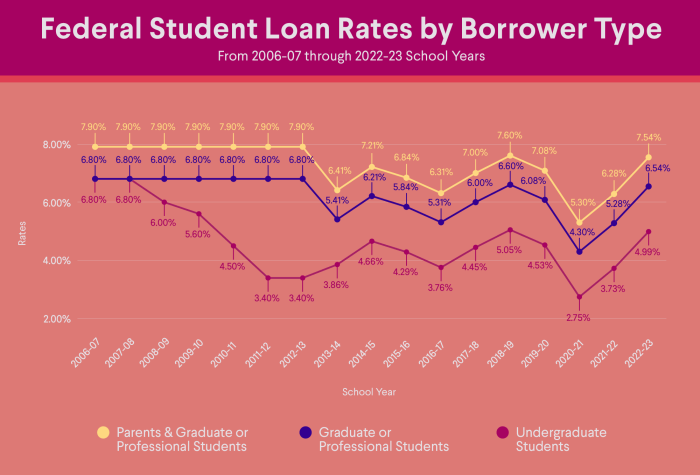

Interest Rate’s Influence on Monthly Payments and Total Interest

The interest rate is the percentage of your outstanding loan balance that accrues as interest over a specific period. A higher interest rate directly translates to a larger monthly interest payment. For example, a loan with a 7% interest rate will accrue more interest each month than a loan with a 5% interest rate, assuming all other factors remain constant. This increased interest payment impacts the overall cost of the loan, leading to a higher total amount paid over the life of the loan. A higher interest rate also means a larger portion of your monthly payment goes towards interest rather than principal, potentially extending the loan repayment period.

Effect of Extra Principal Payments on Total Interest

Making extra principal payments beyond your regular monthly payment significantly reduces the total interest paid over the life of the loan. This is because extra payments directly reduce the principal balance, thereby lowering the base amount on which interest is calculated in subsequent months. For instance, if you consistently pay an additional $100 per month on a $20,000 loan, you’ll substantially decrease the total interest accrued compared to only making the minimum payment. This strategy accelerates the loan payoff timeline and saves considerable money on interest charges in the long run.

Impact of Different Monthly Payment Amounts on Loan Payoff and Total Interest

The amount you pay monthly directly affects both the loan’s repayment timeline and the total interest paid. Higher monthly payments reduce the loan’s lifespan and decrease the total interest. Conversely, lower payments extend the repayment period and increase the overall interest costs. The following table illustrates this relationship:

| Monthly Payment | Loan Payoff Time (Years) | Total Interest Paid | Total Amount Paid |

|---|---|---|---|

| $200 | 15 | $10,000 | $30,000 |

| $300 | 10 | $6,000 | $26,000 |

| $400 | 7 | $3,500 | $23,500 |

Note: These figures are illustrative examples and will vary depending on the initial loan amount, interest rate, and other loan terms. They demonstrate the general principle that higher monthly payments lead to faster repayment and lower overall interest costs.

Visualizing Interest Accrual

Understanding how interest accrues on student loans can be challenging, but visual representations can significantly clarify the process. By graphing the loan balance and accumulated interest over time, we can better understand the impact of interest on the total repayment amount. This section will explore different visual methods to illustrate this complex financial concept.

Interest accrual can be effectively visualized using various graphical representations. These visuals provide a clear picture of how the loan balance changes over time, highlighting the increasing impact of interest.

Loan Balance and Accumulated Interest Over Time

A line graph is an excellent tool to illustrate the growth of both the loan balance and the accumulated interest over the repayment period. The x-axis represents time, typically in months or years, from the loan origination to the final payment. The y-axis represents the monetary value, showing the loan balance (principal remaining) and accumulated interest separately. Two lines would be plotted: one for the loan balance, which decreases over time as payments are made; and another for the accumulated interest, which starts at zero and steadily increases until the loan is fully repaid. Data points on the graph would represent the loan balance and accumulated interest at specific intervals (e.g., monthly or yearly). The difference between the two lines at any given point represents the total amount owed. For example, a 10-year loan with a starting balance of $20,000 and a fixed interest rate might show the loan balance decreasing gradually while the accumulated interest line shows a steady increase, demonstrating the significant impact of accumulated interest over the loan’s life.

Proportion of Principal vs. Interest in Monthly Payments

This illustration focuses on the changing proportion of principal and interest paid within each monthly payment over the loan’s lifespan. A line graph would be most suitable, again with time (in months) on the x-axis. The y-axis would represent the percentage of the monthly payment allocated to either principal or interest. Initially, a much larger portion of the monthly payment will go towards interest, with a smaller portion applied to the principal. As the loan progresses, the percentage allocated to principal will steadily increase, while the percentage allocated to interest decreases. This visual clearly shows how the repayment strategy shifts from predominantly interest-based to predominantly principal-based as the loan matures. For example, in the early months, 80% of the payment might be interest, and 20% principal. By the final months, this might reverse to 20% interest and 80% principal.

Principal and Interest Paid Annually Over 10 Years

A bar graph effectively compares the proportion of principal and interest paid each year over a 10-year loan repayment plan. The x-axis represents the year (Year 1, Year 2… Year 10). The y-axis represents the monetary value, showing the amount of principal and interest paid separately for each year. Two bars would be displayed for each year, one representing the principal paid and the other representing the interest paid. The graph would visually demonstrate that while the total payment remains relatively consistent each year, the proportion allocated to principal increases over time, whereas the portion allocated to interest decreases. For instance, in Year 1, the interest bar might be significantly larger than the principal bar, reflecting the higher interest payment at the beginning of the loan. By Year 10, the principal bar would likely be much larger, illustrating the increased principal repayment towards the end of the loan’s term.

Strategies for Minimizing Interest

Minimizing interest on student loans is crucial for reducing the overall cost of your education. Several strategies can significantly lower your total repayment amount, saving you thousands of dollars over the life of your loans. Understanding these strategies and implementing them effectively can make a substantial difference in your financial future.

Effective strategies for minimizing interest primarily revolve around accelerating repayment and leveraging refinancing opportunities. These methods, while requiring proactive effort and financial planning, offer considerable long-term benefits. Careful consideration of tax implications associated with these strategies is also vital.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. The process typically involves applying with a new lender, providing documentation such as your credit score, income, and existing loan details, and undergoing a credit check. After approval, the new lender pays off your existing loans, and you begin making payments on the new loan.

- Benefits: Lower interest rates, potentially lower monthly payments, simplification of loan management (fewer loans to track).

- Drawbacks: Loss of federal loan benefits (such as income-driven repayment plans or loan forgiveness programs), potential for higher fees, requirement of good credit.

Making Extra Payments

Making extra payments on your student loans, even small amounts, can dramatically reduce the total interest paid and shorten the repayment period. An extra payment each year can save you considerable interest and reduce the time it takes to become debt-free. You can choose to make an extra payment once a year, or split the extra payment into smaller amounts over the course of the year.

Impact of Delaying Loan Repayment

Delaying loan repayment, while tempting in the short term, leads to significantly higher interest accumulation. Interest accrues daily on the outstanding loan balance, and the longer the repayment is deferred, the more interest you’ll pay. This can result in a substantially larger total repayment amount compared to making timely payments. For example, delaying repayment on a $30,000 loan with a 7% interest rate for even a few years could add thousands of dollars to the total cost.

Tax Implications of Interest Reduction Strategies

The tax implications of different interest reduction strategies vary. Interest paid on student loans is generally not tax-deductible unless certain income requirements are met. However, refinancing might impact the tax benefits you may be eligible for if your loans are federal. It’s crucial to consult a tax professional to understand the specific tax implications of your chosen strategy to ensure compliance and maximize potential tax advantages. For instance, if you’re refinancing federal loans to private loans, you might lose eligibility for federal loan forgiveness programs.

Outcome Summary

Successfully managing student loan debt requires a proactive approach and a clear understanding of interest calculations. By carefully considering the factors discussed—interest rates, repayment plans, and payment strategies—borrowers can significantly reduce their overall interest costs and accelerate their path to loan repayment. Remember, informed decision-making is key to achieving financial freedom after graduation.

Q&A

What is the difference between simple and compound interest?

Simple interest is calculated only on the principal amount borrowed, while compound interest is calculated on the principal plus accumulated interest. Compound interest typically results in higher total interest paid over the life of the loan.

Can I pay off my student loans faster than the scheduled repayment plan?

Yes, making extra principal payments can significantly reduce the total interest paid and shorten the loan repayment period. Even small additional payments can make a substantial difference over time.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious financial consequences. Contact your loan servicer immediately if you anticipate difficulty making a payment.

How can I find my student loan interest rate?

Your interest rate is usually specified in your loan documents or on your loan servicer’s website. You can also contact your loan servicer directly to obtain this information.