Navigating the complexities of student loan repayment can feel daunting, especially when understanding the fluctuating interest rates. 2022 presented a unique landscape for borrowers, with various factors influencing the cost of borrowing. This guide provides a clear overview of student loan interest rates in 2022, examining federal and private loan options, government policies, and effective debt management strategies. We’ll explore how these rates impacted repayment plans and offer insights into making informed financial decisions.

Understanding the nuances of interest rates is crucial for long-term financial planning. Whether you’re a current borrower grappling with repayment or a prospective student planning for future education costs, this comprehensive analysis will equip you with the knowledge needed to make sound financial choices. We’ll delve into the specifics of different loan types, repayment options, and the potential impact of government interventions, providing you with a clear picture of the 2022 student loan landscape.

Overview of Student Loan Interest Rates in 2022

The year 2022 presented a complex landscape for student loan borrowers, with interest rates fluctuating based on various economic factors. Understanding these rates is crucial for effective financial planning and responsible debt management. This overview will detail the average interest rates for federal student loans in 2022, highlighting key influencing factors and comparing them to previous years.

Federal Student Loan Interest Rates in 2022

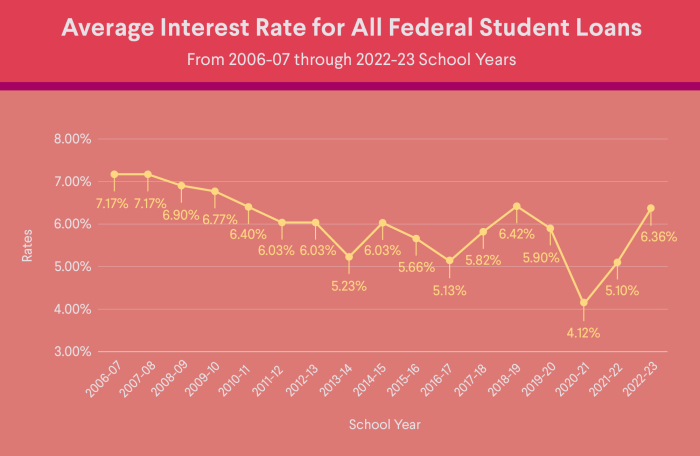

Federal student loan interest rates in 2022 were generally fixed for the life of the loan, meaning they didn’t change after the loan was disbursed. However, the rates varied depending on the loan type and the borrower’s eligibility. Subsidized loans, typically for undergraduate students demonstrating financial need, had lower rates than unsubsidized loans, which are available to both undergraduate and graduate students regardless of financial need. Parent PLUS loans, offered to parents of dependent undergraduate students, generally carried higher interest rates. Precise rates varied slightly depending on when the loan was disbursed within the year, but the following represents average rates for the year. It’s important to note that these are averages and individual rates may vary slightly.

Factors Influencing Interest Rate Fluctuations in 2022

Several factors contributed to the overall interest rate environment in 2022. The most significant was the Federal Reserve’s monetary policy response to inflation. As inflation rose, the Federal Reserve increased the federal funds rate, which is the target rate banks charge each other for overnight loans. This increase trickled down to other interest rates, including those on student loans. Additionally, broader economic conditions, such as the overall cost of borrowing and government fiscal policy, also played a role in shaping interest rates. These factors created an environment of uncertainty and volatility throughout the year.

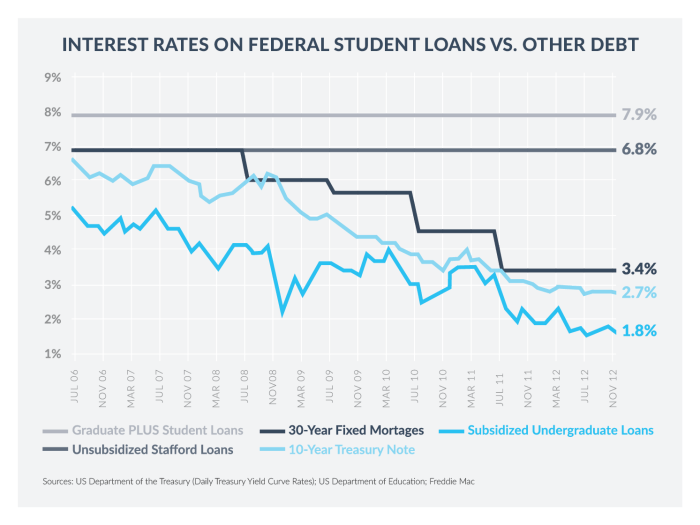

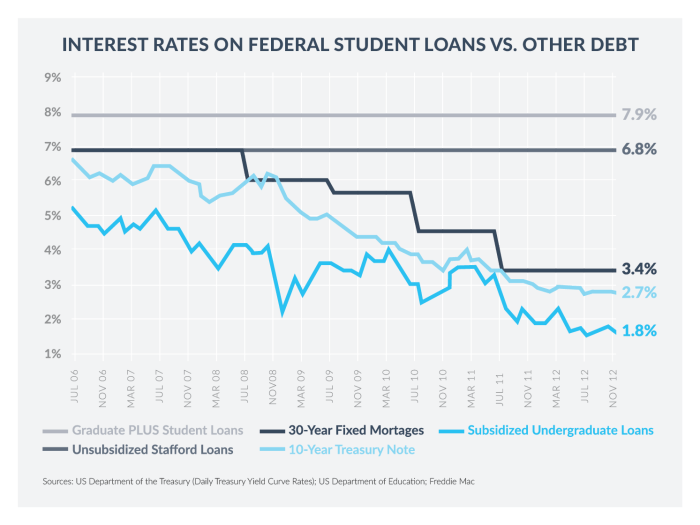

Comparison of 2022 Interest Rates to Previous Years

Comparing 2022 rates to those of previous years provides valuable context. The table below illustrates the average interest rates for selected federal student loan types across several years. Note that these are simplified representations and actual rates could vary based on specific loan programs and disbursement dates.

| Year | Loan Type | Average Interest Rate (%) | Significant Changes |

|---|---|---|---|

| 2020 | Subsidized | 2.75 | Historically low due to pandemic-related economic measures. |

| 2020 | Unsubsidized | 4.30 | Historically low due to pandemic-related economic measures. |

| 2020 | Parent PLUS | 7.08 | Historically low due to pandemic-related economic measures. |

| 2021 | Subsidized | 3.73 | Increase compared to 2020, reflecting a return to more normal economic conditions. |

| 2021 | Unsubsidized | 5.28 | Increase compared to 2020, reflecting a return to more normal economic conditions. |

| 2021 | Parent PLUS | 7.54 | Slight increase compared to 2020. |

| 2022 | Subsidized | 4.99 | Further increase reflecting rising inflation and Federal Reserve actions. |

| 2022 | Unsubsidized | 6.54 | Further increase reflecting rising inflation and Federal Reserve actions. |

| 2022 | Parent PLUS | 8.05 | Further increase reflecting rising inflation and Federal Reserve actions. |

Impact of Interest Rates on Repayment Plans

Understanding how interest rates influence your student loan repayment is crucial for long-term financial planning. The interest rate directly impacts the total amount you’ll pay back, significantly affecting your monthly payments and overall repayment timeline, regardless of the repayment plan chosen. Higher interest rates mean more money paid towards interest, leaving less to reduce the principal loan balance.

The total cost of repaying student loans is heavily influenced by the interest rate applied to the loan. This impact is magnified by the loan amount and the repayment plan selected. A standard repayment plan, typically spanning 10 years, will accumulate less interest than an extended plan, which can stretch over 25 years. Graduated repayment plans, where payments start low and gradually increase, can initially seem more manageable, but may ultimately lead to higher total interest paid over the life of the loan compared to a standard plan.

Interest Rate Impact on Monthly Payments and Total Repayment

The following examples illustrate how varying interest rates and loan amounts affect monthly payments across different repayment plans. These figures are illustrative and do not account for potential fees or changes in interest rates during the repayment period. Actual amounts will depend on the specific lender and loan terms.

- Scenario 1: $20,000 Loan

- 5% Interest (Standard 10-year plan): Approximately $212 monthly payment, $25,440 total repayment.

- 7% Interest (Standard 10-year plan): Approximately $233 monthly payment, $27,960 total repayment.

- 5% Interest (Extended 25-year plan): Approximately $106 monthly payment, $31,800 total repayment.

- 7% Interest (Extended 25-year plan): Approximately $117 monthly payment, $35,100 total repayment.

- Scenario 2: $50,000 Loan

- 5% Interest (Standard 10-year plan): Approximately $530 monthly payment, $63,600 total repayment.

- 7% Interest (Standard 10-year plan): Approximately $582 monthly payment, $70,000 total repayment.

- 5% Interest (Extended 25-year plan): Approximately $265 monthly payment, $94,500 total repayment.

- 7% Interest (Extended 25-year plan): Approximately $292 monthly payment, $105,000 total repayment.

Long-Term Financial Implications of Interest Rates

Higher interest rates significantly increase the total cost of repayment over the loan’s lifetime. This can lead to a prolonged period of debt, limiting opportunities for saving, investing, and other financial goals. For example, a borrower with a $50,000 loan at 7% interest on a standard plan would pay approximately $16,400 more in interest than a borrower with the same loan at 5% interest. This extra cost can significantly impact long-term financial stability and could potentially delay major life milestones such as homeownership or retirement planning. Conversely, lower interest rates result in lower total repayment costs and allow for quicker debt elimination, freeing up funds for other financial priorities. Choosing a repayment plan that minimizes long-term interest costs is essential for responsible financial management.

Government Policies and Interest Rate Changes in 2022

The year 2022 saw a complex interplay between government policies, economic conditions, and student loan interest rates. While no single sweeping change directly altered the rates themselves for existing federal student loans, various government actions and the broader economic climate significantly impacted borrowers. Understanding these factors is crucial for grasping the overall financial landscape for student loan debt in that year.

Government policies indirectly affected interest rates primarily through their influence on the overall economic environment. Inflationary pressures and rising interest rates across the board, largely driven by Federal Reserve actions to combat inflation, were felt by student loan borrowers. These broader economic shifts are the primary drivers of change, as opposed to specific, targeted student loan legislation. This indirect impact highlights the interconnectedness of macroeconomic factors and individual financial situations.

Economic Conditions and Interest Rate Adjustments

The Federal Reserve’s efforts to curb inflation in 2022 involved raising the federal funds rate, a key benchmark interest rate that influences other rates in the economy. This increase impacted borrowing costs across the board, including potentially affecting the cost of future federal student loans, even though existing loan rates remained unchanged for the most part. The resulting higher interest rates meant that new borrowers faced higher costs for their education financing, potentially leading to larger overall debt burdens. For example, a hypothetical student taking out a new loan in 2022, compared to a similar student in 2021, would have faced a higher interest rate, resulting in increased total repayment costs over the loan’s lifetime. This is a direct consequence of the Federal Reserve’s monetary policy response to inflation.

Government Interventions and Their Effects on Borrowers

While no direct changes to existing student loan interest rates occurred in 2022, the government did extend the pause on student loan repayments that had been initiated earlier during the COVID-19 pandemic. This payment pause, while offering temporary relief to borrowers, did not alter the underlying interest rates on their loans. However, the continued accrual of interest during the pause meant that borrowers still faced a larger total debt upon the resumption of payments. The extension provided short-term financial breathing room, but ultimately did not lessen the long-term financial burden of the accumulated interest. This highlights the complexity of government interventions; while intended to provide relief, they may not always fully address the underlying issues driving financial hardship. Furthermore, the uncertainty surrounding the eventual resumption of payments added stress and difficulty in financial planning for many borrowers.

Private Student Loan Interest Rates in 2022

Private student loans, unlike federal loans, are offered by banks, credit unions, and other private lenders. Their interest rates are variable, meaning they fluctuate based on market conditions, and are generally higher than those of federal loans. This section will explore the intricacies of private student loan interest rates in 2022, comparing them to their federal counterparts and highlighting key differences in terms and conditions.

Private student loan interest rates in 2022 were significantly influenced by prevailing economic conditions. The rates varied considerably depending on the lender, the borrower’s creditworthiness, and the loan’s terms. Unlike federal student loans, which often have fixed interest rates for certain loan types, private loans frequently carried variable rates, exposing borrowers to the risk of increased monthly payments if interest rates rose. This volatility made budgeting and long-term financial planning more challenging for borrowers.

Comparison of Private and Federal Student Loan Interest Rates in 2022

The most significant difference between private and federal student loans in 2022 was the interest rate. Federal student loan interest rates are typically lower than those offered by private lenders. This is because federal loans are backed by the government, reducing the risk for lenders and allowing them to offer more favorable terms. Private lenders, on the other hand, assess borrowers’ creditworthiness more rigorously, resulting in higher interest rates for those with less-than-perfect credit. For example, a federal unsubsidized loan might have had a fixed interest rate around 5%, while a comparable private loan could have carried a variable rate starting at 7%, potentially increasing over the life of the loan.

Key Differences in Terms and Conditions

Beyond interest rates, several other key differences existed between private and federal student loans in 2022. Federal loans often offered more flexible repayment options, including income-driven repayment plans that adjusted monthly payments based on the borrower’s income and family size. Private loans typically had less flexible repayment options, often requiring fixed monthly payments regardless of financial circumstances. Furthermore, federal loans provided borrower protections, such as deferment and forbearance options in case of financial hardship. These protections were generally not as readily available with private loans. Eligibility requirements also differed significantly. Federal loans generally had broader eligibility criteria, whereas private loans often required a strong credit history or a co-signer.

Comparison Table: Private vs. Federal Student Loans in 2022

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates (2022 Example) | Variable depending on loan type and year, generally lower (e.g., 3-7%) | Variable, generally higher (e.g., 7-15%), often dependent on credit score |

| Repayment Options | Multiple options, including income-driven repayment plans | Fewer options, often fixed monthly payments |

| Eligibility | Generally based on enrollment in an eligible educational program | Based on creditworthiness, often requiring a co-signer |

| Borrower Protections | Deferment, forbearance options available | Limited or no borrower protections |

| Loan Forgiveness Programs | Potential eligibility for certain loan forgiveness programs | No loan forgiveness programs available |

Strategies for Managing Student Loan Debt with High Interest Rates

Managing student loan debt, particularly when faced with high interest rates, requires a proactive and strategic approach. Effective strategies combine careful budgeting, aggressive repayment plans, and a thorough understanding of available government programs. The goal is to minimize the total interest paid and achieve debt freedom as quickly as possible.

High interest rates significantly increase the overall cost of borrowing. A seemingly small difference in interest can translate to thousands of extra dollars paid over the life of the loan. Therefore, understanding your options and implementing a suitable strategy is crucial for long-term financial health.

Aggressive Repayment Strategies

Prioritizing high-interest loans is a key element of efficient debt management. Focusing repayment efforts on loans with the highest interest rates first minimizes the total interest accrued over time. This strategy, often called the “avalanche method,” allows you to pay down the most expensive debt faster, saving money in the long run. For example, if you have one loan at 8% interest and another at 4%, focusing on the 8% loan first will yield greater savings compared to focusing on the smaller loan first.

Budgeting and Debt Management Techniques

Creating a detailed budget is essential for successful debt repayment. Track all income and expenses meticulously to identify areas where spending can be reduced. This involves prioritizing essential expenses like housing and food while cutting back on non-essential spending like entertainment or dining out. Consider using budgeting apps or spreadsheets to monitor progress and stay organized. For instance, allocating a specific amount each month towards loan repayment, even if it’s a small amount, can make a significant difference over time. This consistent payment contributes to quicker debt reduction.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce the overall cost of borrowing, especially if your credit score has improved since taking out the original loans. However, it’s important to carefully compare offers from different lenders and ensure that the new loan terms are favorable. For example, refinancing a $50,000 loan from 7% to 4% could save thousands of dollars in interest over the life of the loan. However, be aware that refinancing may eliminate certain government protections.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payments based on your income and family size. These plans are offered by the federal government and can significantly lower your monthly payments, making them more manageable. While these plans extend the repayment period, resulting in potentially higher total interest paid over the life of the loan, they can provide much-needed short-term financial relief. For instance, an individual earning a low income might qualify for a payment significantly lower than the standard repayment amount.

Debt Consolidation

Consolidating multiple student loans into a single loan simplifies repayment and can potentially lower your monthly payments. While this doesn’t necessarily lower your interest rate, it streamlines the repayment process and makes it easier to track progress. This can be especially helpful for borrowers with several loans from different lenders with varying interest rates and repayment terms. For example, managing three different loans with varying due dates can be complex; consolidation simplifies this to a single monthly payment.

Illustrative Example: Impact of a 1% Interest Rate Increase

This example demonstrates the potential effect of a seemingly small 1% interest rate increase on a typical student loan. We’ll analyze a hypothetical scenario to illustrate the long-term financial implications, focusing on total interest paid and overall repayment duration. The figures used are for illustrative purposes and may not reflect the precise calculations of all lenders.

Let’s consider a student loan with a principal balance of $30,000, a 10-year repayment term (120 months), and an initial fixed interest rate of 5%. We will then compare this to a scenario where the interest rate increases by 1% to 6%.

Loan Repayment Comparison: 5% vs. 6% Interest

The following table compares the monthly payments and total interest paid under both scenarios. These calculations are based on standard amortization schedules, where each payment covers both principal and interest.

| Interest Rate | Monthly Payment | Total Interest Paid | Total Repaid |

|---|---|---|---|

| 5% | $330.37 | $7,644.40 | $37,644.40 |

| 6% | $359.62 | $9,150.40 | $39,150.40 |

The table shows that a 1% increase in the interest rate results in a significant increase in the total interest paid over the life of the loan. This difference, while seemingly small initially, compounds over time.

Long-Term Financial Implications

The impact of this 1% interest rate increase extends beyond the total interest paid. It also affects the borrower’s overall financial health.

- Increased Monthly Payment: The monthly payment increases by $29.25, which may seem manageable initially, but it can impact a borrower’s budget, particularly if they have other financial obligations.

- Higher Total Repayment: The total amount repaid increases by $1,506. This represents a significant additional cost over the life of the loan.

- Delayed Financial Goals: The extra expense can delay achieving other financial goals, such as saving for a down payment on a house, investing, or paying off other debts.

- Potential for Financial Stress: The increased financial burden can lead to stress and difficulty managing personal finances, potentially affecting credit scores and future borrowing opportunities.

This example highlights the importance of understanding the impact of even small interest rate changes on student loan repayment. Borrowers should carefully consider their repayment options and explore strategies to minimize the long-term cost of their loans.

Last Recap

Successfully managing student loan debt requires a proactive approach and a thorough understanding of the associated costs. By analyzing the interest rate fluctuations of 2022, comparing federal and private loan options, and exploring various repayment strategies, we’ve gained valuable insights into minimizing long-term financial burdens. Remember, careful planning, informed decision-making, and exploring available resources are key to navigating the complexities of student loan repayment and achieving long-term financial stability. Proactive engagement with your loan servicer and exploration of available repayment options are essential steps in this process.

FAQ Overview

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest throughout.

Can I refinance my federal student loans into a private loan?

Yes, but be aware that refinancing federal loans into private loans means losing federal protections like income-driven repayment plans.

What is an income-driven repayment plan?

Income-driven repayment plans base your monthly payment on your income and family size, potentially leading to loan forgiveness after 20-25 years.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score.

Where can I find my student loan interest rate information?

Your interest rate information is available on your loan servicer’s website or through your loan documents.