Navigating the complex world of student loan debt can feel overwhelming, especially when grappling with interest rates. Reddit, a vibrant online community, offers a unique lens into the experiences, anxieties, and strategies employed by borrowers facing this challenge. This exploration delves into the diverse discussions surrounding student loan interest on Reddit, uncovering common themes, strategies for management, the impact of government policies, and the crucial role of financial literacy.

From firsthand accounts of high-interest struggles to insightful discussions on refinancing and repayment plans, Reddit provides a wealth of unfiltered perspectives. We’ll examine how users navigate the emotional and psychological impacts of high interest rates, exploring their coping mechanisms and the prevalence of misconceptions surrounding these financial burdens. The analysis will highlight both the challenges and the potential solutions revealed within these online conversations.

Reddit Discussions on Student Loan Interest Rates

Reddit serves as a significant platform for individuals to share their experiences and opinions on various financial matters, including student loan debt. Discussions surrounding student loan interest rates are prevalent, offering a glimpse into the challenges and strategies employed by borrowers navigating this complex landscape. These online conversations provide valuable insights into the emotional and financial impact of varying interest rates.

Common Themes in Reddit Discussions on Student Loan Interest Rates

Several recurring themes emerge from analyzing Reddit threads focused on student loan interest rates. Users frequently express concerns about the high cost of borrowing, particularly for those with private loans or variable interest rates. Another common theme is the difficulty in understanding the complexities of loan amortization and the long-term implications of interest accrual. Strategies for loan repayment, such as refinancing and income-driven repayment plans, are also frequently discussed, along with the emotional toll of managing significant student loan debt. The impact of interest rate changes on overall repayment timelines and total interest paid is a consistently debated topic.

Examples of User Experiences with High and Low Interest Rates

Reddit users often share their personal experiences with both high and low interest rates. For example, one user might describe the frustration of having a private loan with a 10% interest rate, significantly increasing their total repayment cost and extending the repayment period. Conversely, another user might detail their success in refinancing their loans to a lower rate, saving them thousands of dollars over the life of the loan. These anecdotal accounts provide a powerful illustration of the substantial financial differences that even small variations in interest rates can create.

Reddit Threads Discussing the Impact of Interest Rates on Repayment Plans

Many Reddit threads focus on the impact of interest rates on different repayment plans. Users frequently debate the merits of income-driven repayment (IDR) plans versus standard repayment plans, particularly considering how interest rates affect the total amount paid over the life of the loan. Discussions often center on the trade-offs between lower monthly payments under IDR plans and the potential for significantly higher total interest payments. Users also share strategies for minimizing interest accrual, such as making extra principal payments or refinancing to a lower interest rate. These discussions highlight the importance of understanding the intricacies of different repayment options and their relationship to interest rates.

Summary of Reddit Discussions on Student Loan Interest Rates

| Topic | Frequency | Sentiment |

|---|---|---|

| High interest rates on private loans | Very High | Negative |

| Difficulty understanding loan amortization | High | Negative |

| Strategies for loan repayment (refinancing, IDR) | High | Mixed |

| Impact of interest rate changes on repayment timelines | High | Negative |

| Emotional toll of student loan debt | Medium | Negative |

| Success stories with loan refinancing | Medium | Positive |

Strategies for Managing Student Loan Interest

Managing student loan interest effectively is crucial to minimizing the overall cost of repayment. Many strategies exist, each with its own advantages and disadvantages, and the best approach depends on individual circumstances and financial goals. Reddit discussions offer a wealth of user experiences and advice on navigating this complex process.

Repayment Plan Strategies

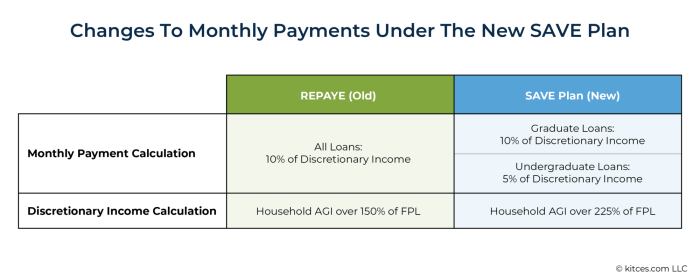

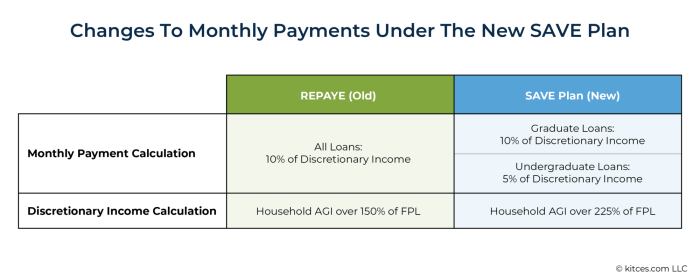

Reddit users frequently discuss various repayment plans offered by loan servicers. The standard 10-year repayment plan is often compared to income-driven repayment (IDR) plans, such as ICR, PAYE, and REPAYE. IDR plans base monthly payments on your income and family size, resulting in lower monthly payments but potentially extending the repayment period and increasing overall interest paid. A common theme is the trade-off between lower monthly payments and longer repayment timelines. For example, a borrower with a high loan balance might find an IDR plan more manageable in the short term, but ultimately pay significantly more in interest over the life of the loan compared to someone who opts for the standard 10-year plan and can afford higher monthly payments.

Student Loan Refinancing

Refinancing student loans is another frequently discussed strategy on Reddit. This involves securing a new loan from a private lender to consolidate existing federal and/or private loans at a lower interest rate. Reddit users share their experiences with refinancing, highlighting the potential for significant savings, especially for borrowers with good credit scores. However, refinancing federal loans means losing access to federal benefits like income-driven repayment plans and potential loan forgiveness programs. A borrower considering refinancing should carefully weigh the potential interest rate savings against the loss of these benefits. For instance, a borrower with high credit and multiple loans at relatively high interest rates might find substantial savings through refinancing, while a borrower with average credit and loans eligible for public service loan forgiveness might be better served by sticking with their existing federal loans.

Additional Interest Reduction Strategies

Beyond repayment plans and refinancing, Reddit users suggest several additional strategies to minimize interest accrual. These include making extra principal payments whenever possible, aiming for bi-weekly payments to effectively make an extra monthly payment each year, and diligently tracking loan balances and interest rates to ensure accuracy and identify opportunities for savings. These methods, while requiring more proactive financial management, can lead to substantial long-term savings.

- Standard Repayment Plan: Fixed monthly payments over 10 years; lower total interest paid but higher monthly payments.

- Income-Driven Repayment (IDR) Plans: Lower monthly payments based on income, but potentially longer repayment periods and higher total interest paid.

- Refinancing: Potential for lower interest rates, but loss of federal loan benefits.

- Extra Principal Payments: Reduces principal balance faster, lowering total interest paid.

- Bi-Weekly Payments: Effectively makes an extra monthly payment annually.

Impact of Government Policies on Student Loan Interest

Government policies significantly influence student loan interest rates, impacting millions of borrowers. Reddit serves as a vital platform for discussions surrounding these policies, offering a window into the collective sentiment and experiences of those affected. Users frequently share their perspectives on the fairness, effectiveness, and overall impact of various government initiatives.

Government policy changes regarding student loan interest rates are frequently debated on Reddit. Discussions often center around the political motivations behind these changes, the economic consequences for borrowers, and the perceived fairness of the resulting interest rates. Users analyze proposed legislation, track the progress of bills, and share personal anecdotes illustrating the real-world effects of these policies on their financial situations. The tone of these discussions ranges from frustrated to hopeful, depending on the specifics of the policy in question.

Reddit User Sentiment Towards Specific Government Initiatives

Reddit threads concerning specific government initiatives often reveal a wide spectrum of user sentiment. For example, policies that offer temporary interest rate reductions are generally met with enthusiasm and relief, expressed through comments celebrating the financial breathing room they provide. Conversely, policies perceived as benefiting lenders over borrowers, such as increases in interest rates or limitations on repayment options, tend to elicit anger and frustration. Users often cite personal hardship and the perceived unfairness of the system, pointing out the long-term implications of high interest rates on their ability to achieve financial stability. These discussions frequently highlight the perceived disconnect between policymakers and the lived experiences of student loan borrowers.

Examples of Reddit Discussions Concerning Policy Fairness and Effectiveness

Many Reddit discussions dissect the fairness and effectiveness of current student loan interest rate policies. Users frequently debate the equity of the current system, particularly in relation to income-based repayment plans and loan forgiveness programs. Some argue that these programs are insufficient to address the systemic issues contributing to student loan debt, while others advocate for their expansion and improvement. The effectiveness of these policies is also questioned, with users sharing anecdotal evidence of the difficulties they face in navigating the complex repayment systems and accessing available assistance programs. These discussions often highlight the need for greater transparency and simplification of the student loan process.

Illustrative Narrative: Impact of a Hypothetical Policy Change

Imagine a hypothetical policy change: the government introduces a program that caps student loan interest rates at 2% for borrowers from low-income families. On Reddit, the response would likely be overwhelmingly positive. Users who previously faced crippling interest rates would share stories of newfound financial hope. For example, a user named “u/HopefulBorrower” might post: “Finally! After years of struggling with 7% interest, this new cap means I can actually see the light at the end of the tunnel. I can finally start saving for a down payment on a house.” Conversely, users from higher-income families might express some resentment at not being included, leading to discussions about the equity and fairness of such targeted relief programs. The overall narrative would showcase the significant impact even small policy changes can have on individual borrowers’ lives and the broader societal discussion surrounding student loan debt.

Emotional and Psychological Impacts of Student Loan Debt and Interest

The crushing weight of student loan debt, particularly when compounded by high interest rates, extends far beyond the financial realm. It significantly impacts the mental and emotional well-being of borrowers, leading to pervasive stress, anxiety, and even depression. Reddit discussions reveal a stark picture of the emotional toll this debt takes, painting a portrait of individuals struggling with the long-term implications of their educational investment.

Reddit threads dedicated to student loan debt frequently showcase the profound psychological effects of high interest rates. The constant awareness of accumulating debt, the fear of default, and the perceived impossibility of repayment contribute to a pervasive sense of hopelessness and overwhelm. This emotional burden often spills over into other aspects of life, affecting relationships, career choices, and overall life satisfaction.

Examples of Reddit Posts Reflecting Stress and Anxiety

Many Reddit posts detail the debilitating anxiety associated with student loan debt. Users often describe sleepless nights spent worrying about payments, feelings of being trapped in a cycle of debt, and the pervasive fear of impacting their future financial stability. For instance, one common theme is the frustration of seeing minimal progress on loan repayment despite consistent payments, due to the significant portion of those payments going towards interest rather than principal. Another recurring sentiment revolves around the feeling of being “stuck,” unable to make significant life decisions like buying a house or starting a family due to the looming debt. These posts often include detailed accounts of the impact on their mental health, such as increased stress levels, difficulty concentrating, and feelings of despair.

Coping Mechanisms Employed by Reddit Users

Reddit communities provide a crucial support network for individuals grappling with student loan debt. Users share coping strategies, offering mutual support and practical advice. Common coping mechanisms include budgeting techniques, exploring income-driven repayment plans, and actively seeking financial counseling. Many users find solace in connecting with others facing similar challenges, validating their experiences and reducing feelings of isolation. Some actively engage in mindfulness practices or seek professional mental health support to manage the stress and anxiety associated with their debt. The shared experiences and advice offered within these communities serve as a vital lifeline for many struggling with the emotional burden of student loan debt.

Illustrative Emotional Journey of a Student

Imagine Sarah, a recent graduate burdened with $50,000 in student loans. Initially, the excitement of graduation was quickly overshadowed by the daunting reality of monthly payments. As the interest began to accrue, a sense of dread started to creep in. Each statement felt like a punch to the gut, highlighting the slow but steady growth of her debt. The weight of this financial burden impacted her sleep, her appetite, and her ability to focus on her career. She felt trapped, her dreams of homeownership and starting a family seeming increasingly distant. The constant worry gnawed at her, fueling feelings of anxiety and self-doubt. Her initial optimism about the future was gradually replaced by a sense of despair and resignation. She found solace in online communities, connecting with others who understood her struggle and provided practical advice and emotional support. Through this support and a renewed focus on budgeting and repayment strategies, Sarah started to regain a sense of control, slowly rebuilding her hope for a brighter future.

Last Point

Reddit’s collective wisdom on student loan interest reveals a complex interplay of financial realities, government policies, and personal experiences. While the emotional burden of high interest rates is undeniable, the platform also showcases the power of community support, shared strategies for debt management, and the importance of financial literacy. Understanding the nuances of these online discussions provides valuable insights for both current borrowers and those planning for future education financing.

Top FAQs

What are the most common misconceptions about student loan interest found on Reddit?

Common misconceptions include believing interest only accrues after graduation (it often starts accruing while in school), underestimating the long-term impact of compound interest, and assuming all repayment plans are created equal.

How can I find relevant Reddit threads about student loan interest?

Use specific s in the Reddit search bar, such as “student loan interest,” “student loan refinancing,” or “student loan repayment plan.” Subreddits like r/personalfinance and r/StudentLoans are good starting points.

Is it safe to share personal financial information on Reddit?

Exercise caution. Avoid posting sensitive details like your full name, Social Security number, or loan account numbers. Focus on sharing general experiences and seeking advice, rather than disclosing private information.