Navigating the world of student loans can feel overwhelming, especially when understanding the maximum amounts you can borrow. This guide clarifies the complexities of federal and private student loan limits, offering insights into eligibility factors and the long-term implications of your borrowing decisions. We’ll explore how cost of attendance, credit history, and even your academic performance influence your loan options.

Understanding these limitations is crucial for responsible financial planning. By exploring both federal and private loan options, you can make informed decisions to minimize debt and maximize your educational opportunities. This guide aims to equip you with the knowledge to navigate this crucial aspect of higher education funding.

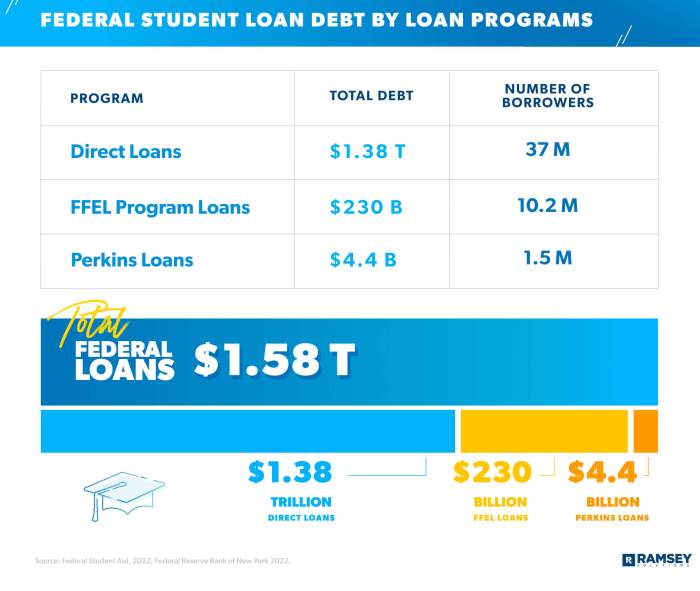

Federal Student Loan Limits

Understanding federal student loan limits is crucial for prospective students and their families in planning for higher education costs. These limits vary based on factors such as dependency status and the level of study (undergraduate or graduate). Knowing these limits helps students borrow responsibly and avoid accumulating excessive debt.

Undergraduate Federal Student Loan Limits

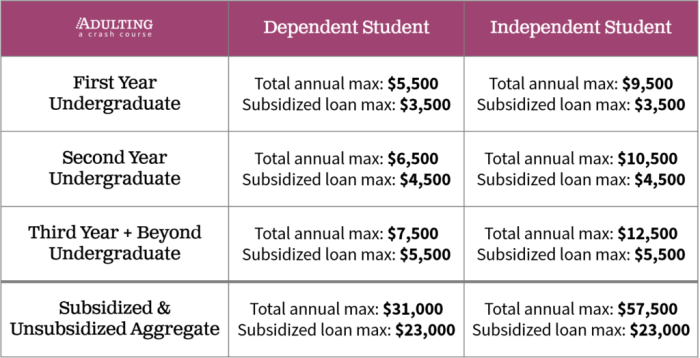

Federal student loan programs offer both subsidized and unsubsidized loans to undergraduate students. Subsidized loans don’t accrue interest while the student is enrolled at least half-time, while unsubsidized loans accrue interest from the time the loan is disbursed. The maximum loan amount a student can receive depends on their year in school and their dependency status. Dependent students are those who are claimed as dependents on their parents’ or guardians’ tax returns. Independent students are those who are not claimed as dependents.

Dependency Status and Loan Limits for Undergraduate Students

The annual loan limits for undergraduate students differ significantly based on their dependency status. Dependent students generally have lower limits than independent students, reflecting the assumption that parents may be able to contribute more to their education. Independent students often have access to higher loan amounts to compensate for the potential lack of parental financial support.

Graduate Federal Student Loan Limits

Graduate students have access to different loan limits than undergraduate students. Generally, the maximum loan amounts for graduate students are higher, reflecting the typically higher costs associated with graduate-level education. These limits also apply to both subsidized and unsubsidized loan types, although subsidized loans are less common at the graduate level.

Federal Student Loan Limit Summary Table

| Loan Type | Dependent Student Limit | Independent Student Limit | Graduate Student Limit |

|---|---|---|---|

| Subsidized & Unsubsidized Loans (Annual) | $3,500 (Freshman), $4,500 (Sophomore), $5,500 (Junior & Senior) | $5,500 (Freshman), $6,500 (Sophomore), $7,500 (Junior & Senior) | $20,500 (Annual) |

| Aggregate Loan Limit (Undergraduate) | $27,000 | $57,500 | N/A |

| Aggregate Loan Limit (Graduate) | N/A | N/A | $138,500 (Combined undergraduate and graduate loans) |

Note: These amounts are subject to change and may vary slightly depending on the specific federal student loan program. It is crucial to consult the official Federal Student Aid website for the most up-to-date information. These figures represent the maximum amounts available and do not guarantee that a student will be approved for the full amount. Financial need and creditworthiness are also factors in loan approval.

Private Student Loan Limits

Private student loans offer a crucial funding option for students whose educational expenses exceed the limits of federal student aid. Unlike federal loans, private lenders establish their own lending criteria and limits, leading to a more variable and often less predictable borrowing experience. Understanding these limits and their implications is vital for responsible financial planning.

Factors Influencing Private Student Loan Amounts

Several factors significantly influence the maximum loan amount a private lender will offer. Credit history plays a dominant role; a strong credit score generally translates to higher loan approval amounts and more favorable interest rates. Income and employment stability are also key considerations, as lenders assess the borrower’s ability to repay the loan. The student’s chosen school and program of study can influence loan amounts, with programs at prestigious institutions sometimes justifying larger loans. Finally, co-signers, who agree to repay the loan if the borrower defaults, can significantly increase the loan amount approved. Lenders often prefer to see co-signers with excellent credit history and stable income.

Interest Rates and Repayment Terms: Private vs. Federal Loans

Private student loans typically carry higher interest rates than federal loans. This is because private lenders assess risk differently and charge more for the perceived higher risk associated with lending to students. Repayment terms also vary significantly between private and federal loans. Federal loans often offer flexible repayment plans, including income-driven repayment options that adjust payments based on income. Private loan repayment terms are generally less flexible, often requiring fixed monthly payments over a shorter timeframe. For example, a federal loan might offer a 10-year repayment plan with income-based adjustments, while a private loan might mandate a 5-year repayment plan with a fixed monthly payment.

Scenarios Requiring Private Student Loans

Students might require private loans when their educational costs exceed the maximum amount available through federal loans. For instance, a student attending a high-cost private university with a high tuition and living expenses might easily surpass the federal loan limits. Another scenario could involve a student pursuing a longer, more expensive graduate degree program after already maxing out their undergraduate federal loan eligibility. International students, who often don’t qualify for federal loans, are also likely to rely on private loans to finance their education.

Risks Associated with Private Student Loans

Taking out private student loans carries several potential risks.

- Higher interest rates compared to federal loans, leading to significantly higher overall repayment costs.

- Less flexible repayment options, potentially making repayment more challenging during periods of financial hardship.

- The lack of government protections and benefits offered with federal loans, such as income-driven repayment plans and loan forgiveness programs.

- Potential for predatory lending practices from some private lenders, resulting in unfavorable terms and high fees.

- Negative impact on credit score if payments are missed or defaulted.

Factors Affecting Loan Eligibility

Securing student loans, whether federal or private, involves more than just applying. Lenders assess various factors to determine your eligibility and the loan amount they’re willing to offer. Understanding these factors can significantly improve your chances of obtaining the funding you need. This section details the key elements that influence loan approval and the maximum loan amount you can receive.

Beyond your credit history, several other factors play a crucial role in a lender’s decision-making process. These factors often interact, meaning a strong performance in one area can sometimes offset weaknesses in another. However, understanding each factor’s individual influence is essential for prospective borrowers.

Credit Score and Co-signer’s Role

A strong credit score significantly impacts your loan eligibility and the amount you can borrow. Lenders view a high credit score as an indicator of responsible financial behavior, reducing their perceived risk. A higher credit score often translates to more favorable interest rates and higher loan limits. Conversely, a low or nonexistent credit score can make it difficult to secure a loan, especially a large one, or result in significantly higher interest rates. A co-signer, someone with a strong credit history who agrees to repay the loan if you cannot, can greatly improve your chances of approval and increase the loan amount offered, even with a limited credit history. The co-signer essentially acts as a guarantor, mitigating the lender’s risk. For example, a student with no credit history might qualify for a $10,000 loan with a co-signer, whereas without one, they might be denied or only approved for a much smaller amount.

Academic Standing’s Influence

Your academic standing, primarily measured by your Grade Point Average (GPA), can influence your loan eligibility, particularly for private lenders. A higher GPA demonstrates academic success and potential for future earnings, making you a less risky borrower. Many private lenders use GPA as a factor in their underwriting process. For instance, a student with a high GPA might qualify for a larger loan amount and more favorable terms compared to a student with a lower GPA. Some lenders may have specific GPA requirements for loan approval, while others might use it to differentiate loan offers and interest rates. Federal loans typically have less stringent GPA requirements than private loans.

Table of Factors Affecting Loan Amount

| Factor | Impact on Loan Amount |

|---|---|

| Credit Score | Higher scores generally lead to larger loan amounts and better interest rates. Low scores can limit eligibility or result in higher interest rates and smaller loan amounts. |

| Co-signer | A co-signer with good credit can significantly increase loan approval chances and the amount offered, especially for borrowers with limited or no credit history. |

| Academic Standing (GPA) | A higher GPA often improves the chances of loan approval and may lead to larger loan amounts, particularly with private lenders. Lower GPAs can restrict eligibility or result in smaller loan amounts. |

| Debt-to-Income Ratio | A lower debt-to-income ratio suggests greater financial responsibility, potentially leading to higher loan approvals and amounts. A high ratio may limit eligibility or reduce the loan amount. |

| Income (or Expected Income) | Lenders assess your ability to repay the loan. Higher current or projected income generally increases your chances of approval and the amount you can borrow. |

| Type of Degree Program | The type of degree program (e.g., professional vs. undergraduate) can sometimes influence loan amounts, as some programs are associated with higher earning potential. |

Cost of Attendance and Loan Amounts

Understanding the cost of attendance (COA) is crucial for determining how much student loan debt you might accumulate. The COA varies significantly between institutions, impacting the amount of financial aid – including loans – you’ll need to secure. This section will explore how to estimate your COA, plan your borrowing accordingly, and calculate your potential total debt.

The cost of attendance encompasses tuition fees, room and board, books and supplies, transportation, and other personal expenses. Private universities generally have higher COAs than public institutions, and even within those categories, costs vary widely depending on location and program specifics. For instance, a prestigious private university in a major city will likely have a much higher COA than a smaller public college in a rural area. This directly influences the amount of student loans a student may need to borrow to cover their education.

Estimating Total Cost of Attendance

Estimating your total cost of attendance involves gathering information directly from the college or university you plan to attend. Most institutions provide a detailed breakdown of their COA on their websites, often broken down by categories such as tuition, fees, housing, and personal expenses. You should carefully review this information, considering both direct and indirect costs. Direct costs are those charged directly by the institution (tuition, fees), while indirect costs cover living expenses (rent, food, transportation).

For example, let’s say a student is considering attending State University and a private university, “Prestigious College.” State University’s COA might be $25,000 per year, while Prestigious College’s COA might be $60,000 per year. This $35,000 difference highlights the significant impact of institutional choice on overall costs and, consequently, loan requirements.

Planning Borrowing Based on COA and Personal Savings

To effectively plan your borrowing, you need to subtract any personal savings or other financial aid (grants, scholarships) from your total COA. This will reveal the amount you need to borrow through student loans.

- Determine your COA: Obtain the official COA from your chosen institution.

- Calculate your available funds: Estimate your personal savings, grants, scholarships, and any other financial aid you’ve secured.

- Subtract available funds from COA: This difference represents your potential loan need.

- Check loan limits: Compare your calculated loan need with the maximum federal and private loan limits to determine the feasible borrowing amount.

- Create a budget: Develop a realistic budget that accounts for all your expenses throughout your education.

Calculating Total Accumulated Debt

Calculating your total debt requires considering the loan amount, interest rate, and repayment period. The longer the repayment period, the more interest you will accrue. Different loan types often have different interest rates. Federal loans typically have lower interest rates than private loans.

For instance, suppose a student borrows $20,000 in federal loans at 5% interest and $10,000 in private loans at 7% interest over a 10-year repayment period. Using a loan calculator (many are available online), they can estimate their total repayment amount, including interest, which will be significantly higher than the initial loan principal. Accurate calculation requires using a loan amortization schedule which details each payment’s principal and interest components.

Step-by-Step Guide to Estimating Loan Needs

This guide helps students estimate their potential student loan needs.

- Gather COA information: Obtain the official COA from your institution.

- List all financial resources: Include savings, grants, scholarships, and expected family contributions.

- Calculate net cost: Subtract all available funds from your total COA.

- Determine loan need: The remaining amount is your estimated loan need.

- Research loan options: Explore federal and private loan options, comparing interest rates and repayment terms.

- Consider repayment strategies: Plan how you’ll manage your student loan debt after graduation.

Repayment Strategies and Implications

Navigating student loan repayment can feel overwhelming, but understanding the available options and their long-term implications is crucial for financial well-being. Choosing the right repayment plan significantly impacts your monthly budget and the total amount you ultimately pay back.

Available Repayment Plans and Their Impact on Monthly Payments

Several federal student loan repayment plans cater to different financial situations. The Standard Repayment Plan involves fixed monthly payments over 10 years. The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on your income and family size, resulting in potentially lower payments but longer repayment periods. Extended Repayment Plans offer longer repayment terms than the standard plan, reducing monthly payments but increasing the total interest paid. The choice depends on your current financial capacity and long-term financial goals.

Long-Term Costs and Interest Capitalization

The long-term cost of repayment varies significantly across plans. While IDR plans offer lower monthly payments, they often extend the repayment period, leading to a higher total interest paid over the life of the loan. Interest capitalization, where accrued interest is added to the principal loan balance, further increases the total cost, especially with longer repayment periods. For example, a $30,000 loan with a 6% interest rate repaid over 10 years under the standard plan might cost around $36,000 in total, whereas the same loan under an IDR plan with a 20-year repayment period could cost significantly more due to accumulated interest.

Implications of Student Loan Default

Defaulting on student loans has severe consequences. Your credit score will be severely damaged, making it difficult to obtain loans, credit cards, or even rent an apartment. The government can garnish your wages, tax refunds, and Social Security benefits to recover the debt. Furthermore, default can lead to the loss of professional licenses in some fields and impact your ability to obtain federal financial aid in the future. In some cases, default may even result in legal action.

Illustrative Comparison of Repayment Costs

Imagine three scenarios with a $25,000 loan at a 5% interest rate:

Scenario 1: Standard Repayment Plan (10 years): This plan might result in a total repayment cost of approximately $30,000, showing a relatively modest increase from the initial loan amount.

Scenario 2: Graduated Repayment Plan (10 years): The total repayment cost would likely be similar to the standard plan, although initial payments are lower and increase over time.

Scenario 3: Income-Driven Repayment Plan (20-25 years): This plan might result in a total repayment cost of approximately $35,000 to $40,000 or even more, due to the extended repayment period and accumulated interest.

This illustrates a visual representation: A bar graph could display the three scenarios, with the bars representing the total repayment cost for each plan. The bar for the IDR plan would be noticeably taller than the other two, visually highlighting the higher total cost associated with longer repayment periods.

Summary

Securing funding for higher education requires careful consideration of available resources and potential long-term financial implications. By understanding the maximum amounts available through federal and private student loans, and the factors influencing eligibility, students can approach borrowing responsibly. Remember to carefully weigh the benefits and risks associated with each loan type and develop a repayment strategy that aligns with your post-graduation financial goals. Proactive planning is key to a successful and manageable path toward higher education.

Detailed FAQs

What happens if I exceed the maximum federal student loan amount?

You may need to explore private student loans to cover the remaining costs. However, be aware that private loans often have higher interest rates and less favorable repayment terms.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing is an option once you have existing student loan debt. However, it’s crucial to compare offers from different lenders to find the best rates and terms. Be sure to understand the implications before refinancing.

What are the consequences of defaulting on student loans?

Defaulting on student loans can severely damage your credit score, leading to difficulty obtaining loans or credit cards in the future. It can also result in wage garnishment and tax refund offset.

How does my credit score affect my loan eligibility?

A higher credit score generally improves your chances of loan approval and can potentially lead to more favorable interest rates and higher loan amounts, especially with private lenders.