Navigating the complexities of student loan repayment can feel overwhelming, especially when faced with the monthly payment burden. Understanding the various factors influencing these payments—interest rates, loan types, and repayment plans—is crucial for effective financial management. This guide provides a clear and concise overview of student loan monthly payments, offering practical strategies and resources to help you navigate this significant financial commitment.

From calculating your monthly payment to exploring different repayment strategies and understanding the long-term impact on your finances, we aim to empower you with the knowledge needed to make informed decisions and achieve your financial goals. We’ll delve into budgeting techniques, explore options like income-driven repayment and refinancing, and highlight the resources available to support you throughout the repayment process.

Understanding Student Loan Monthly Payments

Understanding your monthly student loan payments is crucial for effective financial planning. Several factors interact to determine the amount you’ll pay each month, and choosing the right repayment plan can significantly impact your overall loan repayment journey.

Factors Influencing Monthly Student Loan Payments

The amount you pay monthly on your student loans is determined by a combination of factors. The most significant are the interest rate, the loan type, and the repayment plan you choose. Higher interest rates lead to larger monthly payments, as a greater portion of your payment goes towards interest rather than principal. Different loan types (e.g., subsidized vs. unsubsidized, federal vs. private) often come with varying interest rates and repayment options. Finally, the repayment plan you select directly influences your monthly payment amount; some plans offer lower monthly payments initially but extend the repayment period, while others prioritize faster repayment with higher monthly costs.

Repayment Plan Examples and Their Impact

Several repayment plans are available, each with a different impact on your monthly payments. The Standard Repayment Plan, for example, typically spreads payments over 10 years, resulting in a fixed monthly payment. The Extended Repayment Plan extends the repayment period, leading to lower monthly payments but higher overall interest paid. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR) plan, tie your monthly payments to your income, making them more manageable if your income is low. However, IDR plans often extend the repayment period and can lead to higher total interest paid over the life of the loan. For instance, a $50,000 loan with a 5% interest rate on a Standard Repayment Plan might have a monthly payment of around $530, whereas the same loan on an Extended Repayment Plan could have a monthly payment closer to $350 but with a much longer repayment period and higher total interest paid.

Calculating Monthly Student Loan Payments

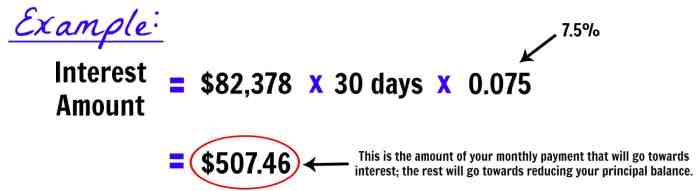

Calculating your monthly student loan payment can be done using several methods. The most common involves using a loan amortization calculator, readily available online. These calculators require you to input the loan amount, interest rate, and loan term. Alternatively, a more complex formula can be used:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount

i = Monthly Interest Rate (Annual Interest Rate / 12)

n = Total Number of Payments (Loan Term in Years * 12)

This formula allows for a precise calculation, but using an online calculator is often simpler and less prone to errors.

Comparison of Monthly Payments Across Loan Types

| Loan Type | Interest Rate | Loan Amount | Monthly Payment |

|---|---|---|---|

| Federal Subsidized Loan | 4.5% | $20,000 | ~$222 |

| Federal Unsubsidized Loan | 6.8% | $20,000 | ~$248 |

| Private Loan | 7.5% | $10,000 | ~$160 |

| Private Loan | 9.0% | $30,000 | ~$330 |

*Note: These are sample calculations and actual monthly payments may vary based on the specific terms of your loan and repayment plan.*

Repayment Strategies for Student Loans

Managing student loan debt effectively requires a proactive approach and a well-defined repayment strategy. Understanding your options and tailoring a plan to your individual financial circumstances is crucial for minimizing stress and achieving long-term financial stability. This section explores various strategies to help you navigate the repayment process and make informed decisions.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable by basing your monthly payment on your income and family size. These plans typically offer lower monthly payments than standard repayment plans, potentially extending the repayment period. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). The specific terms and eligibility requirements vary depending on the plan and your loan type. While IDR plans offer lower monthly payments, it’s important to note that they often lead to higher total interest payments over the life of the loan due to the extended repayment period. For example, a borrower with a $50,000 loan might see their monthly payment reduced significantly under an IDR plan, but the total interest paid could increase by several thousand dollars compared to a standard 10-year repayment plan.

Student Loan Refinancing

Refinancing involves replacing your existing student loans with a new loan from a private lender. This can be beneficial if you qualify for a lower interest rate, potentially reducing your monthly payment and the total interest paid. However, refinancing typically requires a good credit score and a stable income. It’s also important to note that refinancing federal student loans converts them into private loans, potentially losing access to federal repayment programs like IDR plans and loan forgiveness programs. For instance, a borrower with multiple federal loans at 6% interest might refinance and secure a new loan at 4%, leading to considerable savings over the repayment period. However, if the borrower later experiences financial hardship, they might lose the flexibility of federal repayment options.

Budgeting and Financial Planning for Student Loan Payments

Creating a realistic budget is essential for successfully managing student loan payments. This involves tracking your income and expenses, identifying areas where you can cut back, and allocating funds specifically for your loan payments. Consider using budgeting apps or spreadsheets to monitor your finances and stay on track. A sample budget might include allocating a certain percentage of your income towards student loan payments, along with essential expenses like housing, food, transportation, and utilities. Savings for emergencies and other financial goals should also be incorporated.

Sample Budget Incorporating Student Loan Payments

| Income | Amount |

|---|---|

| Monthly Salary | $3,000 |

| Expenses | Amount |

| Housing | $1,000 |

| Food | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $500 |

| Savings | $250 |

| Other Expenses | $500 |

This sample budget demonstrates how to incorporate student loan payments while still allocating funds for essential expenses and savings. Adjust the amounts based on your individual circumstances. Remember, this is a simplified example, and a more detailed budget might be necessary for a comprehensive financial plan.

Impact of Student Loan Debt on Personal Finances

Navigating the complexities of student loan repayment requires a clear understanding of its potential long-term impact on personal finances. High monthly payments can significantly affect various aspects of your financial well-being, from your ability to save for the future to your overall creditworthiness. This section will explore these effects in detail.

Long-Term Effects on Financial Stability

High monthly student loan payments can severely constrain your financial stability. A large portion of your income dedicated to loan repayment leaves less available for essential expenses like housing, food, and transportation, as well as crucial long-term goals such as saving for retirement, purchasing a home, or investing. For example, someone with a $1,000 monthly student loan payment might find it challenging to simultaneously save for a down payment on a house or contribute adequately to a retirement account. This can lead to delayed major life milestones and increased financial stress. The longer the repayment period, the more significant this impact becomes, potentially delaying financial independence for many years.

Financial Implications of Different Repayment Approaches

The choice of repayment plan significantly influences long-term financial outcomes. Standard repayment plans offer lower monthly payments initially but extend the repayment period, leading to higher overall interest payments. Income-driven repayment plans offer lower monthly payments based on income but can result in loan forgiveness after a certain period, but also potentially extend the repayment period even further and lead to higher overall interest. Refinancing can lower your interest rate and monthly payment, but it might require excellent credit. Careful consideration of these factors is crucial to align the repayment strategy with individual financial goals and risk tolerance. For instance, choosing an income-driven plan might be beneficial for someone with a low income immediately after graduation, while refinancing could be advantageous for someone with a stable job and good credit score.

Impact on Credit Scores and Borrowing Capacity

Student loan debt, particularly missed or late payments, significantly impacts credit scores. A lower credit score can hinder access to credit in the future, making it more difficult to obtain mortgages, auto loans, or even credit cards at favorable interest rates. This can create a vicious cycle, limiting opportunities for financial advancement. For instance, someone with a poor credit score due to delinquent student loan payments might face higher interest rates on a mortgage, significantly increasing the overall cost of homeownership. Consistent on-time payments, on the other hand, demonstrate responsible financial behavior and can positively influence credit scores, increasing borrowing capacity in the long run.

Potential Financial Hardships Resulting from High Student Loan Payments

The burden of high student loan payments can lead to various financial hardships.

These difficulties can significantly impact an individual’s financial well-being and overall quality of life.

- Difficulty saving for retirement or other long-term goals.

- Inability to purchase a home or vehicle.

- Increased reliance on credit cards, potentially leading to high-interest debt.

- Delayed marriage or starting a family.

- Reduced ability to handle unexpected expenses (e.g., medical emergencies).

- Increased financial stress and anxiety.

Resources and Support for Student Loan Borrowers

Navigating the complexities of student loan repayment can feel overwhelming, but numerous resources and support systems are available to help borrowers manage their debt effectively and explore options for repayment and potential forgiveness. Understanding these resources is crucial for successful long-term financial planning. This section Artikels key organizations and strategies to assist you in this process.

Government and Non-profit Organizations Offering Assistance

Several government agencies and non-profit organizations provide valuable assistance to student loan borrowers. These entities offer guidance, counseling, and support tailored to individual circumstances. Access to these resources can significantly impact your ability to manage and reduce your student loan debt.

- Federal Student Aid (FSA): The primary source of information and resources for federal student loans. FSA’s website provides comprehensive information on repayment plans, loan forgiveness programs, and other relevant resources.

- National Foundation for Credit Counseling (NFCC): A non-profit organization offering free and low-cost credit counseling services, including assistance with student loan debt management. They can help you create a budget, explore repayment options, and negotiate with your lenders.

- The United States Department of Education (ED): The ED oversees federal student loan programs and provides information on repayment plans, loan forgiveness programs, and other resources. Their website is a valuable resource for understanding your rights and responsibilities as a borrower.

- Student Loan Borrower Assistance Program (SLBAP): Many states operate programs offering free or low-cost assistance to student loan borrowers. These programs often provide personalized guidance and support based on your individual situation and needs. Check your state’s website for details.

Resources for Managing Student Loan Debt

Effective student loan debt management requires a multifaceted approach that includes financial planning and budgeting, understanding available repayment options, and seeking professional guidance when needed. Utilizing available resources is crucial for successful navigation of this process.

- Financial Counseling Services: Many non-profit organizations and credit unions offer free or low-cost financial counseling services. These services can provide personalized guidance on budgeting, debt management, and exploring repayment options tailored to your specific financial situation. A financial counselor can help you create a realistic repayment plan and avoid default.

- Online Student Loan Calculators: Numerous online tools allow you to estimate your monthly payments under different repayment plans and explore the long-term impact of various strategies. These calculators can be valuable tools for making informed decisions about your repayment plan.

- Student Loan Repayment Apps: Several apps are designed to help you track your student loan payments, manage your debt, and explore different repayment options. These apps often offer features such as payment reminders, budgeting tools, and personalized financial advice.

Applying for Income-Driven Repayment Plans or Loan Forgiveness Programs

Income-driven repayment (IDR) plans and loan forgiveness programs can significantly reduce monthly payments and potentially lead to loan forgiveness after a specified period. The application process for these programs varies depending on the specific plan or program.

Generally, applying for an IDR plan involves completing an application through the Federal Student Aid website. You will need to provide information about your income and family size. The application process for loan forgiveness programs can be more complex and may require meeting specific eligibility requirements, such as working in a public service job for a certain number of years. Each program has its own specific requirements and application process, which are detailed on the Federal Student Aid website.

Frequently Asked Questions about Student Loan Repayment

Understanding the answers to common questions can greatly simplify the process of managing your student loans. The following list addresses some frequently asked questions.

- What are the different types of student loan repayment plans? There are several repayment plans available, including standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. The best plan for you will depend on your individual financial circumstances.

- How do I consolidate my student loans? Loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. You can apply for loan consolidation through the Federal Student Aid website.

- What are the eligibility requirements for loan forgiveness programs? Eligibility requirements vary depending on the specific program. Some programs require working in a public service job for a certain number of years, while others have income-based requirements. Detailed eligibility criteria are available on the Federal Student Aid website.

- What happens if I default on my student loans? Defaulting on your student loans can have serious consequences, including wage garnishment, tax refund offset, and damage to your credit score. It is crucial to contact your loan servicer immediately if you are experiencing difficulty making your payments.

Visual Representation of Monthly Payment Scenarios

Understanding the various repayment options for student loans is crucial for effective financial planning. Different repayment plans significantly impact your monthly payments, total interest paid, and the overall loan payoff timeline. The following scenarios illustrate these differences.

Standard Repayment Plan

The Standard Repayment Plan is a fixed-payment plan where you pay a fixed amount each month for 10 years. This plan typically results in the lowest total repayment time but may lead to higher monthly payments and overall interest paid compared to income-driven plans. Let’s consider an example: A student loan of $30,000 with a 6% interest rate would have a monthly payment of approximately $330. The total interest paid over the 10-year period would be approximately $10,000, resulting in a total repayment of $40,000.

Income-Driven Repayment Plan

Income-driven repayment plans adjust your monthly payments based on your income and family size. This option typically results in lower monthly payments, especially in the early years, but often extends the repayment period, leading to a higher total interest paid over the life of the loan. For the same $30,000 loan at 6% interest, an income-driven plan might result in a monthly payment of $200, but the repayment period could extend to 20 or even 25 years. The total interest paid would likely exceed $10,000, possibly reaching $20,000 or more due to the extended repayment period.

Accelerated Repayment Plan

An accelerated repayment plan involves making larger monthly payments than required under the standard plan, significantly shortening the loan repayment period. This results in lower total interest paid. Using the same $30,000 loan example at 6% interest, an accelerated plan might involve a monthly payment of $500. This would drastically reduce the repayment period, possibly to 5 years or less. The total interest paid would be significantly lower than the standard plan, potentially around $5,000.

Comparison of Total Interest Paid Across Repayment Plans

A bar chart effectively visualizes the differences in total interest paid across these three scenarios. The horizontal axis would label each repayment plan (Standard, Income-Driven, Accelerated). The vertical axis would represent the total interest paid, scaled appropriately to accommodate the highest interest amount. Three bars would represent the total interest paid for each plan. The Standard Repayment plan bar would be the tallest, showing approximately $10,000. The Income-Driven Repayment plan bar would be taller than the Accelerated plan bar, reflecting a higher total interest paid (e.g., $20,000). The Accelerated Repayment plan bar would be the shortest, representing the lowest total interest paid (e.g., $5,000). Clear labels and a legend would ensure easy interpretation of the data. The chart’s title would clearly state “Comparison of Total Interest Paid Across Student Loan Repayment Plans”.

Final Thoughts

Successfully managing student loan debt requires a proactive and informed approach. By understanding the intricacies of monthly payments, exploring various repayment strategies, and utilizing available resources, you can effectively navigate this financial journey. Remember, planning and proactive management are key to minimizing the long-term impact of student loan debt and achieving overall financial well-being. This guide serves as a starting point—continue your research and seek personalized financial advice to tailor a repayment plan that best suits your individual circumstances.

FAQ Overview

What happens if I miss a student loan payment?

Missing a payment can result in late fees, damage to your credit score, and potentially even default on your loan, leading to serious financial consequences.

Can I consolidate my student loans?

Yes, consolidating multiple loans into a single loan can simplify repayment, potentially lower your monthly payment (though not always), and streamline the process.

What is forbearance?

Forbearance is a temporary postponement of your student loan payments, often granted due to financial hardship. However, interest usually continues to accrue during this period.

Where can I find free financial counseling?

Many non-profit organizations offer free or low-cost financial counseling services. Check with your local community resources or the National Foundation for Credit Counseling (NFCC).