Navigating the complexities of student loan repayment can be challenging, especially when understanding how these loans impact your credit score. Many borrowers are unaware that not all student loans are consistently reported to credit bureaus, potentially affecting their creditworthiness. This oversight can have significant implications for future borrowing and financial opportunities, highlighting the importance of understanding the reporting process and addressing any discrepancies promptly.

This exploration delves into the reasons why student loans might not be reported, the consequences of this non-reporting, and the steps borrowers can take to ensure accurate reporting and maintain a healthy credit profile. We’ll examine both federal and private student loans, addressing the nuances of each loan type and its impact on credit. Understanding these intricacies empowers borrowers to proactively manage their financial well-being.

Understanding Loan Reporting Practices

Student loan reporting to credit bureaus is a crucial process impacting borrowers’ credit scores and future financial opportunities. Understanding how this process works, including variations and potential exceptions, is essential for responsible financial management. This section details the typical procedures and factors influencing whether or not your student loans appear on your credit report.

Generally, student loan servicers report borrowers’ loan activity to at least one of the three major credit bureaus (Equifax, Experian, and TransUnion). This reporting typically begins after the loan enters repayment, although some lenders may report during deferment or forbearance periods. The information reported includes loan balances, payment history (on-time or late payments), and loan status (current, delinquent, etc.). This data is used by credit bureaus to calculate credit scores, which lenders use to assess creditworthiness.

Types of Student Loans and Reporting Variations

Different types of student loans may have variations in their reporting practices. Federal student loans, such as subsidized and unsubsidized Stafford Loans, and PLUS Loans, are generally reported to credit bureaus. Private student loans also typically get reported, but the specific reporting practices may vary depending on the lender. For instance, some private lenders may only report loans with delinquent payments, while others report all loan activity. The frequency of reporting also differs; some lenders report monthly, while others report quarterly or annually. Consistency in reporting is not guaranteed across all lenders.

Situations Where Student Loans Might Not Be Reported

Several factors can prevent student loans from appearing on credit reports. These situations are often temporary and don’t necessarily reflect negatively on the borrower’s creditworthiness. However, it is important to understand why a loan may not be reported. For example, loans that are still in deferment or forbearance periods may not be reported, as there are no payment activities to track. Additionally, some smaller or lesser-known lenders might not have the resources or established systems to report to credit bureaus regularly. Loans in default may also not be reported in some cases, as lenders prioritize collection efforts over credit reporting. Finally, there are situations where a technical error or oversight on the lender’s part may prevent the loan from being reported.

Common Reasons for Non-Reporting of Student Loans

| Reason | Description | Impact on Credit Score | Resolution |

|---|---|---|---|

| Loan in Deferment/Forbearance | Payments are temporarily suspended. | No immediate impact, but prolonged periods may affect credit if not reported later. | Contact the lender to confirm reporting practices once repayment begins. |

| Loan not yet in repayment | Loans in grace period or before repayment starts are not usually reported. | No impact. | Reporting will begin once repayment starts. |

| Lender does not report to credit bureaus | Some smaller lenders may not report loan activity. | No negative impact if other credit accounts are positive. | Contact the lender to inquire about reporting practices. |

| Technical error | Oversight or technical issues can prevent reporting. | Potentially negative impact if not corrected. | Contact the lender and credit bureaus to rectify the error. |

Impact of Non-Reporting on Credit Scores

The absence of student loan information on your credit report, whether federal or private, can significantly impact your creditworthiness and ability to secure future loans or credit. While it might seem inconsequential, this missing data can hinder lenders’ ability to fully assess your financial responsibility and risk profile. This section will explore the ramifications of this omission and how lenders navigate the complexities of incomplete credit histories.

The most immediate effect of missing student loan information is a potentially lower credit score. Credit scoring models rely on a comprehensive picture of your borrowing and repayment history. When a significant portion of your debt, like student loans, is absent, the algorithms cannot accurately assess your overall credit risk. This results in a less complete picture of your financial situation, which can lead to a lower credit score than if the loans were reported. This lower score can make it more challenging to qualify for loans with favorable interest rates or even be approved for certain types of credit.

Lender Assessment of Creditworthiness with Missing Student Loan Data

Lenders use various methods to evaluate creditworthiness, even with incomplete data. They often look for alternative indicators of financial responsibility, such as length of credit history, payment history on other accounts, and the overall utilization of available credit. However, the absence of student loan information makes this assessment more challenging and potentially less accurate. Lenders might interpret the missing information negatively, assuming the worst-case scenario – that the applicant has a history of missed payments or defaulted loans. This can lead to higher interest rates, stricter approval criteria, or even outright rejection of loan applications. In essence, lenders have less data to work with, increasing the uncertainty associated with lending to an individual with a partially incomplete credit report.

Federal vs. Private Student Loan Reporting Impact

The credit reporting impact differs between federal and private student loans. Federal student loans are generally reported to the credit bureaus, but only after certain conditions are met, such as delinquency. Private student loans, however, are more likely to be reported consistently throughout the repayment period, regardless of delinquency. Consequently, the absence of federal student loan data on a credit report might be less detrimental than the absence of private student loan data, especially if other credit accounts demonstrate responsible borrowing and repayment behavior. However, the absence of *any* student loan data can still negatively impact your score, regardless of the loan type.

Hypothetical Scenario Illustrating Consequences of Non-Reporting

Imagine Sarah, a recent graduate with a strong credit history outside of her student loans. She has consistently paid her credit card bills on time and has a good credit score. However, her federal student loans are not reported to the credit bureaus because she is currently making timely payments. When Sarah applies for a mortgage, the lender sees a relatively short credit history and no student loan information. While her credit card history is positive, the lender might perceive a higher risk due to the missing student loan data, potentially leading to a higher interest rate or stricter loan terms compared to an applicant with a complete credit history, including reported student loans. This highlights the potential negative impact even with otherwise positive credit behavior.

Identifying and Addressing Non-Reporting Issues

Discovering that your student loans aren’t being reported to the credit bureaus can be frustrating, but it’s a solvable problem. Taking proactive steps to verify reporting accuracy and address any discrepancies is crucial for building and maintaining a strong credit history. This section Artikels the necessary steps to identify and resolve these issues.

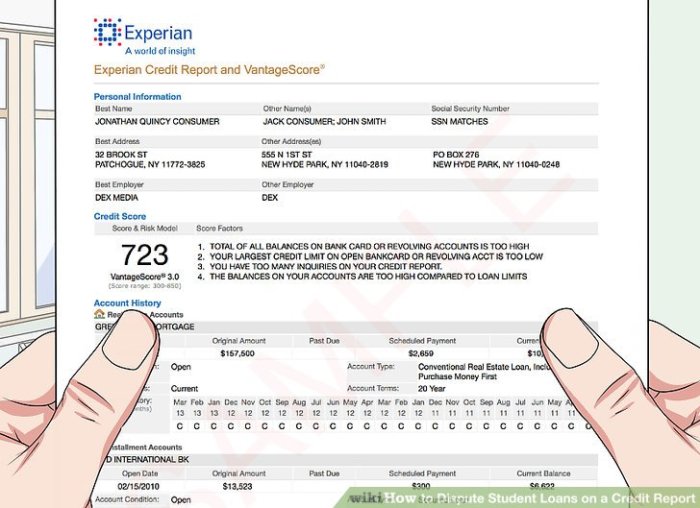

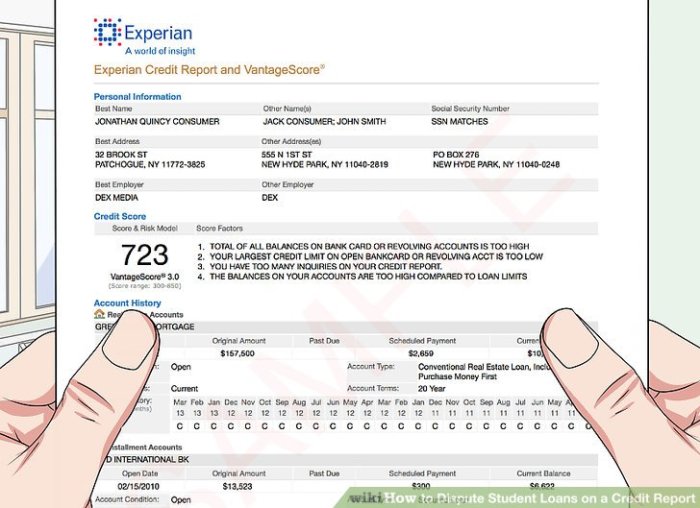

Verifying Student Loan Reporting Accuracy

Accurately assessing the reporting status of your student loans requires a multi-pronged approach. First, obtain your credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion. These reports will show the student loans that are currently being reported and their associated details. Compare the information on your credit reports with your loan documents. Discrepancies, such as incorrect loan balances, payment history, or missing loans entirely, indicate a reporting problem. Secondly, directly contact your loan servicer to request a copy of your loan servicing history. This detailed statement will confirm the exact payment history and loan status. Comparing this information with your credit reports will help identify any discrepancies.

Contacting Your Loan Servicer to Resolve Reporting Discrepancies

If your credit report reveals inaccuracies or missing student loan information, promptly contact your loan servicer. Begin by gathering all relevant documentation, as Artikeld in the next section. When contacting the servicer, clearly explain the discrepancy, providing specific details like the loan number, account number, and the nature of the inaccuracy (e.g., incorrect balance, missed payments, or missing loan). Be polite but firm in your request for a correction. Keep detailed records of all communication, including dates, times, and the names of the representatives you spoke with. If the issue isn’t resolved promptly, consider escalating your complaint to a higher-level representative or supervisor.

Documentation Needed for Reporting Correction Requests

Supporting your request for a reporting correction requires comprehensive documentation. This includes copies of your credit reports showing the inaccuracies, your loan documents (promissory notes, loan agreements), and your loan servicing history statement. Any communication with your loan servicer regarding the issue should also be included. Furthermore, if you have evidence of on-time payments that are not reflected on your credit report, provide supporting documentation such as bank statements or canceled checks. Clearly label all documents and organize them chronologically for easy review. The more comprehensive your documentation, the stronger your case for correction.

Potential Solutions for Addressing Non-Reporting Problems

Several solutions might address student loan non-reporting issues. The most common solution is a direct correction by the loan servicer. After providing the necessary documentation and explaining the situation, the servicer will investigate and, if the error is on their end, correct the information and notify the credit bureaus. If the servicer is unresponsive or refuses to correct the information, you can file a dispute with the credit bureaus directly. Each bureau has a dispute process, and you’ll need to follow their specific instructions. In some cases, the issue may stem from the loan being transferred to a new servicer. In this scenario, ensure the new servicer is aware of the reporting issue and has the necessary information to update the credit bureaus. Finally, in rare cases, legal intervention might be necessary if other methods fail to resolve the problem. This is a last resort, and consulting with a consumer rights attorney would be advisable.

Legal and Regulatory Aspects

The Fair Credit Reporting Act (FCRA) is the primary federal law governing the collection, dissemination, and use of consumer credit information in the United States. While it doesn’t specifically address student loan reporting in every detail, its principles significantly impact how this information is handled. Understanding the FCRA and related regulations is crucial for both lenders and borrowers navigating the student loan landscape.

The FCRA Artikels borrowers’ rights regarding their credit reports, including the right to access their reports, dispute inaccurate information, and be notified if a lender takes adverse action based on their credit report. It also establishes responsibilities for credit reporting agencies (CRAs) to ensure the accuracy and completeness of the information they provide. Furthermore, state laws may add additional layers of consumer protection, varying in their specifics.

Relevant Laws and Regulations Governing Student Loan Reporting

The FCRA’s impact on student loan reporting is indirect but substantial. It dictates how CRAs must handle information from lenders, including student loan servicers. The law requires that reported information be accurate, complete, and updated regularly. Violations of the FCRA can result in significant penalties for lenders and CRAs. Other relevant regulations might include state-specific laws concerning debt collection practices and consumer protection, which can influence how student loan information is managed and reported. For instance, some states have stricter regulations regarding the frequency of contact from debt collectors, impacting the communication related to delinquent student loans. Compliance with these regulations is crucial for all parties involved.

Borrowers’ Rights and Responsibilities Regarding Credit Reporting

Borrowers have a right to obtain a free copy of their credit report annually from each of the three major CRAs (Equifax, Experian, and TransUnion). They also have the right to dispute any inaccurate or incomplete information found on their report. This is particularly important for student loans, as errors in reporting can negatively impact credit scores and future borrowing opportunities. Responsibilities include understanding the terms of their loan agreements, making timely payments, and actively monitoring their credit reports for accuracy. Failure to do so could lead to adverse consequences, such as late payment fees, increased interest rates, and damage to creditworthiness.

Consumer Protection Measures Related to Credit Reporting Errors

The FCRA provides several consumer protection measures to address credit reporting errors. The process typically involves submitting a dispute directly to the CRA. The CRA is then required to investigate the dispute and take corrective action if the information is found to be inaccurate. If the error is not resolved, borrowers can escalate the issue to the Consumer Financial Protection Bureau (CFPB) or file a lawsuit against the CRA or the lender. The CFPB offers resources and guidance to consumers facing credit reporting problems. For example, they provide sample dispute letters and explain the steps involved in resolving credit reporting errors. This process is vital for safeguarding a borrower’s financial standing.

Steps to Take if You Suspect a Violation of Reporting Regulations

Preventive Measures

Proactive steps are crucial to ensure the accurate reporting of your student loans to credit bureaus. This not only safeguards your credit score but also prevents potential future complications. Taking control of your loan information and maintaining open communication with your servicer are key components of this process.

Maintaining a positive credit history requires diligence and informed action. By following best practices and understanding your rights, you can mitigate the risk of inaccurate reporting and protect your financial well-being. This section Artikels several preventive measures to help you achieve this.

Ensuring Accurate Student Loan Reporting

To guarantee accurate reporting, it’s vital to confirm your loan details are correctly registered with your loan servicer from the outset. This includes verifying your name, address, Social Security number, and loan amounts. Any discrepancies should be immediately reported and corrected. Furthermore, consistently making on-time payments demonstrates responsible financial behavior and contributes to a positive credit history. This consistent payment history is a crucial factor in how lenders and credit bureaus assess your creditworthiness. For instance, if your payment history shows a pattern of late or missed payments, it can negatively impact your credit score, even if the underlying loan information is accurate. Therefore, meticulous record-keeping and prompt payment are essential for accurate and positive credit reporting.

Maintaining Effective Communication with Loan Servicers

Open and regular communication with your loan servicer is paramount. This involves promptly notifying them of any address changes, employment changes, or other significant life events that might affect your repayment plan. Regularly reviewing your loan statements for accuracy is also essential. If you notice any discrepancies, contact your servicer immediately to resolve them. For example, if you discover a payment wasn’t properly recorded, contacting your servicer with proof of payment (such as a bank statement) will ensure the error is rectified and your credit report reflects the accurate information. This proactive approach helps prevent misunderstandings and ensures the information reported to credit bureaus is accurate and up-to-date.

Regular Credit Report Review

Regularly reviewing your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) is crucial for detecting inaccuracies. This should be done at least annually, or even more frequently if you suspect any problems. Free access to your credit reports is available through AnnualCreditReport.com, the only official source authorized by federal law. By comparing your loan information on your credit report with your loan documents, you can identify any discrepancies and take steps to correct them. For instance, a missed payment that’s inaccurately reported as late could significantly affect your credit score. Catching and correcting such errors promptly is essential to maintaining a healthy credit profile.

Disputing Inaccurate Credit Report Information

If you discover inaccuracies on your credit report, promptly dispute them with the relevant credit bureau. Each bureau has a specific process for filing a dispute, which is typically Artikeld on their website. You’ll need to provide documentation supporting your claim, such as loan statements or payment confirmations. The credit bureau will then investigate the matter and update your report if the error is confirmed. For example, if your credit report shows a loan that you don’t recognize, or lists an incorrect balance, providing documentation proving the inaccuracy will facilitate the correction process. Persistence is key; if the initial dispute isn’t resolved satisfactorily, you may need to follow up and provide additional supporting documentation.

Alternative Credit Reporting Methods

Building credit can be challenging, especially when key financial activities like student loan repayments aren’t reported to the major credit bureaus. Fortunately, several alternative methods exist to demonstrate creditworthiness and establish a positive credit history. These methods leverage different aspects of your financial behavior to provide a more comprehensive view of your creditworthiness than traditional credit reports alone.

Alternative credit scoring models and reporting methods offer a valuable path for individuals whose credit history might be limited or incomplete due to unreported student loans. Understanding these options can significantly improve your chances of securing loans, renting an apartment, or obtaining other financial products.

Alternative Credit Scoring Models

Many alternative credit scoring models utilize data beyond traditional credit reports to assess credit risk. These models may incorporate factors such as rent payments, utility bill payments, and even telecommunications records. The algorithms behind these models vary, but the common thread is the use of non-traditional data to build a more complete picture of an individual’s financial responsibility. For instance, a model might assign positive credit weight to consistent on-time rent payments, even if those payments aren’t reflected in a traditional credit report. This approach is particularly beneficial for individuals with limited credit history or those whose student loans aren’t reported. The accuracy and predictive power of these models are constantly improving as more data becomes available and the algorithms are refined.

Advantages and Disadvantages of Credit-Building Strategies

Different credit-building strategies offer varying advantages and disadvantages. Secured credit cards, for example, offer a low-risk way to build credit but may come with annual fees. On the other hand, becoming an authorized user on someone else’s credit card can provide a quick boost to credit scores but carries the risk of negative impacts if the primary cardholder is irresponsible. Similarly, utilizing a credit-builder loan provides a structured approach to credit building with guaranteed reporting, but it requires discipline in repayment. Carefully weighing the pros and cons of each strategy is crucial before implementation. For example, while a secured credit card offers a controlled environment for building credit, the interest rates might be higher compared to unsecured cards. Conversely, while becoming an authorized user can quickly improve credit scores, it relies on the responsible behavior of the primary cardholder.

Alternative Credit Reporting Options

Building credit without relying solely on traditional credit reporting requires a proactive approach. Below is a list of alternative options:

- Secured Credit Cards: These cards require a security deposit, which acts as your credit limit, mitigating lender risk. Consistent on-time payments directly contribute to credit score improvement.

- Credit-Builder Loans: These loans are specifically designed to help build credit. The loan amount is typically held in a savings account until the loan is repaid in full, demonstrating responsible borrowing behavior.

- Becoming an Authorized User: Being added as an authorized user on a credit card with a good payment history can positively impact your credit score, assuming the primary cardholder maintains good credit habits.

- Rent Reporting Services: Several companies report your on-time rent payments to credit bureaus, adding positive payment history to your credit report.

- Utility Payment Reporting Services: Similar to rent reporting, some services report consistent utility payments to credit bureaus.

Conclusive Thoughts

In conclusion, the accurate reporting of student loans to credit bureaus is crucial for maintaining a strong credit history. While some situations may lead to non-reporting, understanding the reasons, consequences, and available recourse empowers borrowers to take control of their financial future. By actively monitoring their credit reports, communicating effectively with loan servicers, and utilizing available resources, individuals can mitigate potential negative impacts and ensure their student loans are accurately reflected, ultimately contributing to a positive credit profile.

Questions Often Asked

What if my student loan servicer is unresponsive to my reporting inquiries?

Consider escalating the issue to the relevant regulatory agency, such as the Consumer Financial Protection Bureau (CFPB), for assistance in resolving the discrepancy.

Can I build credit without my student loans being reported?

Yes, alternative methods like secured credit cards or credit-builder loans can help establish credit history even without student loan reporting.

How often should I check my credit report for accuracy?

It’s recommended to review your credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) at least annually to identify and address any inaccuracies promptly.

What if I discover fraudulent activity related to my student loans on my credit report?

Immediately contact your loan servicer and each credit bureau to report the fraudulent activity and initiate a dispute process. File a police report as well.