Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide explores “Plan B” – alternative repayment strategies beyond the standard plan – offering insights into income-driven repayment, refinancing, and proactive financial planning. We’ll delve into the various federal and private loan types, their long-term implications, and practical steps to manage your debt effectively.

From creating a realistic budget and negotiating lower payments to understanding the nuances of refinancing and building an emergency fund, we provide a comprehensive roadmap for tackling student loan debt. This guide emphasizes the crucial role of financial literacy in achieving long-term financial well-being, even with significant student loan burdens.

Understanding Student Loan Debt and its Impact

Student loan debt has become a significant financial burden for millions of Americans, shaping their career paths, life choices, and long-term financial well-being. Understanding the complexities of this debt is crucial for navigating the challenges it presents.

The current landscape of student loan debt in the United States is characterized by staggering numbers. The total amount of student loan debt outstanding exceeds trillions of dollars, making it the second-largest consumer debt category after mortgages. This debt is distributed across millions of borrowers, many of whom struggle to manage their repayments. The high cost of higher education, coupled with limited financial aid options, has contributed significantly to this growing crisis.

Types of Student Loans

Student loans are broadly categorized into federal and private loans. Federal student loans are offered by the U.S. government and generally offer more favorable repayment terms and protections for borrowers. These include subsidized and unsubsidized loans, PLUS loans (for parents and graduate students), and Perkins loans (a need-based loan program). Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. They typically have higher interest rates and less borrower protection than federal loans. Choosing between federal and private loans depends heavily on individual financial circumstances and creditworthiness.

Long-Term Financial Consequences of High Student Loan Debt

High student loan debt can have profound and long-lasting financial consequences. It can delay major life milestones such as homeownership, starting a family, and retirement planning. High monthly payments can significantly restrict disposable income, limiting the ability to save and invest. The weight of this debt can also lead to increased stress and anxiety, impacting overall mental health and well-being. Furthermore, high debt levels can negatively impact credit scores, making it difficult to obtain loans for other purposes in the future. For example, someone burdened with $100,000 in student loan debt might struggle to save for a down payment on a house or to invest in their retirement.

Impact of Student Loan Debt on Career Choices and Life Decisions

Student loan debt often influences career choices and life decisions. Borrowers may prioritize higher-paying jobs, even if they are less fulfilling, to accelerate loan repayment. They may also delay pursuing advanced education or starting their own businesses due to financial constraints. For instance, a recent graduate with substantial debt might forgo a desired but lower-paying position in the arts to take a higher-paying job in finance, even if their passion lies elsewhere. Similarly, the fear of accumulating more debt might deter someone from pursuing a postgraduate degree, limiting their long-term career prospects.

Federal Student Loan Repayment Plans

The following table compares various federal student loan repayment plans. The best plan depends on individual income and financial circumstances.

| Repayment Plan | Payment Calculation | Loan Forgiveness Potential | Pros | Cons |

|---|---|---|---|---|

| Standard Repayment | Fixed monthly payments over 10 years | None | Simple, predictable payments | High monthly payments |

| Graduated Repayment | Payments start low and gradually increase | None | Lower initial payments | Payments increase significantly over time |

| Extended Repayment | Payments spread over a longer period (up to 25 years) | None | Lower monthly payments | Pay more in interest overall |

| Income-Driven Repayment (IDR) | Payments based on income and family size | Potential for loan forgiveness after 20-25 years | Affordable payments | Longer repayment period |

Exploring Plan B Options for Student Loan Repayment

Navigating student loan debt can be challenging, but understanding the available repayment options is crucial for long-term financial health. Beyond the standard 10-year repayment plan, several alternative strategies exist to make managing your debt more manageable. These plans often offer flexibility based on your individual financial circumstances.

Income-Driven Repayment Plans: Benefits and Drawbacks

Income-driven repayment (IDR) plans link your monthly payment to your income and family size. This means lower monthly payments, potentially making repayment more affordable during periods of lower income or financial hardship. However, IDR plans typically extend the repayment period, leading to higher overall interest paid over the life of the loan. The extended repayment period can also delay the long-term benefits of becoming debt-free. Careful consideration of the trade-off between lower monthly payments and increased total interest is essential.

Applying for and Qualifying for Income-Driven Repayment

The application process for IDR plans generally involves completing a form with your income and family size information. You’ll need to provide documentation to verify this information, such as tax returns or pay stubs. Eligibility criteria vary depending on the specific plan, but generally include having federal student loans and demonstrating financial need based on your income and family size. The process typically involves accessing your student loan servicer’s website or contacting them directly.

Comparison of Income-Driven Repayment Plans

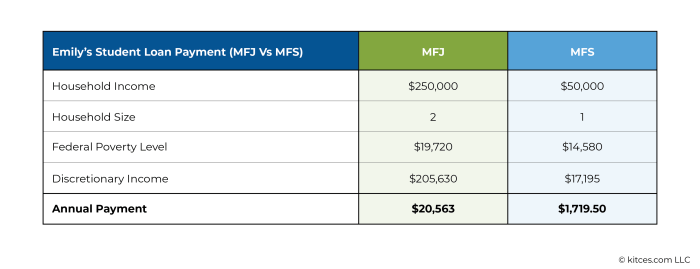

Several IDR plans exist, each with slightly different eligibility requirements and repayment calculations. These include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). While all aim to lower monthly payments based on income, the specific formulas used to calculate these payments differ, resulting in variations in monthly payments and total interest paid. For example, IBR and PAYE are generally considered more favorable to borrowers with lower incomes, while REPAYE offers a more straightforward calculation. ICR often results in higher payments than other plans. A thorough comparison of these plans is necessary to determine the most suitable option for individual circumstances.

Examples of Successful Income-Driven Repayment Plan Implementation

Consider a recent graduate with a significant amount of student loan debt and a low-paying entry-level job. By enrolling in an IDR plan like REPAYE, they were able to significantly reduce their monthly payment, making budgeting easier and preventing default. Another example is a teacher who experienced a period of unemployment. The flexibility of an IDR plan allowed them to adjust their payments during this time, avoiding delinquency and preserving their credit score. These cases highlight how IDR plans can provide crucial financial support and prevent potential crises for borrowers facing temporary or long-term financial challenges.

Non-Traditional Approaches to Student Loan Management

Navigating significant student loan debt requires a proactive and often unconventional approach. This section explores strategies beyond standard repayment plans, focusing on practical steps to manage debt effectively and minimize long-term financial strain. These strategies demand careful planning, diligent research, and proactive communication with lenders.

Hypothetical Budget for a Student with Significant Student Loan Debt

This budget example illustrates a potential approach for a student with $50,000 in student loan debt and a monthly payment of $700. The goal is to allocate funds while prioritizing debt reduction. Remember that this is a sample; your specific needs will require adjustments.

| Income | Amount |

|---|---|

| Monthly Net Income (after taxes) | $3000 |

| Expenses | Amount |

| Housing (Rent/Mortgage) | $1000 |

| Student Loan Payment | $700 |

| Groceries | $300 |

| Transportation | $200 |

| Utilities | $150 |

| Debt Reduction (Extra Payment) | $150 |

| Savings/Emergency Fund | $100 |

| Other Expenses | $200 |

This budget prioritizes loan repayment and includes an extra $150 for accelerated debt reduction. Adjustments to spending in other categories may be necessary based on individual circumstances.

Negotiating Lower Monthly Payments with Loan Servicers

Negotiating lower monthly payments involves directly contacting your loan servicer. This might involve exploring options like income-driven repayment plans (IDR) which base your monthly payments on your income and family size. Documentation of your income and expenses will be crucial. Be prepared to discuss your financial hardship and explore potential solutions collaboratively. Persistence and clear communication are key to achieving a favorable outcome.

Refinancing Student Loans with a Private Lender

Refinancing involves replacing your existing federal student loans with a new loan from a private lender. This process usually requires a credit check, and a good credit score is essential for securing favorable terms. Private lenders may offer lower interest rates than your current federal loans, potentially reducing your monthly payments and overall interest paid. The application process involves comparing offers from multiple lenders, reviewing terms and conditions carefully, and submitting all necessary documentation.

Risks and Benefits Associated with Student Loan Refinancing

Refinancing student loans presents both advantages and disadvantages. Benefits include potentially lower interest rates and monthly payments, simplifying repayment with a single loan, and potentially shortening the repayment term. However, refinancing federal loans with a private lender means losing access to federal loan forgiveness programs and income-driven repayment plans. It’s essential to weigh these factors carefully before making a decision. A thorough cost-benefit analysis is recommended.

Resources Available to Students Struggling with Loan Repayment

Understanding available resources is crucial for managing student loan debt. These resources can provide guidance, support, and potential solutions to financial challenges.

- National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services, including student loan debt management.

- StudentAid.gov: The official U.S. Department of Education website providing information on federal student aid, repayment plans, and loan forgiveness programs.

- Your Loan Servicer: Contacting your loan servicer directly can provide personalized guidance and explore available repayment options.

- Financial Aid Office at your College/University: Your institution may offer post-graduation financial counseling and resources.

- Nonprofit Credit Counseling Agencies: These agencies offer financial literacy programs and assistance with debt management strategies.

The Role of Financial Literacy in Managing Student Loan Debt

Successfully navigating student loan repayment requires more than just understanding repayment plans; it demands a strong foundation in financial literacy. A comprehensive understanding of personal finance empowers borrowers to make informed decisions, optimize their repayment strategy, and ultimately achieve financial well-being. This section explores the crucial role of financial literacy in managing student loan debt and provides practical strategies for improving financial skills.

Creating a Comprehensive Financial Plan

A well-structured financial plan acts as a roadmap to financial health. It involves assessing your current financial situation, setting realistic financial goals (such as becoming debt-free), and developing a strategy to achieve those goals. This plan should include a detailed budget, a debt repayment strategy (which might incorporate student loan repayment), savings goals (including an emergency fund), and long-term financial objectives, such as homeownership or retirement planning. Failing to plan is planning to fail; a comprehensive financial plan provides a framework for making sound financial decisions, particularly when managing significant debt like student loans.

Strategies for Improving Financial Literacy and Budgeting Skills

Improving financial literacy involves actively seeking knowledge and developing practical skills. This can be achieved through various resources such as free online courses offered by reputable institutions (e.g., Khan Academy), workshops offered by community organizations, or personal finance books and articles from trusted sources. Budgeting skills are crucial; effective budgeting involves tracking income and expenses meticulously to understand spending patterns and identify areas for potential savings. Utilizing budgeting apps or spreadsheets can greatly simplify this process. Regularly reviewing and adjusting the budget is also essential to ensure it aligns with changing circumstances and financial goals.

Debt Consolidation and its Potential Implications

Debt consolidation involves combining multiple debts into a single loan, often with a lower interest rate. For student loans, this could mean consolidating federal loans into a single federal loan or refinancing private student loans. While debt consolidation can simplify repayment and potentially lower monthly payments, it’s crucial to carefully evaluate the terms and conditions of any consolidation or refinancing offer. A higher interest rate over the life of the loan could negate any short-term benefits. Borrowers should compare offers from multiple lenders before making a decision and understand the potential impact on their credit score. For example, refinancing private loans might impact access to federal loan forgiveness programs.

Tracking Expenses and Managing Debt Effectively

Effective expense tracking is fundamental to successful debt management. Methods include using budgeting apps, maintaining a spreadsheet, or utilizing a simple notebook. Categorizing expenses (e.g., housing, transportation, food) provides a clear picture of spending habits. Identifying areas where expenses can be reduced allows for more funds to be allocated towards student loan repayment. Furthermore, prioritizing high-interest debt, such as credit card debt, while strategically managing student loan payments can significantly reduce the overall debt burden. For instance, the avalanche method (paying off the highest interest debt first) can be particularly effective.

Building an Emergency Fund While Paying Off Student Loans

Building an emergency fund is crucial, even while actively repaying student loans. The general recommendation is to aim for 3-6 months’ worth of living expenses in an easily accessible savings account. This fund acts as a safety net, protecting against unexpected events (job loss, medical emergencies) that could otherwise derail repayment efforts. Start small; even saving a small amount consistently contributes to the fund over time. Consider automating savings by setting up regular transfers from your checking account to your savings account. Prioritize saving a small amount consistently over attempting to save a large sum all at once. For example, if your monthly expenses are $2,000, aiming to save $250-$500 per month will help you build a $3,000-$6,000 emergency fund within a reasonable timeframe.

Long-Term Financial Planning and Student Loan Debt

Student loan debt significantly impacts long-term financial planning, potentially delaying or altering major life milestones and requiring careful consideration of budgeting, saving, and investing strategies. Understanding its influence is crucial for building a secure financial future.

Student loan payments represent a significant ongoing expense that directly affects a person’s ability to save and invest. This necessitates a proactive and well-structured approach to financial management to navigate these challenges effectively.

Impact of Student Loan Debt on Major Life Goals

Student loan debt can significantly postpone or even prevent achieving major life goals. For instance, the monthly payments can reduce the amount available for a down payment on a house, making homeownership more difficult or requiring a longer timeframe to achieve. Similarly, saving for a down payment, covering closing costs, and accumulating enough for a comfortable emergency fund all become more challenging when significant portions of income are allocated to student loan repayment. The burden can also affect other significant life goals such as starting a family, funding higher education for children, or pursuing entrepreneurial endeavors. The size of the debt and the repayment terms directly influence the timeline for achieving these goals. For example, someone with a $100,000 loan at 7% interest will have a longer repayment period and less disposable income than someone with a $20,000 loan at 4%.

Strategies for Investing and Saving While Managing Student Loan Debt

Prioritizing saving and investing alongside student loan repayment requires a disciplined approach. A common strategy is to maximize employer-sponsored retirement plans, taking advantage of matching contributions to effectively increase savings. Additionally, focusing on high-yield savings accounts or low-risk investments, like government bonds, can provide a safe place for emergency funds while gradually building wealth. Budgeting is paramount; tracking expenses and identifying areas for cost reduction frees up funds for both loan repayment and savings. For example, reducing dining-out expenses or opting for less expensive transportation can free up hundreds of dollars monthly, which can be channeled into loan payments or investments. Another important strategy is to carefully consider the interest rates on student loans. If possible, aggressively paying down high-interest loans while making minimum payments on lower-interest loans can reduce the overall debt burden faster.

Creating a Long-Term Financial Plan Incorporating Student Loan Repayment

Developing a comprehensive financial plan involves several key steps. First, create a realistic budget that accounts for all income and expenses, including student loan payments. Next, determine a manageable repayment strategy, such as the standard repayment plan, graduated repayment plan, or income-driven repayment plan, to understand the monthly commitment. Then, establish short-term and long-term financial goals, such as paying off the loans within a specific timeframe and saving for a down payment or retirement. Prioritize high-interest debt reduction to minimize the total interest paid over the loan’s life. Regularly review and adjust the plan as needed, considering factors such as income changes, interest rate fluctuations, and unexpected expenses. Utilizing budgeting apps and financial planning software can assist in this process, providing tools for tracking progress and making informed decisions.

Balancing Student Loan Repayment with Other Financial Priorities

Balancing student loan repayment with other financial priorities, such as saving for a down payment or retirement, requires careful prioritization and resource allocation. One approach is to adopt the debt snowball or debt avalanche method, focusing on paying off the smallest or highest-interest debts first, respectively, to build momentum and motivation. Another strategy involves automating loan payments and savings contributions, ensuring consistent progress towards both goals. Consider negotiating lower interest rates with your lender, or refinancing your loans to a lower interest rate, which can significantly reduce the total repayment amount and free up more funds for other financial priorities. This can also shorten the repayment period, allowing quicker access to funds for other life goals.

Impact of Student Loan Debt on Retirement Planning

Student loan debt can significantly impact retirement planning. The ongoing monthly payments reduce the amount available for retirement savings, potentially leading to a smaller nest egg. To mitigate this, individuals can consider contributing the maximum amount to retirement accounts, such as 401(k)s and IRAs, while simultaneously managing student loan payments. Delaying retirement or working longer may be necessary to compensate for the reduced retirement savings due to student loan debt. Early and consistent retirement savings, combined with a strategic approach to student loan repayment, are crucial to ensure a comfortable retirement. For example, someone with a $50,000 student loan debt and a $50,000 retirement savings at age 30 will likely need to increase their retirement contributions significantly compared to someone without student loan debt to reach a similar retirement savings goal.

Visual Representation of Student Loan Repayment Strategies

Understanding the various repayment plans available can be overwhelming. Visual aids offer a clear and concise way to compare the timelines and potential financial implications of each option. This section will describe two visual representations that can help clarify the complexities of student loan repayment.

Effective visualization is crucial for understanding the long-term impact of different student loan repayment strategies. By presenting data graphically, individuals can quickly grasp the differences in repayment periods, total interest paid, and monthly payments under various plans. This facilitates informed decision-making, enabling borrowers to choose the plan best suited to their financial circumstances.

Timeline Comparison of Student Loan Repayment Plans

This visual would take the form of a bar chart, with each bar representing a different repayment plan (e.g., Standard, Extended, Income-Driven Repayment). The horizontal axis would represent time in years, showing the total repayment period for each plan. The vertical axis would represent the cumulative amount paid, showing the total principal and interest over the life of the loan. The bars would be color-coded for easy differentiation: Standard Repayment could be blue, Extended Repayment could be green, and Income-Driven Repayment could be orange. A legend would clearly label each bar and its corresponding repayment plan. Additional visual elements could include annotations highlighting the total interest paid under each plan, emphasizing the cost differences between strategies. For example, a longer, thinner blue bar might show a Standard plan’s quicker repayment but higher monthly payments, while a longer, thicker orange bar might represent an Income-Driven plan with lower monthly payments but a much longer repayment period and significantly higher total interest.

Income, Expenses, and Student Loan Payment Infographic

This infographic would utilize a circular chart (pie chart) to illustrate the relationship between income, expenses, and student loan payments. The entire circle would represent the borrower’s monthly income. Different segments of the circle would be allocated to represent various expense categories: housing (dark blue), food (light blue), transportation (green), student loan payments (red), and other expenses (grey). The size of each segment would be proportional to the amount allocated to that category. For example, if student loan payments represent 20% of the monthly income, the red segment would occupy 20% of the circle. The infographic would also include a small table listing the actual dollar amounts for each category, allowing for a more precise understanding of the financial picture. The use of contrasting colors and clear labels would enhance readability and comprehension. A small illustrative icon beside each category would make it even more user-friendly (e.g., a house icon for housing, a car icon for transportation). This visual would effectively highlight the impact of student loan payments on the borrower’s overall budget, enabling them to assess their financial capacity and make necessary adjustments. For instance, if the “other expenses” segment is too small, it might suggest the need for a budget review and potential adjustments to other spending habits.

Last Recap

Successfully managing student loan debt requires a proactive and informed approach. By understanding the diverse repayment options, employing effective budgeting strategies, and prioritizing financial literacy, you can significantly reduce the long-term impact of student loans. Remember, a well-defined plan, coupled with consistent effort, empowers you to achieve your financial goals and build a secure future. This guide serves as a starting point; seeking personalized financial advice is crucial for navigating your unique circumstances.

Commonly Asked Questions

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can discuss options like forbearance, deferment, or income-driven repayment plans to help you manage your payments temporarily.

Can I consolidate my federal and private student loans?

You can’t consolidate federal and private loans together. However, you can refinance your private loans or consolidate your federal loans into a Direct Consolidation Loan.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends your payments, but interest may still accrue. Deferment postpones payments, and under certain circumstances, interest may be subsidized (not accruing).

How does income-driven repayment affect my credit score?

Making timely payments on any repayment plan, including income-driven plans, is positive for your credit score. Consistent missed payments, however, will negatively impact your score.