Navigating the complex world of student loans can feel overwhelming, but understanding the prequalification process can significantly simplify your journey. Prequalification offers a crucial first step, allowing you to explore potential loan options without impacting your credit score and providing valuable insights into your borrowing power. This process empowers you to make informed decisions, compare offers effectively, and ultimately secure the best possible financing for your education.

This guide will demystify student loan prequalification, providing a clear understanding of what it entails, how it works, and how to leverage it to your advantage. We’ll cover key factors influencing your eligibility, the benefits and drawbacks, and crucial steps to take after receiving a prequalification offer. We’ll also address common questions and concerns to ensure you feel confident and prepared throughout the entire process.

Understanding “Student Loans Prequalification”

Student loan prequalification is a valuable tool for prospective borrowers. It provides a preliminary assessment of your eligibility for student loans without impacting your credit score, allowing you to explore your borrowing options and plan accordingly. This process offers a glimpse into potential loan amounts and interest rates, helping you make informed decisions before committing to a formal application.

Prequalification and a formal application are distinct stages in the student loan process. Prequalification involves providing basic financial information to receive an estimate of your loan eligibility. A formal application, on the other hand, requires a more detailed submission of documents and undergoes a thorough credit check to determine the final loan terms. Think of prequalification as a “test drive” before committing to buying a car – it gives you a feel for the vehicle without obligating you to purchase it. A formal application is the equivalent of completing the purchase.

The Student Loan Prequalification Process

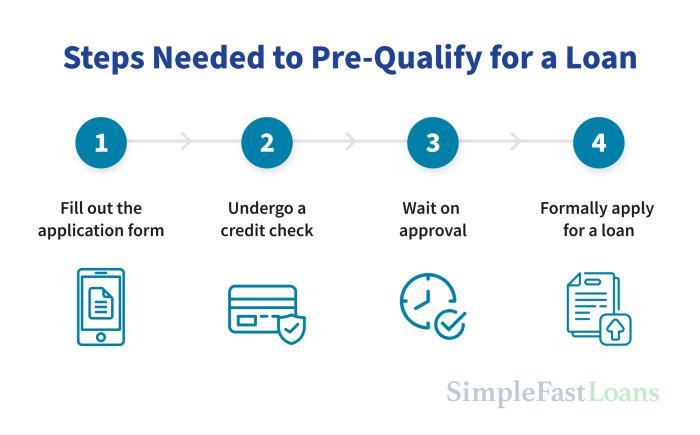

The prequalification process generally follows these steps:

- Gather Necessary Information: You will need basic personal and financial details such as your Social Security number, date of birth, anticipated college costs, and current income (if applicable).

- Complete the Prequalification Form: Most lenders offer online prequalification forms that require you to input the collected information. The form will usually ask for details about your education plans, such as the school you plan to attend and your intended degree program.

- Review Your Prequalification Results: Once you submit the form, the lender will provide a preliminary assessment of your eligibility. This typically includes an estimated loan amount and interest rate range. Keep in mind that this is not a guaranteed loan offer.

- Compare Offers (If Applicable): If you prequalify with multiple lenders, compare their offerings to find the best terms. Consider factors such as interest rates, fees, and repayment options.

Comparison of Student Loan Prequalification Tools

Different lenders offer varying prequalification tools. Comparing these tools can help you find the best fit for your needs. While specific features may vary depending on the lender, here’s a general comparison:

| Feature | Lender A | Lender B | Lender C |

|---|---|---|---|

| Online Application Availability | Yes | Yes | Yes |

| Information Required | SSN, Date of Birth, Estimated College Costs | SSN, Date of Birth, Estimated College Costs, Income | SSN, Date of Birth, Estimated College Costs, Credit Check (Soft Pull) |

| Speed of Results | Instant | Within 24 hours | Within 48 hours |

| Additional Features | Loan amount and interest rate range | Loan amount, interest rate range, repayment options | Loan amount, interest rate range, repayment options, personalized financial advice |

Factors Affecting Prequalification

Securing a student loan prequalification hinges on several key factors that lenders meticulously assess. Understanding these factors empowers prospective borrowers to improve their chances of a favorable outcome and to better understand the process itself. The more prepared you are, the smoother your application process will likely be.

Credit Score

Your credit score is a cornerstone of the prequalification process. Lenders use it to gauge your creditworthiness and repayment reliability. A higher credit score generally translates to better loan terms, including lower interest rates and potentially higher loan amounts. Conversely, a low credit score can significantly limit your eligibility or result in less favorable loan options. For example, a credit score above 700 often signifies a lower risk to the lender, potentially leading to preferential treatment, while a score below 600 may result in higher interest rates or even loan denial. Credit reports, which contain information on your payment history, debt levels, and length of credit history, directly influence your credit score and are vital in the prequalification process.

Income and Debt-to-Income Ratio

Lenders carefully scrutinize your income to determine your ability to repay the loan. A stable and sufficient income demonstrates your capacity to manage monthly payments without undue financial strain. Furthermore, your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income, plays a crucial role. A lower DTI indicates a greater capacity to handle additional debt, increasing your chances of prequalification. For instance, a borrower with a high income and low existing debt will likely have a lower DTI and a higher likelihood of prequalification compared to someone with a lower income and high existing debt. The calculation of DTI is typically expressed as a percentage:

(Total Monthly Debt Payments / Gross Monthly Income) x 100 = DTI%

A lower DTI percentage is generally preferred by lenders.

Financial Situation Examples

Let’s consider two hypothetical scenarios to illustrate how different financial situations impact prequalification. Scenario A: A student with a high credit score (750), a stable income of $50,000 per year, and minimal existing debt (DTI of 10%) is likely to receive a favorable prequalification offer with potentially low interest rates and a high loan amount. Scenario B: A student with a low credit score (550), inconsistent income, and high existing debt (DTI of 60%) faces a significantly lower chance of prequalification. If approved, they would likely receive a loan with less favorable terms, such as higher interest rates and a lower loan amount. These scenarios highlight the importance of a strong financial profile in the prequalification process.

Benefits and Drawbacks of Prequalification

Student loan prequalification offers a valuable opportunity to understand your borrowing power before formally applying for loans. This process allows you to explore potential loan amounts and interest rates without impacting your credit score, giving you a clearer picture of your financial options for higher education. However, it’s crucial to understand both the advantages and limitations of this tool to make informed decisions.

Prequalification provides a snapshot of your eligibility, enabling you to compare different lenders and loan products more effectively. This allows for a more strategic approach to the loan application process, ultimately potentially saving you time and money. By understanding your prequalification parameters, you can better manage your expectations and avoid the disappointment of being rejected for loans you are unlikely to qualify for.

Advantages of Prequalification

Prequalification offers several key advantages. It allows you to shop around for the best loan terms without impacting your credit score, a significant benefit compared to directly applying for multiple loans. The process is generally quick and easy, often requiring only basic personal and financial information. This preliminary assessment provides a realistic view of your borrowing capacity, preventing you from pursuing loans that are unattainable. Finally, knowing your prequalification details empowers you to adjust your financial plans accordingly, potentially allowing for better budgeting and preparation for college expenses.

Drawbacks of Prequalification

While prequalification offers benefits, it’s important to recognize its limitations. A prequalification is not a guarantee of loan approval; it’s simply an indication of your potential eligibility. The final loan terms, including the interest rate and loan amount, may differ from the prequalification offer. Furthermore, the information provided during prequalification is only a snapshot in time; changes in your financial situation could affect your eligibility later on. Lastly, relying solely on prequalification without further research could lead to overlooking potentially better loan options from lenders not included in your initial search.

Comparison of Prequalification and Direct Application

Directly applying for a student loan involves a more thorough review of your financial history and creditworthiness. This process may result in a credit score impact, potentially affecting your eligibility for other types of credit in the future. Prequalification, on the other hand, is a softer inquiry that typically doesn’t impact your credit score, allowing you to explore multiple options without risking your credit rating. While prequalification offers a preliminary assessment, a direct application provides a definitive answer regarding loan approval and specific terms. The choice between these methods depends on the borrower’s priorities and risk tolerance.

Pros and Cons of Prequalification

Before deciding whether to use a prequalification tool, consider the following:

- Pros:

- No impact on credit score (generally).

- Quick and easy process.

- Allows comparison shopping for best loan terms.

- Provides a realistic expectation of borrowing power.

- Helps in budgeting and financial planning.

- Cons:

- Not a guarantee of loan approval.

- Final loan terms may differ from prequalification offer.

- Eligibility can change over time.

- May not encompass all available loan options.

Finding and Using Prequalification Tools

Finding the right student loan can feel overwhelming, but prequalification tools can significantly simplify the process. These tools offer a quick snapshot of your potential borrowing power without impacting your credit score, allowing you to compare different loan options and make informed decisions. Understanding how to effectively use these tools is key to securing the best financing for your education.

Prequalification tools provide a valuable first step in the student loan application journey. By inputting basic financial information, you can receive an estimate of the loan amount you may qualify for, helping you set realistic expectations and refine your college funding strategy. This allows for more effective comparison shopping and a smoother transition into the formal application process.

Reputable Sources for Student Loan Prequalification Tools

Several reputable sources offer student loan prequalification tools. It’s crucial to use only trusted platforms to protect your personal information. Choosing a well-established lender or financial institution minimizes the risk of scams and ensures data security.

- Major Lenders: Many large banks and financial institutions (e.g., Sallie Mae, Discover, Citizens Bank) offer prequalification tools directly on their websites. These lenders often provide detailed information about their loan terms and interest rates.

- Government Websites: While not always offering direct prequalification, government websites like StudentAid.gov (in the US) provide valuable information about federal student loan programs and eligibility requirements. This information can be used to inform your prequalification expectations with private lenders.

- Independent Comparison Websites: Several independent websites compare student loan options from various lenders. Some of these may incorporate prequalification tools to help you narrow your choices. However, always verify the legitimacy and security of any such website before submitting personal information.

Using a Prequalification Tool: A Flowchart

The process of using a prequalification tool is generally straightforward. The following flowchart illustrates the typical steps involved:

[Imagine a flowchart here. The flowchart would begin with a “Start” box. The next box would be “Access Prequalification Tool (website or app).” This would lead to a box titled “Enter Required Information (e.g., income, credit score, education level).” This would connect to a box labeled “Submit Information.” Then, a decision box: “Is the information valid?” A “Yes” branch leads to a box “Receive Prequalification Results (loan amount, interest rate estimates).” A “No” branch leads to a box “Correct Errors and Resubmit.” Both branches ultimately connect to an “End” box.]

Information Typically Requested During Prequalification

Prequalification tools generally request basic personal and financial information to generate an estimate. The specific information required may vary, but typically includes:

- Social Security Number (SSN): Used for verification and credit check (a soft pull, which doesn’t affect your credit score).

- Date of Birth: For identification purposes.

- Annual Income: To assess your repayment capacity.

- Credit Score (sometimes): Some tools may request this, though many use a soft pull which doesn’t affect credit scores.

- Education Level and Intended Program: To determine the loan amount needed.

- School Information (sometimes): This may be required to estimate costs and potential loan amounts.

Tips for Effectively Using Prequalification Tools

To maximize the benefits of prequalification tools, consider these tips:

- Compare Multiple Lenders: Use prequalification tools from several lenders to compare interest rates, fees, and repayment options. This ensures you get the best possible deal.

- Understand the Limitations: Remember that prequalification is just an estimate. Your actual loan terms may vary based on a full credit check and the final loan application.

- Review the Fine Print: Carefully read the terms and conditions of each lender’s prequalification tool and loan offerings before making any decisions.

- Protect Your Information: Only use prequalification tools from reputable lenders and websites to safeguard your personal data.

Next Steps After Prequalification

Receiving a student loan prequalification isn’t the finish line; it’s a crucial stepping stone. This prequalification gives you a general idea of how much you might borrow, but it’s not a guaranteed loan offer. Several important steps remain to secure the best possible financing for your education.

After receiving your prequalification, you’ll need to carefully review the terms and then actively compare offers from various lenders to find the most suitable loan. This process involves understanding the interest rates, fees, repayment terms, and any other conditions associated with the loan. Negotiation may also be possible to secure more favorable terms.

Comparing Loan Offers from Different Lenders

Comparing loan offers requires a methodical approach. Don’t just focus on the interest rate; consider the total cost of the loan, including fees and the length of the repayment period. Each lender will have different criteria and terms, and a seemingly lower interest rate might be offset by higher fees or less favorable repayment options. A longer repayment period might result in lower monthly payments but could lead to significantly higher interest paid over the life of the loan. Consider using a loan comparison tool or spreadsheet to organize the information.

Negotiating Loan Terms After Prequalification

While prequalification doesn’t guarantee loan approval, it strengthens your negotiating position. Having multiple prequalification offers from different lenders provides leverage. You can use these offers to negotiate better terms with individual lenders. For instance, if one lender offers a lower interest rate but higher fees, you might be able to use a competing offer with lower fees to negotiate a reduction in fees from the first lender. Remember to be polite but firm in your negotiations, clearly stating your preferred terms and the competing offers you have received.

Key Aspects to Consider When Comparing Loan Offers

The following table summarizes crucial factors to consider when comparing student loan offers. Remember that the best loan for you will depend on your individual financial situation and circumstances.

| Loan Provider | Interest Rate (APR) | Fees | Repayment Terms |

|---|---|---|---|

| Lender A | 6.5% | $100 origination fee | 10-year fixed repayment |

| Lender B | 7.0% | No origination fee | 15-year fixed repayment |

| Lender C | 6.8% | $50 origination fee | 10-year variable repayment |

Illustrative Scenarios

Understanding how student loan prequalification works in practice is best illustrated through specific examples. These scenarios highlight both the benefits and potential challenges of using prequalification tools.

Successful Prequalification and Favorable Loan

Sarah, a recent graduate with a strong academic record and a credit score of 750, used a prequalification tool offered by a reputable lender. The tool indicated she was likely eligible for a loan amount of $30,000 at a competitive interest rate of 5%. Armed with this information, Sarah felt confident in applying for the loan. She then submitted a formal application, and, as anticipated, received approval for a loan very close to the prequalified amount with an interest rate only slightly higher than initially indicated. The prequalification process allowed Sarah to shop around for the best loan terms and ultimately secured a favorable loan offer, saving her time and potentially money.

Prequalification Revealing a Need for Financial Improvement

Mark, a student with limited credit history and some outstanding debt, used a prequalification tool and was surprised to find that his eligibility for a student loan was significantly lower than expected. The tool suggested he might only qualify for a small loan amount at a much higher interest rate. This prequalification acted as a wake-up call. Mark realized he needed to improve his credit score and reduce his outstanding debt before applying for a larger loan. He began by paying down his existing debts and diligently paying his bills on time. This proactive approach improved his financial standing and set him on the path to securing a more favorable loan in the future.

Impact of Different Credit Scores on Prequalification

Consider two students, both applying for a $25,000 student loan. Anna has an excellent credit score of 800, while Ben has a fair credit score of 650. Using the same prequalification tool, Anna receives a prequalification offer indicating eligibility for the full $25,000 at a low interest rate of 4%. Ben, on the other hand, receives a prequalification indicating eligibility for only $15,000 at a higher interest rate of 7%. This scenario clearly demonstrates how credit score significantly impacts the prequalification results, influencing both the loan amount and the interest rate offered.

Comparing Results from Different Prequalification Tools

David used two different online prequalification tools to gauge his eligibility for a student loan. Tool A, from Lender X, indicated eligibility for $20,000 at 6% interest. Tool B, from Lender Y, suggested eligibility for $18,000 at 5.5% interest. The discrepancy highlights the importance of using multiple tools. While both tools provided a range of potential loan offers, the variation in amounts and interest rates underscores the need for thorough research and comparison shopping before formally applying for a student loan. The differences could be due to the lenders’ varying credit scoring models and lending criteria.

Closing Notes

Securing student loans is a significant financial undertaking, and understanding the prequalification process is key to making informed choices. By carefully reviewing your financial situation, utilizing available prequalification tools, and comparing loan offers, you can navigate this process with confidence. Remember, prequalification is a valuable tool for exploring your options and securing the best possible financing for your educational goals. Don’t hesitate to utilize the resources available and seek professional guidance if needed.

FAQs

What information is typically needed for prequalification?

Generally, lenders require basic personal information such as your name, date of birth, Social Security number, and information about your education plans (school, degree, etc.). They may also request details about your income and existing debt.

Does prequalifying for a student loan affect my credit score?

No, a prequalification inquiry typically does not impact your credit score. Hard credit inquiries, which occur when a lender formally reviews your application, are the ones that typically affect your score.

What if I’m prequalified for a loan but the terms aren’t favorable?

You are not obligated to accept a prequalification offer. Use the information to compare offers from other lenders and negotiate terms to find a more suitable loan.

How long does the prequalification process usually take?

The process is usually quick, often taking only a few minutes to complete online. However, receiving a formal loan offer after prequalification may take longer.