Navigating the world of student loans can feel overwhelming, especially when considering private lenders. This guide delves into the intricacies of private student loans, offering a clear understanding of interest rates, eligibility requirements, repayment options, and crucial comparisons with federal loans. We’ll explore the advantages and disadvantages, helping you make informed decisions about financing your education.

Understanding the nuances of private student loans is vital for responsible borrowing. This guide aims to demystify the process, providing practical advice and insights to empower you in your financial journey. We’ll cover everything from application processes to managing repayment and avoiding predatory lending practices.

Interest Rates and Fees for Private Student Loans

Securing a private student loan involves careful consideration of several key factors, primarily interest rates and associated fees. Understanding these aspects is crucial for making informed borrowing decisions and managing your repayment effectively. This section will provide a comparative overview of interest rates from various lenders, detail common fee structures, and explain how these rates are determined.

Private Student Loan Interest Rate Comparison

The interest rate you’ll receive on a private student loan is highly variable and depends on several factors, as discussed below. The following table offers a comparison of interest rate ranges from three major private student loan lenders. Note that these rates are subject to change and represent a snapshot in time. Always check directly with the lender for the most current information.

| Lender | Interest Rate Range (Example – Variable Rates) | Fee Structure | Loan Terms |

|---|---|---|---|

| Lender A (Example: Sallie Mae) | 6.00% – 13.00% | Origination fee (e.g., 1-4%), late payment fees, potential prepayment penalties (check lender specifics) | 5-15 years |

| Lender B (Example: Discover) | 6.50% – 14.00% | Origination fee (e.g., 0-2%), late payment fees, potential prepayment penalties (check lender specifics) | 5-10 years |

| Lender C (Example: Citizens Bank) | 7.00% – 14.50% | Origination fee (e.g., 0-3%), late payment fees, potential prepayment penalties (check lender specifics) | 5-15 years |

Private Student Loan Fees

Understanding the various fees associated with private student loans is critical for budgeting and overall financial planning. These fees can significantly impact the total cost of your education.

Several types of fees are commonly associated with private student loans:

- Origination Fees: These are one-time fees charged by the lender when the loan is disbursed. They typically represent a percentage of the loan amount. For example, a 1% origination fee on a $10,000 loan would be $100.

- Late Payment Fees: These fees are charged if you miss a loan payment. The amount varies by lender, but it can be substantial. Consistent on-time payments are crucial to avoid these fees.

- Prepayment Penalties: Some lenders may charge a fee if you pay off your loan early. It’s important to check the loan agreement to determine if this applies.

- Other Fees: Additional fees might include application fees or fees for specific services like deferment or forbearance.

Factors Determining Private Student Loan Interest Rates

Private student loan interest rates are not fixed; they are dynamic and determined by a combination of factors that assess your creditworthiness. Lenders use a complex algorithm to assess risk.

Key factors influencing your interest rate include:

- Credit Score: A higher credit score generally indicates lower risk to the lender, resulting in a lower interest rate. A poor credit history might lead to a higher rate or even loan denial.

- Co-signer Availability: Having a co-signer with good credit can significantly improve your chances of securing a loan and obtaining a lower interest rate. The co-signer assumes responsibility for repayment if you default.

- Loan Amount: Larger loan amounts may carry slightly higher interest rates due to the increased risk for the lender.

- Interest Rate Type: Loans may offer fixed or variable interest rates. Fixed rates remain constant throughout the loan term, while variable rates fluctuate based on market conditions. Variable rates may initially be lower but can increase over time.

Eligibility Requirements and Application Process

Securing a private student loan involves navigating specific eligibility criteria and a multi-step application process. Understanding these aspects is crucial for prospective borrowers to successfully obtain the funding they need for their education. This section details the typical requirements and steps involved, along with a comparison of two example lenders.

Eligibility Criteria for Private Student Loans

Private lenders assess loan applications based on a range of factors to determine creditworthiness and the likelihood of repayment. These criteria often vary between lenders, but some common elements are Artikeld below. It’s essential to check the specific requirements of each lender you consider.

- Credit History: Most lenders require a strong credit history, often demonstrated through a credit score above a certain threshold (this varies by lender, but a good credit score is generally needed). A co-signer with good credit might be necessary for applicants with limited or poor credit history.

- Income: Lenders typically assess your income or the income of your co-signer to ensure sufficient repayment capacity. This helps them gauge your ability to make monthly payments after graduation.

- Debt-to-Income Ratio: This ratio compares your existing debt to your income. A lower ratio generally indicates a lower risk for the lender.

- Enrollment Status: You must be enrolled or accepted at an eligible educational institution. The lender may require proof of enrollment.

- Degree Program: Some lenders may specify eligible degree programs or limit funding based on the type of program.

- Citizenship and Residency: Most lenders require applicants to be U.S. citizens or permanent residents.

Steps in the Private Student Loan Application Process

The application process for private student loans typically follows a structured sequence of steps. Understanding these steps will help you prepare and streamline the process.

- Pre-qualification: Many lenders offer pre-qualification tools that allow you to check your eligibility without impacting your credit score. This provides an initial estimate of your potential loan terms.

- Application Submission: Complete the lender’s online application form, providing personal and financial information.

- Document Submission: Gather and submit the necessary documentation, such as proof of enrollment, tax returns, and credit reports.

- Credit Check and Review: The lender will review your application and conduct a credit check to assess your creditworthiness.

- Loan Approval or Denial: You will receive notification of the lender’s decision regarding your loan application.

- Loan Agreement: If approved, you will review and sign the loan agreement outlining the terms and conditions.

- Loan Disbursement: The loan funds will be disbursed according to the terms Artikeld in your loan agreement, often directly to your educational institution.

Comparison of Private Student Loan Application Processes

The following table compares the application processes of two hypothetical private student loan lenders, Lender A and Lender B. Note that these are examples and actual processes may vary.

| Lender | Application Process Steps | Required Documentation | Processing Time |

|---|---|---|---|

| Lender A | Online application, credit check, document upload, loan agreement signing, electronic disbursement | Proof of enrollment, tax returns, bank statements, credit report | 7-10 business days |

| Lender B | Online application, pre-qualification, document upload via portal, loan agreement review, disbursement to institution | Proof of enrollment, transcripts, parent tax returns (if co-signed), credit report | 5-7 business days |

Repayment Options and Default Risks

Understanding your repayment options and the potential consequences of default is crucial for responsible private student loan management. Choosing the right repayment plan can significantly impact your monthly budget and long-term financial health. Equally important is understanding the serious repercussions of failing to meet your repayment obligations.

Private Student Loan Repayment Plans

The repayment plan you select will influence your monthly payments, the loan’s overall cost, and your creditworthiness. Several options are typically available, each with its own advantages and disadvantages.

| Repayment Plan | Monthly Payment Calculation | Loan Term | Potential Impact on Credit Score |

|---|---|---|---|

| Standard Repayment (Fixed-Rate) | Fixed monthly payment over a set period (e.g., 10 years). Calculated based on the loan amount, interest rate, and loan term. | Typically 10-15 years | On-time payments improve credit score; late or missed payments negatively impact credit score. |

| Extended Repayment (Fixed-Rate) | Lower monthly payment spread over a longer period (e.g., 20-25 years). | Typically 20-25 years | While lower monthly payments offer short-term relief, the longer repayment period results in paying significantly more interest overall and may not improve credit score as quickly. |

| Graduated Repayment (Variable-Rate) | Payments start low and gradually increase over time. Interest rates can fluctuate. | Typically 10-15 years | Payment predictability is low, making it harder to budget consistently. Credit score impact depends on consistent payments despite fluctuations. |

| Income-Driven Repayment (May or may not be available depending on lender) | Monthly payments are calculated based on a percentage of your discretionary income. | Typically 20-25 years | May offer more flexibility in managing payments, but potential for forgiveness may lead to a tax liability. Consistent payments are still crucial for credit health. |

Consequences of Defaulting on Private Student Loans

Defaulting on a private student loan has severe financial and legal ramifications. These consequences can significantly impact your future borrowing ability and overall financial well-being.

- Negative Impact on Credit Score: A default will severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: Lenders can legally garnish your wages to recover the debt. This means a portion of your paycheck will be directly sent to the lender.

- Bankruptcy: While student loans are generally not dischargeable in bankruptcy, some exceptions exist depending on your circumstances. However, bankruptcy will severely damage your credit.

- Legal Action: Lenders may take legal action, including lawsuits, to recover the debt. This can lead to additional fees and court costs.

- Collection Agencies: Your debt may be sold to collection agencies, who will aggressively pursue payment. This can further damage your credit and create significant stress.

Strategies for Managing Private Student Loan Debt

Effective debt management strategies can significantly reduce the risk of default. Proactive planning and responsible financial behavior are key to successful repayment.

- Create a Budget: Track your income and expenses to determine how much you can realistically afford to pay each month.

- Explore Repayment Options: Carefully consider the various repayment plans available and choose the one that best suits your financial situation. Contact your lender to discuss options.

- Communicate with Your Lender: If you anticipate difficulty making payments, contact your lender immediately to discuss potential options, such as forbearance or deferment.

- Consider Refinancing: If interest rates have fallen since you took out your loans, refinancing could lower your monthly payments and reduce the total interest paid. Shop around for the best rates.

- Seek Financial Counseling: A non-profit credit counseling agency can provide guidance on managing your debt and creating a realistic repayment plan.

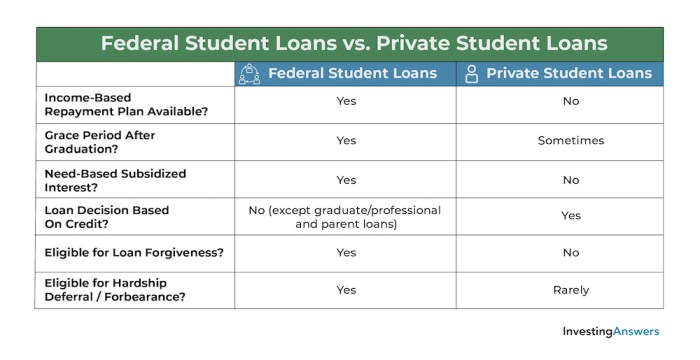

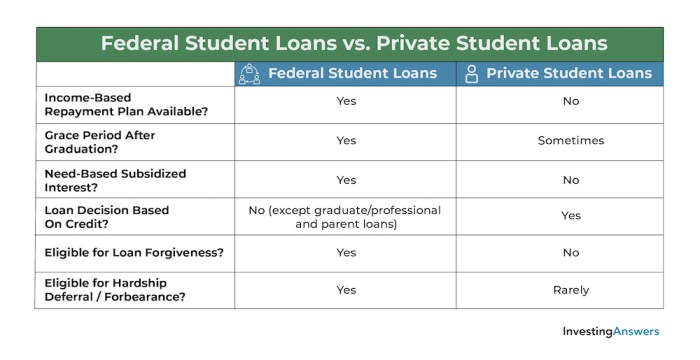

Comparison with Federal Student Loans

Choosing between private and federal student loans is a crucial decision impacting your financial future. Understanding the key differences between these loan types is essential for making an informed choice that aligns with your individual circumstances and financial goals. This section will compare and contrast these options, highlighting their respective benefits and drawbacks.

Federal and private student loans differ significantly in terms of interest rates, repayment options, and borrower protections. While federal loans generally offer more favorable terms and protections, private loans can sometimes be necessary to cover the remaining educational costs. Careful consideration of your financial situation and long-term implications is paramount.

Private vs. Federal Loan Features

| Feature | Private Loans | Federal Loans | Key Differences |

|---|---|---|---|

| Interest Rates | Variable or fixed; generally higher than federal loans. | Variable or fixed; generally lower than private loans, subject to change based on market conditions. | Private loan interest rates are typically higher, leading to greater overall borrowing costs. Federal loan rates are often subsidized, meaning the government pays the interest during certain periods. |

| Fees | Origination fees, late payment fees, and other fees may apply. | Generally lower fees than private loans; some federal loans have no origination fees. | Private loans often carry higher fees, adding to the total cost of borrowing. |

| Eligibility | Credit history and co-signer often required; income verification may be needed. | Based on enrollment status and financial need; generally more accessible than private loans. | Federal loans are generally more accessible to students with limited or no credit history. |

| Repayment Options | Fewer repayment options available compared to federal loans; less flexibility. | Various repayment plans available, including income-driven repayment options, which can adjust payments based on income. | Federal loans provide greater flexibility in repayment, potentially lowering monthly payments and preventing default. |

| Borrower Protections | Limited borrower protections; less government oversight. | Strong borrower protections, including deferment and forbearance options in times of financial hardship. | Federal loans offer significantly more protection for borrowers facing financial difficulties. |

| Loan Forgiveness Programs | Generally not eligible for federal loan forgiveness programs. | Eligibility for various loan forgiveness programs depending on the type of loan and employment. Examples include Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. | Federal loans provide access to potential loan forgiveness programs, significantly reducing or eliminating debt under specific circumstances. |

Situations Where Private Student Loans Might Be Suitable

While federal loans are generally preferred, there are circumstances where private student loans might be a necessary supplement.

- When federal loan limits are insufficient to cover educational expenses.

- When a student has excellent credit and can secure a favorable interest rate.

- In situations where a co-signer with strong credit can mitigate risk and secure a lower interest rate.

Situations Where Private Student Loans Might Not Be Suitable

There are several situations where private student loans might not be the best option.

- When a student has poor or limited credit history, resulting in high interest rates and potentially unfavorable terms.

- When the student lacks a co-signer with good credit.

- When the student anticipates financial difficulties during repayment.

- When the student is unsure of their ability to repay the loan promptly.

Implications of Taking Both Federal and Private Student Loans

Borrowing both federal and private student loans can create complexities in repayment management. Juggling multiple loan types with varying interest rates, repayment plans, and servicers can be challenging. It’s crucial to meticulously track all loans, understand the terms of each, and prioritize repayment strategies effectively. Consider consolidating loans where possible to simplify the process.

For example, a student might have federal subsidized loans with a low interest rate and a grace period, alongside private unsubsidized loans with a higher interest rate and immediate repayment requirements. This necessitates a carefully planned repayment strategy to manage both loan types simultaneously and avoid delinquency or default.

Consumer Protection and Lender Practices

Navigating the world of private student loans requires a keen awareness of consumer protection and the practices of various lenders. Understanding your rights and responsibilities is crucial to avoiding potential pitfalls and ensuring a positive borrowing experience. This section will provide guidance on identifying predatory lending practices, accessing resources for struggling borrowers, and the importance of thoroughly reviewing loan agreements.

Borrowers should be particularly vigilant in protecting themselves from unscrupulous lending practices. Private lenders, unlike federal loan programs, are not subject to the same level of government oversight, meaning it is even more critical for students to carefully research and compare lenders before committing to a loan.

Avoiding Predatory Lending Practices

Predatory lending practices can significantly burden borrowers with excessive fees and unfavorable terms. To avoid these traps, prospective borrowers should follow these guidelines:

- Compare interest rates and fees from multiple lenders: Don’t settle for the first offer you receive. Shop around and compare offers to find the most favorable terms.

- Read the fine print carefully: Understand all fees, including origination fees, late payment fees, and prepayment penalties. Be wary of hidden fees or unclear terms.

- Be cautious of lenders who pressure you into borrowing more than you need: Only borrow the amount necessary to cover your educational expenses.

- Verify the lender’s legitimacy: Research the lender thoroughly to ensure they are reputable and licensed to operate in your state.

- Avoid lenders who offer loans with excessively high interest rates or fees: High interest rates can significantly increase the total cost of your loan.

- Understand the repayment terms: Know how long you have to repay the loan and what your monthly payments will be. Consider your post-graduation income and employment prospects.

Resources for Students Struggling with Repayment

Many resources are available to assist students facing difficulties repaying their private student loans. Early intervention is key to preventing serious financial hardship. The following table summarizes some of these resources:

| Resource Type | Organization | Contact Information | Services Offered |

|---|---|---|---|

| Non-profit Credit Counseling Agency | National Foundation for Credit Counseling (NFCC) | Website: nfcc.org (Find a local agency through their website) | Budgeting assistance, debt management plans, financial education |

| Government Agency | Consumer Financial Protection Bureau (CFPB) | Website: consumerfinance.gov | Information on consumer rights, complaint filing, resources for resolving debt issues |

| Student Loan Servicer | (Varies by lender) | Contact information provided on your loan documents | Deferment or forbearance options, repayment plan modifications |

| Legal Aid Society | (Local Legal Aid Organizations) | Search online for “legal aid” + your location | Legal advice and representation for borrowers facing legal issues related to student loan debt |

Importance of Understanding Loan Agreements

Before signing any private student loan agreement, it’s imperative to thoroughly understand all terms and conditions. This includes, but is not limited to, the interest rate, fees, repayment terms, and any potential penalties for late or missed payments. Failing to understand these terms can lead to unforeseen financial burdens and potentially damaging credit consequences. If any aspect of the agreement is unclear, seek clarification from the lender before signing. A signed agreement represents a legally binding contract.

Remember: A clear understanding of your loan agreement is your best defense against financial hardship.

Final Summary

Securing funding for higher education is a significant step, and choosing between federal and private student loans requires careful consideration. This guide has provided a framework for understanding the complexities of private student loans, emphasizing the importance of responsible borrowing and informed decision-making. By understanding the terms, fees, and potential risks, you can navigate the process with confidence and make choices that align with your financial goals.

Expert Answers

What is the difference between a co-signer and an endorser on a private student loan?

A co-signer shares responsibility for the loan, while an endorser simply guarantees payment if the borrower defaults. The co-signer’s credit is directly impacted, whereas the endorser’s impact is less direct.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payment. However, be sure to compare offers carefully before refinancing.

What happens if I miss a payment on a private student loan?

Late payments will negatively impact your credit score and may incur late fees. Consistent missed payments can lead to loan default, resulting in serious financial consequences.

Are there any government programs to help with private student loan repayment?

While there aren’t direct government programs for private student loans like there are for federal loans, some organizations offer counseling and assistance with repayment strategies.