Navigating the complex world of student loans can feel overwhelming, but understanding your options is crucial for a secure financial future. This review delves into the various types of student loans, repayment strategies, and forgiveness programs available, equipping you with the knowledge to make informed decisions about your debt.

From federal and private loan distinctions to the intricacies of loan consolidation and refinancing, we’ll explore effective debt management techniques and the long-term implications of student loan debt on your credit score and financial well-being. We’ll also highlight valuable resources to assist you throughout the process.

Types of Student Loans

Choosing the right student loan is a crucial step in financing your education. Understanding the differences between federal and private loans, along with the various repayment options and associated costs, will help you make informed decisions and avoid potential financial pitfalls. This section will Artikel the key distinctions between these loan types and explore the available repayment plans.

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government, while private student loans are provided by banks, credit unions, and other private lenders. Federal loans generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs, which are not always available with private loans. Eligibility for federal loans is determined by your financial need and enrollment status, whereas private loan eligibility is primarily based on your creditworthiness and co-signer availability. The terms and conditions of private loans can vary significantly between lenders.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, allowing borrowers to tailor their payments to their financial situations. These plans differ in terms of payment amounts, loan terms, and potential for loan forgiveness. Choosing the right plan can significantly impact your monthly budget and overall repayment costs.

Interest Rates and Fees

Interest rates and fees associated with student loans vary depending on the loan type, lender, and borrower’s creditworthiness. Federal student loan interest rates are generally lower than those for private loans and are often fixed, while private loan interest rates can be variable and may be higher depending on market conditions and your credit score. Fees, such as origination fees for federal loans or application fees for private loans, can add to the overall cost of borrowing. It’s essential to compare interest rates and fees carefully before selecting a loan.

| Loan Type | Interest Rate | Repayment Plans | Fees |

|---|---|---|---|

| Federal Subsidized Loan | Variable; set annually by the government. Generally lower than private loans. | Standard, Graduated, Extended, Income-Driven Repayment (IDR) plans (IBR, PAYE, REPAYE, ICR) | Origination fee (typically a percentage of the loan amount). |

| Federal Unsubsidized Loan | Variable; set annually by the government. Generally lower than private loans. | Standard, Graduated, Extended, Income-Driven Repayment (IDR) plans (IBR, PAYE, REPAYE, ICR) | Origination fee (typically a percentage of the loan amount). |

| Federal PLUS Loan (Graduate/Parent) | Variable; set annually by the government. Generally higher than subsidized/unsubsidized loans. | Standard, Graduated, Extended, Income-Driven Repayment (IDR) plans (IBR, PAYE, REPAYE, ICR) | Origination fee (typically a percentage of the loan amount). |

| Private Student Loan | Variable or fixed; determined by the lender based on creditworthiness. Generally higher than federal loans. | Varies by lender; typically standard repayment plans. May offer options similar to federal IDR plans, but not guaranteed. | Application fees, origination fees (may vary significantly between lenders). |

Loan Forgiveness Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several loan forgiveness programs exist to help alleviate the burden for eligible borrowers. These programs offer varying degrees of relief, depending on factors such as your profession, income, and loan type. Understanding the specifics of each program is crucial to determining your eligibility and maximizing your chances of obtaining forgiveness.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, or tribal) and not-for-profit organizations.

The eligibility requirements include having Direct Loans, working full-time for a qualifying employer, and making 120 qualifying monthly payments under a qualifying repayment plan (such as the Income-Driven Repayment plans). The application process involves submitting an Employment Certification form annually to your loan servicer, confirming your employment with a qualifying employer. The timeline for forgiveness can take several years, as you must make 120 qualifying payments.

- Pros: Complete loan forgiveness after 10 years of qualifying payments for those in public service.

- Cons: Strict eligibility requirements, lengthy repayment period, and potential for delays in processing applications.

Teacher Loan Forgiveness Program

This program offers forgiveness of up to $17,500 on your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. Eligibility requires teaching in a low-income school or educational service agency, holding a teaching license, and having federal student loans. The application process involves submitting an application and required documentation to your loan servicer. Forgiveness is typically granted after completing the five years of teaching.

- Pros: Significant loan forgiveness for teachers in need.

- Cons: Limited to teachers in low-income schools, requires five consecutive years of teaching, and specific documentation is needed.

Income-Driven Repayment (IDR) Plans

While not strictly loan forgiveness programs, Income-Driven Repayment (IDR) plans can lead to loan forgiveness after 20 or 25 years of payments. These plans base your monthly payments on your income and family size. After making payments for the required period, any remaining loan balance may be forgiven. Eligibility depends on your income and loan type. The application process involves applying through your loan servicer and providing income documentation. The timeline involves making payments for 20 or 25 years.

- Pros: Lower monthly payments, potential for loan forgiveness after a set period.

- Cons: Forgiveness may result in a significant tax liability, and the length of the repayment period is considerable.

Other Federal Loan Forgiveness Programs

Several other federal loan forgiveness programs exist, often targeted toward specific professions or circumstances. These programs may have varying eligibility requirements and application processes. It’s crucial to research these programs individually to understand their specific requirements and timelines. Examples include programs for nurses, military personnel, and those working in specific underserved areas. These programs frequently have limited funding and competitive application processes. Thorough research is essential to determine eligibility and navigate the application process successfully.

Managing Student Loan Debt

Successfully navigating student loan repayment requires careful planning and proactive management. Understanding your options, creating a realistic budget, and consistently making payments are crucial for avoiding the serious consequences of default. This section will Artikel effective strategies for managing your student loan debt and achieving financial stability.

Budgeting and Managing Student Loan Payments

Effective budgeting is paramount to successful student loan repayment. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your finances. Prioritize essential expenses like housing, food, and transportation, then allocate the remaining funds to your student loans. Remember to build in a buffer for unexpected expenses to avoid falling behind on payments. Regularly review your budget to ensure it aligns with your financial goals and adjust as needed. Consider exploring strategies like the debt snowball or debt avalanche methods to prioritize higher-interest loans for faster repayment.

Creating a Realistic Repayment Plan

A realistic repayment plan is essential to avoid financial stress and ensure timely payments. Begin by determining your total student loan debt, interest rates, and repayment terms. Explore different repayment plans offered by your loan servicer, such as standard, extended, graduated, or income-driven repayment. Choose a plan that aligns with your current financial situation and long-term goals. Factor in your monthly income, expenses, and other financial obligations when selecting a repayment plan. A realistic plan will allow you to make consistent payments without jeopardizing your financial stability. Consider setting up automatic payments to avoid missed payments and late fees.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe financial consequences. This includes damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is seized to repay the debt, is a possibility. Tax refund offset is another consequence, where the government intercepts your tax refund to pay your student loans. Furthermore, default can lead to legal action, including lawsuits and potential collection agency involvement. In some cases, default can even affect your ability to obtain professional licenses or security clearances. Avoiding default is crucial for maintaining your financial health and future opportunities.

Sample Monthly Budget Incorporating Student Loan Payments

This is a sample budget; adjust it to reflect your specific income and expenses.

| Income | Amount |

|---|---|

| Net Monthly Salary | $3,000 |

| Expenses | Amount |

| Housing (Rent/Mortgage) | $1,000 |

| Food | $400 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $300 |

| Other Expenses (Entertainment, Savings, etc.) | $150 |

| Total Expenses | $2300 |

| Net Savings | $700 |

Remember, this is a sample budget. Your actual budget will vary depending on your individual circumstances. It is crucial to track your spending carefully and adjust your budget as needed.

Refinancing Student Loans

Refinancing student loans can be a strategic move to lower your monthly payments and potentially save money over the life of your loan. However, it’s crucial to carefully weigh the benefits against the potential drawbacks before making a decision. This section will explore the key aspects of refinancing to help you determine if it’s the right choice for your financial situation.

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can lead to significant savings, especially if you have a substantial loan balance and a high interest rate. However, refinancing may not always be beneficial, and it’s essential to understand the potential downsides before proceeding.

Benefits and Drawbacks of Refinancing Student Loans

The decision to refinance student loans hinges on a careful comparison of its advantages and disadvantages. A lower interest rate is the most significant benefit, translating to lower monthly payments and reduced overall interest paid. Consolidation of multiple loans into a single payment simplifies repayment management. However, refinancing might lengthen the repayment period, potentially increasing the total interest paid over time. Furthermore, refinancing can impact eligibility for certain loan forgiveness programs. Finally, a lower interest rate may not be guaranteed and depends on your creditworthiness and the prevailing market conditions.

Factors to Consider Before Refinancing

Several key factors should be evaluated before pursuing student loan refinancing. Your credit score significantly influences the interest rate you’ll qualify for; a higher score generally leads to better terms. Your current interest rates and loan balances play a crucial role; refinancing is most advantageous when current rates are significantly higher than those offered by refinancing lenders. The length of your existing loan and your desired repayment term should be considered, as extending the repayment period lowers monthly payments but may increase total interest paid. Finally, assessing your eligibility for income-driven repayment plans or loan forgiveness programs is critical, as refinancing may forfeit these benefits. For example, someone with a 750 credit score and multiple federal loans at 7% interest might benefit significantly from refinancing if they can secure a rate of 4% or lower. Conversely, someone with a lower credit score and loans already on an income-driven repayment plan might find refinancing less beneficial.

Finding a Suitable Refinancing Lender

Finding the right refinancing lender requires research and comparison. Start by checking online lenders specializing in student loan refinancing. Compare interest rates, fees, and repayment terms offered by multiple lenders. Review customer reviews and ratings to gauge the lender’s reputation and customer service. Consider lenders with transparent fees and a user-friendly application process. Remember to pre-qualify with several lenders to get a sense of your potential interest rates without impacting your credit score. A comparison table outlining the interest rates, fees, and repayment terms from different lenders would be a helpful tool in this process.

Calculating Potential Savings from Refinancing

Calculating potential savings involves comparing your current monthly payments and total interest paid with those under a refinanced loan. Use online refinancing calculators to estimate potential savings based on your loan balance, interest rate, and desired repayment term. For example, if you have a $50,000 loan at 7% interest with a 10-year repayment term, a refinancing to 4% with a 12-year term could significantly reduce your monthly payments and overall interest paid. The formula for calculating simple interest is:

Interest = Principal x Rate x Time

However, most student loans accrue compound interest, requiring more complex calculations best handled by online calculators or financial advisors.

Student Loan Consolidation

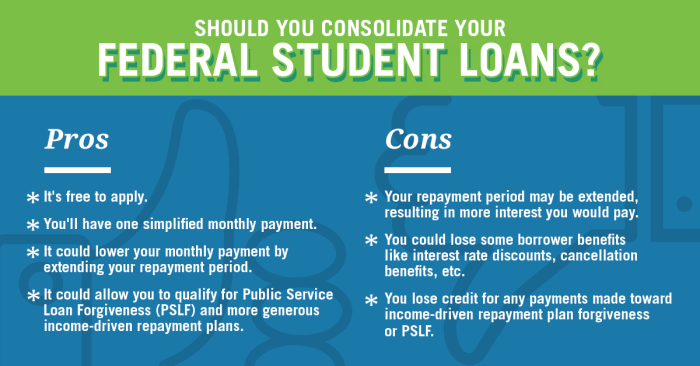

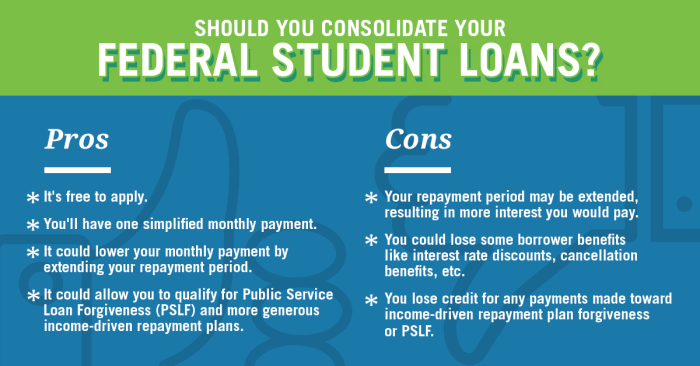

Consolidating your student loans means combining multiple federal student loans into a single, new loan. This can simplify repayment by reducing the number of monthly payments you need to track and potentially lowering your monthly payment amount. However, it’s crucial to understand both the advantages and disadvantages before making a decision.

Consolidation can offer several benefits, but it also comes with potential drawbacks. Careful consideration of your individual financial situation is essential to determine if consolidation is the right choice for you.

Advantages of Student Loan Consolidation

Consolidating federal student loans can streamline your repayment process, potentially leading to a more manageable monthly payment. This simplification can reduce the risk of missed payments and improve your credit score over time. Furthermore, depending on your repayment plan, consolidation might offer access to income-driven repayment plans, which adjust your monthly payments based on your income and family size. This can be particularly beneficial during periods of lower income or unexpected financial hardship.

Disadvantages of Student Loan Consolidation

While consolidation simplifies payments, it can also extend the repayment period. This means you’ll pay more interest overall, potentially increasing the total cost of your loans. Additionally, you may lose benefits associated with specific loan types, such as lower interest rates or loan forgiveness programs. For instance, consolidating federal loans into a private loan will typically eliminate eligibility for federal income-driven repayment plans and public service loan forgiveness. It’s vital to carefully weigh these trade-offs.

The Process of Applying for Loan Consolidation

Applying for federal student loan consolidation involves several key steps. It is a relatively straightforward process, but it’s important to be organized and have all the necessary information readily available.

- Gather your loan information: Collect details about all your federal student loans, including loan numbers, lenders, and outstanding balances.

- Complete the Direct Consolidation Loan application: This application is available online through the Federal Student Aid website (StudentAid.gov).

- Submit your application: Once completed, submit your application electronically.

- Await processing: The Department of Education will process your application, which typically takes several weeks.

- Receive your new loan: Once approved, you will receive your new consolidated loan and information about your new repayment schedule.

Situations Where Consolidation Might Be Beneficial

Consolidation can be particularly helpful in certain circumstances. For example, if you have multiple loans with varying interest rates, consolidation can simplify your payments and potentially lower your average interest rate. Additionally, if you’re struggling to manage multiple payments, consolidating into a single, more manageable payment can improve your financial organization and reduce the risk of default. Finally, consolidation can provide access to income-driven repayment plans, offering more flexibility during financial hardship. Consider these scenarios carefully before making a decision.

Impact of Student Loans on Financial Future

Student loan debt can significantly impact your financial future, extending far beyond the repayment period. Understanding these long-term implications is crucial for making informed decisions about higher education and managing your finances effectively. The weight of student loan debt can influence major life choices, from homeownership to retirement planning, and even impact your overall financial well-being for years to come.

Student loan debt’s influence on your financial future is multifaceted. It’s not just about the monthly payments; it’s about the opportunity cost of that money, the potential strain on your budget, and the impact on your ability to achieve other financial goals. The consequences can be far-reaching, affecting everything from your ability to save for retirement to your capacity to handle unexpected expenses.

Credit Scores and Future Borrowing Capacity

Student loan debt directly affects your credit score. Missed or late payments can significantly lower your score, making it harder to secure loans in the future, such as mortgages, auto loans, or even credit cards. A lower credit score can lead to higher interest rates on future borrowing, increasing the overall cost of those loans. For example, someone with a lower credit score might pay several percentage points more on a mortgage than someone with excellent credit, resulting in tens of thousands of dollars in extra interest over the life of the loan. Maintaining a good payment history on your student loans is crucial for protecting your creditworthiness.

Minimizing the Long-Term Impact of Student Loans

Several strategies can help minimize the long-term impact of student loan debt. Careful budgeting and prioritizing loan repayment are essential. Exploring income-driven repayment plans can help manage monthly payments, ensuring they align with your income level. Additionally, actively seeking opportunities to increase your income can accelerate the repayment process and reduce the overall interest paid. Consider negotiating a lower interest rate with your lender or exploring loan refinancing options to potentially lower your monthly payments and reduce the total amount you pay over the life of the loan. These proactive steps can significantly reduce the long-term burden of student loan debt.

Visual Representation of Repayment Strategies

Imagine a graph charting the total debt remaining over time. One line represents a standard repayment plan, showing a steady decline but with a relatively long repayment period and a higher total interest paid. A second line shows an aggressive repayment strategy, with a steeper decline, a shorter repayment period, and significantly less interest paid. A third line represents an income-driven repayment plan, where the initial decline is slower, reflecting lower monthly payments, but the total repayment period might be longer. This visual representation highlights how different repayment strategies impact the overall cost and duration of student loan repayment. The aggressive repayment strategy demonstrates the substantial savings possible through higher monthly payments, while the income-driven plan showcases the trade-off between manageable monthly payments and a longer repayment timeline.

Resources for Student Loan Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, numerous resources exist to provide support and guidance to borrowers throughout their repayment journey. Understanding these resources and how to access them is crucial for effective debt management and achieving long-term financial well-being. This section Artikels several reputable organizations and websites that offer valuable assistance.

Reputable Organizations and Websites for Student Loan Borrowers

Accessing the right resources can significantly impact your ability to manage and ultimately eliminate your student loan debt. The following table provides a summary of several key organizations and their services. Remember to always verify information independently before making any financial decisions.

| Organization Name | Website | Services Offered | Contact Information |

|---|---|---|---|

| Federal Student Aid (FSA) | studentaid.gov | Information on federal student loans, repayment plans, loan forgiveness programs, and financial aid; access to loan accounts and repayment tools. | 1-800-4-FED-AID (1-800-433-3243) |

| National Foundation for Credit Counseling (NFCC) | nfcc.org | Credit counseling services, including debt management plans and financial education resources; may assist with student loan repayment strategies. | Information available on their website. |

| The Institute of Student Loan Advisors (TISLA) | tisla.org | Provides certification and resources for student loan counselors; helps borrowers find qualified professionals for assistance. Note that finding a certified advisor is not a guarantee of lower rates or better repayment options. | Information available on their website. |

| Consumer Financial Protection Bureau (CFPB) | consumerfinance.gov | Information on consumer rights, debt collection practices, and resources for resolving financial disputes; provides educational materials related to student loans. | Information available on their website. |

Effectively Utilizing Available Resources

To maximize the benefits of these resources, borrowers should actively engage with the available tools and information. This includes regularly reviewing loan account statements, exploring different repayment options, and seeking professional guidance when needed. For example, utilizing the repayment calculators provided by FSA can help borrowers understand the long-term implications of various repayment plans. Contacting the organizations directly with specific questions or concerns is also crucial. Understanding your rights and responsibilities as a borrower is key to successful debt management.

Final Summary

Successfully managing student loan debt requires careful planning and proactive engagement. By understanding the different loan types, repayment options, and available resources, you can create a personalized strategy that aligns with your financial goals. Remember, seeking guidance from financial professionals and utilizing available resources can significantly ease the burden of student loan repayment and pave the way for a brighter financial future.

Clarifying Questions

Can I consolidate private and federal student loans together?

Generally, no. Consolidation programs typically focus on federal loans. Private loans may require separate refinancing.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious financial consequences.

Are there income-driven repayment plans for private student loans?

Income-driven repayment plans are primarily available for federal student loans. Private lenders may offer different repayment options.

How long does it take to apply for student loan forgiveness?

The application process and timeline vary significantly depending on the specific forgiveness program. Expect a lengthy process requiring substantial documentation.