Navigating the complexities of student loan repayment can feel overwhelming, but understanding the potential tax benefits can significantly ease the burden. The student loan interest deduction offers a valuable opportunity to reduce your tax liability, potentially saving you hundreds or even thousands of dollars. This guide provides a clear and concise explanation of the eligibility requirements, calculation methods, and filing procedures associated with this crucial tax break.

This deduction isn’t a one-size-fits-all solution; eligibility hinges on factors such as your modified adjusted gross income (MAGI) and the type of student loan you hold. We’ll explore these criteria in detail, providing practical examples to illustrate how the deduction works in various scenarios. Furthermore, we’ll compare this deduction to other student loan repayment assistance programs, helping you determine the most beneficial option for your individual circumstances.

Eligibility Requirements for the Student Loan Tax Deduction

Claiming the student loan interest deduction can provide significant tax relief, but understanding the eligibility requirements is crucial. This section Artikels the key factors determining whether you qualify for this deduction. Failure to meet these criteria will result in the disallowance of the deduction.

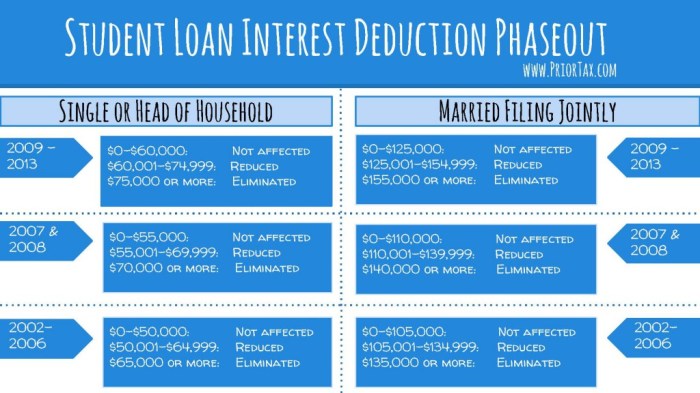

Income Limitations for the Student Loan Interest Deduction

The student loan interest deduction is subject to income limitations. The maximum amount of student loan interest you can deduct is dependent upon your Modified Adjusted Gross Income (MAGI). For the 2023 tax year, single filers can claim the full deduction if their MAGI is below $85,000. For married couples filing jointly, the MAGI limit is $170,000. Above these thresholds, the deduction is phased out. The phase-out range is not a cliff; it’s a gradual reduction of the deduction as MAGI increases. The exact amount of the deduction allowed within the phase-out range will depend on the specific MAGI.

Qualifying Student Loans

To be eligible for the deduction, the student loan must be used to pay for qualified education expenses. This includes tuition, fees, and other educational expenses paid for the taxpayer, their spouse, or their dependent. The loan must be taken out to pay for educational expenses at an eligible educational institution. Loans used for purposes other than qualified education expenses, such as personal expenses, do not qualify. Furthermore, the loan must be a loan, not a grant or scholarship. Parent PLUS loans and loans taken out by a student for their own education both qualify, provided the other requirements are met.

Determining Eligibility Based on Modified Adjusted Gross Income (MAGI)

Calculating your eligibility involves determining your MAGI. This is your adjusted gross income (AGI) with certain deductions added back. These adjustments vary, so it’s crucial to consult the IRS instructions or tax software. Once you’ve calculated your MAGI, compare it to the applicable limits for your filing status. If your MAGI is below the threshold, you can claim the full deduction. If it’s within the phase-out range, a portion of the deduction may be claimed. If it exceeds the phase-out range, no deduction is allowed. Tax software can often automate this calculation, reducing the complexity.

Examples of Eligibility

Let’s consider some examples. A single filer with a MAGI of $70,000 who paid $2,000 in student loan interest would be eligible for the full $2,000 deduction. Conversely, a married couple filing jointly with a MAGI of $200,000 would not be eligible for any deduction, as their MAGI is far above the phase-out limit. A single filer with a MAGI of $90,000 and $1,500 in student loan interest would likely have a reduced deduction, the precise amount depending on the phase-out rules for that tax year. It is important to note that these are illustrative examples and the actual deduction allowed will depend on the specific MAGI and the applicable tax year’s rules.

Calculating the Deduction Amount

The student loan interest deduction allows you to reduce your taxable income by the amount of interest you paid on qualified student loans during the tax year. However, the amount you can deduct is not simply the total interest paid; it’s subject to limitations based on your modified adjusted gross income (MAGI) and the amount of interest you actually paid. Understanding these limitations is key to accurately calculating your deduction.

The deduction amount is the smaller of the actual student loan interest you paid during the year or the maximum allowable deduction based on your MAGI. Your MAGI is your adjusted gross income (AGI) with certain deductions added back in. This means the deduction might be less than the total interest you paid.

Maximum Deduction Based on AGI

The maximum amount you can deduct depends on your modified adjusted gross income (MAGI). The IRS adjusts this limit annually, so it’s crucial to check the most recent IRS guidelines. The following table provides a general illustration. Remember to consult the official IRS publications for the most up-to-date information.

| Modified Adjusted Gross Income (MAGI) | Maximum Deduction |

|---|---|

| $70,000 or less (Single filer) / $140,000 or less (Married filing jointly) | Full amount of student loan interest paid (up to $2,500) |

| $70,001 – $85,000 (Single filer) / $140,001 – $170,000 (Married filing jointly) | Partially reduced deduction |

| Above $85,000 (Single filer) / Above $170,000 (Married filing jointly) | No deduction |

Note: This table is a simplified representation and may not reflect the exact current limits. Consult IRS Publication 970 for the most accurate information.

Calculating the Deduction: Scenarios

Let’s illustrate the calculation with a few scenarios:

Scenario 1: Sarah is single, paid $1,500 in student loan interest, and has a MAGI of $60,000. Since her MAGI is below the threshold, her deduction is the full $1,500.

Scenario 2: John and Mary are married filing jointly, paid $2,200 in student loan interest, and have a MAGI of $150,000. Their MAGI falls within the range where the deduction is partially reduced. The exact reduction would need to be determined using the current IRS guidelines. It would be less than $2,200 but more than $0.

Scenario 3: David is single, paid $3,000 in student loan interest, and has a MAGI of $90,000. Because his MAGI exceeds the limit, he cannot claim any student loan interest deduction.

Reporting the Deduction on Tax Forms

The student loan interest deduction is claimed on Form 1040, Schedule 1 (Additional Income and Adjustments to Income). You’ll report the deduction on line 21. You’ll need Form 1098-E, Student Loan Interest Statement, which your lender provides, to verify the amount of interest you paid. This form details the total interest paid during the tax year. Ensure the amount you claim on your tax return matches the amount reported on Form 1098-E. Carefully review the instructions for Form 1040 and Schedule 1 to ensure accurate reporting. Incorrect reporting can lead to delays in processing or potential penalties.

Tax Form and Filing Procedures

Claiming the student loan interest deduction requires careful completion of the appropriate tax form and accurate reporting of your student loan interest payments. Understanding the process ensures you receive the correct deduction and avoid potential IRS penalties. This section will guide you through the necessary steps.

Form 1040 and Schedule 1 (Form 1040): Additional Income and Adjustments to Income

The student loan interest deduction is claimed on Schedule 1 (Form 1040), specifically in Part I, “Adjustments to Income.” This schedule is used to report various adjustments to your gross income, including the student loan interest deduction. You will then transfer the total amount from Schedule 1 to your Form 1040. Form 1040 is the main tax form used to report your total income, deductions, and credits to determine your tax liability.

Required Information for Student Loan Interest Deduction

To accurately claim the deduction, you will need the following information:

- Your total student loan interest payments made during the tax year. This information is usually provided on Form 1098-E, Student Loan Interest Statement, which your lender should send you by January 31st of the following year. If you don’t receive a Form 1098-E, you may still be able to deduct the interest based on other documentation, such as bank statements or payment confirmations from your lender.

- Your adjusted gross income (AGI). Your AGI is your gross income less certain deductions. You will need this to determine if you meet the modified AGI requirements for the deduction.

- Your filing status (single, married filing jointly, etc.). This determines your applicable AGI limits for the deduction.

Gathering this information beforehand streamlines the filing process and helps prevent errors. Keep all relevant documentation for at least three years in case of an audit.

Step-by-Step Guide to Completing Schedule 1 (Form 1040)

- Locate Schedule 1 (Form 1040): This form is usually included with your Form 1040 package, or you can download it from the IRS website.

- Find Part I: This section lists various adjustments to income. Look for line 21, “Student loan interest.”

- Enter the Amount: Enter the total amount of student loan interest you paid during the tax year on line 21. This should match the amount reported on your Form 1098-E, if you received one. If you are using other documentation, be sure to keep a copy for your records.

- Transfer to Form 1040: Transfer the amount from line 21 of Schedule 1 to line 37 of Form 1040.

Potential Errors to Avoid

- Incorrect AGI: Double-check your AGI calculation to ensure you meet the modified AGI requirements for the deduction. Exceeding the limit will disqualify you from the deduction.

- Inaccurate Interest Amount: Carefully review your Form 1098-E or other documentation to ensure the interest amount you enter is accurate. Even a small discrepancy can lead to delays or adjustments.

- Missing Documentation: Keep copies of all relevant documents, including Form 1098-E, bank statements, and payment confirmations, in case the IRS requests verification.

- Filing Without Eligibility: Verify that you meet all eligibility requirements before claiming the deduction. Claiming the deduction when ineligible can result in penalties and adjustments to your tax return.

Comparison with Other Student Loan Repayment Options

The student loan interest deduction, while helpful, isn’t the only avenue for relief available to borrowers struggling with student loan debt. Several federal and state programs offer alternative repayment assistance, each with its own set of eligibility criteria, benefits, and drawbacks. Understanding these options is crucial for borrowers to choose the most advantageous strategy for their individual financial situation.

Understanding the nuances of various student loan repayment programs is key to effective debt management. This section compares the student loan interest deduction with other federal and state programs, highlighting their respective advantages and disadvantages to aid in informed decision-making.

Federal Student Loan Repayment Programs

The federal government offers several programs designed to assist borrowers in managing their student loan debt. These programs differ significantly in their eligibility requirements and the type of assistance they provide. Some focus on income-driven repayment plans, while others offer loan forgiveness based on specific professions or employment settings.

| Program | Description | Benefits | Drawbacks |

|---|---|---|---|

| Income-Driven Repayment (IDR) Plans | These plans adjust your monthly payment based on your income and family size. Several plans exist, including ICR, PAYE, REPAYE, andIBR. | Lower monthly payments, potentially leading to loan forgiveness after 20-25 years. | Payments may be higher than the standard 10-year repayment plan in the short term; accumulated interest can lead to a larger overall repayment amount. Forgiveness isn’t guaranteed and may be subject to tax implications. |

| Public Service Loan Forgiveness (PSLF) | Forgives the remaining balance on your federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. | Complete loan forgiveness after 10 years of qualifying payments. | Strict eligibility requirements, including working for a qualifying employer and making consistent, on-time payments under an IDR plan. The program has undergone significant changes, affecting many borrowers’ eligibility. |

| Teacher Loan Forgiveness | Forgives up to $17,500 of your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. | Significant reduction in loan burden for qualifying teachers. | Strict eligibility requirements, including teaching in a designated low-income school and meeting specific employment criteria. |

State-Level Student Loan Repayment Assistance Programs

Many states also offer their own programs to help residents manage student loan debt. These programs often vary significantly in their structure and benefits, so it’s essential to research the specific programs available in your state. Some states may offer grants, tax credits, or other forms of assistance.

Comparing the Student Loan Interest Deduction with Other Programs

The student loan interest deduction offers a tax benefit, reducing your taxable income, while other programs directly lower your monthly payment or potentially forgive a portion of your loan balance. The best option depends on your individual circumstances. For instance, a high-income borrower might benefit more from the interest deduction, while a low-income borrower might find an IDR plan more beneficial. A borrower working in public service might find PSLF to be the most advantageous option.

Example Scenarios

Let’s consider two individuals: Maria, a high-income lawyer with significant student loan debt, and David, a low-income teacher working for a qualifying non-profit. Maria might find the student loan interest deduction more advantageous, reducing her tax liability. David, however, would likely benefit more from an IDR plan and the potential for PSLF, significantly lowering his monthly payments and potentially leading to loan forgiveness.

Impact of Tax Reform on the Student Loan Interest Deduction

The student loan interest deduction, a provision allowing taxpayers to deduct the interest paid on qualified student loans, has been a subject of significant change and debate throughout its history. Recent tax legislation has altered its parameters, impacting the eligibility and deduction amount for many borrowers. Understanding this evolution is crucial for anyone navigating the complexities of student loan repayment and tax planning.

The student loan interest deduction wasn’t always a feature of the US tax code. Its origins trace back to the 1980s, emerging as a way to provide targeted tax relief for students burdened with significant loan debt. Over the years, it has been modified several times, reflecting shifts in tax policy and economic priorities. These changes have affected not only the maximum deduction amount but also who qualifies for the benefit.

Historical Context and Evolution of the Deduction

The deduction’s history is marked by periods of expansion and contraction. Initially, the deduction was less generous, with lower limits and stricter eligibility requirements. Over time, Congress gradually increased the maximum amount deductible and broadened eligibility criteria in response to rising tuition costs and increasing student loan debt. However, these expansions have not been consistent. Periods of fiscal conservatism have often led to attempts to reduce or eliminate the deduction entirely, highlighting the political complexities surrounding student loan relief. This dynamic tension between providing student loan relief and fiscal responsibility shapes the ongoing evolution of this tax provision.

Changes Resulting from Recent Tax Legislation

The Tax Cuts and Jobs Act of 2017 (TCJA) significantly altered the student loan interest deduction. While it did not eliminate the deduction entirely, the TCJA made changes that affected many taxpayers. For example, the standard deduction was significantly increased, resulting in fewer taxpayers being able to itemize their deductions and therefore claim the student loan interest deduction. This effectively reduced the number of individuals who benefited from this provision. Further, the TCJA’s changes to other tax provisions, like the limitation on state and local tax deductions, indirectly impacted the number of taxpayers who itemized and could utilize the student loan interest deduction.

Potential Implications of Future Tax Reforms

Predicting future tax reforms is inherently speculative. However, given the ongoing debate surrounding student loan debt and the federal budget deficit, the student loan interest deduction is likely to remain a target for potential modifications. Future tax reforms could involve further limitations on the deduction amount, stricter eligibility requirements (such as income limits), or even complete elimination. For instance, a future administration or Congress might prioritize different methods of addressing student loan debt, potentially rendering the tax deduction less relevant or cost-effective as a policy tool. The possibility of a shift towards direct student loan forgiveness programs, for example, could lessen the political pressure to maintain the student loan interest deduction in its current form.

Timeline of Significant Changes

To illustrate the evolution of the student loan interest deduction, a timeline of significant changes is presented below. Note that this is not an exhaustive list, but it highlights key moments in the deduction’s history.

| Year | Significant Change |

|---|---|

| 1986 | The student loan interest deduction is first introduced as part of the Tax Reform Act of 1986. |

| 1997 | Modifications are made to increase the maximum deduction amount and expand eligibility. |

| 2001 | Further adjustments are made to the deduction’s parameters. |

| 2017 | The Tax Cuts and Jobs Act (TCJA) indirectly reduces the number of taxpayers who benefit from the deduction by increasing the standard deduction. |

| Ongoing | The future of the student loan interest deduction remains uncertain, with potential for further modifications or elimination. |

Illustrative Examples

Understanding the student loan interest deduction requires examining specific scenarios. The following examples illustrate how the deduction works under different circumstances, highlighting the impact of income and loan amount. Remember that tax laws can change, so always consult the most up-to-date IRS guidelines.

Scenario 1: High Income, High Loan Interest

This scenario depicts a taxpayer with a high adjusted gross income (AGI) and significant student loan interest payments.

Let’s say Sarah earns an AGI of $100,000 and paid $2,500 in student loan interest during the tax year. Assuming she’s single, the phaseout range for the student loan interest deduction begins at $70,000 for the 2023 tax year (this value may vary by year). Since her AGI exceeds this threshold, the deduction is subject to a phaseout. The phaseout range ends at $85,000 for single filers in 2023 (this value may also vary by year).

The calculation to determine the reduced deduction is as follows: ($85,000 – $70,000) / $15,000 = 1. This is the amount the deduction is reduced by for each $15,000 over the $70,000 threshold. Sarah’s AGI is $30,000 over the threshold ($100,000 – $70,000). Therefore, the deduction is reduced by 2 ($30,000 / $15,000). Her maximum deduction is then $2,500 – ($2,500 * 2) = $0.

- AGI: $100,000

- Student Loan Interest Paid: $2,500

- Phaseout Range (Single): $70,000 – $85,000

- Deduction Calculation: $2,500 – ($2,500 * 2) = $0

- Final Deduction: $0

Scenario 2: Low Income, Moderate Loan Interest

This scenario illustrates a taxpayer with a lower AGI and moderate student loan interest payments.

John’s AGI is $50,000, and he paid $1,800 in student loan interest. His AGI is below the phaseout range for the student loan interest deduction. Therefore, he can deduct the full amount of his student loan interest.

- AGI: $50,000

- Student Loan Interest Paid: $1,800

- Phaseout Range (Single): $70,000 – $85,000 (AGI is below the threshold)

- Final Deduction: $1,800

Scenario 3: Married Filing Jointly, High Loan Interest

This example demonstrates the deduction for a married couple filing jointly.

Maria and David file jointly, with a combined AGI of $90,000. They paid $3,500 in student loan interest. For the 2023 tax year, the phaseout range for married filing jointly begins at $140,000. Since their AGI is below this threshold, they can deduct the full amount of their student loan interest.

- Filing Status: Married Filing Jointly

- AGI: $90,000

- Student Loan Interest Paid: $3,500

- Phaseout Range (Married Filing Jointly): $140,000 – $165,000 (AGI is below the threshold)

- Final Deduction: $3,500

Epilogue

Successfully claiming the student loan interest deduction requires careful attention to detail and a thorough understanding of the applicable rules and regulations. By carefully reviewing your eligibility, accurately calculating the deduction amount, and correctly completing the necessary tax forms, you can maximize your tax savings and make significant progress towards paying off your student loans. Remember to consult with a tax professional if you have any specific questions or complex situations.

Frequently Asked Questions

What if I paid off my student loans early? Can I still claim the deduction?

Yes, you can claim the deduction for the interest paid during the tax year, regardless of when the loan was repaid.

Can I claim the deduction if I’m a dependent on someone else’s tax return?

Generally, no. You must be able to file as an independent taxpayer to claim this deduction.

What happens if I overestimate my deduction?

If you overestimate the deduction, you may owe additional taxes when you file your return. Accurate record-keeping is crucial.

Are there any penalties for claiming the deduction incorrectly?

Yes, penalties may apply for inaccuracies or intentional misrepresentation of information on your tax return. Accuracy is paramount.