Navigating the complex world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. From federal loan programs offering various repayment options to private loans with potentially higher interest rates, the landscape is vast. This guide aims to clarify the key distinctions between these loan types, helping you choose the best path for your educational journey and long-term financial well-being.

This exploration will delve into the specifics of federal student loans, including Stafford, PLUS, and Perkins loans, examining their eligibility requirements, interest rates, and repayment plans. We’ll also contrast these with private student loans, outlining their advantages and disadvantages and when they might be appropriate. Furthermore, we’ll cover crucial aspects like loan consolidation, forgiveness programs, and the serious consequences of defaulting, equipping you with the knowledge to manage your student loan debt effectively.

Private Student Loans

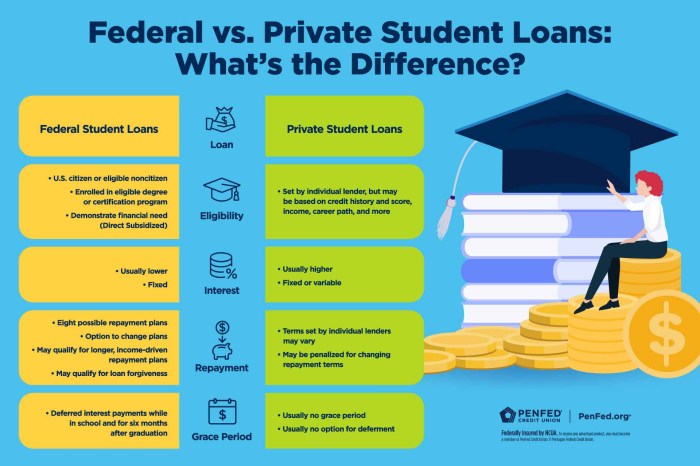

Private student loans are offered by banks, credit unions, and other private lenders, unlike federal student loans which are backed by the government. This key difference significantly impacts the terms, eligibility requirements, and overall borrowing experience. Understanding these distinctions is crucial for students and families navigating the complexities of financing higher education.

Private student loans often have variable interest rates, meaning the rate can fluctuate over the life of the loan, unlike some federal loan options which may offer fixed rates. This variability introduces an element of uncertainty into repayment planning. Additionally, private lenders typically require a creditworthy co-signer, someone with a strong credit history who agrees to be responsible for the loan if the borrower defaults. This requirement can be a significant barrier for students with limited credit history.

Eligibility and Interest Rate Determination

Private lenders assess several factors when determining eligibility and setting interest rates for private student loans. Credit score is a major factor; borrowers with higher credit scores generally qualify for lower interest rates. Income, debt-to-income ratio, and the applicant’s overall financial history are also carefully reviewed. The lender will also consider the school’s reputation and the borrower’s academic standing. Finally, the loan amount requested relative to the borrower’s expected income after graduation plays a role in interest rate calculations. A larger loan amount, particularly when compared to post-graduation earning potential, will often result in a higher interest rate.

Suitable and Unsuitable Situations for Private Student Loans

Private student loans can be a suitable option when federal loan limits are insufficient to cover educational expenses. For example, a student attending a very expensive private university might need to supplement federal loans with a private loan to meet their tuition costs. However, private loans are generally less desirable than federal loans due to their higher interest rates and lack of borrower protections. Private loans might not be suitable if the borrower lacks a creditworthy co-signer, has a low credit score, or anticipates difficulty repaying the loan after graduation. For example, a student pursuing a degree with limited job prospects might find themselves struggling to manage private loan repayments.

Advantages and Disadvantages of Private Student Loans

Understanding the potential benefits and drawbacks is crucial before considering private student loans.

- Advantages: May be necessary to cover costs exceeding federal loan limits; potentially higher loan amounts available compared to federal loans.

- Disadvantages: Higher interest rates compared to federal loans; variable interest rates can lead to unpredictable monthly payments; stricter eligibility requirements often necessitate a co-signer; lack of federal borrower protections such as income-driven repayment plans or loan forgiveness programs.

Loan Repayment Plans

Choosing the right repayment plan for your federal student loans is crucial for managing your finances and minimizing long-term debt. Understanding the various options available and their implications is key to making an informed decision. This section will Artikel the different federal student loan repayment plans, comparing their features and long-term financial effects.

Federal Student Loan Repayment Plan Options

The federal government offers several repayment plans designed to cater to different financial situations and repayment preferences. These plans differ significantly in monthly payment amounts, loan repayment periods, and the potential for loan forgiveness. The main categories include Standard, Graduated, and Income-Driven Repayment (IDR) plans. Each plan offers a distinct approach to managing student loan debt.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, leading to lower overall interest payments compared to longer-term plans. However, the fixed monthly payments might be higher than other options, potentially straining borrowers’ budgets, especially in the early stages of their careers.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower initial monthly payments that gradually increase over time. This can be beneficial for borrowers anticipating income growth, such as recent graduates. However, it ultimately leads to a higher total interest paid compared to the Standard plan because of the longer repayment period.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment plans are designed to make student loan repayment more manageable by basing monthly payments on your income and family size. Several IDR plans exist, including the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. These plans typically extend the repayment period to 20 or 25 years, potentially resulting in higher total interest paid but offering lower monthly payments that align better with a borrower’s income. Some IDR plans also offer loan forgiveness after a certain number of qualifying payments.

Applying for an Income-Driven Repayment Plan

Applying for an IDR plan typically involves completing the appropriate application form through the StudentAid.gov website. Required documentation usually includes tax returns (IRS Form 1040) and W-2 forms to verify income and family size. Additional documentation may be requested depending on the specific plan and individual circumstances. The application process generally involves submitting the required documentation and waiting for the loan servicer to process the request.

Comparison of Repayment Plans

| Repayment Plan | Payment Amount | Repayment Period | Loan Forgiveness Potential |

|---|---|---|---|

| Standard | Fixed, higher | 10 years | None |

| Graduated | Starts low, increases | 10 years | None |

| Income-Based Repayment (IBR) | Based on income and family size | 20 or 25 years | Potential for forgiveness after 20 or 25 years |

| Pay As You Earn (PAYE) | Based on income and family size | 20 years | Potential for forgiveness after 20 years |

| Revised Pay As You Earn (REPAYE) | Based on income and family size | 20 or 25 years | Potential for forgiveness after 20 or 25 years |

| Income-Contingent Repayment (ICR) | Based on income and family size | 25 years | Potential for forgiveness after 25 years |

Understanding Interest Rates and Fees

Understanding interest rates and fees is crucial for managing your student loan debt effectively. The interest rate determines how much your loan costs over time, while fees add to the overall expense. Both federal and private loans have different structures for determining these costs.

Interest rates on federal student loans are set by the government and generally reflect prevailing market conditions. They can vary depending on the loan type (subsidized, unsubsidized, PLUS), the borrower’s creditworthiness (in the case of PLUS loans), and the loan’s disbursement date. Private student loans, on the other hand, are offered by banks and other financial institutions. Their interest rates are influenced by factors such as the borrower’s credit score, credit history, the loan amount, and the repayment term. Generally, borrowers with higher credit scores and better credit histories qualify for lower interest rates. It’s important to shop around and compare offers from multiple lenders before selecting a private loan.

Federal and Private Loan Interest Rate Calculation Methods

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rate Determination | Set by the government, influenced by market conditions and loan type. Rates are fixed for the life of the loan unless otherwise stated. | Determined by the lender based on the borrower’s creditworthiness, loan amount, and market conditions. Rates can be fixed or variable, impacting monthly payments over the life of the loan. |

| Rate Changes | Generally fixed for the life of the loan. | Can be fixed or variable; variable rates can fluctuate based on market indices, leading to changes in monthly payments. |

| Subsidized vs. Unsubsidized | Subsidized loans may not accrue interest while the borrower is in school, during grace periods, or during deferment. Unsubsidized loans accrue interest throughout. | No distinction between subsidized and unsubsidized loans. Interest accrues from disbursement. |

| Credit Check | Credit checks are not required for most federal student loans, except for PLUS loans. | A credit check is always required for private student loans, significantly impacting the interest rate offered. |

Student Loan Fees

Several fees can be associated with student loans, significantly impacting the total cost. Origination fees, charged by the lender at the time the loan is disbursed, are a common example. Late payment fees are incurred when a payment is not made by the due date. Other fees might include application fees, prepayment penalties (though less common in federal loans), and returned check fees. These fees vary depending on the lender and the type of loan.

Impact of Interest Rates and Fees on Loan Cost

Let’s illustrate the impact of different interest rates and fees. Suppose you borrow $20,000 with a 5% interest rate and a $200 origination fee. Over a 10-year repayment period, the total cost will be significantly higher than a loan with a 3% interest rate and no origination fee. A higher interest rate leads to a larger amount of interest paid over the life of the loan. The addition of origination fees adds directly to the principal balance, further increasing the total repayment amount. For example, a loan with a 7% interest rate and a $400 origination fee would result in a substantially higher total cost compared to a loan with a 5% interest rate and a $200 origination fee, even with the same loan amount and repayment period. Careful consideration of interest rates and fees is therefore essential to minimizing the overall cost of borrowing.

Student Loan Consolidation

Consolidating your student loans means combining multiple federal or private student loans into a single, new loan. This simplifies your repayment process by reducing the number of monthly payments you need to manage. However, it’s crucial to understand the implications before making a decision, as consolidation isn’t always the best option for everyone.

The Consolidation Process

The process of consolidating federal student loans typically involves applying through the Federal Student Aid website. You’ll need to provide information about your existing loans and choose a consolidation loan servicer. Once approved, your old loans are paid off, and you begin making payments on your new consolidated loan. Private loan consolidation processes vary depending on the lender, often involving a similar application process but potentially with different eligibility requirements. The specific steps involved will depend on the type of loans you are consolidating and the lender you choose.

Benefits of Loan Consolidation

Consolidation can simplify repayment by reducing the number of monthly payments and potentially streamlining communication with lenders. A fixed interest rate on a consolidated federal loan can offer predictability, unlike variable rates on some individual loans. Furthermore, some consolidation programs offer income-driven repayment plans that can lower monthly payments based on income and family size. For example, a borrower with several loans at varying interest rates, each with a different due date, could significantly benefit from a single, manageable payment.

Drawbacks of Loan Consolidation

Consolidating federal loans into a new federal loan may result in a higher overall interest rate than the weighted average of your existing loans, extending the repayment period and potentially increasing the total interest paid over the life of the loan. This is because the new interest rate is often calculated based on a weighted average of the interest rates of your existing loans, plus a small margin. Also, consolidating private loans may not always offer better interest rates or terms. Consolidating loans might also mean losing access to certain repayment options or benefits available on individual loans. For instance, a borrower might lose the benefits of a loan forgiveness program applicable to only one of their original loans.

Interest Rates and Repayment Terms After Consolidation

The interest rate on a consolidated federal loan is usually a weighted average of the interest rates of your existing loans, rounded up to the nearest one-eighth of a percent. This means your new interest rate might be higher than the lowest rate among your original loans. The repayment term for a consolidated loan can be extended, potentially lowering your monthly payments but increasing the total interest paid over the loan’s life. For private loans, the interest rate and repayment terms will vary depending on the lender and your creditworthiness. It’s essential to compare offers from multiple lenders before consolidating private loans.

Scenarios Where Consolidation Might Be Beneficial or Not

Consolidation can be beneficial for borrowers with multiple federal loans at varying interest rates, seeking simplified repayment or access to income-driven repayment plans. For example, a recent graduate with several federal student loans carrying different interest rates and repayment schedules could simplify their finances by consolidating them into one loan with a fixed interest rate and a manageable monthly payment. However, consolidation might not be advantageous if your current interest rates are low, you are eligible for loan forgiveness programs tied to specific loans, or you plan to pay off your loans quickly. A borrower with a single low-interest federal loan and a plan to aggressively pay it down within a short period might find consolidation unnecessary and potentially detrimental due to a potential increase in the overall interest rate.

Defaulting on Student Loans

Defaulting on your student loans has serious and far-reaching consequences that can significantly impact your financial future. It’s a situation to be avoided at all costs through proactive planning and responsible debt management. Understanding the potential repercussions and available resources is crucial for borrowers facing financial hardship.

Defaulting on student loans means failing to make your required payments for a specific period, typically 270 days or nine months, depending on the loan type. This triggers a cascade of negative effects that can last for years, even decades.

Consequences of Student Loan Default

Defaulting results in immediate and long-term financial damage. Your credit score will plummet, making it difficult to obtain loans, rent an apartment, or even secure certain jobs. The government can garnish your wages, seize your tax refunds, and even suspend your professional licenses. Furthermore, you may face legal action, including lawsuits and wage garnishment. The total amount you owe will increase due to accruing late fees and interest. These penalties can significantly inflate your debt, making repayment even more challenging. In short, defaulting has devastating consequences for your credit, finances, and overall well-being.

Managing Student Loan Debt and Avoiding Default

Effective management of student loan debt is essential to prevent default. This involves careful budgeting, understanding your repayment options, and proactively seeking assistance when needed. Creating a realistic budget that prioritizes loan payments is the first step. Explore different repayment plans offered by your loan servicer, such as income-driven repayment (IDR) plans which adjust payments based on your income and family size. Staying in regular communication with your loan servicer and keeping them informed of any financial difficulties is also critical. They may be able to offer forbearance or deferment, temporarily suspending payments or reducing the monthly amount.

Options for Borrowers Struggling to Make Payments

Several options exist for borrowers struggling to meet their loan payments. Income-driven repayment (IDR) plans are designed to make monthly payments more manageable by basing them on your income and family size. Deferment postpones payments temporarily, while forbearance reduces or suspends payments for a specified period. Loan consolidation combines multiple loans into a single loan with a potentially lower monthly payment. Seeking professional financial counseling can provide personalized guidance and strategies for managing debt effectively. These resources can help borrowers navigate their financial challenges and avoid default.

Rehabilitating Defaulted Student Loans

Rehabilitating a defaulted student loan involves making consistent payments over a period of time, typically nine months, as determined by your loan servicer. The process requires contacting your loan servicer and agreeing to a rehabilitation plan. This plan Artikels the number and amount of payments required to rehabilitate the loan. Once you complete the required payments, your loan’s default status is removed, and you may be eligible for certain repayment options again. However, it’s important to understand that even after rehabilitation, your credit report will still reflect the previous default. It’s a long and challenging process, but it offers a pathway to restore your financial standing. Failure to adhere to the rehabilitation agreement can lead to further negative consequences.

Last Recap

Successfully managing student loan debt requires a proactive and informed approach. By understanding the nuances of federal and private loan options, repayment plans, and potential forgiveness programs, you can create a personalized strategy to minimize your financial burden. Remember to carefully consider your individual circumstances, explore all available resources, and seek professional advice when needed to ensure a smooth and successful path towards debt repayment and financial independence. Proactive planning and informed decision-making are key to navigating the complexities of student loans and achieving your financial goals.

Detailed FAQs

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

Can I refinance my federal student loans with a private lender?

Yes, but be aware that refinancing federal loans with a private lender means losing federal protections like income-driven repayment plans and potential forgiveness programs.

What happens if I miss a student loan payment?

Late payments will negatively impact your credit score and may incur late fees. Consistent missed payments can lead to default, resulting in serious consequences such as wage garnishment and tax refund offset.

How do I find a student loan counselor?

Many non-profit organizations and government agencies offer free student loan counseling services. You can also search online for reputable counselors in your area.