Navigating the complexities of student loan repayment can be daunting, especially in a state as diverse as Washington. This guide provides a comprehensive overview of the various student loan repayment programs, forgiveness options, and resources available to Washington residents struggling with student loan debt. We’ll explore federal and state-specific programs, highlighting eligibility requirements, benefits, and potential drawbacks to help you make informed decisions about your financial future.

From understanding income-driven repayment plans to navigating the Public Service Loan Forgiveness (PSLF) program, we aim to demystify the process and empower you to take control of your student loan debt. We’ll also examine the broader economic impact of student loan debt on Washington residents and provide valuable resources to connect you with the support you need.

Student Loan Repayment Programs in Washington State

Navigating student loan repayment can be challenging, but Washington State offers several programs designed to assist borrowers. Understanding the nuances of each program is crucial for selecting the most beneficial option based on individual circumstances. This section details the key features of several prominent programs.

Washington State Public Service Loan Forgiveness (PSLF) Program

The Washington State PSLF program mirrors the federal PSLF program, offering loan forgiveness for those working in public service. Eligibility requires employment by a qualifying government or non-profit organization, and repayment under an income-driven repayment plan. The program forgives the remaining balance after 120 qualifying monthly payments. A significant benefit is the potential for complete loan forgiveness, eliminating substantial debt. However, a drawback is the stringent eligibility requirements and the lengthy 10-year repayment period. Meeting the qualifying employment criteria and maintaining consistent payments are crucial for success.

Income-Driven Repayment Plans

Several income-driven repayment plans are available through federal student loan programs, applicable to Washington residents. These plans calculate monthly payments based on income and family size, offering lower monthly payments than standard repayment plans. Eligibility is generally based on federal student loan debt and income verification. The primary benefit is reduced monthly payments, making repayment more manageable. However, these plans often extend the repayment period, leading to potentially higher total interest paid over the life of the loan. For example, a borrower might pay less each month but end up paying significantly more interest over 20-25 years compared to a 10-year standard plan.

Teacher Loan Forgiveness Program

This federal program offers loan forgiveness to qualified teachers who have completed five years of full-time teaching in a low-income school or educational service agency. Eligibility hinges on teaching in a designated low-income school and maintaining full-time employment for the five-year period. The benefit is partial or full loan forgiveness, providing substantial financial relief. The drawback is the requirement to work in a specific type of school for a considerable length of time, potentially limiting career choices.

| Program | Eligibility Requirements | Repayment Terms | Forgiveness Options |

|---|---|---|---|

| Washington State PSLF | Public service employment, income-driven repayment plan | 120 qualifying monthly payments | Full loan forgiveness after 120 payments |

| Income-Driven Repayment Plans (Federal) | Federal student loans, income verification | Variable, often 20-25 years | No forgiveness, but lower monthly payments |

| Teacher Loan Forgiveness Program (Federal) | Teaching in low-income school, 5 years full-time employment | Standard repayment plan until eligibility for forgiveness | Partial or full loan forgiveness after 5 years |

Washington State’s Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers a pathway to loan forgiveness for those working in public service. While the program is federal, its eligibility and application process are relevant to Washington State residents employed in qualifying public service roles. Understanding the requirements and navigating the application process are crucial for Washingtonians seeking loan forgiveness under PSLF.

PSLF Requirements in Washington State

To qualify for PSLF in Washington, or anywhere else, borrowers must meet specific criteria. These include having federal Direct Loans, working full-time for a qualifying employer, and making 120 qualifying monthly payments under an income-driven repayment plan. Importantly, the definition of “qualifying employer” and “qualifying payments” remains consistent across all states, including Washington. This means that Washington State employees in eligible roles are subject to the same national standards as those in other states. The key is demonstrating consistent employment and payment history according to federal guidelines.

Applying for PSLF in Washington

The application process for PSLF is primarily handled online through the federal government’s StudentAid.gov website. Washington State residents follow the same steps as borrowers in other states. This involves consolidating federal loans (if necessary) into a Direct Consolidation Loan, certifying employment with a qualifying employer, and submitting the PSLF application form. Regular monitoring of employment certification and payment counts is essential throughout the process. While there are no Washington-specific application portals or processes, resources and assistance might be available through state-based organizations or educational institutions that offer guidance on federal student loan programs.

Qualifying Professions for PSLF in Washington

A wide range of professions qualify for PSLF. In Washington, as in other states, this includes government employees at all levels (federal, state, local), teachers at public schools and universities, and non-profit employees working in areas such as public health, social services, and environmental protection. Specific examples in Washington might include employees of the Washington State Department of Health, teachers in Seattle Public Schools, or social workers employed by non-profit organizations serving vulnerable populations in Spokane. The key is that the employer must be a qualifying public service organization as defined by the federal government.

Potential Benefits and Challenges of Pursuing PSLF in Washington

The primary benefit of PSLF is the potential for complete loan forgiveness after 120 qualifying payments. This can significantly alleviate financial burden and contribute to long-term financial stability for Washington State residents. However, the process is lengthy and complex. Challenges include maintaining consistent employment with a qualifying employer for ten years, ensuring all payments are accurately counted as qualifying payments, and navigating the sometimes cumbersome application and certification process. Furthermore, income-driven repayment plans, often necessary to qualify for PSLF, can result in higher overall interest payments compared to other repayment plans, if loan forgiveness is not achieved. Careful planning and consistent effort are critical to successfully navigate the PSLF program in Washington.

Income-Driven Repayment (IDR) Plans in Washington

Choosing the right income-driven repayment (IDR) plan is crucial for managing student loan debt in Washington State. These plans link your monthly payments to your income and family size, offering potentially lower payments than standard repayment plans. However, it’s essential to understand how each plan functions and its long-term implications before making a decision.

IDR Plans Available in Washington

Washington residents have access to the same federal income-driven repayment plans offered nationwide. These plans are designed to make student loan repayment more manageable, especially for borrowers with lower incomes. The specific details and calculations might vary slightly depending on the lender, but the fundamental principles remain consistent across all plans.

Income Calculation for IDR Plans

Income for IDR plans is typically based on your adjusted gross income (AGI) from your most recent federal tax return. This AGI reflects your gross income less certain deductions. For married couples filing jointly, the combined AGI is used. The Department of Education uses this information to calculate your payment amount, taking into consideration your family size and loan balance. It’s important to ensure your tax information is accurate and up-to-date to avoid payment discrepancies or potential issues with your plan. Self-employed individuals may need to provide additional documentation to verify their income.

Long-Term Repayment Implications of Different IDR Plans

Different IDR plans have varying repayment periods and potential for loan forgiveness after a specified period (typically 20 or 25 years). While lower monthly payments offer immediate relief, they often extend the repayment period significantly, leading to potentially higher total interest paid over the life of the loan. Conversely, plans with shorter repayment periods might have higher monthly payments but lower overall interest costs. Careful consideration of your financial situation and long-term goals is crucial in selecting the most suitable plan. For example, a borrower choosing a plan with a longer repayment period and lower monthly payments might save money in the short-term, but may end up paying significantly more in interest over the life of the loan. A borrower choosing a plan with higher monthly payments might see their debt eliminated faster, and pay less in interest.

Comparison of IDR Plans

Understanding the key differences between IDR plans is essential for making an informed decision. The following bullet points highlight the main features of common plans:

- Income-Based Repayment (IBR): Payments are calculated based on your discretionary income (AGI minus 150% of the poverty guideline for your family size) and loan balance. Repayment period is up to 25 years, with potential loan forgiveness after 20 or 25 years, depending on when the loan was originated. This plan is generally beneficial for borrowers with low incomes and high loan balances.

- Pay As You Earn (PAYE): Payments are calculated based on 10% of your discretionary income (AGI minus 150% of the poverty guideline for your family size) and loan balance. The repayment period is 20 years, with potential loan forgiveness after 20 years. This plan is similar to IBR but with a fixed 20-year repayment period.

- Revised Pay As You Earn (REPAYE): Payments are calculated based on 10% of your discretionary income (AGI minus 150% of the poverty guideline for your family size) and loan balance. The repayment period is 20 or 25 years, depending on loan origination date, with potential loan forgiveness after 20 or 25 years. This plan offers a potentially lower monthly payment compared to PAYE, but the repayment period can be longer.

- Income-Contingent Repayment (ICR): Payments are calculated based on a formula considering your income, family size, and loan balance. The repayment period is 25 years, with potential loan forgiveness after 25 years. This plan may offer lower initial payments, but often results in higher overall interest paid.

Student Loan Forgiveness Programs Specific to Washington

Washington State doesn’t currently offer its own comprehensive student loan forgiveness program comparable to federal initiatives like Public Service Loan Forgiveness (PSLF). While there aren’t state-specific loan forgiveness programs that directly eliminate loan balances, several state-level initiatives indirectly assist borrowers in managing their student loan debt. These initiatives focus on providing resources and support rather than direct loan forgiveness.

State-Level Initiatives Supporting Student Loan Repayment

Washington State prioritizes making higher education more affordable and accessible. Several programs aim to alleviate the burden of student loan debt, although they don’t provide direct forgiveness. These programs typically focus on financial literacy, career counseling, and connecting students with resources that can aid in repayment. These indirect supports are crucial for borrowers as they navigate the complexities of student loan repayment. For example, the state may offer workshops and online resources on budgeting and financial planning, directly impacting a borrower’s ability to manage and potentially accelerate their repayment. Furthermore, access to career counseling can help graduates secure higher-paying jobs, thus enabling quicker repayment of their student loans.

Comparison of State and Federal Student Loan Forgiveness Programs

Federal programs, such as PSLF and Income-Driven Repayment (IDR) plans, offer direct pathways to loan forgiveness or reduced monthly payments based on specific criteria (public service employment for PSLF, income for IDR). These programs are nationwide and have established eligibility requirements and application processes. In contrast, Washington State’s approach focuses on indirect support, empowering borrowers with resources and knowledge to manage their debt effectively. The state’s initiatives lack the direct loan forgiveness offered by federal programs but provide valuable support to help borrowers navigate their repayment journey successfully. This difference reflects the varying roles and responsibilities of federal and state governments in addressing student loan debt.

Hypothetical Flowchart: Accessing State-Level Financial Literacy Resources

This flowchart illustrates a simplified process for accessing financial literacy resources, a common type of support offered at the state level in Washington. Remember that specific programs and their application processes may vary. This is a generalized example.

[The following describes a flowchart. It cannot be visually represented in plain text. Imagine a flowchart with three boxes. ]

Box 1: Identify Need: The borrower recognizes the need for assistance in managing their student loan debt. This could stem from difficulty budgeting, understanding repayment options, or general financial stress.

Box 2: Locate Resources: The borrower searches for relevant resources through the Washington State government website, educational institutions, or non-profit organizations. These resources may include workshops, online tools, and one-on-one counseling.

Box 3: Access and Utilize Resources: The borrower participates in workshops, uses online tools, or schedules counseling sessions to improve their financial literacy and debt management skills.

Resources and Assistance for Student Loan Borrowers in Washington

Navigating the complexities of student loan repayment can be challenging. Fortunately, several organizations in Washington State offer valuable resources and support to borrowers facing difficulties. These resources provide a range of assistance, from counseling and advocacy to practical repayment strategies. Utilizing these services can significantly improve your ability to manage your student loan debt effectively.

Organizations Offering Assistance to Student Loan Borrowers in Washington

Finding the right support is crucial for managing student loan debt. The following table lists organizations that offer assistance to student loan borrowers in Washington, providing contact information and the types of services they provide. It’s important to note that services and availability may change, so always verify information directly with the organization.

| Organization Name | Contact Information | Website | Type of Assistance |

|---|---|---|---|

| Washington State Department of Financial Institutions (DFI) | (360) 902-8700 Consumer Hotline: 1-877-RING-DFI (1-877-746-4334) |

https://www.dfi.wa.gov/ | Consumer protection, complaint resolution, information on student loan laws and regulations. |

| National Foundation for Credit Counseling (NFCC) | Find a local NFCC member agency through their website. | https://www.nfcc.org/ | Credit counseling, debt management plans, budgeting assistance, financial education. |

| Student Loan Borrower Assistance Project (SLBAP) (If available in Washington – verify availability) | Contact information varies by location – search online for local chapters. | (Website varies by location – check for local chapters) | Legal assistance, advocacy, negotiation with lenders. |

| United States Department of Education (ED) | (800) 4-FED-AID (800-433-3243) | https://studentaid.gov/ | Information on federal student loan programs, repayment plans, and loan forgiveness options. |

Impact of Student Loan Debt on Washington Residents

Student loan debt significantly impacts Washington residents’ economic well-being, affecting major life decisions and long-term financial stability. The substantial cost of higher education, coupled with rising tuition fees, has led to a considerable increase in student loan debt across the state, creating a ripple effect throughout the Washington economy.

The weight of student loan repayments affects various aspects of life for Washingtonians. The burden of monthly payments restricts financial flexibility, hindering crucial financial goals and impacting overall quality of life.

Student Loan Debt and Homeownership

High student loan debt often delays or prevents Washington residents from achieving homeownership. The substantial monthly payments reduce the amount of disposable income available for saving for a down payment, closing costs, and ongoing mortgage payments. This is particularly challenging in a competitive housing market like Washington’s, where home prices are often high. The financial strain of student loan repayment can make it difficult to qualify for a mortgage, pushing homeownership further out of reach for many. For example, a young professional might find themselves choosing between paying down their student loans aggressively or saving for a down payment, significantly delaying their ability to purchase a home.

Student Loan Debt and Starting Businesses

The financial constraints imposed by student loan debt can also deter Washington residents from starting their own businesses. Entrepreneurs often require significant capital investment to launch and sustain a new venture. With a substantial portion of their income allocated to loan repayments, individuals may lack the necessary funds to invest in their business ideas or to cover unexpected expenses. This limits entrepreneurial activity and potentially slows economic growth within the state. Many aspiring entrepreneurs might forgo their dreams due to the overwhelming debt burden, leading to missed opportunities for innovation and job creation.

Student Loan Debt and Overall Financial Well-being

Student loan debt significantly impacts overall financial well-being in Washington. The consistent monthly payments create financial stress, limiting the ability to save for retirement, emergencies, or other long-term goals. It can also lead to delayed marriage, family planning, and other life milestones. The constant pressure of repayment can negatively affect mental health and overall quality of life. For instance, individuals may delay investing in their health or education due to the pressure of loan repayment, further compounding the financial challenges they face.

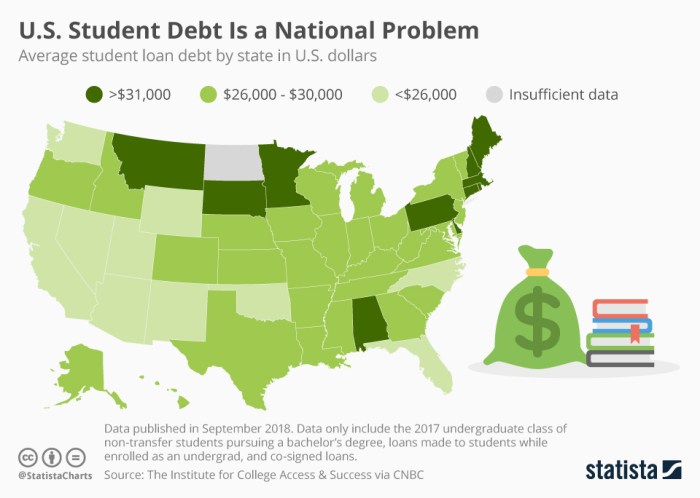

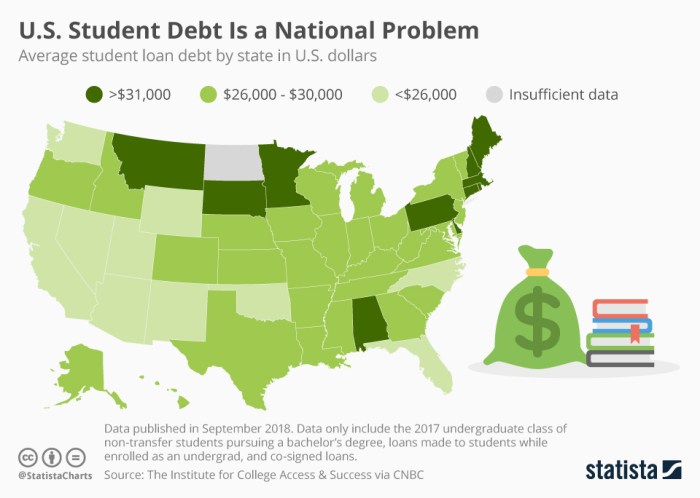

Comparison of Student Loan Debt Burden in Washington to Other States

The student loan debt burden in Washington can be compared to other states using various metrics, such as average loan amount, percentage of borrowers with debt, and the ratio of debt to income. A bar chart comparing these metrics across several states would provide a visual representation of Washington’s position relative to its peers.

Bar Chart Description

A bar chart depicting the average student loan debt per borrower across ten states, including Washington, would show the relative position of Washington’s average debt. The chart’s horizontal axis would list the states, while the vertical axis would represent the average student loan debt in dollars. The bars would visually represent the average debt for each state, allowing for easy comparison. Washington’s bar would be positioned among the others, allowing for a direct visual comparison of the state’s average student loan debt to other states. The chart would help illustrate whether Washington’s student loan debt burden is higher, lower, or similar to that of other states, providing a clear visual representation of the state’s relative position in this area. Additional data points, such as the percentage of borrowers with debt and the debt-to-income ratio, could be overlaid on the chart to provide a more comprehensive picture.

Final Thoughts

Managing student loan debt in Washington requires careful planning and understanding of the available options. By exploring the various repayment programs, forgiveness opportunities, and available resources, Washington residents can develop a strategic approach to debt reduction. Remember to actively seek assistance from the organizations listed and consider your individual circumstances when choosing a repayment plan. Taking proactive steps today can significantly impact your long-term financial well-being.

Essential FAQs

What is the Washington Student Achievement Council (WSAC)?

The WSAC is a state agency that provides financial aid information and resources to Washington students, including information on student loans.

Can I consolidate my federal student loans in Washington?

Yes, you can consolidate multiple federal student loans into a single loan through the federal government’s Direct Consolidation Loan program. This doesn’t change the total amount you owe, but it may simplify repayment.

What happens if I default on my student loans in Washington?

Defaulting on your student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to contact your loan servicer immediately if you’re struggling to make payments.

Are there any student loan scams to watch out for in Washington?

Be wary of companies promising quick loan forgiveness or debt relief without legitimate government backing. Always verify the legitimacy of any organization offering student loan assistance.