Navigating the complex world of student loans can feel overwhelming, especially when the goal is securing the lowest possible interest rate. This impacts not only your monthly payments but also the total amount you ultimately repay. Understanding the various federal and private loan options, along with the factors influencing interest rates, is crucial for making informed decisions and minimizing long-term debt.

This guide explores the diverse landscape of student loans, offering a comprehensive overview of federal programs, private loan alternatives, and effective repayment strategies. We’ll delve into the intricacies of interest rate calculations, highlighting key factors such as credit history and economic conditions. Ultimately, our aim is to empower you with the knowledge needed to secure the most favorable loan terms and pave the way for a financially sound future.

Types of Federal Student Loans

Navigating the world of federal student loans can feel overwhelming, but understanding the different types available is crucial for making informed borrowing decisions. This section will detail the key federal student loan programs, their eligibility requirements, and repayment options. Remember that interest rates are subject to change annually, so always check the official Federal Student Aid website for the most up-to-date information.

Federal Subsidized Loans

Federal Subsidized Loans are awarded based on financial need as determined by the Free Application for Federal Student Aid (FAFSA). A key benefit is that the government pays the interest on the loan while you’re in school at least half-time, during grace periods, and during deferment periods. This means your loan balance doesn’t grow during these times. Eligibility requires demonstrating financial need through the FAFSA and maintaining satisfactory academic progress. The interest rate is set annually by the government.

Federal Unsubsidized Loans

Unlike subsidized loans, Federal Unsubsidized Loans are not based on financial need. Any student who meets eligibility requirements can borrow this type of loan, regardless of their financial situation. Interest begins accruing immediately, from the moment the loan is disbursed, even while you’re in school. Eligibility primarily hinges on being enrolled at least half-time in an eligible educational program and meeting other general student aid requirements. The interest rate is set annually by the government and is typically slightly higher than the subsidized loan rate.

Federal PLUS Loans

Federal PLUS Loans are designed for graduate students and parents of undergraduate students. These loans are not need-based, but credit checks are conducted to assess creditworthiness. Parents applying for PLUS loans on behalf of their children are known as Parent PLUS Loans. Graduate students applying for themselves are known as Graduate PLUS Loans. Borrowers must have a satisfactory credit history (or meet certain exceptions), and maintain satisfactory academic progress. Interest rates are set annually and are generally higher than unsubsidized loans.

Direct Consolidation Loans

Direct Consolidation Loans allow borrowers to combine multiple federal student loans into a single loan with a new interest rate. This can simplify repayment by consolidating multiple monthly payments into one. The new interest rate is a weighted average of the interest rates of the loans being consolidated, rounded up to the nearest one-eighth of one percent. Eligibility requires having existing federal student loans. This isn’t a new loan with a new borrowing amount, but rather a way to manage existing debt.

Repayment Plan Comparison

The following table compares common federal student loan repayment plans and their impact on interest accrual. The total amount repaid will vary based on the chosen plan, and the longer the repayment period, the more interest will accrue over time.

| Repayment Plan | Payment Amount | Repayment Period | Interest Accrual Impact |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment | 10 years | Lower total interest paid compared to longer plans |

| Graduated Repayment Plan | Payments start low and increase over time | 10 years | Higher total interest paid due to lower initial payments |

| Extended Repayment Plan | Lower monthly payments | Up to 25 years | Significantly higher total interest paid due to longer repayment period |

| Income-Driven Repayment Plan (IBR, PAYE, REPAYE, ICR) | Based on income and family size | Up to 20-25 years | Potentially lower monthly payments but higher total interest paid over the long repayment period. Loan forgiveness may be possible after 20-25 years depending on the plan. |

Interest Rate Factors

Understanding the factors that influence your student loan interest rate is crucial for planning and budgeting. Several key elements contribute to the final interest rate you’ll pay, impacting your overall borrowing cost. These factors interact in complex ways, so it’s important to consider them holistically.

Several factors determine the interest rate you’ll receive on your student loans. These include your credit history, the type of loan you obtain, and the prevailing economic conditions. The interaction of these factors can significantly affect the total cost of your education.

Credit History’s Influence on Interest Rates

A strong credit history generally leads to lower interest rates. Lenders assess your creditworthiness based on factors like your payment history, debt levels, and length of credit history. A history of responsible credit management demonstrates your ability to repay loans, making you a less risky borrower in the eyes of the lender. Conversely, a poor credit history, characterized by missed payments or high debt, will likely result in higher interest rates or even loan denial. For example, a borrower with an excellent credit score might qualify for a 4% interest rate, while a borrower with a poor credit score might face an interest rate of 7% or higher on a similar loan.

Loan Type and Interest Rates

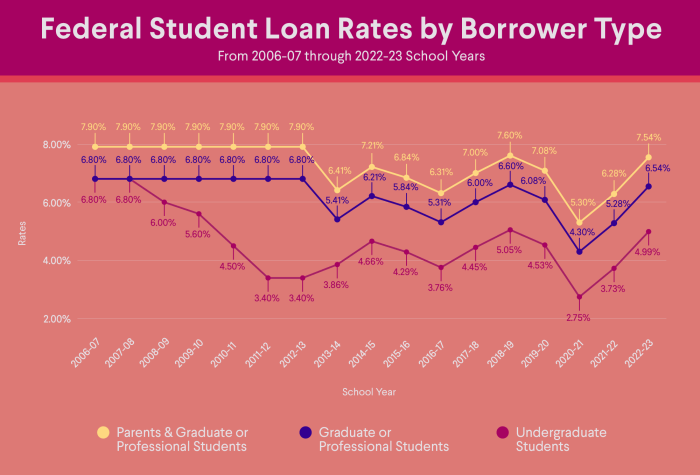

Different types of student loans carry different interest rates. Federal student loans, for instance, typically have lower interest rates than private student loans because they are backed by the government and considered less risky. Within federal loans, the interest rate can vary depending on the loan program (e.g., subsidized vs. unsubsidized loans). Furthermore, interest rates can fluctuate based on market conditions, which means rates can be different for each new loan period. For example, a subsidized federal Stafford loan might have a fixed interest rate of 4.5%, while a private loan from a bank could have a variable interest rate that changes periodically based on market indicators.

Economic Climate’s Impact on Interest Rates

The overall economic climate plays a significant role in student loan interest rates. When interest rates are generally low across the economy (a period of monetary easing), student loan rates tend to be lower as well. Conversely, during periods of high inflation and rising interest rates (a period of monetary tightening), student loan rates typically increase to reflect the higher cost of borrowing. For example, during a period of economic expansion with low inflation, a student might secure a loan with a 3% interest rate. However, during a recession or period of high inflation, the same loan could carry a 6% interest rate or more.

Private Student Loans

Private student loans offer an alternative funding source for higher education, supplementing or replacing federal loan options. Understanding their intricacies is crucial for making informed borrowing decisions, as they differ significantly from federal loans in terms of interest rates, repayment terms, and borrower protections.

Private student loans are offered by banks, credit unions, and other private lenders. Unlike federal loans, eligibility and interest rates are determined based on individual creditworthiness and financial history. This means that students with strong credit (often established through a co-signer) will typically secure lower interest rates than those with limited or poor credit.

Comparison of Private and Federal Student Loan Interest Rates

Federal student loan interest rates are generally lower than those offered by private lenders. This is because federal loan programs are backed by the government, reducing the risk for lenders. Private lenders, on the other hand, assess risk individually, leading to higher interest rates for borrowers deemed higher risk. The specific interest rate for a federal loan will vary depending on the loan type (subsidized, unsubsidized, etc.) and the year the loan was disbursed. In contrast, a private loan’s interest rate is largely dependent on the borrower’s credit score, debt-to-income ratio, and the prevailing market interest rates. For example, a student with excellent credit might secure a private loan with an interest rate comparable to a federal loan, but a student with poor credit might face an interest rate significantly higher than even the highest federal loan rate.

Advantages and Disadvantages of Private Student Loans

Private student loans can offer flexibility in loan amounts and repayment options not always available with federal loans. However, they lack the crucial borrower protections afforded by federal loans.

- Advantage: Potentially higher loan amounts to cover educational expenses beyond federal loan limits.

- Advantage: Flexibility in repayment plans, although these often come with higher costs.

- Disadvantage: Generally higher interest rates compared to federal loans, leading to greater overall borrowing costs.

- Disadvantage: Lack of federal protections, such as income-driven repayment plans and loan forgiveness programs.

- Disadvantage: More stringent eligibility requirements, often requiring a co-signer with good credit.

Key Considerations When Comparing Private Loan Offers

Before accepting a private student loan, carefully compare offers from multiple lenders. Consider these factors:

- Interest Rate: The annual percentage rate (APR) is the most important factor. A lower APR will save you money in the long run.

- Fees: Look for loans with low or no origination fees, late payment fees, and prepayment penalties.

- Repayment Terms: Compare repayment periods and the total interest you will pay over the life of the loan. Shorter repayment periods will lead to higher monthly payments but less interest paid overall.

- Deferment and Forbearance Options: Understand the terms and conditions for deferring or forbearing payments if you experience financial hardship. These options may or may not be available, and their terms can vary significantly.

- Co-signer Requirements: If a co-signer is required, understand their responsibilities and the impact on their credit.

Repayment Strategies

Choosing the right repayment strategy for your student loans is crucial for minimizing the total interest paid and avoiding long-term financial strain. Different plans offer varying levels of monthly payments and repayment periods, impacting the overall cost significantly. Understanding these options and their implications is key to responsible loan management.

The most effective repayment strategy depends on your individual financial circumstances, loan amounts, and interest rates. Factors such as your income, expenses, and future financial goals should all be considered when selecting a repayment plan. Careful planning and proactive management can save you thousands of dollars in interest over the life of your loans.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over 10 years. This plan offers predictable payments, making budgeting easier. However, the monthly payments can be higher than other plans, leading to faster repayment but potentially impacting your short-term cash flow. For example, a $30,000 loan at 5% interest would have a monthly payment of approximately $330, resulting in a total repayment of approximately $39,600.

Extended Repayment Plan

The Extended Repayment Plan stretches the repayment period to up to 25 years. This significantly lowers your monthly payments, making them more manageable for borrowers with tighter budgets. However, the longer repayment period results in paying substantially more interest over the life of the loan. Using the same $30,000 loan example at 5% interest, the monthly payment would be approximately $165, but the total repayment would be around $49,500, a difference of almost $10,000 in interest compared to the standard plan.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This plan can be beneficial for borrowers anticipating income growth, as the payments become more manageable in the early years. However, the increasing payments can become challenging to manage later if income growth does not keep pace. While the exact payment schedule varies based on the loan amount and interest rate, this plan often results in a total repayment amount that falls somewhere between the Standard and Extended plans.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans link your monthly payment to your income and family size. These plans include options such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). IDR plans typically result in lower monthly payments, especially during periods of lower income, but they may extend the repayment period to 20 or 25 years, leading to higher overall interest payments. For borrowers facing financial hardship, IDR plans can offer much-needed flexibility. The long-term cost should be carefully weighed against the short-term affordability.

Step-by-Step Guide to Choosing a Repayment Plan

Selecting the optimal repayment plan requires careful consideration of several factors. Following a structured approach can simplify the decision-making process.

- Assess your current financial situation: Analyze your monthly income, expenses, and debt obligations. Determine how much you can comfortably afford to pay each month towards your student loans.

- Compare repayment plan options: Research the different repayment plans available, focusing on their monthly payment amounts, total repayment costs, and repayment periods. Use online loan calculators to estimate payments for each plan based on your loan amount and interest rate.

- Consider your long-term financial goals: Think about your career aspirations, potential income growth, and future financial obligations (e.g., buying a house, starting a family). Align your repayment plan with your long-term financial objectives.

- Factor in potential income fluctuations: If you anticipate changes in your income, consider the flexibility offered by income-driven repayment plans. These plans can adjust your payments based on your income, providing greater stability during periods of financial uncertainty.

- Make an informed decision: Weigh the pros and cons of each repayment plan, considering your short-term and long-term financial goals. Choose the plan that best fits your individual circumstances and financial capabilities.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payments on your income and family size. These plans offer lower monthly payments than standard repayment plans, potentially leading to loan forgiveness after a set period of time. However, it’s crucial to understand how these plans work and their long-term implications.

IDR plans calculate your monthly payment based on a formula that considers your discretionary income (income above a certain poverty guideline) and family size. Because your payment is tied to your income, it can fluctuate as your income changes. While this provides flexibility, it also means you might pay more interest over the life of your loan compared to a standard repayment plan, as the lower monthly payment means a longer repayment period. The extended repayment period allows more time for interest to accrue. The potential for loan forgiveness after a significant repayment period is a key benefit, but it’s essential to carefully weigh the potential for higher overall interest costs.

Income-Driven Repayment Plan Examples

Let’s illustrate how IDR plans affect monthly payments and loan forgiveness. Suppose a borrower has $50,000 in student loans and an annual income of $40,000. Under a standard repayment plan, their monthly payment might be substantial. However, under an IDR plan, their monthly payment could be significantly lower, perhaps around $200, depending on the specific plan and income thresholds. This lower payment allows them to manage their budget more effectively. However, because of the lower monthly payment, it would take longer to repay the loan, leading to the accumulation of more interest. After 20 or 25 years of consistent payments under an IDR plan, depending on the specific plan’s requirements, the remaining balance might be forgiven. However, this forgiven amount is considered taxable income. This means the borrower receives relief from the loan, but they will owe taxes on the forgiven amount.

Income-Driven Repayment Plan Comparison

The following table summarizes some common income-driven repayment plans and their eligibility criteria. Eligibility requirements can change, so it’s always best to check the official government website for the most up-to-date information.

| Plan Name | Eligibility | Payment Calculation | Loan Forgiveness (Approximate) |

|---|---|---|---|

| Income-Based Repayment (IBR) | Federal student loans | 10-15% of discretionary income | 20-25 years |

| Pay As You Earn (PAYE) | Federal student loans disbursed after October 1, 2007 | 10% of discretionary income | 20 years |

| Revised Pay As You Earn (REPAYE) | Most federal student loans | 10% of discretionary income | 20-25 years |

| Income-Driven Repayment (IDR) | Federal student loans | Varies by plan; generally 10-15% of discretionary income | 20-25 years |

Loan Consolidation and Refinancing

Navigating the complexities of student loan repayment often leads borrowers to explore options like consolidation and refinancing. These strategies can potentially simplify repayment and potentially lower monthly payments, but it’s crucial to understand the implications before making a decision. Both processes involve combining multiple loans into a single one, but they differ significantly in their execution and impact.

Consolidation and refinancing offer distinct advantages and disadvantages that borrowers should carefully weigh. Consolidation, typically offered through the federal government, simplifies repayment by combining multiple federal loans into one. Refinancing, on the other hand, involves replacing your existing loans—federal or private—with a new loan from a private lender. This often comes with the possibility of securing a lower interest rate, but at the cost of losing federal loan benefits.

Interest Rate Impacts of Consolidation and Refinancing

Consolidating federal student loans usually results in a weighted average interest rate based on the interest rates of your existing loans. This means your new interest rate might be slightly higher or lower than your current average, depending on the specific rates of your individual loans. However, the key benefit of federal consolidation lies in simplifying repayment, not necessarily lowering the interest rate. Refinancing, conversely, aims to secure a lower interest rate by leveraging your creditworthiness and the current market conditions. Private lenders offer competitive rates, but these rates are variable and depend on factors such as your credit score, income, and debt-to-income ratio. A higher credit score typically leads to a lower interest rate. It is crucial to compare offers from multiple lenders before choosing a refinancing option to ensure you get the best possible rate.

Case Study: Refinancing Impact

Imagine Sarah, a recent graduate with $50,000 in federal student loans at an average interest rate of 6%. Her monthly payment is approximately $550 over a 10-year repayment plan. Sarah decides to refinance her loans with a private lender, securing a new loan at a 4% interest rate. By refinancing, her monthly payment is reduced to approximately $470, resulting in a monthly savings of $80. Over the 10-year repayment period, this translates to a total savings of approximately $9,600. However, it’s important to note that Sarah loses access to federal loan benefits such as income-driven repayment plans and potential loan forgiveness programs. This scenario highlights the potential financial benefits of refinancing, but also underscores the importance of carefully considering the trade-offs involved.

Avoiding Student Loan Scams

Navigating the world of student loans can be challenging, and unfortunately, it also exposes students to the risk of scams. These scams can lead to significant financial losses and long-term debt burdens. Understanding common tactics and how to identify legitimate lenders is crucial for protecting your financial future.

Scammers often employ deceptive tactics to lure unsuspecting students into fraudulent loan schemes. These tactics prey on the urgency and stress associated with financing education. Knowing what to look for can help you avoid becoming a victim.

Common Student Loan Scam Tactics

Scammers use a variety of deceptive methods to trick students into handing over their personal information and money. These tactics range from seemingly legitimate websites to high-pressure sales calls. Being aware of these methods is your first line of defense.

- Phishing Emails and Texts: Scammers often send emails or text messages that appear to be from legitimate student loan providers or government agencies. These communications may request personal information, such as Social Security numbers or bank account details, under the guise of loan processing or verification.

- Fake Websites: Fraudulent websites may mimic the appearance of legitimate student loan providers or government websites. These sites often contain misleading information and may request personal and financial information to steal identities or commit financial fraud.

- Advance Fee Scams: Some scammers demand upfront fees for loan processing or guarantee loan approval. Legitimate lenders never require upfront payments for loan application processing.

- High-Pressure Sales Tactics: Scammers may use high-pressure sales tactics to convince students to apply for loans quickly, without giving them time to research or compare options. They may use emotional appeals or false promises of easy loan approval.

- Guaranteed Loan Approval Scams: Scammers may claim to guarantee loan approval regardless of the applicant’s credit history or financial situation. Legitimate lenders assess applicants’ creditworthiness and financial history before approving loans.

Verifying the Legitimacy of Student Loan Offers

Before accepting any student loan offer, it’s crucial to take steps to verify its legitimacy. This proactive approach can prevent you from falling victim to a scam.

- Check the Lender’s Credentials: Verify the lender’s legitimacy by researching its registration and licensing information with relevant regulatory bodies. Look for information on their website and cross-reference it with government resources.

- Contact the Lender Directly: Don’t rely solely on unsolicited emails or phone calls. Contact the lender directly through official channels listed on their website to verify the offer.

- Compare Interest Rates and Fees: Compare the interest rates and fees offered with those from other reputable lenders. Unusually low interest rates or high fees may be a red flag.

- Review the Loan Terms Carefully: Thoroughly review the loan agreement before signing. Pay close attention to the repayment terms, interest rates, fees, and any other conditions.

- Report Suspicious Activity: If you suspect a student loan scam, report it immediately to the appropriate authorities, such as the Federal Trade Commission (FTC) or your state’s attorney general’s office.

Legitimate Lender vs. Fraudulent Lender Characteristics

Understanding the key differences between legitimate and fraudulent lenders is crucial for protecting yourself.

| Characteristic | Legitimate Lender | Fraudulent Lender |

|---|---|---|

| Website | Professional, secure website with contact information and clear terms and conditions. | Poorly designed website with missing or inaccurate information; may lack contact details. |

| Communication | Clear and professional communication; answers questions thoroughly and promptly. | Pressuring, vague, or evasive communication; avoids answering questions directly. |

| Fees | Transparent and clearly stated fees; no upfront fees required for loan application. | Hidden fees or excessive upfront fees; may claim to guarantee loan approval for a fee. |

| Interest Rates | Competitive interest rates based on creditworthiness and market conditions. | Unusually low interest rates that seem too good to be true. |

| Loan Terms | Clearly defined loan terms and repayment options. | Vague or unclear loan terms; may include hidden clauses or penalties. |

Financial Literacy Resources

Navigating the complexities of student loans requires a strong foundation in financial literacy. Understanding key concepts like interest rates, repayment plans, and budgeting is crucial for responsible debt management and long-term financial well-being. This section provides a list of reputable resources and emphasizes the importance of financial literacy in effectively managing student loan debt.

Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy empowers students to make informed decisions regarding their student loans, preventing potential pitfalls and fostering responsible borrowing habits. A solid understanding of personal finance principles allows students to create realistic budgets, track expenses, and prioritize loan repayment strategically. Without financial literacy, students may struggle to understand loan terms, leading to higher interest payments, missed payments, and ultimately, a more significant financial burden. This can have long-term consequences, impacting credit scores, future borrowing capabilities, and overall financial security. Proactive financial planning, informed by financial literacy, is essential for minimizing the long-term impact of student loan debt.

Reputable Financial Literacy Resources for Students

Accessing reliable information is key to making informed decisions about student loans. Several organizations offer free or low-cost resources to help students understand and manage their debt effectively.

- The National Foundation for Credit Counseling (NFCC): The NFCC offers free and low-cost credit counseling services, including guidance on managing student loan debt. They provide resources on budgeting, debt management strategies, and financial planning. Their website is a valuable resource for educational materials and tools.

- The Consumer Financial Protection Bureau (CFPB): The CFPB is a U.S. government agency dedicated to consumer protection. They offer a wealth of information on student loans, including resources on understanding loan terms, avoiding scams, and exploring repayment options. Their website provides clear and concise explanations of complex financial concepts.

- Federal Student Aid (FSA): FSA, part of the U.S. Department of Education, provides comprehensive information on federal student loan programs. Their website offers detailed explanations of different loan types, repayment plans, and other relevant information. It’s a primary source for accurate and up-to-date information on federal student loans.

- My Money Map: This interactive tool from the CFPB helps individuals create a personalized financial plan, including budgeting and debt management strategies. It provides a step-by-step approach to planning and tracking finances, tailored to individual needs and goals.

Flowchart for Effective Student Loan Debt Management

A structured approach is vital for successfully managing student loan debt. The following flowchart Artikels a step-by-step process for effective debt management. This process allows for proactive planning and minimizes the risk of financial hardship.

[Imagine a flowchart here. The flowchart would begin with “Understand Your Loans” (listing loan types, interest rates, repayment amounts). This would branch to “Create a Budget” (tracking income and expenses). This would branch to “Prioritize Repayment” (exploring repayment options, such as standard, graduated, or income-driven repayment). This would branch to “Monitor Progress and Adjust as Needed” (regularly reviewing budget and repayment plan, making adjustments as necessary). Finally, it would lead to “Achieve Debt Freedom”.]

Visual Representation of Interest Accrual

Understanding how interest accrues on student loans is crucial for effective financial planning. This section provides a simplified visual representation to illustrate this process. We will use a hypothetical scenario to demonstrate the compounding effect of interest over time.

Imagine a simple bar graph. The horizontal axis represents time, measured in years, and the vertical axis represents the total loan balance. We’ll track the balance of a $10,000 loan with a fixed annual interest rate of 5%, assuming no payments are made.

Interest Accrual Over Five Years

The first bar, representing year one, shows a height corresponding to $10,500. This is the initial principal ($10,000) plus the interest accrued in the first year ($10,000 x 0.05 = $500). The second bar, representing year two, will be taller, reflecting the interest calculated not only on the original principal but also on the accumulated interest from year one. Specifically, the year two balance is calculated as: $10,500 + ($10,500 x 0.05) = $11,025. This process continues for each subsequent year. Year three would show a balance of approximately $11,576.25, year four approximately $12,155.06, and year five approximately $12,762.81. The bars progressively increase in height, visually demonstrating the exponential growth of the loan balance due to compounding interest. The steeper the slope of the line connecting the tops of the bars, the faster the interest is accruing. This visual clearly shows how a seemingly small interest rate can significantly impact the total loan amount over time. The difference between the final balance and the initial principal represents the total interest paid. In this example, it’s approximately $2,762.81 over five years.

Impact of Loan Forgiveness Programs

Student loan forgiveness programs aim to alleviate the burden of student debt for specific groups of borrowers. These programs, while offering significant financial relief, have complex eligibility requirements and varying impacts on both individual borrowers and the overall cost of higher education. Understanding these programs is crucial for anyone considering or currently managing student loan debt.

Eligibility criteria for loan forgiveness programs are often stringent and vary widely depending on the specific program. Factors such as the type of loan, the borrower’s occupation, income level, and loan repayment history all play a significant role in determining eligibility. For instance, some programs prioritize borrowers working in public service, while others focus on those with specific types of federal loans or who have experienced economic hardship. The application processes can also be lengthy and require extensive documentation.

Types of Student Loan Forgiveness Programs

Several federal programs offer loan forgiveness opportunities. The Public Service Loan Forgiveness (PSLF) program, for example, forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness Program offers forgiveness for qualified teachers who have completed five years of teaching in low-income schools or educational service agencies. Other programs exist, each with its own specific eligibility requirements and limitations.

Impact of Loan Forgiveness on Education Costs

The existence of loan forgiveness programs can influence the overall cost of education in several ways. The potential for forgiveness might encourage students to borrow more, knowing there’s a chance a portion of their debt could be eliminated. This could lead to increased tuition costs as institutions may respond to higher student debt levels. Conversely, the availability of these programs can make higher education more accessible to individuals who might otherwise be deterred by the prospect of significant debt. The net effect is complex and subject to ongoing debate among economists and policymakers.

Examples of Individuals Benefitting from Loan Forgiveness

Many individuals have benefited significantly from loan forgiveness programs. For example, a teacher working in a low-income school district for ten years might see a substantial portion, or even all, of their student loans forgiven through the Teacher Loan Forgiveness Program, allowing them to achieve financial stability. Similarly, a social worker employed by a non-profit organization could qualify for PSLF after a decade of service, freeing them from the long-term burden of student loan debt. These examples illustrate the potential for loan forgiveness to positively impact the lives and financial well-being of individuals pursuing careers in public service and other vital fields.

End of Discussion

Securing student loans with the lowest interest rates requires careful planning and a thorough understanding of the available options. By comparing federal and private loan programs, analyzing interest rate factors, and implementing effective repayment strategies, borrowers can significantly reduce their long-term debt burden. Remember to leverage available resources, maintain financial literacy, and always be vigilant against loan scams. With diligent research and informed decision-making, you can navigate the student loan process successfully and achieve your educational and financial goals.

Questions Often Asked

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves switching from a federal loan to a private loan, potentially losing federal protections.

How does my credit score affect my student loan interest rate?

A higher credit score generally leads to lower interest rates, especially with private student loans. Federal loans primarily consider your loan type and income.

What are income-driven repayment plans?

Income-driven repayment plans adjust your monthly payments based on your income and family size, potentially leading to loan forgiveness after a set period.