Securing student loans can be challenging, especially for students lacking established credit or a cosigner. Traditional lenders often rely heavily on credit history and cosigner guarantees to assess risk. This absence can create significant hurdles for those starting their higher education journey without a financial safety net. This guide navigates the complexities of obtaining student loans under these circumstances, exploring alternative options and strategies to improve your chances of approval.

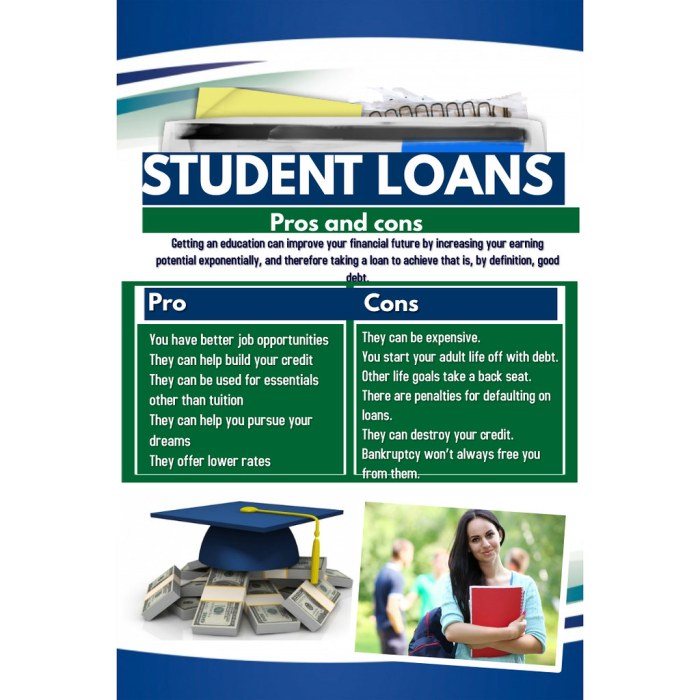

We’ll delve into the intricacies of federal loan programs, comparing their eligibility requirements, application processes, and the advantages and disadvantages they offer. We’ll also discuss methods for building credit, exploring alternative ways to mitigate lender risk, and addressing the potential pitfalls and scams that unfortunately exist in the student loan landscape. Finally, we’ll consider the long-term financial implications of student loan debt and provide practical strategies for responsible repayment.

Understanding the Challenges of Obtaining Student Loans Without Credit or a Cosigner

Securing student loans without a credit history or a cosigner presents significant hurdles for many prospective students. Lenders, understandably, require some assurance of repayment, and the absence of a credit history or a financially responsible cosigner dramatically increases the perceived risk. This makes the loan application process considerably more difficult and often leads to higher interest rates or loan denial.

Lenders typically assess loan applications based on several key factors. These include credit score (or lack thereof), income, debt-to-income ratio, and the applicant’s academic record. A strong credit history demonstrates responsible financial behavior, providing lenders with confidence in the applicant’s ability to repay the loan. Similarly, a cosigner with good credit acts as a guarantor, mitigating the lender’s risk. The absence of both significantly weakens the application.

Increased Lender Risk Without Credit History or Cosigner

The lack of a credit history presents a considerable challenge for lenders because it leaves them unable to assess the applicant’s past financial behavior. This uncertainty increases the risk of default, meaning the borrower fails to repay the loan. Without a cosigner to share the responsibility, the lender bears the entire risk. This increased risk often translates into higher interest rates for those who do qualify or, more commonly, outright loan rejection. For instance, a lender might assess a borrower with no credit history and no cosigner as having a significantly higher probability of default compared to a borrower with excellent credit and a co-signing parent. This higher risk directly impacts the lender’s decision-making process.

Situations Leading to Lack of Credit History or Cosigner

Many individuals find themselves in situations where securing a student loan without a credit history or cosigner is challenging. For example, students who are emancipated minors or those who have been estranged from their families might lack access to a cosigner. International students may also face difficulties due to limited credit history in the country where they are applying for loans. Furthermore, individuals who have experienced financial hardship in the past, potentially resulting in a poor credit score, might struggle to find a cosigner willing to assume the risk. Finally, some students may simply lack the awareness or resources to build credit before applying for student loans.

Common Misconceptions About Securing Student Loans Without Credit History or Cosigner

A common misconception is that obtaining a student loan without a credit history or cosigner is impossible. While significantly more difficult, it’s not entirely impossible. Some lenders specialize in loans for students with limited or no credit history, although these loans often come with higher interest rates. Another misconception is that all federal student loans require a cosigner. While federal loans often have more lenient requirements than private loans, they still assess creditworthiness and may deny applications based on financial factors. Finally, some believe that simply having a job guarantees loan approval. While income is a factor, it’s not the sole determining factor, and a steady income doesn’t automatically compensate for the lack of a credit history or cosigner.

Exploring Alternative Loan Options

Securing student loans without a credit history or cosigner presents significant challenges, but several alternative options exist. Understanding the nuances of federal loan programs and their eligibility requirements is crucial for navigating this process successfully. This section will explore these options, focusing on federal student loan programs and their comparison with private loans.

Federal student loan programs offer a viable pathway to funding education for students who lack established credit or a cosigner. These programs are backed by the federal government, making them generally more accessible than private loans. However, each program has specific eligibility criteria, interest rates, and repayment terms.

Federal Student Loan Programs and Eligibility

The primary federal student loan programs are the Direct Subsidized Loan, the Direct Unsubsidized Loan, and the Direct PLUS Loan. Eligibility for each program varies depending on factors such as financial need, enrollment status, and credit history (in the case of PLUS loans). The application process for all three involves completing the Free Application for Federal Student Aid (FAFSA), a crucial step that determines your eligibility for federal student aid.

Federal Student Loan Application Process

The application process for federal student loans differs significantly from private loans. Unlike private loans that often require a credit check and cosigner, federal student loans primarily assess financial need and enrollment status through the FAFSA. This form collects information about your income, assets, and family circumstances. Once processed, the information is used to determine your eligibility for various federal aid programs, including student loans. The disbursement of funds usually occurs directly to the educational institution.

Advantages and Disadvantages of Federal vs. Private Student Loans

Federal student loans generally offer several advantages over private loans, particularly for students with no credit or a cosigner. These advantages include more flexible repayment plans, potential for loan forgiveness programs, and lower interest rates compared to private loans which often carry higher interest rates and stricter eligibility requirements. However, federal loans may have lower loan limits than some private loans, meaning they may not cover the full cost of tuition and expenses. Private loans may offer larger loan amounts but often come with a higher risk, especially for borrowers with poor credit.

Comparison of Federal Student Loan Programs

| Loan Program | Interest Rate (Example – Rates Vary) | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Direct Subsidized Loan | Variable, set by the government | Starts after graduation or dropping below half-time enrollment | Demonstrated financial need, enrollment at least half-time in an eligible program |

| Direct Unsubsidized Loan | Variable, set by the government | Starts after graduation or dropping below half-time enrollment | Enrollment at least half-time in an eligible program |

| Direct PLUS Loan (Parent/Graduate) | Variable, set by the government | Starts after disbursement | Credit check; adverse credit history may require a cosigner or higher interest rate. Graduate students must be enrolled at least half-time. |

Strategies for Improving Loan Eligibility

Securing student loans without a credit history or cosigner presents significant challenges. However, proactive steps can significantly improve your chances of loan approval. Building a positive credit history is key, and this can be achieved through consistent responsible financial behavior over time. By demonstrating financial responsibility, you increase your attractiveness to lenders.

Building credit before applying for student loans requires a strategic approach. It’s a process that takes time and discipline, but the rewards are well worth the effort. The better your credit score, the more favorable loan terms you’ll likely qualify for. This includes lower interest rates and potentially more favorable repayment options.

Credit Building Strategies

Establishing a solid credit history requires consistent and responsible financial management. This involves demonstrating your ability to borrow money and repay it on time. Several methods can help you achieve this. For example, becoming an authorized user on a credit card held by someone with a good credit history can help build your credit. Another effective strategy is to obtain a secured credit card, requiring a security deposit that serves as your credit limit. Responsible use of either type of card will help establish a positive credit profile.

Actions Impacting Credit Scores

Several actions directly impact your credit score. Paying bills on time is paramount; late payments significantly damage your creditworthiness. Maintaining a low credit utilization ratio (the amount of credit used compared to the total credit available) is also crucial. Keeping your credit utilization below 30% is generally recommended. Furthermore, applying for multiple loans or credit cards in a short period can negatively affect your score, as it signals potential financial risk to lenders. Conversely, consistently paying down debt demonstrates financial responsibility, positively impacting your credit score. A long credit history, even if short, also indicates a stable financial track record.

Resources for Financial Literacy and Creditworthiness

Numerous resources are available to assist individuals in improving their financial literacy and creditworthiness. Non-profit credit counseling agencies provide free or low-cost guidance on budgeting, debt management, and credit repair. Government websites, such as the Consumer Financial Protection Bureau (CFPB) website, offer valuable information on credit scores, credit reports, and responsible credit use. Many online resources, including reputable personal finance websites, provide educational materials and tools to help individuals understand and manage their finances effectively. Utilizing these resources can empower you to make informed decisions and improve your financial standing.

Step-by-Step Guide to Improving Credit Scores (One-Year Plan)

A structured approach is vital for improving credit scores within a year. This plan focuses on building a positive credit history, which takes time. However, consistent effort will yield results.

- Months 1-3: Establish Credit – Apply for a secured credit card or become an authorized user on a credit card with a good credit history. Begin tracking your spending and ensure all bills are paid on time.

- Months 4-6: Monitor Credit Report – Obtain your free credit reports from AnnualCreditReport.com and review them for accuracy. Understand your credit score and identify areas for improvement. Continue paying all bills on time and keep your credit utilization low.

- Months 7-9: Reduce Debt – Focus on paying down existing debts, such as credit card balances, to lower your credit utilization ratio. This demonstrates responsible financial behavior.

- Months 10-12: Maintain Good Habits – Continue paying all bills on time and maintaining a low credit utilization ratio. Avoid applying for new credit unless absolutely necessary. Regularly review your credit report to ensure accuracy and identify any potential issues.

Exploring the Role of a Cosigner Substitute

Securing a student loan without a cosigner presents significant challenges, primarily due to the lender’s perceived increased risk. However, several strategies can mitigate this risk and potentially make loan approval more feasible, effectively acting as a cosigner substitute. These alternatives offer a pathway to financing education without relying on a traditional cosigner’s creditworthiness.

The absence of a cosigner necessitates demonstrating a strong commitment to repayment and reducing the lender’s perceived risk. This can be achieved through various methods that provide alternative assurances of repayment capability.

Alternative Forms of Security

Lenders assess risk based on the borrower’s ability and willingness to repay. Without a cosigner, alternative forms of security can help bolster a loan application. These might include providing collateral, such as a savings account, a certificate of deposit (CD), or even a valuable asset like a car or property. The value of the collateral must significantly outweigh the loan amount to assure the lender of recovery in case of default. The lender will typically hold this collateral until the loan is fully repaid. For example, a borrower might pledge a $20,000 CD as security for a $10,000 student loan. The lender’s risk is considerably reduced because they have a tangible asset to seize if repayment fails.

Guarantor Programs

While not a direct cosigner substitute in the traditional sense, some institutions or organizations offer guarantor programs. These programs might involve a third party – perhaps a family member or trusted individual – who agrees to vouch for the borrower’s repayment ability, although their financial liability might be less extensive than a cosigner’s. The exact nature of the guarantee will vary depending on the program and the lender. For instance, a guarantor might offer a smaller financial commitment or act as a reference to attest to the borrower’s character and responsibility. These programs often require rigorous vetting of both the borrower and the guarantor.

Comparison of Responsibilities

A traditional cosigner assumes full responsibility for loan repayment should the borrower default. This means the cosigner is legally obligated to cover the entire outstanding balance. In contrast, alternative forms of security, such as collateral, limit the lender’s recourse to the specific asset pledged. If the borrower defaults, the lender can seize and sell the collateral to recover losses. A guarantor program typically involves a less extensive commitment, varying in liability depending on the program’s specifics; the guarantor’s liability may be limited to a certain amount or conditional on specific circumstances. The degree of risk and responsibility varies considerably between these approaches.

Understanding the Implications of High-Interest Rates

Securing a student loan with no credit or cosigner often means accepting a higher interest rate. This seemingly small difference can significantly impact the total cost of your education over the life of the loan. Understanding these implications is crucial for responsible financial planning. Failing to account for high interest can lead to unexpected debt burdens and prolonged repayment periods.

High interest rates dramatically increase the total amount you repay compared to the principal loan amount. This is because interest accrues on the outstanding balance over time, compounding the debt. A seemingly small percentage increase in the interest rate can translate to thousands of extra dollars paid over the loan’s lifetime. Consider this: a $10,000 loan at 7% interest will cost significantly more than the same loan at 5%, even with the same repayment plan. The longer the repayment period, the greater the impact of the higher interest rate.

Loan Repayment Scenarios with Varying Interest Rates

Let’s compare two scenarios for a $20,000 student loan, repaid over 10 years, with differing interest rates. In Scenario A, the interest rate is 7%, while in Scenario B, it’s 10%. Using a standard amortization calculator (easily found online), we can see that in Scenario A, the monthly payment would be approximately $240 and the total interest paid over the 10 years would be roughly $8,800. However, in Scenario B, with the 10% interest rate, the monthly payment jumps to approximately $260, and the total interest paid balloons to roughly $12,000. This demonstrates a $3,200 difference in interest paid solely due to a 3% increase in the interest rate. This difference underscores the importance of seeking the lowest possible interest rate.

Strategies for Managing High-Interest Debt

Managing high-interest student loan debt requires a proactive approach. Prioritizing repayment and exploring options to lower interest rates are key strategies. One approach is to make extra payments whenever possible. Even small additional payments can significantly reduce the total interest paid and shorten the repayment period. Another strategy is to refinance your loan once your credit improves, potentially securing a lower interest rate. Finally, exploring income-driven repayment plans may provide temporary relief, though it typically extends the repayment period.

Budgeting Tools and Techniques for Student Loan Repayment

Effective budgeting is paramount for managing student loan repayments, especially with high-interest rates. Several tools and techniques can assist. Budgeting apps, such as Mint or YNAB (You Need A Budget), allow you to track income and expenses, helping you identify areas where you can save. The 50/30/20 budgeting rule (50% needs, 30% wants, 20% savings and debt repayment) provides a simple framework for allocating funds. Creating a detailed monthly budget that includes your student loan payment as a non-negotiable expense is crucial. Regularly reviewing and adjusting your budget as your financial situation changes ensures you remain on track. Consider using spreadsheets or personal finance software to visualize your progress and make informed decisions about your repayment strategy.

Potential Pitfalls and Scams to Avoid

Securing student loans can be stressful, especially without established credit or a cosigner. Unfortunately, this vulnerability makes some students prime targets for predatory lenders and outright scams. Understanding the red flags and knowing where to find reliable information is crucial for protecting your financial future. This section will highlight common pitfalls and provide guidance on how to navigate the loan application process safely.

Predatory lending practices and outright scams often prey on students’ desperation for funding. These schemes can lead to crippling debt and long-term financial hardship. By recognizing warning signs and understanding the characteristics of legitimate lenders, you can significantly reduce your risk.

Common Student Loan Scams

Many scams involve deceptive marketing tactics promising easy loan approvals, regardless of credit history or income. These often include high-pressure sales techniques and exaggerated claims about low interest rates or minimal fees. Be wary of any lender who guarantees approval without a proper credit check or requires upfront payments before disbursing funds. Legitimate lenders will thoroughly review your application and will never demand payment before you receive the loan. For example, a scam might involve a website advertising “guaranteed student loans, no credit check needed!” This should immediately raise a red flag.

Warning Signs of Predatory Lending

Several key indicators can help you identify predatory lending practices. These include exceptionally high interest rates (significantly above the national average for student loans), hidden fees, and confusing or unclear loan terms. Aggressive sales tactics, such as constant phone calls or emails, are also common. A legitimate lender will provide clear, concise information and answer all your questions patiently. For instance, an interest rate exceeding 20% for a federal student loan should be considered a serious warning sign. Similarly, a lender demanding significant upfront fees before loan disbursement is highly suspicious.

Identifying and Avoiding Loan Scams

The best defense against loan scams is vigilance and due diligence. Always research lenders thoroughly before applying. Check their reputation with the Better Business Bureau and read online reviews from other students. Never provide personal information or financial details unless you are certain the lender is legitimate and secure. If a deal seems too good to be true, it probably is. Take your time, compare offers from multiple lenders, and seek advice from a trusted financial advisor before making any decisions.

Reputable Sources for Student Loan Information and Assistance

Finding reliable information is essential to avoid scams. Here are some reputable sources for student loan information and assistance:

- Federal Student Aid (FSA): The official U.S. government website for student aid information.

- Your College or University’s Financial Aid Office: They can provide personalized guidance and resources.

- National Consumer Law Center (NCLC): Offers resources and advocacy for consumer protection.

- Better Business Bureau (BBB): Allows you to check the reputation of lenders and other financial institutions.

- Your State’s Attorney General’s Office: Can assist with complaints about predatory lending or fraud.

Illustrating the Long-Term Financial Implications

Student loan debt, while enabling access to education, can significantly impact your long-term financial well-being. The consequences extend far beyond the immediate repayment period, influencing major life decisions and potentially hindering the achievement of long-term financial goals. Understanding these implications is crucial for responsible borrowing and financial planning.

The weight of student loan debt can cast a long shadow over future financial goals. The monthly payments required to service the loan can severely restrict your ability to save for a down payment on a home, impacting your ability to achieve homeownership. Similarly, substantial loan payments can significantly reduce the amount you can contribute to retirement savings, potentially delaying or diminishing your retirement security. The earlier you address these potential impacts, the better equipped you’ll be to navigate them successfully.

Impact on Homeownership

Securing a mortgage requires a strong credit score and a manageable debt-to-income ratio. High student loan payments can significantly reduce your disposable income, making it challenging to save for a down payment and meet lender requirements for a mortgage. For example, a monthly student loan payment of $500 could represent a substantial portion of a young professional’s income, leaving limited funds for saving and other essential expenses. This can delay homeownership by several years or even make it unattainable without substantial lifestyle changes. This delay in homeownership translates to missed opportunities for building equity and wealth.

Impact on Retirement Planning

Student loan debt can severely impact retirement savings. The funds allocated to monthly loan repayments could have otherwise been invested in retirement accounts, such as 401(k)s or IRAs. The compounding effect of missing out on years of investment growth can have a dramatic impact on your retirement nest egg. For instance, consistently contributing $500 per month to a retirement account earning an average annual return of 7% over 30 years would accumulate significantly more than if that same $500 were consistently paid towards student loans. This reduction in retirement savings can lead to a less comfortable retirement or necessitate working longer than initially planned.

Example of a 10-Year Repayment Plan

Let’s consider a $30,000 student loan with a 7% interest rate, amortized over 10 years. The monthly payment would be approximately $360. However, over the 10-year repayment period, the total amount paid would be approximately $43,200. This means that the total interest paid over the life of the loan would be $13,200. This example illustrates the significant cost of borrowing and the importance of considering the total repayment amount when taking out student loans.

Visual Representation of Cumulative Interest

Imagine a bar graph. The horizontal axis represents different interest rates (e.g., 5%, 7%, 9%, 11%). The vertical axis represents the total cumulative interest paid over a 10-year loan period for a $30,000 loan. Each bar would visually represent the total interest paid at a specific interest rate. The bar representing 11% would be significantly taller than the bar representing 5%, clearly illustrating how a higher interest rate dramatically increases the total interest paid over the life of the loan. This visual representation effectively demonstrates the long-term financial implications of choosing a loan with a higher interest rate.

Wrap-Up

Navigating the world of student loans without credit or a cosigner requires careful planning and a thorough understanding of available resources. While the path may seem challenging, numerous options exist. By understanding federal loan programs, proactively building credit, and employing responsible financial strategies, students can secure the funding necessary to pursue their educational goals. Remember to always be vigilant against predatory lending practices and prioritize financial literacy to make informed decisions throughout the process. Your future financial well-being depends on it.

Questions and Answers

What if I have a limited credit history but some positive financial activity?

Lenders may consider positive financial activity, such as consistently paying bills on time, even with a limited credit history. Documenting this can strengthen your application.

Are there any scholarships or grants I can explore to reduce my loan need?

Yes, numerous scholarships and grants are available based on merit, financial need, and other criteria. Explore resources like FAFSA and your college’s financial aid office.

What happens if I default on my student loan?

Defaulting on a student loan can have serious consequences, including damage to your credit score, wage garnishment, and potential legal action. It’s crucial to explore repayment options if you encounter difficulties.

Can I refinance my student loans later to get a lower interest rate?

Yes, refinancing is an option once you’ve established a stronger credit history. However, it’s important to compare offers from multiple lenders to find the best terms.