Securing higher education funding can be challenging, especially for students lacking established credit or a co-signer. This often leads to anxiety and uncertainty about how to finance their studies. Fortunately, several options exist to help students navigate this process and access the financial resources they need to pursue their academic goals. This guide explores various avenues for obtaining student loans without a credit history or co-signer, including federal loan programs, private loan options, and alternative funding sources. We’ll also delve into strategies for building credit and understanding loan repayment plans.

We will examine the eligibility requirements, interest rates, repayment terms, and potential risks associated with each option. The goal is to empower students with the knowledge and tools to make informed decisions about financing their education and successfully manage their student loan debt.

Types of Student Loans Available Without Credit or Cosigner

Securing student loans without a credit history or a cosigner can be challenging, but several options exist for students needing financial assistance for higher education. Understanding the distinctions between federal and private loan programs is crucial for making informed decisions. This section Artikels the various loan types available, their eligibility requirements, and a comparison of their key features.

Federal Student Loans Without a Cosigner

Federal student loans are generally considered more accessible than private loans, especially for those lacking credit history or a cosigner. The government prioritizes providing access to education, making these loans a preferred starting point for many students.

Eligibility for federal student loans hinges primarily on demonstrating enrollment in an eligible educational program and meeting specific citizenship and residency requirements. Credit score and cosigner requirements are typically absent. However, students may need to complete a FAFSA (Free Application for Federal Student Aid) form to determine eligibility for federal grants and loans.

Interest rates on federal student loans are generally lower than those offered by private lenders. Repayment terms are flexible, offering various repayment plans to accommodate different financial situations. Federal loans also provide borrower protections, such as deferment and forbearance options in case of financial hardship.

Private Student Loans Without a Cosigner

Private student loans are offered by banks, credit unions, and other financial institutions. Securing a private student loan without a cosigner is considerably more difficult due to the higher risk for the lender. Many private lenders require a strong credit history and a good credit score to approve loan applications. The absence of a cosigner significantly increases this risk.

Eligibility for private student loans without a cosigner is highly dependent on the individual lender’s policies and the applicant’s financial profile. While some lenders might consider applicants with limited credit history, a strong academic record, and evidence of future earning potential, most will require a cosigner or excellent credit.

Interest rates on private student loans without a cosigner are typically higher than federal loans, reflecting the increased risk for the lender. Repayment terms can vary depending on the lender and the loan amount, but are often less flexible than federal loan repayment plans. Private loans may also carry additional fees, such as origination fees or prepayment penalties.

Comparison of Federal and Private Student Loans

The following table summarizes the key differences between federal and private student loans for borrowers without a cosigner. Keep in mind that specific interest rates and repayment terms can vary based on the lender and the individual applicant’s profile.

| Loan Type | Eligibility | Interest Rate | Repayment Terms |

|---|---|---|---|

| Federal Subsidized/Unsubsidized Loans | Enrollment in eligible program, FAFSA completion, US citizenship/residency | Variable, generally lower than private loans | Standard, graduated, extended, income-driven repayment plans |

| Private Student Loans (without cosigner) | Strong academic record, potential future earning capacity (highly lender-dependent; often difficult to obtain) | Variable, generally higher than federal loans | Variable, often less flexible than federal loan plans |

Federal Student Loan Programs for Students Without Credit

Federal student loans offer a crucial pathway to higher education for students who may not yet have established credit history. Unlike private loans, federal loan programs prioritize access based on financial need and enrollment status, rather than credit scores. This makes them a particularly valuable option for students without a credit history or a cosigner.

The primary federal student loan programs accessible to students without credit are the Direct Subsidized and Unsubsidized Loan programs. These programs are administered by the U.S. Department of Education and offer a range of benefits designed to support students throughout their educational journey.

Direct Subsidized and Unsubsidized Loans: Eligibility and Access

Both Direct Subsidized and Unsubsidized Loans are available to eligible undergraduate and graduate students. The key difference lies in whether the government pays the interest while the student is in school. Crucially, neither requires a credit check or a cosigner. Eligibility is determined primarily by financial need (for Subsidized loans) and enrollment status at a participating institution. Students must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility and loan amounts.

Application Process for Federal Student Loans

The application process for federal student loans begins with completing the FAFSA. This form gathers information about the student’s financial situation and educational goals. Once submitted, the FAFSA data is used to determine eligibility for federal aid, including student loans. Students will then receive a Student Aid Report (SAR) summarizing their eligibility and loan offers. The next step involves accepting the loan offer and completing a Master Promissory Note (MPN), which is a legal agreement outlining the terms and conditions of the loan. Additional documentation may be required depending on the individual student’s circumstances and institution’s policies.

Benefits and Drawbacks of Federal Student Loans Compared to Private Alternatives

Federal student loans offer several advantages over private loans, particularly for students without credit. These include more flexible repayment plans, income-driven repayment options, and protections against default. Federal loans often come with lower interest rates than private loans, particularly for those with limited or no credit history. However, the application process can be more complex, and the loan amounts may be capped based on financial need and cost of attendance. Private loans, while potentially offering higher loan amounts, often come with higher interest rates and less favorable repayment terms for those without established credit.

Key Advantages and Disadvantages of Federal Loan Programs

Understanding the specific advantages and disadvantages of each program is essential for informed decision-making.

- Direct Subsidized Loans:

- Advantages: Government pays interest while in school, grace period before repayment begins, lower interest rates than unsubsidized loans.

- Disadvantages: Stricter eligibility requirements based on financial need, lower loan amounts available.

- Direct Unsubsidized Loans:

- Advantages: No financial need requirement, higher loan amounts available than subsidized loans.

- Disadvantages: Interest accrues while in school, potentially leading to a larger total loan amount upon graduation, higher interest rates than subsidized loans.

Private Student Loan Options Without a Cosigner

Securing a student loan without a cosigner can be challenging, but several private lenders offer programs designed for students with limited or no credit history. These options often come with higher interest rates than loans with a cosigner, reflecting the increased risk for the lender. Understanding the terms and conditions of these loans is crucial before committing.

Several private lenders are known for their willingness to consider applicants without cosigners. However, it’s important to remember that approval is not guaranteed, and the terms offered may vary significantly depending on individual creditworthiness, academic standing, and other factors. It’s always recommended to compare offers from multiple lenders before making a decision.

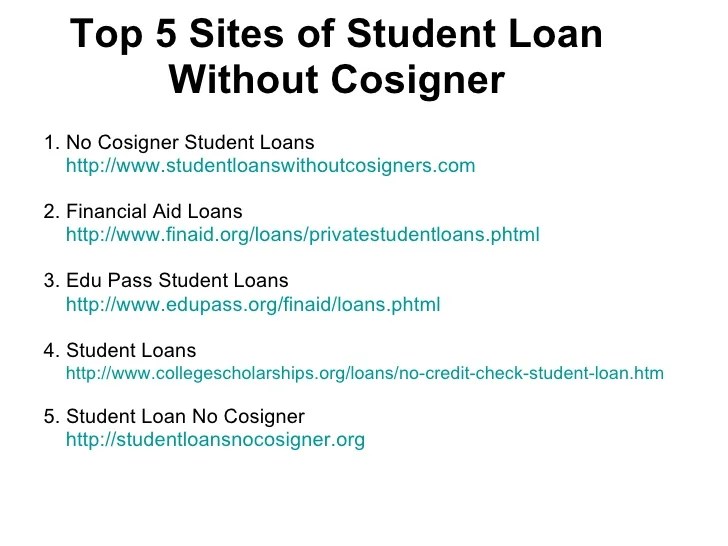

Private Lenders Offering Cosigner-less Student Loans

Finding a private lender willing to provide a student loan without a cosigner requires diligent research. While many lenders prefer cosigners to mitigate risk, some specialize in loans for students with limited or no credit. These lenders often assess applications based on factors beyond credit score, such as academic performance, future earning potential, and the chosen field of study. The availability of these programs can change, so it’s essential to check directly with the lenders for the most up-to-date information.

Examples of Private Loan Programs Without Cosigners

Several private lenders offer programs tailored to students without cosigners. These programs typically involve a more rigorous application process and may require additional documentation to demonstrate creditworthiness. Examples include programs focusing on students pursuing specific high-demand fields or those demonstrating strong academic achievement. However, specific program names and details are subject to change, so checking directly with the lender is essential.

Comparison of Interest Rates and Repayment Terms

Interest rates and repayment terms for private student loans without cosigners vary significantly depending on the lender, the borrower’s profile, and the loan amount. Generally, these loans have higher interest rates than those with a cosigner due to the increased risk for the lender. Repayment options may include fixed or variable interest rates, and repayment periods can range from several years to a decade or more. The table below provides a general comparison, but it’s crucial to obtain personalized quotes from individual lenders to accurately assess your options. Note that the interest rates and repayment options provided are examples and may not represent current offerings. Always check directly with the lender for the most current information.

| Lender | Loan Program (Example) | Interest Rate (Example) | Repayment Options (Example) |

|---|---|---|---|

| Lender A | Student Loan for High-Achievers | 7-10% Variable | Standard, Graduated, Extended |

| Lender B | No Cosigner Needed Loan | 8-12% Fixed | Standard, Income-Based Repayment (IBR) |

| Lender C | Future Focused Loan | 9-13% Variable | Standard, Accelerated |

Building Credit to Improve Loan Eligibility

Securing student loans without a credit history or cosigner can be challenging. However, proactively building credit before applying for loans significantly improves your chances of approval and can lead to more favorable interest rates. By establishing a positive credit history, you demonstrate your financial responsibility to lenders, making you a less risky borrower.

Establishing credit before applying for student loans involves demonstrating responsible financial behavior over time. This process takes effort and patience, but the rewards are well worth the investment. The key is to show lenders that you can manage credit responsibly and repay your debts on time.

Methods for Establishing Credit

Building credit requires a consistent and responsible approach. Several methods can help students establish a credit history. These include becoming an authorized user on a trusted individual’s credit card account, obtaining a secured credit card, or taking out a small loan specifically designed for credit building. Each option offers a unique pathway to building a credit profile. Consistent and responsible use of any of these options will contribute positively to your credit score.

Improving Credit Scores Through Responsible Financial Behavior

A step-by-step guide to improving credit scores emphasizes consistent, responsible financial management. First, obtain a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) to understand your current credit standing. Second, pay all bills on time; late payments significantly harm your credit score. Third, keep credit utilization low (ideally below 30% of your available credit). Fourth, avoid opening multiple credit accounts in a short period. Fifth, monitor your credit report regularly for errors and address them promptly. Sixth, consider using a credit-building tool or service. Consistent adherence to these steps will gradually improve your credit score over time. For example, a student who consistently pays their credit card bills on time and keeps their credit utilization low will see a gradual increase in their credit score within six to twelve months.

Impact of Credit History on Loan Interest Rates and Approval Chances

A strong credit history significantly influences both loan approval chances and interest rates. Lenders view individuals with good credit as lower risk, resulting in a higher likelihood of loan approval. Moreover, a higher credit score often translates to lower interest rates, saving borrowers substantial amounts of money over the life of the loan. For instance, a student with an excellent credit score might qualify for a student loan with an interest rate several percentage points lower than a student with a poor credit score or no credit history. This difference in interest rates can translate into thousands of dollars in savings over the repayment period.

Practical Strategies for Building Good Credit

Building good credit is a gradual process that requires consistent effort and responsible financial behavior.

- Become an authorized user on a credit card account of someone with good credit. This allows you to benefit from their positive credit history, assuming they maintain good financial habits.

- Apply for a secured credit card. These cards require a security deposit, which serves as collateral, making them easier to obtain for those with limited credit history.

- Pay all bills on time, every time. Even a single late payment can negatively impact your credit score.

- Keep your credit utilization low. Aim to use less than 30% of your available credit.

- Avoid opening multiple new credit accounts within a short period.

- Monitor your credit report regularly for errors and report any discrepancies immediately.

- Consider using a credit-building service or tool, which can provide guidance and support.

Alternatives to Traditional Student Loans

Securing funding for higher education can be a significant challenge, especially for students who lack established credit or a co-signer. While student loans are a common route, exploring alternative financing options can significantly reduce reliance on debt and provide a more manageable path to completing your degree. These alternatives, while requiring effort and research, can offer substantial financial relief and contribute to a more sustainable financial future.

Many students successfully fund their education without relying solely on loans. A multifaceted approach, combining several funding sources, often proves most effective. This involves strategically utilizing scholarships, grants, and work-study opportunities, potentially supplementing these with savings or family contributions.

Types of Scholarships and Grants

Scholarships and grants represent non-repayable forms of financial aid. They are awarded based on merit, need, or a combination of both. Unlike loans, they do not require repayment, making them highly desirable funding sources. The application process can be competitive, requiring students to dedicate time and effort to research and apply for numerous opportunities.

Resources for Finding Scholarships and Grants

Several online resources assist students in their search for financial aid. Websites like Fastweb, Scholarship America, and the College Board’s BigFuture offer extensive databases of scholarships and grants, allowing students to filter options based on their academic field, demographics, and financial need. Individual colleges and universities also maintain their own scholarship programs, often advertised through their financial aid offices or student services departments. State and local governments, as well as private organizations, frequently offer scholarships specific to their regions or interests. Thorough research across these diverse platforms is crucial for maximizing the chances of securing funding.

Advantages and Disadvantages of Alternative Funding Compared to Student Loans

| Feature | Alternative Funding (Scholarships, Grants, Work-Study) | Traditional Student Loans |

|---|---|---|

| Repayment | No repayment required | Requires repayment with interest |

| Impact on Future Finances | No long-term debt burden | Can create significant long-term debt |

| Accessibility | Competitive application process; limited availability | Generally more accessible, but comes with debt |

| Application Process | Requires research and multiple applications | Relatively straightforward application |

Combining Funding Sources to Cover Education Expenses

A comprehensive approach often involves combining multiple funding sources. For instance, a student might secure a partial scholarship covering tuition, supplement this with a grant for books and supplies, and participate in a work-study program to cover living expenses. Savings, family contributions, and even part-time jobs outside of work-study can further contribute to reducing reliance on loans. Careful budgeting and financial planning are crucial in coordinating these diverse funding streams to meet the overall cost of education. A realistic budget, considering all anticipated expenses, allows for effective allocation of resources from different sources.

Understanding Loan Repayment Plans

Choosing the right student loan repayment plan is crucial for managing your debt effectively. The plan you select significantly impacts your monthly payments, the total amount of interest you pay, and your overall financial health. Several options exist, each with its own advantages and disadvantages. Understanding these nuances is essential for making an informed decision.

Standard Repayment Plan

The standard repayment plan is the simplest option. It involves fixed monthly payments over a 10-year period. This plan is straightforward and predictable, making budgeting easier. However, the fixed monthly payments can be high, especially for borrowers with significant loan balances.

- Benefit: Predictable monthly payments and a relatively short repayment period.

- Drawback: Higher monthly payments compared to income-driven plans, potentially leading to financial strain.

- Example: A $50,000 loan at 5% interest would result in approximately $550 monthly payments under a standard 10-year plan. The total interest paid would be around $11,000.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years. Lower monthly payments are a key advantage, making it more manageable for borrowers with limited income. However, this comes at the cost of significantly higher total interest paid over the life of the loan.

- Benefit: Lower monthly payments, making repayment more affordable in the short term.

- Drawback: Substantially higher total interest paid due to the longer repayment period.

- Example: The same $50,000 loan at 5% interest, spread over 25 years, would result in approximately $280 monthly payments. However, the total interest paid would be close to $27,000, more than double the standard plan.

Graduated Repayment Plan

With a graduated repayment plan, your monthly payments start low and gradually increase over time. This can be helpful for recent graduates who anticipate higher income in the future. However, the increasing payments can become challenging to manage if income growth doesn’t match expectations.

- Benefit: Lower initial payments, making it easier to manage debt in the early years after graduation.

- Drawback: Payments increase over time, potentially becoming difficult to manage if income doesn’t increase accordingly. Total interest paid is generally higher than the standard plan, but potentially less than an extended plan.

- Example: The initial payments for a $50,000 loan under a graduated plan might be around $300, gradually increasing to over $600 by the end of the repayment period. The total interest paid would fall somewhere between the standard and extended repayment plans, depending on the specific plan’s schedule.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans base your monthly payments on your income and family size. These plans include options like the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. They offer lower monthly payments, often making repayment more manageable, especially during periods of lower income. However, they typically extend the repayment period to 20 or 25 years, leading to higher total interest paid. Furthermore, any remaining loan balance after 20 or 25 years may be forgiven (though this is subject to tax implications).

- Benefit: Significantly lower monthly payments, making repayment more affordable, especially during periods of lower income. Potential for loan forgiveness after 20 or 25 years.

- Drawback: Longer repayment period, resulting in significantly higher total interest paid. Loan forgiveness is subject to tax implications.

- Example: For a $50,000 loan, an IDR plan might result in monthly payments as low as $150-$200 depending on income and family size. However, the total interest paid and the length of the repayment period will be significantly higher than under a standard plan.

Potential Risks and Considerations

Securing student loans without a cosigner or established credit history can present significant financial challenges. Understanding these risks is crucial before committing to a loan, as they can significantly impact your financial future. Borrowers should carefully weigh the potential benefits of higher education against the potential drawbacks of substantial debt.

High interest rates and substantial debt are primary concerns for borrowers without a cosigner. Lenders often perceive these individuals as higher risk, resulting in less favorable loan terms. This can lead to a much larger overall repayment amount compared to loans with lower interest rates, potentially extending the repayment period for many years. The total cost of education, therefore, can far exceed the initial tuition fees.

High Interest Rates and Debt Burden

Loans without a cosigner frequently come with significantly higher interest rates than those secured with a cosigner or strong credit history. This means a larger portion of each payment goes towards interest rather than principal, slowing down the repayment process and increasing the overall cost. For example, a $20,000 loan at a 10% interest rate will cost considerably more over its lifetime than a similar loan at a 5% interest rate. The difference in total repayment can amount to thousands of dollars. Furthermore, the accumulation of interest can quickly lead to a substantial debt burden, making it difficult to manage other financial responsibilities.

Understanding Loan Terms and Conditions

Before signing any loan agreement, it is paramount to thoroughly understand all terms and conditions. This includes the interest rate, repayment schedule, fees (origination fees, late payment fees, etc.), and any potential penalties for default. Failing to comprehend these details can lead to unexpected financial strain and long-term consequences. Read the fine print carefully, and don’t hesitate to ask for clarification on anything you don’t understand.

Implications of Defaulting on Student Loans

Defaulting on student loans has severe repercussions. This includes damage to your credit score, making it harder to secure loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and even legal action are potential outcomes. The consequences can extend far beyond the initial loan amount, significantly impacting your financial well-being for years to come. For example, a default can make it extremely difficult to purchase a home or a car, impacting major life milestones.

Careful financial planning is essential before taking on student loan debt. Consider all available options, including grants, scholarships, and part-time employment, to minimize borrowing. Create a realistic budget that accounts for loan repayment and other expenses. Failing to do so can lead to overwhelming debt and financial hardship.

Final Thoughts

Navigating the world of student loans without credit or a co-signer requires careful planning and research. While challenges exist, numerous resources and strategies are available to help students secure the necessary funding for their education. By understanding the different loan options, exploring alternative funding sources, and proactively building credit, students can significantly increase their chances of accessing affordable and manageable financing. Remember to thoroughly review loan terms and conditions before committing to any agreement, and prioritize responsible financial management throughout the entire process.

FAQ Explained

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during deferment. Unsubsidized loans accrue interest from the time they’re disbursed.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing may be possible, but it often requires established credit. Explore options after building credit or securing a co-signer.

What happens if I default on my student loans?

Defaulting can result in wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to explore repayment options if facing difficulty.

Are there any government programs that assist with student loan repayment?

Yes, several income-driven repayment plans and potential forgiveness programs exist, depending on your employment and loan type. Research these options through the relevant government websites.