Securing higher education often requires significant financial planning. For many families, the Student Parent PLUS Loan serves as a crucial funding source. This guide delves into the intricacies of this federal loan program, providing a clear understanding of eligibility criteria, interest rates, repayment options, and potential long-term financial implications. We aim to equip parents with the knowledge necessary to make informed decisions regarding this significant financial commitment.

Understanding the Student Parent PLUS Loan involves navigating a complex landscape of regulations and financial considerations. From initial eligibility assessments to long-term repayment strategies, the process demands careful attention to detail. This guide provides a structured approach, breaking down the key aspects of the loan program into manageable sections, offering practical advice and clear explanations to empower parents to confidently manage this aspect of their child’s education.

Loan Eligibility Criteria

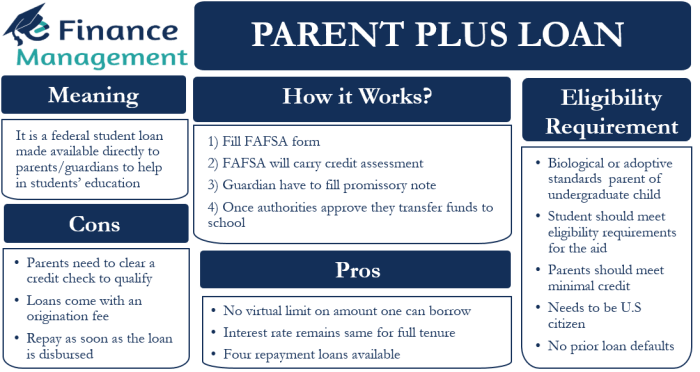

Securing a Student Parent PLUS Loan requires meeting specific eligibility criteria established by the U.S. Department of Education. Understanding these requirements is crucial for prospective borrowers to determine their eligibility and plan accordingly. This section details the necessary qualifications and provides a comparison with other federal student loan programs.

Parent PLUS Loan Eligibility Requirements

To be eligible for a Parent PLUS Loan, applicants must meet several key requirements. These requirements ensure responsible lending practices and protect both the borrower and the government. Failure to meet any of these criteria will result in loan ineligibility.

| Requirement | Description | Impact on Eligibility | Resources |

|---|---|---|---|

| U.S. Citizenship or Eligible Non-Citizen Status | Applicants must be a U.S. citizen or eligible non-citizen. | Ineligible if not a U.S. citizen or eligible non-citizen. | Department of Homeland Security website for information on eligible non-citizen statuses. |

| Student Enrollment | The student must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible school. | Ineligible if the student is not enrolled at least half-time at an eligible institution. | Federal Student Aid website for a list of eligible schools. |

| Financial Responsibility | Applicants must not have an adverse credit history, as defined by the Department of Education. This includes serious delinquencies, defaults, or bankruptcies. | Ineligible if an adverse credit history is found. May be eligible with an endorser. | Federal Student Aid website for details on credit history requirements. |

| Parent Status | The applicant must be a parent of a dependent student. The definition of a dependent student is determined by the Free Application for Federal Student Aid (FAFSA). | Ineligible if not a parent of a dependent student. | Federal Student Aid website for information on dependency status. |

| Satisfactory Credit History | The applicant must demonstrate a satisfactory credit history, which means they have not experienced significant credit problems in recent years. Specific criteria are Artikeld by the Department of Education. | Ineligible if credit history is unsatisfactory. May be eligible with an endorser. | Contact a lender or the Federal Student Aid website for clarification on credit history requirements. |

Comparison with Other Federal Student Loan Programs

Parent PLUS Loans differ from other federal student loan programs, such as Direct Subsidized and Unsubsidized Loans, primarily in their eligibility criteria and terms. Direct Subsidized and Unsubsidized Loans are available to students directly, based on financial need (Subsidized) or without need-based considerations (Unsubsidized). Parent PLUS Loans, however, are solely for parents of dependent students, requiring a credit check and focusing on parental financial responsibility for the student’s education. The interest rates and repayment terms may also differ between these loan types.

Credit History Requirements for Parent PLUS Loan Applicants

The Department of Education carefully reviews the credit history of Parent PLUS Loan applicants. This review assesses factors such as payment history on existing loans and credit accounts, bankruptcies, and other significant credit events. Applicants with adverse credit history, such as defaults or significant delinquencies, may be denied a Parent PLUS Loan. However, in some cases, applicants with adverse credit history may still be eligible if they obtain an endorser who agrees to repay the loan if the applicant defaults. The specific criteria for evaluating creditworthiness are not publicly available in detail, but generally involve a review of credit reports from major credit bureaus.

Interest Rates and Fees

Understanding the interest rates and fees associated with Parent PLUS Loans is crucial for effective financial planning. This section will clarify the current rates, how they’re determined, and the impact of origination fees on the total loan cost. Accurate information in this area allows parents to make informed borrowing decisions and avoid unexpected expenses.

Parent PLUS Loan interest rates are variable and are determined by the U.S. Department of Education. The rate is set annually, and it is fixed for the life of the loan. The rate is not based on an individual applicant’s creditworthiness in the same way a private loan might be. However, if a parent is denied a Parent PLUS loan due to adverse credit history, they may be able to obtain a loan with an endorser or by securing a private education loan, which may have different interest rates based on credit.

Interest Rate Determination

The interest rate for Parent PLUS Loans is determined by a formula set by the federal government. This formula considers several factors, including prevailing market interest rates and the overall cost of borrowing for the federal government. The rate is announced each year prior to the start of the new academic year and remains consistent for the duration of the loan. It’s important to note that the rate is fixed, meaning it won’t fluctuate over the life of the loan, providing predictability for budgeting.

Origination Fees

Parent PLUS Loans are subject to an origination fee, which is a percentage of the loan amount. This fee is deducted from the loan proceeds before the funds are disbursed to the borrower. The origination fee helps cover the costs associated with processing and administering the loan. The exact percentage of the origination fee can vary slightly from year to year, but it remains a relatively small percentage of the overall loan amount. For example, a 4.228% origination fee on a $10,000 loan would result in a $422.80 fee. This fee adds to the total cost of the loan, ultimately increasing the amount that must be repaid.

Interest Rates and Fees Comparison (Example Data – Illustrative Purposes Only)

| Academic Year | Interest Rate | Origination Fee |

|---|---|---|

| 2023-2024 | 8.05% | 4.228% |

| 2022-2023 | 7.54% | 4.228% |

| 2021-2022 | 6.28% | 4.228% |

Note: The above table presents illustrative data and is not exhaustive. Actual rates and fees are subject to change and should be verified directly with the Department of Education or a financial aid office. This table is intended to show the potential variation in interest rates over time, while the origination fee has remained consistent in the example provided. It is crucial to check the current rates before making any borrowing decisions.

Loan Repayment Options

Understanding your repayment options for Parent PLUS Loans is crucial for effective financial planning. Choosing the right plan depends on your individual financial situation and long-term goals. Several repayment plans are available, each with its own advantages and disadvantages. Careful consideration of these factors will help you manage your loan debt effectively.

Parent PLUS Loan Repayment Plan Options

The Department of Education offers several repayment plans for Parent PLUS Loans. These plans differ primarily in their payment calculation methods and potential for loan forgiveness. The most common plans include Standard Repayment, Extended Repayment, and Income-Driven Repayment (IDR) plans. Each plan has unique characteristics that borrowers should evaluate before selecting one.

Applying for an Income-Driven Repayment Plan

Applying for an income-driven repayment plan involves submitting an application through the Federal Student Aid website (StudentAid.gov). You will need to provide information about your income and family size. The application process typically requires verification of your income through tax documents or pay stubs. Once approved, your monthly payment will be recalculated based on your income and family size. The specific IDR plan chosen (e.g., ICR, PAYE, REPAYE) will influence the length of the repayment period and the potential for loan forgiveness.

Comparison of Repayment Plan Options

Choosing the right repayment plan involves weighing the benefits and drawbacks of each option. For instance, a Standard Repayment plan offers a shorter repayment period but higher monthly payments. Conversely, an IDR plan may result in lower monthly payments but a longer repayment period and potentially higher overall interest paid. The Extended Repayment plan offers a longer repayment period than the Standard plan, resulting in lower monthly payments but higher total interest paid. The optimal choice depends on individual circumstances and priorities.

| Plan Name | Payment Calculation Method | Minimum Payment | Loan Forgiveness Potential |

|---|---|---|---|

| Standard Repayment | Fixed monthly payment over 10 years | Based on loan amount and interest rate | None |

| Extended Repayment | Fixed monthly payment over up to 25 years | Lower than Standard Repayment | None |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE) | Based on your discretionary income and family size | Varies based on income | Potential for loan forgiveness after 20 or 25 years, depending on the plan |

Loan Consolidation and Refinancing

Managing your Parent PLUS Loans effectively involves understanding the options available for simplifying repayment. Consolidation and refinancing are two key strategies that can potentially reduce your monthly payments or lower your overall interest costs, but it’s crucial to carefully weigh the pros and cons of each before making a decision. Both methods aim to streamline your loan payments, but they differ significantly in their approach and implications.

Consolidating and refinancing Parent PLUS Loans can offer significant advantages, but also present potential drawbacks. Choosing the right path depends on your individual financial situation and long-term goals. Let’s explore each option in detail.

Consolidating Parent PLUS Loans with Other Federal Student Loans

Parent PLUS Loans can be consolidated with other federal student loans (including your child’s federal student loans, if applicable) through the federal Direct Consolidation Loan program. This process combines multiple loans into a single loan with a new interest rate, typically a weighted average of the interest rates of the original loans. The new interest rate is fixed, and the repayment term may be extended, leading to lower monthly payments. However, extending the repayment term can result in paying more interest over the life of the loan. It’s important to carefully calculate the total interest paid under different repayment scenarios. The consolidation process is managed through the Federal Student Aid website.

Refinancing a Parent PLUS Loan with a Private Lender

Refinancing involves replacing your federal Parent PLUS Loan with a new loan from a private lender, such as a bank or credit union. Private lenders often offer lower interest rates than federal loans, particularly for borrowers with excellent credit scores. However, refinancing a federal loan with a private lender means losing the benefits associated with federal student loans, including income-driven repayment plans, deferment options, and potential forgiveness programs. Private refinancing loans typically require a credit check and may have stricter eligibility requirements. It is essential to compare interest rates and fees from multiple private lenders before making a decision.

Comparison of Consolidation and Refinancing

| Feature | Consolidation (Federal) | Refinancing (Private) |

|---|---|---|

| Loan Type | Federal Direct Consolidation Loan | Private Loan |

| Interest Rate | Weighted average of original loan rates (fixed) | Variable or fixed, typically based on credit score |

| Eligibility | Generally available to all federal student loan borrowers | Credit check required, stricter eligibility criteria |

| Repayment Plans | Access to federal repayment plans, including income-driven repayment | Limited or no access to federal repayment plans |

| Loan Forgiveness | Potential for loan forgiveness programs | No access to federal loan forgiveness programs |

| Fees | Minimal or no fees | May involve origination fees or other charges |

Steps Involved in the Loan Consolidation Process

The process of consolidating federal student loans is relatively straightforward, but requires careful planning and attention to detail. It’s important to understand the implications of consolidation before proceeding.

- Gather necessary information: Collect your federal student loan details, including loan numbers, balances, and interest rates.

- Complete the Direct Consolidation Loan application: Submit the application through the Federal Student Aid website.

- Review and accept the terms: Carefully review the terms of the consolidated loan before accepting.

- Monitor your loan account: After consolidation, track your loan balance and payments through the designated loan servicer.

Potential Financial Implications

Borrowing with a Parent PLUS Loan can have significant long-term financial consequences. Understanding these implications is crucial for responsible financial planning. Careful consideration of the loan amount, interest rates, and repayment options is essential to minimize potential negative impacts.

The total cost of a Parent PLUS Loan significantly exceeds the initial loan amount due to accumulated interest and fees. These additional costs can substantially impact a family’s budget and long-term financial goals. Failing to account for these added expenses can lead to unforeseen financial difficulties.

Total Cost Calculation Example

Let’s consider a $20,000 Parent PLUS Loan with a 7.5% fixed interest rate and a 10-year repayment period. Using a standard amortization calculator (easily found online), the total repayment amount would be approximately $27,868. This means an additional $7,868 is paid solely in interest and fees over the life of the loan. If the interest rate were higher, or the repayment period longer, the total cost would increase significantly. A longer repayment period lowers monthly payments, but increases the total interest paid over the life of the loan. A shorter repayment period increases monthly payments, but decreases the total interest paid.

Consequences of Default

Defaulting on a Parent PLUS Loan has severe repercussions. These include damage to credit scores, wage garnishment, tax refund offset, and potential difficulty obtaining future loans. Default can make it challenging to secure mortgages, auto loans, or even credit cards, significantly hindering financial stability. The negative impact on credit scores can last for years, making it more expensive to borrow money in the future. In some cases, default can lead to legal action.

Impact of Repayment Plan Choices

The choice of repayment plan directly influences the total interest paid. A standard 10-year repayment plan typically results in higher monthly payments but lower overall interest compared to longer repayment plans, such as an extended repayment plan. While extended repayment plans reduce monthly payments, they significantly increase the total interest paid over the loan’s lifetime. For example, extending the $20,000 loan mentioned above to 20 years could result in a total repayment amount exceeding $35,000, depending on the interest rate and fees. Borrowers should carefully weigh the trade-offs between manageable monthly payments and minimizing long-term interest costs.

Financial Aid Alternatives

Securing funding for higher education is a significant undertaking, and the Parent PLUS loan is just one avenue. Exploring alternative financial aid options can significantly reduce reliance on loans and potentially lessen the long-term financial burden. This section details various alternatives, comparing their advantages and disadvantages to help you make informed decisions.

Comparison of Financial Aid Options

Understanding the nuances of different financial aid options is crucial for effective planning. The following table summarizes key aspects of scholarships, grants, and other federal student loans, allowing for a direct comparison of their accessibility and application procedures.

| Financial Aid Option | Availability | Application Process | Benefits | Drawbacks |

|---|---|---|---|---|

| Scholarships | Highly competitive; varies by institution and sponsor. Many are merit-based, while others are need-based or specific to particular demographics (e.g., major, ethnicity, etc.). | Typically involves completing an application, submitting transcripts, and potentially writing essays or providing letters of recommendation. Deadlines vary greatly. | Free money; does not need to be repaid. Can significantly reduce overall educational costs. | Highly competitive; requires significant time and effort to apply for multiple scholarships. Award amounts can vary widely. |

| Grants | Based on financial need; availability varies by institution and government programs (e.g., Pell Grants). | Requires completing the FAFSA (Free Application for Federal Student Aid). Some institutional grants may have additional application requirements. | Free money; does not need to be repaid. Can significantly reduce overall educational costs. | Often limited funding; may not cover the entire cost of education. Eligibility criteria can be restrictive. |

| Federal Subsidized/Unsubsidized Loans (Stafford Loans) | Available to eligible undergraduate and graduate students who demonstrate financial need (Subsidized) or regardless of financial need (Unsubsidized). | Requires completing the FAFSA. Loan amounts are determined based on financial need and cost of attendance. | Lower interest rates compared to private loans; flexible repayment options are available. | Must be repaid with interest; can contribute to significant student loan debt if not managed carefully. Subsidized loans have interest paid by the government while the student is enrolled at least half-time; Unsubsidized loans accrue interest while the student is enrolled. |

| Federal Work-Study | Part-time employment program for undergraduate and graduate students with financial need. | Requires completing the FAFSA. Eligibility and job opportunities vary by institution. | Provides part-time income to help pay for educational expenses; valuable work experience. | Limited hours; may not cover all educational expenses. Job availability and suitability may vary. |

Additional Considerations for Choosing Financial Aid

Choosing the right mix of financial aid requires careful consideration of individual circumstances, including academic performance, financial need, and long-term financial goals. Factors such as the type of institution (public vs. private), the student’s chosen field of study, and the length of the program will all influence the availability and suitability of different financial aid options. For example, a student pursuing a high-demand career might be more likely to secure scholarships, while a student with significant financial need might rely more heavily on grants and federal loans. Thorough research and planning are essential for making informed decisions.

Impact on Credit Score

Taking out a Parent PLUS loan will impact your credit score, but the extent of the impact depends on several factors and how you manage your loan repayment. Understanding these factors and employing sound financial strategies can help mitigate negative effects and even improve your creditworthiness over time.

Parent PLUS loans, like other loans, are reported to credit bureaus. The addition of this loan to your credit report will increase your debt-to-credit ratio, which is a key factor in determining your credit score. A higher debt-to-credit ratio generally leads to a lower credit score. However, responsible repayment demonstrates creditworthiness and can offset the initial negative impact.

Factors Influencing Credit Score Impact

Several factors influence how a Parent PLUS loan affects your credit score. These include your existing credit history, the loan amount, your payment history, and your overall debt management. A strong credit history prior to taking out the loan can help buffer the impact of the new debt. Conversely, a weaker credit history might experience a more significant drop. Similarly, a larger loan amount will generally have a more substantial impact than a smaller one, as it increases your overall debt burden. Consistent and timely payments are crucial in mitigating any negative effects. Excellent payment history on the Parent PLUS loan, as well as other credit accounts, will show lenders that you are a responsible borrower, positively influencing your credit score. Finally, effectively managing your overall debt, including other loans and credit cards, is key. Keeping your debt-to-credit ratio low will help maintain a healthy credit score.

Managing Credit Scores During Repayment

Managing your credit score while repaying a Parent PLUS loan involves proactive steps to minimize negative impacts and build positive credit history. This includes consistently making on-time payments, monitoring your credit report regularly for accuracy, and maintaining a low debt-to-credit ratio. Consider budgeting carefully to ensure you can afford the monthly payments without resorting to late payments or default. Regularly checking your credit report helps identify and address any errors that might negatively impact your score. This proactive approach helps to demonstrate responsible financial behavior to lenders. Furthermore, maintaining a low debt-to-credit ratio, by strategically paying down other debts, helps improve your creditworthiness.

Strategies for Maintaining a Good Credit Score

Maintaining a good credit score during and after repayment of a Parent PLUS loan requires a multi-faceted approach. Here are some key strategies:

- Make on-time payments: This is the single most important factor in determining your credit score. Even one missed payment can have a significant negative impact.

- Keep your debt-to-credit ratio low: Strive to keep your credit utilization ratio (the amount of credit you use compared to your total available credit) below 30%. This shows lenders that you are managing your debt responsibly.

- Monitor your credit report regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) annually to identify and correct any errors.

- Diversify your credit: Having a mix of credit accounts (e.g., student loans, credit cards, auto loans) can positively influence your credit score, provided they are managed responsibly.

- Consider debt consolidation: If you have multiple debts, consolidating them into a single loan with a lower interest rate can simplify repayment and potentially improve your credit score over time.

- Avoid opening new credit accounts unnecessarily: Each new credit inquiry can slightly lower your score. Only open new accounts when you genuinely need them.

Closing Notes

Successfully navigating the Student Parent PLUS Loan process requires careful planning and a thorough understanding of the program’s intricacies. By carefully considering eligibility requirements, interest rates, repayment options, and potential long-term financial implications, parents can make informed decisions that support their child’s educational goals while minimizing potential financial strain. Remember to explore all available financial aid options and seek professional advice when needed to ensure a responsible and successful approach to financing higher education.

FAQ

What happens if I can’t make my Parent PLUS Loan payments?

Missed payments can lead to delinquency, negatively impacting your credit score and potentially resulting in loan default. Contact your loan servicer immediately to explore options like deferment or forbearance.

Can I get a Parent PLUS Loan even if I have a slightly lower credit score?

While a good credit history is preferred, you may still qualify even with a less-than-perfect score. The Department of Education will consider other factors. It’s advisable to apply and see if you’re approved.

How does the interest rate on my Parent PLUS Loan compare to other loan types?

Parent PLUS Loan interest rates are typically higher than subsidized federal student loans. The exact rate varies and is determined by the prevailing market interest rate at the time of loan disbursement.

What is the difference between a Parent PLUS Loan and a Direct Unsubsidized Loan?

A Parent PLUS Loan is taken out by the parent, while an Unsubsidized loan is taken out by the student. Interest accrues on Unsubsidized loans immediately, whereas Parent PLUS Loan interest accrues after disbursement.