Navigating the complexities of student loan repayment can feel overwhelming. Fortunately, studentaid.gov/loan-consolidation offers a potential solution for borrowers seeking to streamline their debt. This guide explores the process of consolidating federal student loans, outlining the eligibility requirements, financial implications, and steps involved in applying. We’ll examine the advantages and disadvantages to help you determine if consolidation is the right choice for your financial situation.

Understanding the nuances of loan consolidation is crucial for making informed decisions about your student loan debt. This resource aims to provide a clear and comprehensive overview, empowering you to take control of your repayment strategy. From exploring different repayment plans to understanding the impact on interest rates and loan forgiveness programs, we cover key aspects to ensure you’re well-prepared throughout the process.

Understanding studentaid.gov/loan-consolidation

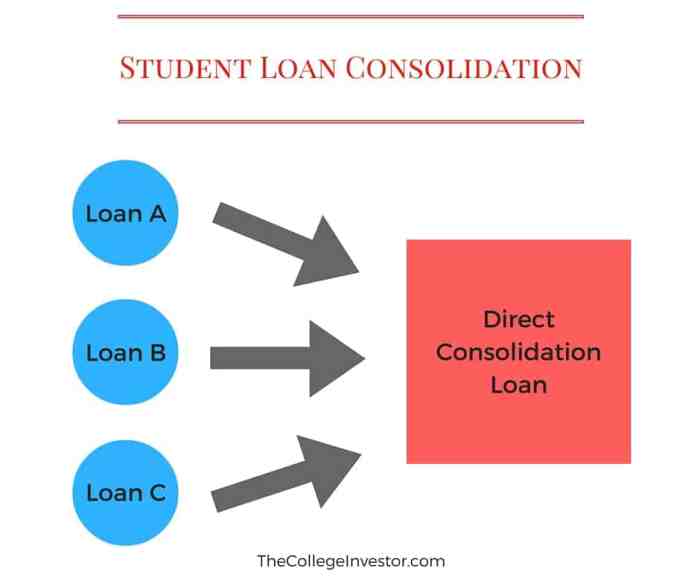

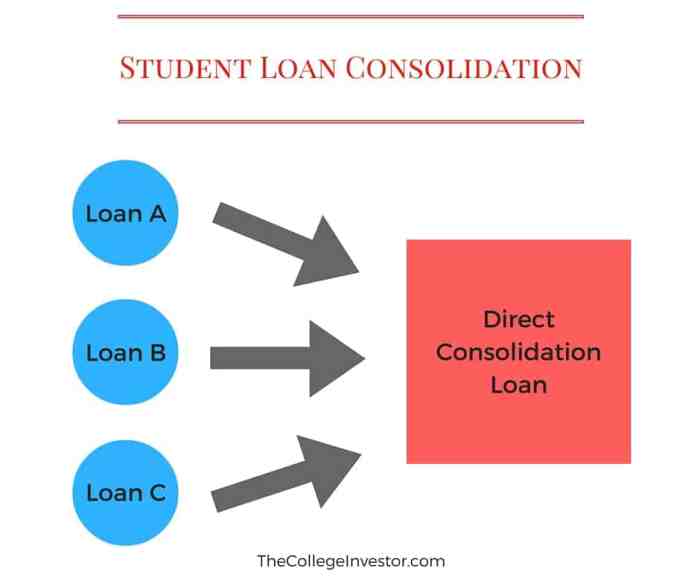

Loan consolidation, as presented on studentaid.gov, is a process that combines multiple federal student loans into a single, new loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. It’s a valuable tool for managing your student loan debt, but understanding its intricacies is crucial before proceeding.

Purpose of Loan Consolidation

The primary purpose of federal student loan consolidation is to streamline the repayment process. By combining multiple loans, borrowers receive one monthly payment, making it easier to track and manage their debt. This can lead to improved organization and potentially reduced administrative burden. Consolidation does not, however, lower the total amount of debt owed.

Eligible Federal Student Loans

Several types of federal student loans are eligible for consolidation. These generally include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for both parents and graduate students), and Federal Stafford Loans (older programs). However, it’s important to check the studentaid.gov website for the most up-to-date list of eligible loans, as this information can change. Private student loans are not eligible for federal consolidation.

Step-by-Step Application Process

The application process for federal student loan consolidation through studentaid.gov is generally straightforward. While specific steps may be subject to change, the general process usually involves these steps:

1. Gather Information: Collect your Federal Student Aid (FSA) ID, loan details (loan numbers, amounts, and lenders), and Social Security number.

2. Complete the Application: Access the online application on studentaid.gov. You will need to provide all the necessary information about your existing federal student loans.

3. Review and Submit: Carefully review your application for accuracy before submitting it. Ensure all information is correct to avoid delays.

4. Loan Disbursement: After your application is approved, your new consolidated loan will be disbursed, and your old loans will be paid off. You will then begin making payments on your consolidated loan.

5. Understand Your New Repayment Plan: Familiarize yourself with the terms and conditions of your new loan, including the interest rate, repayment schedule, and any applicable fees.

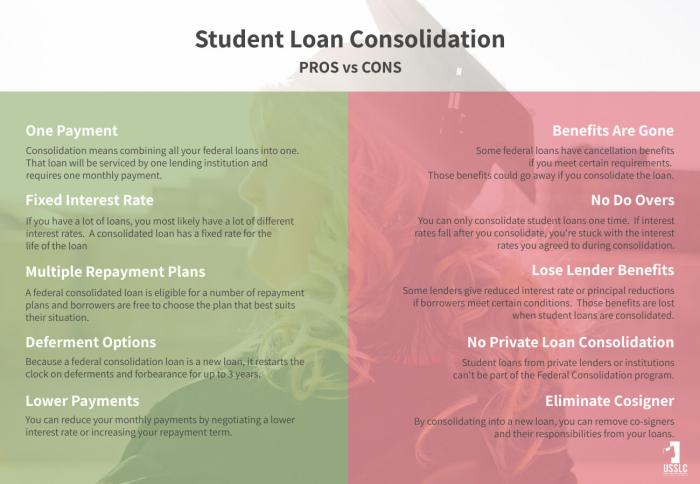

Advantages and Disadvantages of Loan Consolidation

| Advantages | Disadvantages |

|---|---|

| Simplified repayment with a single monthly payment | May result in a longer repayment period and potentially higher total interest paid |

| Potentially lower monthly payment amount (depending on the repayment plan chosen) | Loss of certain benefits associated with specific loan types (e.g., income-driven repayment plans may have different terms after consolidation) |

| Improved organization and easier tracking of loan payments | Potential increase in the total interest paid over the life of the loan if a longer repayment term is selected |

Eligibility Criteria for Loan Consolidation

Consolidating your federal student loans can simplify your repayment process by combining multiple loans into a single one. However, eligibility requirements must be met before you can consolidate. Understanding these requirements is crucial to ensure a smooth and successful consolidation.

Federal Student Loan Eligibility

To be eligible for federal student loan consolidation, you must have eligible federal student loans. This generally includes Direct Loans, Federal Family Education Loans (FFEL), and Federal Perkins Loans. However, not all loans within these programs are eligible; for instance, some FFEL loans held by private lenders may not qualify. You should check the official studentaid.gov website for the most up-to-date list of eligible loan types. The consolidation process involves submitting an application through the Federal Student Aid website, providing information on your existing loans, and confirming your identity. It’s important to note that defaulted loans may still be eligible for consolidation, but this often requires addressing the default status first.

Income-Based Repayment Plans After Consolidation

After consolidating your federal student loans, you may be eligible for several income-driven repayment plans. These plans adjust your monthly payment based on your income and family size. The availability of specific plans (such as Income-Driven Repayment, Pay As You Earn, Revised Pay As You Earn, and Income-Based Repayment) depends on your loan type and the specific program details. These plans can significantly lower your monthly payments, especially during periods of lower income, but it’s crucial to understand that extending the repayment period will generally result in paying more interest over the life of the loan.

Impact of Credit History on Consolidation

Your credit history does not directly affect your eligibility for federal student loan consolidation. This is a key difference between federal consolidation and private loan refinancing options, which often consider credit scores. However, while your credit score isn’t a factor in eligibility, a poor credit history might affect your eligibility for certain repayment plans or other financial products in the future.

Comparison of Repayment Plan Options Post-Consolidation

Understanding the various repayment plan options available after consolidation is essential for effective financial planning. Choosing the right plan depends on your individual financial situation and long-term goals.

Below is a comparison of common repayment plans available after consolidation:

- Standard Repayment Plan:

- Fixed monthly payments over 10 years.

- Highest monthly payments, but shortest repayment period.

- Generally results in the lowest total interest paid.

- Extended Repayment Plan:

- Fixed monthly payments over a longer period (up to 25 years).

- Lower monthly payments than the standard plan.

- Results in higher total interest paid due to the longer repayment period.

- Graduated Repayment Plan:

- Payments start low and gradually increase over time.

- Can be helpful in the early stages of your career when income is typically lower.

- Payments may become significantly higher later in the repayment period.

- Income-Driven Repayment Plans (IDR):

- Monthly payments are based on your income and family size.

- Lower monthly payments, but typically longer repayment periods.

- Potential for loan forgiveness after a set number of payments (depending on the specific plan).

Financial Implications of Consolidation

Consolidating your federal student loans can significantly impact your finances, both positively and negatively. Understanding these implications is crucial before making a decision. This section will explore how consolidation affects your interest rate, total interest paid, loan forgiveness programs, and repayment term.

Consolidation’s Effect on Interest Rates

Consolidation combines multiple loans into a single loan with a new interest rate. This new rate is a weighted average of your existing loan interest rates, often rounded up. While this might seem advantageous if you have high-interest loans, it’s important to note that the weighted average might not always result in a lower rate than your lowest existing rate. In some cases, the new rate could be slightly higher. It’s essential to compare your current interest rates to the offered consolidated rate before proceeding.

Comparison of Total Interest Paid Before and After Consolidation

The following hypothetical scenarios illustrate how consolidation can affect the total interest paid over the life of your loans. These are simplified examples and your actual results may vary.

| Scenario | Initial Interest | Consolidated Interest | Total Interest Saved/Lost |

|---|---|---|---|

| Scenario A: Three loans with high interest rates consolidated into one lower rate | $20,000 | $18,000 | $2,000 Saved |

| Scenario B: Two loans with low interest rates consolidated, resulting in a slightly higher rate | $10,000 | $10,500 | $500 Lost |

| Scenario C: Multiple loans with varying interest rates, resulting in a rate close to the average | $15,000 | $14,800 | $200 Saved |

Impact of Consolidation on Loan Forgiveness Programs

Consolidating your loans can affect your eligibility for certain loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF). The type of loans you consolidate and the terms of your new loan will determine the impact. For example, consolidating Direct Loans into a Direct Consolidation Loan generally maintains eligibility for income-driven repayment plans and PSLF, but consolidating Federal Family Education Loans (FFEL) into a Direct Consolidation Loan may reset your progress towards forgiveness under PSLF. It is crucial to carefully review the requirements of any loan forgiveness program you are pursuing before consolidating.

Consolidation’s Effect on Loan Repayment Term

Consolidation allows you to choose a new repayment term, typically ranging from 10 to 30 years. A longer repayment term lowers your monthly payment, but it also increases the total interest you pay over the life of the loan. Conversely, a shorter repayment term increases your monthly payments but reduces the total interest paid. The optimal repayment term depends on your financial situation and priorities. Choosing a shorter term might be preferable to minimize long-term interest costs, while a longer term provides immediate affordability.

The Consolidation Process and Associated Forms

Consolidating your federal student loans simplifies your repayment by combining multiple loans into a single one. This process involves completing specific forms and providing necessary documentation to the Department of Education. Understanding these requirements is crucial for a smooth and efficient consolidation.

The primary form used for loan consolidation is the Direct Consolidation Loan application. This form requests detailed information about your existing federal student loans, including lender names, loan amounts, and interest rates. You’ll also need to provide personal information, such as your Social Security number, date of birth, and contact details. Supporting documentation usually includes a list of your federal student loans, obtained from your loan servicers. This list should clearly detail the loan amount, interest rate, and any outstanding balance. Additional documentation might be required depending on your individual circumstances; for instance, if you’re consolidating Parent PLUS loans, you might need to provide documentation confirming your parental relationship to the student borrower.

Required Forms and Documentation

The Direct Consolidation Loan application is the cornerstone of the process. Accurate completion is paramount to avoid delays. Along with the application, you will need to gather documentation verifying your federal student loans. This often involves contacting your current loan servicers to request official loan statements. These statements must clearly show the loan details, including the loan type, balance, and interest rate. Failure to provide complete and accurate information can lead to processing delays or rejection of your application.

Flowchart Illustrating the Consolidation Process

Imagine a flowchart beginning with the “Start” box. The next step would be “Gather Loan Information and Complete Application,” followed by “Submit Application and Supporting Documentation.” After this comes a decision box: “Application Approved?” If yes, the process moves to “Loan Consolidation Completed.” If no, the process branches to a box stating “Address Application Issues,” looping back to “Submit Application and Supporting Documentation.” Finally, the flowchart ends with an “End” box. This visual representation simplifies the process, showing the potential for iteration if issues arise.

Common Mistakes During the Application Process

Many applicants make common mistakes that delay the process or even lead to rejection. One frequent error is providing incomplete or inaccurate information on the application form. Another is failing to submit all the required supporting documentation. Some applicants also fail to understand the financial implications of consolidation, leading to unexpected consequences. Finally, not thoroughly reviewing the application before submission is a significant oversight that often causes problems. Addressing these potential issues proactively minimizes the risk of application delays.

Tips for a Successful Loan Consolidation Application

To ensure a smooth consolidation process, several key steps should be followed. Careful preparation is essential.

- Gather all necessary documentation well in advance: This includes loan statements, contact information for loan servicers, and personal identification.

- Complete the application accurately and thoroughly: Double-check all information for accuracy before submitting.

- Submit all required documentation: Ensure all supporting documents are included with the application.

- Understand the financial implications: Carefully consider the potential impact on your interest rate and repayment terms.

- Keep copies of all documents: Maintain copies of your application and supporting documentation for your records.

Post-Consolidation Management

Consolidating your federal student loans simplifies your repayment process by combining multiple loans into a single, new loan. However, effective management of this consolidated loan is crucial to avoid future financial difficulties. Understanding your responsibilities and available resources after consolidation is key to successful repayment.

Managing your consolidated loan involves regular monitoring of your account, making timely payments, and understanding your options should you encounter financial hardship. Access to your account information is readily available online through the designated student loan servicer’s website. This website provides a comprehensive overview of your loan details, including your current balance, interest rate, payment due date, and repayment schedule. You can also update your contact information and enroll in automatic payments through this platform.

Making Payments on Consolidated Loans

Payments on your consolidated loan are typically made monthly to your designated loan servicer. You can choose from several payment methods, including online payments, mail, or automatic debit from your bank account. Automatic payments often offer convenience and can help avoid late payment fees. It is vital to make your payments on time each month to maintain a good credit history and avoid penalties. Missing payments can negatively impact your credit score and potentially lead to more serious consequences.

Options for Borrowers Experiencing Payment Difficulty

If you find yourself struggling to make your monthly loan payments, several options are available to help you manage your debt. These options include forbearance, deferment, and income-driven repayment plans. Forbearance temporarily suspends or reduces your payments, while deferment postpones payments altogether. Income-driven repayment plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers facing financial hardship. It’s crucial to contact your loan servicer as soon as you anticipate difficulties to explore the available options and avoid default.

Consequences of Defaulting on Consolidated Loans

Defaulting on your consolidated student loan has serious consequences. Default occurs when you fail to make payments for a certain period, typically 9 months. The consequences include damage to your credit score, wage garnishment, tax refund offset, and potential legal action. Defaulting can make it difficult to obtain future loans, credit cards, or even rent an apartment. The impact on your financial future can be substantial and long-lasting. It is imperative to proactively address any payment challenges to avoid default.

Example Monthly Payment Schedule

The following table illustrates a sample monthly payment schedule for a consolidated loan. Remember that your actual payment schedule will depend on your individual loan amount, interest rate, and repayment term. This is a simplified example and does not include any potential fees or changes in interest rates.

| Month | Starting Balance | Payment |

|---|---|---|

| 1 | $20,000 | $400 |

| 2 | $19,600 | $400 |

| 3 | $19,200 | $400 |

| 4 | $18,800 | $400 |

| 5 | $18,400 | $400 |

| 6 | $18,000 | $400 |

| … | … | … |

Conclusion

Consolidating federal student loans through studentaid.gov can significantly simplify your repayment journey, potentially reducing monthly payments and offering access to income-driven repayment plans. However, careful consideration of the long-term financial implications, including potential increases in total interest paid, is paramount. By thoroughly understanding the process and your individual circumstances, you can make an informed decision that aligns with your financial goals and long-term well-being.

Essential Questionnaire

What happens to my loan forgiveness progress after consolidation?

The impact on loan forgiveness programs varies depending on the program. Some programs may be affected, while others may not. It’s crucial to check with your loan servicer to understand the specific implications for your situation.

Can I consolidate private student loans?

No, the studentaid.gov consolidation program is only for federal student loans. Private loans cannot be included in the consolidation process.

What if I can’t make my payments after consolidation?

Several options exist, including deferment, forbearance, and income-driven repayment plans. Contact your loan servicer immediately to discuss your options and avoid default.

How long does the consolidation process take?

Processing times can vary, but generally, you can expect the process to take several weeks. You’ll receive updates from your loan servicer throughout the process.