Navigating the complexities of student loan repayment can feel overwhelming. Understanding your options and projecting future costs is crucial for financial planning. A student aid loan simulator offers a powerful tool to visualize different repayment scenarios, allowing you to make informed decisions about your educational debt. This guide explores the functionality of these simulators, demonstrating how they can help you manage and ultimately conquer your student loans.

We’ll delve into the various types of simulators available, the key input parameters influencing the results, and different repayment plans. We will also examine how factors like interest rates, repayment periods, and unexpected life events can significantly impact your total repayment costs. By understanding these dynamics, you can proactively plan for a more financially secure future.

Understanding Student Aid Loan Simulators

Student aid loan simulators are invaluable tools for prospective and current borrowers navigating the complexities of student loan repayment. These online calculators provide a realistic estimate of future loan payments, helping individuals make informed decisions about borrowing and repayment strategies. Understanding how these simulators work is crucial for effective financial planning.

Student loan simulators function by taking various input parameters and applying standard loan amortization formulas to project future payments. The results usually include a detailed repayment schedule, total interest paid, and potential scenarios based on different repayment options. This allows users to explore the financial implications of their borrowing decisions before committing to a loan.

Types of Student Loan Simulators

Student loan simulators can be broadly categorized as either federal or private. Federal simulators often focus on loans provided through government programs like the Federal Direct Loan Program. These simulators will typically incorporate the specific repayment plans offered by the federal government, such as Standard, Extended, Graduated, and Income-Driven Repayment (IDR) plans. Private loan simulators, on the other hand, generally cater to loans from private lenders. These simulators may incorporate different interest rates and repayment options offered by various private lenders, and might not include government-specific repayment plans. The key difference lies in the loan types considered and the repayment options available within each simulator.

Key Input Parameters for Student Loan Simulators

Several key input parameters are crucial for accurate simulation results. These typically include: the total loan amount borrowed, the annual interest rate, the loan term (length of repayment), and the chosen repayment plan. Additional parameters might include any potential grace periods (a period before repayment begins), loan origination fees (fees charged when the loan is disbursed), and the possibility of additional payments during the repayment period. Accurate input is critical, as even small variations in these parameters can significantly impact the projected repayment schedule and total interest paid. For example, a seemingly small difference of 1% in the interest rate can lead to a substantial difference in total repayment costs over the life of the loan.

Comparison of Loan Simulator Features

| Feature | Simulator A | Simulator B | Simulator C |

|---|---|---|---|

| Repayment Plan Options | Standard, Extended, Graduated | Standard, Extended, Income-Driven | Standard, Fixed-Rate, Variable-Rate |

| Interest Rate Calculation | Fixed, Simple Interest | Fixed, Compound Interest | Variable, Compound Interest |

| Additional Features | Loan amortization schedule | Loan amortization schedule, extra payment calculator | Loan amortization schedule, extra payment calculator, debt consolidation option |

| Data Visualization | Text-based output | Text-based output, charts | Interactive charts, graphs |

Exploring Repayment Scenarios

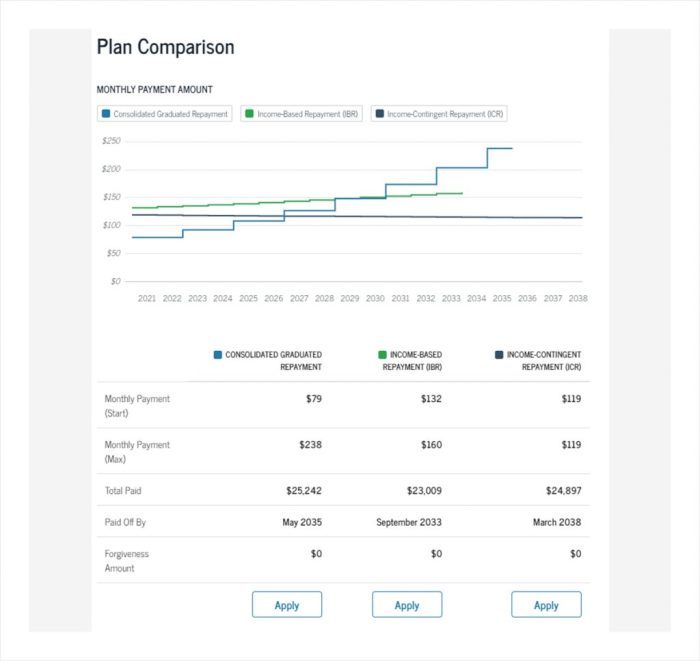

Student loan simulators offer valuable tools for visualizing different repayment strategies and their long-term financial implications. By inputting loan details and experimenting with various repayment options, users can gain a clearer understanding of their potential monthly payments, total interest paid, and overall repayment timelines. This allows for informed decision-making regarding the best approach to managing student loan debt.

Repayment Plan Options

Student loan simulators typically include several repayment plan options, mirroring those offered by actual lenders. These plans often vary in their monthly payment amounts, repayment periods, and ultimately, the total interest accrued. Common examples include Standard Repayment (fixed monthly payments over a standard timeframe, usually 10 years), Extended Repayment (longer repayment periods leading to lower monthly payments but higher total interest), Graduated Repayment (payments increase over time), and Income-Driven Repayment (payments are based on a percentage of your discretionary income). The simulator allows you to see how these different plans affect your budget and long-term financial health.

Interest Rate Impact on Total Repayment

A key factor influencing the total cost of a student loan is the interest rate. Even small changes in interest rates can significantly impact the total amount repaid over the life of the loan. For example, a simulator might show that a $30,000 loan with a 5% interest rate over 10 years would result in a total repayment of approximately $38,000, while the same loan with a 7% interest rate could increase the total repayment to over $42,000. This illustrates the importance of securing the lowest possible interest rate and understanding how interest accrues over time.

Repayment Period and Monthly Payments

The length of the repayment period directly correlates with the monthly payment amount and the total interest paid. Choosing a shorter repayment period (e.g., 10 years) results in higher monthly payments but significantly reduces the total interest paid compared to a longer repayment period (e.g., 20 years). A simulator can demonstrate this clearly, showing the trade-off between manageable monthly payments and minimizing long-term costs. For instance, a $20,000 loan with a 6% interest rate might have a monthly payment of $222 over 10 years, totaling $26,640, whereas the same loan over 20 years might have a monthly payment of $139, resulting in a total repayment of approximately $33,360.

Comparison of Total Interest Paid Under Different Plans

The following scenario demonstrates the differences in total interest paid under various repayment plans, assuming a $40,000 loan with a 6% fixed interest rate:

- Standard Repayment (10 years): Total interest paid: approximately $10,000. Higher monthly payments, but substantially lower overall interest.

- Extended Repayment (20 years): Total interest paid: approximately $24,000. Lower monthly payments, but significantly higher overall interest.

- Graduated Repayment (10 years): Total interest paid: approximately $11,500. Monthly payments start low and increase gradually, resulting in a higher total interest compared to standard repayment.

- Income-Driven Repayment (20-25 years): Total interest paid: This varies greatly depending on income fluctuations throughout the repayment period. While monthly payments are typically lower, the extended repayment timeline often leads to the highest total interest paid over the life of the loan. For example, it could range from $25,000 to $35,000 depending on income changes.

Factors Influencing Loan Simulation Results

Student loan simulators provide valuable estimates of repayment, but the accuracy of these estimates hinges on several key factors. Understanding these factors is crucial for interpreting the results and making informed financial decisions. Accurate input is essential for a reliable simulation.

A student loan simulator’s output is highly sensitive to the data you provide. Small variations in input can lead to significant differences in projected repayment amounts and timelines. This section will explore the key factors influencing these results, including the impact of loan consolidation and unexpected life events.

Loan Amount and Interest Rate

The principal loan amount and the interest rate are the most fundamental factors influencing repayment. A higher loan amount naturally leads to higher monthly payments and a higher total repayment cost. Similarly, a higher interest rate increases both monthly payments and the total amount paid over the life of the loan. For example, a $50,000 loan at 5% interest will have significantly lower monthly payments and total cost than the same loan at 8% interest.

Repayment Plan

The choice of repayment plan dramatically affects the simulation results. Standard repayment plans typically have higher monthly payments but shorter repayment periods, leading to lower overall interest paid. Income-driven repayment plans, on the other hand, offer lower monthly payments but extend the repayment period, resulting in potentially higher total interest paid over time. For instance, a 10-year standard repayment plan will have higher monthly payments but less total interest paid compared to a 20-year income-driven repayment plan.

Loan Consolidation

Consolidating multiple student loans into a single loan can simplify repayment, but the impact on total cost depends on several factors. While it may reduce monthly payments by lowering the interest rate, it can also extend the repayment period, potentially increasing the total interest paid. A hypothetical example: Consolidating five loans with varying interest rates (averaging 7%) into one loan with a 6% interest rate could reduce monthly payments, but a longer repayment term might result in a slightly higher overall cost.

Unexpected Life Events

Unexpected events, such as job loss or illness, can significantly impact repayment. Job loss can necessitate a change to an income-driven repayment plan or even lead to forbearance or deferment, delaying repayment and increasing the total interest paid. A scenario of job loss could result in a temporary pause of payments, accumulating interest during the period of unemployment, and eventually leading to a higher overall repayment amount.

Factors Affecting Loan Simulations

| Factor | Description | Impact on Payments | Impact on Total Cost |

| Loan Amount | The total amount borrowed | Higher amount = Higher payments | Higher amount = Higher total cost |

| Interest Rate | The annual percentage rate charged on the loan | Higher rate = Higher payments | Higher rate = Higher total cost |

| Repayment Plan | The chosen repayment schedule (e.g., standard, income-driven) | Varies widely depending on the plan | Varies widely depending on the plan; longer repayment periods often result in higher total costs due to accumulated interest |

| Loan Consolidation | Combining multiple loans into one | Potentially lower payments | Potentially higher or lower total cost depending on the new interest rate and repayment term |

| Unexpected Life Events | Job loss, illness, etc. | May lead to temporary or permanent payment reductions or deferments | Increases total cost due to accumulated interest during periods of reduced or no payments |

Visualizing Loan Repayment

Understanding how your student loans will be repaid is crucial for effective financial planning. Visual aids can significantly improve comprehension of complex repayment schedules and the long-term impact of various factors. The following examples illustrate how different visualizations can clarify key aspects of loan repayment.

Loan Repayment Schedule

A typical loan repayment schedule is presented as a table. Each row represents a payment period (usually monthly), showing the payment date, the amount paid towards principal, the amount paid towards interest, and the remaining loan balance. For example, a table might show that in month one, $200 is paid, with $150 allocated to interest and $50 to principal, leaving a remaining balance of $9,950 on a $10,000 loan. Subsequent rows would demonstrate the gradual reduction of the principal balance as payments continue. The final row would indicate a zero balance, representing full loan repayment. The table clearly shows how the proportion of principal versus interest changes over time, with a greater portion of early payments allocated to interest.

Interest Rate and Total Interest Paid

A line graph effectively illustrates the relationship between the interest rate and the total interest paid over the loan’s lifetime. The horizontal axis represents different interest rates (e.g., 4%, 5%, 6%), while the vertical axis shows the corresponding total interest paid. The graph would demonstrate an upward-sloping line, indicating that as the interest rate increases, so does the total interest paid. For instance, a $10,000 loan at 4% interest might accrue $1,000 in interest over 10 years, while the same loan at 6% could accrue $1,800. This visual representation clearly highlights the significant impact of even small interest rate variations on the overall cost of borrowing.

Impact of Different Repayment Plans

A bar chart effectively compares the monthly payments under different repayment plans (e.g., standard, extended, income-driven). The horizontal axis would list the repayment plans, while the vertical axis represents the monthly payment amount. Each bar would visually represent the monthly payment amount for a specific plan. For example, a standard repayment plan might show a monthly payment of $300, while an extended plan might show a lower monthly payment of $200, but with a longer repayment period. This allows for easy comparison of the trade-offs between monthly payment amounts and loan repayment durations.

Total Cost of Different Loan Types

A bar chart could effectively compare the total cost (principal plus interest) of different loan types (e.g., subsidized, unsubsidized, private) over a 10-year period. The horizontal axis lists the loan types, while the vertical axis displays the total cost. Each bar would represent the total cost of a specific loan type over the 10-year period. For instance, a subsidized loan might have a lower total cost due to government interest subsidies during periods of deferment, compared to an unsubsidized loan or a private loan with potentially higher interest rates. This visualization clearly shows the financial implications of choosing different loan types.

Using Student Loan Simulators Effectively

Student loan simulators are powerful tools for planning your educational financing and repayment strategy. However, understanding their limitations and using them correctly is crucial for making sound financial decisions. Effective use involves selecting a reliable simulator, interpreting results accurately, and applying the information to your specific circumstances.

Understanding the limitations of student loan simulators is essential. These simulators provide estimations based on the input data you provide. They cannot predict unexpected life events, such as job loss or changes in interest rates, that might significantly affect your repayment plan. Furthermore, simulators often make assumptions about your future income and expenses, which may not always be accurate. The results should be considered a helpful guide, not a definitive prediction of your future financial situation.

Choosing a Reliable and Accurate Student Loan Simulator

Selecting a reliable simulator involves considering several factors. Look for simulators developed by reputable financial institutions, government agencies (like the Federal Student Aid website), or well-known non-profit organizations. These sources generally use accurate data and are less likely to contain biases or misleading information. Consider the features offered; a robust simulator should allow for customization of various factors, such as loan type, interest rates, repayment plans, and potential additional expenses. Transparency in how calculations are performed is another key indicator of reliability. Finally, compare the results of several different simulators to get a more comprehensive picture.

Interpreting Student Loan Simulation Results

The output of a student loan simulator typically shows various repayment scenarios, including total interest paid, monthly payments, and the overall loan repayment timeline. Pay close attention to the sensitivity analysis, which demonstrates how changes in input variables (e.g., interest rate, loan amount) impact the results. This helps to understand the range of possible outcomes. For instance, a small increase in the interest rate could significantly increase the total amount paid over the life of the loan. Understanding these sensitivities allows for better financial planning and preparation for potential variations. Don’t focus solely on the monthly payment; the total cost of the loan, including interest, is equally important to consider.

Using Student Loan Simulators for Informed Borrowing and Repayment Decisions

Student loan simulators are invaluable tools for making informed decisions. Before taking out student loans, use a simulator to explore different borrowing amounts and repayment plans to determine the most manageable option. Consider various scenarios, such as graduating early or needing to extend your repayment period. This allows you to understand the financial implications of each decision. After receiving your loan disbursement, use the simulator to track your progress and adjust your repayment strategy if necessary. For example, if you receive a raise or find additional income streams, you can use the simulator to model how that impacts your repayment timeline and total interest paid. This allows for proactive management of your student loan debt.

Last Recap

Effectively utilizing a student aid loan simulator empowers you to take control of your student loan repayment journey. By understanding the various factors influencing your repayment plan and exploring different scenarios, you can develop a strategy that aligns with your financial goals. Remember to choose a reliable simulator, carefully interpret the results, and consider seeking professional financial advice when needed. Proactive planning and informed decision-making are key to successfully managing your student loan debt and achieving long-term financial well-being.

Clarifying Questions

What if my income changes during repayment?

Many loan programs offer income-driven repayment plans that adjust your monthly payments based on your income and family size. Simulators may or may not include these options; check the simulator’s features.

Can I simulate different loan consolidation options?

Some simulators allow you to input different loan consolidation scenarios to see how combining loans affects your monthly payment and total interest paid.

How accurate are these simulators?

Simulators provide estimates based on the input data. Actual repayment may vary due to unforeseen circumstances or changes in interest rates. They are helpful tools for planning, but not guarantees.

Are there free student loan simulators available?

Yes, many free simulators are available online from various financial institutions and government websites. However, always check reviews and the source’s reputation for accuracy.