Funding graduate education is a significant undertaking, often requiring substantial financial planning. Subsidized loans offer a potential pathway, but understanding their intricacies is crucial for responsible borrowing. This guide delves into the world of subsidized graduate student loans, providing a clear overview of available programs, eligibility requirements, and effective repayment strategies to help you make informed decisions about your financial future.

From exploring the differences between federal and private options to outlining the application process and potential challenges, we aim to equip you with the knowledge needed to navigate the complexities of graduate student financing. We’ll examine various repayment plans, discuss responsible borrowing practices, and point you towards valuable resources to support your journey.

Types of Subsidized Graduate Loans

Securing funding for graduate studies can be a significant undertaking. Understanding the different types of subsidized and unsubsidized loans available is crucial for making informed financial decisions. This section details the various federal and private loan programs designed to assist graduate students, outlining their key features to aid in the selection process.

Federal Graduate Student Loan Programs

The federal government offers several loan programs designed to help graduate students finance their education. These programs generally offer lower interest rates than private loans and have borrower protections built in. However, eligibility requirements and loan limits vary.

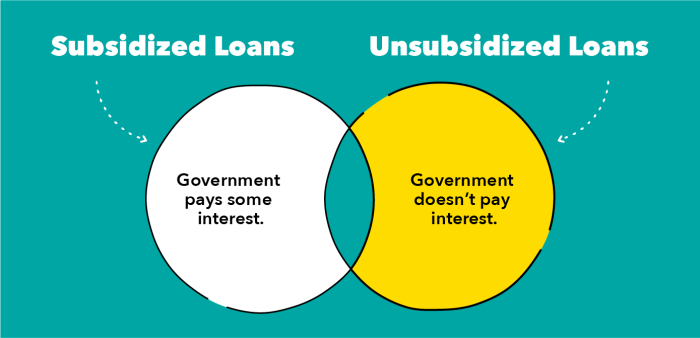

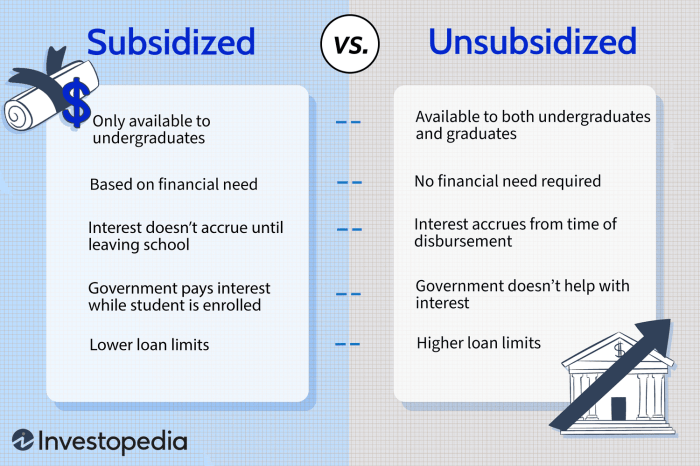

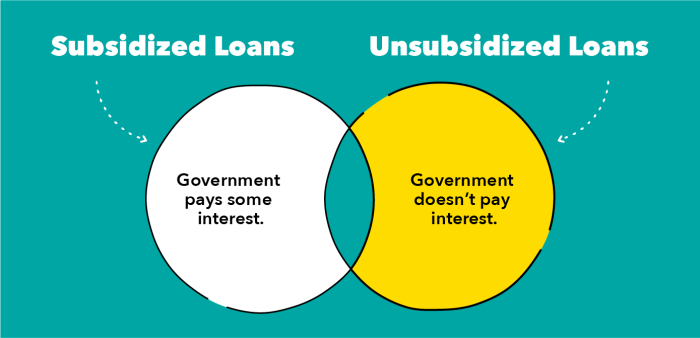

Subsidized vs. Unsubsidized Graduate Loans

A key distinction lies between subsidized and unsubsidized loans. With subsidized federal loans, the government pays the interest while you are in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This accumulated interest can be capitalized (added to the principal balance), increasing the total amount you owe.

Direct Unsubsidized Loans

These loans are available to graduate students who meet the eligibility requirements. Interest accrues from the time the loan is disbursed. Borrowers are responsible for paying this interest during their studies or choosing to capitalize it. Repayment begins six months after graduation or leaving school.

Federal Graduate PLUS Loans

Graduate PLUS Loans are available to graduate students who meet the basic eligibility requirements and have a satisfactory credit history. These loans may cover the cost of attendance not covered by other federal aid. These loans are unsubsidized, meaning interest accrues while you are in school. Borrowers must meet certain credit standards to qualify.

Private Graduate Student Loan Programs

Private lenders also offer graduate student loans, often with varying interest rates, repayment terms, and eligibility requirements. These loans typically have higher interest rates than federal loans and may require a co-signer if the borrower lacks a strong credit history. It’s crucial to compare offers from multiple lenders to secure the most favorable terms.

Comparison of Loan Programs

The following table compares four different loan programs, highlighting key differences:

| Loan Program | Interest Rate (Example) | Repayment Period (Example) | Eligibility Criteria |

|---|---|---|---|

| Direct Unsubsidized Loan | Variable, based on the current market rate (e.g., 7%) | Up to 10-25 years, depending on loan amount | Graduate student status, U.S. citizenship or eligible non-citizen status, satisfactory academic progress |

| Federal Graduate PLUS Loan | Variable, based on the current market rate (e.g., 8%) | Up to 25 years | Graduate student status, U.S. citizenship or eligible non-citizen status, credit check required |

| Private Loan A (Example) | Variable, often higher than federal loans (e.g., 9-12%) | Variable, typically 5-15 years | Graduate student status, credit check, may require a co-signer |

| Private Loan B (Example) | Fixed or Variable (e.g., 8-11%) | Variable, typically 10-20 years | Graduate student status, credit check, may require a co-signer, specific school enrollment |

*Note: Interest rates and repayment periods are examples and are subject to change based on market conditions and lender policies. Always check with the lender for the most current information.*

Eligibility Criteria for Subsidized Graduate Loans

Securing a subsidized graduate loan requires meeting specific criteria established by the lending institution, typically the federal government. Understanding these requirements is crucial for prospective students to determine their eligibility and plan their financial aid strategy accordingly. Failure to meet these requirements can significantly impact a student’s ability to access this vital form of financial assistance.

Eligibility for subsidized graduate loans hinges on several key factors, primarily focusing on the applicant’s financial need, academic progress, and enrollment status. While credit history isn’t a direct eligibility factor for federal subsidized graduate loans, it can indirectly influence eligibility for private loans, which often supplement federal funding. The verification process involves submitting documentation that substantiates the information provided in the loan application. This process ensures the accuracy and integrity of the application and protects both the student and the lender.

Factors Affecting Eligibility

Several factors influence a student’s eligibility for subsidized graduate loans. These include their demonstrated financial need, determined through the Free Application for Federal Student Aid (FAFSA); their academic standing, often measured by GPA and satisfactory academic progress; and their enrollment status, requiring full-time or at least half-time enrollment in a degree program. Maintaining a consistent and positive academic record is paramount for continued eligibility. Furthermore, the specific program of study may also influence eligibility in some cases, though this is less common for federal subsidized loans.

Verification Process and Required Documentation

The verification process aims to confirm the accuracy of the information provided in the FAFSA and other supporting documents. This typically involves submitting official transcripts showing academic progress, tax returns to demonstrate financial need, and other supporting documentation as requested by the lender. Failure to provide the necessary documentation can lead to delays in processing the loan application or even denial of the loan. The verification process is a standard procedure designed to protect against fraud and ensure responsible lending practices.

Common Eligibility Requirements for Federal Subsidized Graduate Loans

The following points Artikel common eligibility requirements:

- Be a U.S. citizen or eligible non-citizen.

- Be enrolled or accepted for enrollment at least half-time in a graduate degree program at an eligible institution.

- Maintain satisfactory academic progress as defined by the institution.

- Demonstrate financial need, as determined by the FAFSA.

- Complete the FAFSA and any required supplemental forms.

- Agree to the terms and conditions of the loan.

Application Process for Subsidized Graduate Loans

Securing a subsidized graduate loan involves a straightforward process, but careful attention to detail is crucial to ensure a successful application. Understanding the steps involved and the role of the FAFSA will significantly increase your chances of obtaining the financial aid you need. This section Artikels the key steps involved in the application process.

The application process for subsidized graduate loans primarily revolves around completing the Free Application for Federal Student Aid (FAFSA) and following up with your chosen lender or institution.

The Role of the FAFSA

The Free Application for Federal Student Aid (FAFSA) is the cornerstone of the federal student aid process. It’s a single application that determines your eligibility for various types of federal student aid, including subsidized graduate loans. The information you provide on the FAFSA, such as your financial information and educational goals, is used by the federal government and participating institutions to calculate your financial need and determine your eligibility for aid. Completing the FAFSA accurately and promptly is essential for a smooth application process.

Steps in the Subsidized Graduate Loan Application Process

The application process for subsidized graduate loans can be broken down into several key steps. Following these steps diligently will help ensure a timely and successful application.

- Complete the FAFSA: Begin by completing the FAFSA form online at StudentAid.gov. Gather all necessary tax information and other required documentation before starting. This is the most crucial step, as it determines your eligibility for federal student aid.

- Select a Lender or Institution: Once your FAFSA is processed, you will receive a Student Aid Report (SAR). This report will show your eligibility for federal student aid. You can then explore your options for lenders or institutions offering subsidized graduate loans. Many schools work directly with the federal government to process loans, simplifying the process. Some students may choose to work with a private lender, but these loans often have higher interest rates and less favorable terms.

- Submit the Loan Application: After choosing a lender or institution, you will need to complete their specific loan application. This application may require additional information beyond what was provided on the FAFSA. Carefully review all requirements and ensure accurate completion.

- Review and Accept the Loan Terms: Once your application is reviewed and approved, you will receive a loan offer outlining the terms and conditions. This includes the loan amount, interest rate, repayment schedule, and any associated fees. Carefully review the terms before accepting the loan. It’s essential to understand the implications of the loan before committing.

- Receive Loan Disbursement: After accepting the loan offer, the funds will be disbursed according to the lender or institution’s schedule. Typically, this happens in installments throughout the academic year, often directly deposited into your student account.

Completing the Loan Application and Receiving Loan Disbursement

The specific procedures for completing the loan application and receiving disbursement will vary depending on the lender or institution. However, generally, the process involves providing accurate personal and financial information, signing necessary loan documents, and understanding the terms and conditions of the loan agreement. Once approved, the funds are typically disbursed directly to the educational institution to cover tuition and fees. In some cases, a portion of the loan may be disbursed directly to the student to cover living expenses.

Repayment Options and Strategies for Subsidized Graduate Loans

Successfully navigating graduate school often involves utilizing subsidized loans. Understanding your repayment options is crucial for responsible financial management after graduation. This section details various repayment plans and strategies to help you effectively manage your student loan debt.

Available Repayment Plans for Subsidized Graduate Loans

Several repayment plans are available for federal subsidized graduate loans, each with its own terms and conditions. The best option depends on your individual financial circumstances and post-graduation income. Choosing the right plan can significantly impact your monthly payments and overall repayment period.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over a 10-year period. While straightforward, it often results in higher monthly payments compared to income-driven plans. However, it leads to faster loan payoff and less overall interest paid.

Graduated Repayment Plan

This plan starts with lower monthly payments that gradually increase over time. This can be beneficial in the early years after graduation when income may be lower, but it ultimately leads to a longer repayment period and higher total interest paid.

Extended Repayment Plan

This plan extends the repayment period to up to 25 years, resulting in lower monthly payments. However, significantly more interest will accrue over the extended repayment term. This option is suitable for borrowers with substantial loan balances who need lower monthly payments.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payment on your income and family size. These plans include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans. IDR plans generally offer lower monthly payments, but repayment periods can extend beyond 20 years. Any remaining balance after 20 or 25 years (depending on the plan) may be forgiven, but this forgiven amount is considered taxable income.

Strategies for Managing Loan Repayment

Effective loan repayment management requires a proactive approach. Budgeting and debt consolidation are two key strategies.

Budgeting for Loan Repayment

Creating a realistic budget is crucial. Track your income and expenses to identify areas where you can save. Allocate a specific amount each month towards loan repayment, treating it as a non-negotiable expense. Consider using budgeting apps or spreadsheets to help you stay organized. For example, a borrower with a $1000 monthly income might allocate $200 towards loan repayment, leaving $800 for living expenses. This necessitates careful planning and prioritization of spending.

Debt Consolidation

Debt consolidation involves combining multiple loans into a single loan with potentially a lower interest rate. This can simplify repayment and potentially reduce the total interest paid. However, carefully evaluate the terms of any consolidation loan before proceeding, ensuring it’s a financially sound decision. For instance, a borrower with three separate loans totaling $30,000 might consolidate them into a single loan with a lower interest rate, reducing their monthly payments and total interest paid over the life of the loan.

Comparison of Repayment Options

| Repayment Plan | Monthly Payment | Interest Accrual | Repayment Period |

|---|---|---|---|

| Standard | High, fixed | Lower overall | 10 years |

| Graduated | Low initially, increasing | Higher overall | 10 years |

| Extended | Low, fixed | Very High overall | Up to 25 years |

| Income-Driven | Variable, based on income | Can be high depending on income and plan | Up to 20-25 years |

Potential Challenges and Risks Associated with Graduate Student Loans

Pursuing a graduate degree is a significant investment, both financially and personally. While subsidized loans can ease the financial burden, it’s crucial to understand the potential challenges and risks associated with borrowing substantial amounts for graduate education. Failing to adequately prepare can lead to long-term financial difficulties.

Graduate student loan debt presents several unique challenges. The sheer volume of debt accumulated can be overwhelming, especially when coupled with the pressure of finding employment after graduation and managing living expenses during the program. Interest accrual, even on subsidized loans, can significantly increase the total repayment amount over time. Furthermore, unexpected life events like illness or job loss can disrupt repayment plans, leading to further financial strain.

Debt Management Challenges

Managing significant graduate student loan debt requires meticulous planning and discipline. The repayment period can extend for many years, potentially impacting major life decisions such as buying a home, starting a family, or investing in retirement. The psychological burden of carrying substantial debt can also affect overall well-being. For instance, a graduate with $100,000 in loan debt might face a monthly payment exceeding $1,000, significantly impacting their disposable income and financial flexibility. Effective budgeting and consistent repayment are essential for minimizing long-term financial stress.

Risks of Substantial Borrowing

Borrowing large sums of money for graduate education carries inherent risks. The most significant risk is the potential for default if unable to make timely payments. Default can have severe consequences, including damage to credit score, wage garnishment, and difficulty obtaining future loans. Moreover, the opportunity cost of borrowing heavily for graduate school should be considered. The money borrowed could have been used for other investments or to reduce existing debt, potentially yielding higher returns over time. For example, a graduate choosing to borrow heavily for an MBA might find their potential earnings increased, but the net gain after repayment could be less than if they had pursued a less expensive option.

Responsible Borrowing and Financial Planning

Responsible borrowing involves carefully assessing the need for graduate education, exploring alternative funding options (scholarships, grants), and borrowing only the minimum amount necessary. A robust financial plan should include a realistic budget, a detailed repayment strategy, and contingency plans for unforeseen circumstances. This proactive approach significantly mitigates the risks associated with graduate student loan debt. For instance, creating a detailed budget that accounts for all expenses, including tuition, living costs, and loan repayments, can help avoid overspending and financial difficulties. Furthermore, exploring options like income-driven repayment plans can make loan repayment more manageable over the long term.

It is absolutely crucial to thoroughly understand the terms and conditions of your loan agreements, including interest rates, repayment schedules, and any associated fees, before signing. Failure to do so could lead to unexpected costs and financial hardship.

Resources and Support for Graduate Students Managing Loan Debt

Navigating the complexities of graduate student loan debt can feel overwhelming, but numerous resources are available to provide guidance and support. Understanding these options and proactively engaging with them is crucial for successful debt management and financial well-being after graduation. This section Artikels key resources, services, and contact information to help graduate students effectively manage their loan repayment.

Loan Counseling Services

Access to professional loan counseling is invaluable for creating a personalized repayment strategy. These services often provide individual consultations to assess your financial situation, explore various repayment options, and develop a plan tailored to your specific circumstances. Many universities offer free or low-cost counseling services through their financial aid offices. Independent, non-profit organizations also provide similar services, often specializing in student loan debt management. These organizations can help you understand your rights and responsibilities as a borrower, navigate the complexities of different repayment plans, and advocate on your behalf if needed.

Financial Aid Workshops and Seminars

Many universities and community organizations host workshops and seminars focused on financial literacy and student loan management. These events often cover topics such as budgeting, creating a repayment plan, understanding different loan types, and exploring options for loan forgiveness or consolidation. Attending these workshops can provide a supportive learning environment and connect you with peers facing similar challenges. Check your university’s financial aid website or local community centers for upcoming events.

Government Agencies and Student Loan Servicers

Direct contact with relevant government agencies and your student loan servicer is crucial for managing your loans effectively. The Federal Student Aid website (studentaid.gov) provides comprehensive information on federal student loans, repayment plans, and available resources. This website also allows you to access your loan information, make payments, and contact your loan servicer. Your loan servicer is the company responsible for managing your student loans. Their contact information is typically found on your loan documents or the Federal Student Aid website. They can answer questions about your specific loan terms, repayment options, and any issues you may encounter. The Consumer Financial Protection Bureau (CFPB) is another valuable resource that offers guidance on consumer financial protection and can help resolve disputes with your loan servicer.

List of Resources

- Federal Student Aid (studentaid.gov): The official website for federal student aid programs, providing information on loans, grants, and repayment options. You can access your loan information, make payments, and find contact information for your loan servicer here.

- National Foundation for Credit Counseling (NFCC): A non-profit organization offering free and low-cost credit counseling services, including assistance with student loan debt management. They can help you create a budget, explore repayment options, and negotiate with your creditors.

- Consumer Financial Protection Bureau (CFPB): A government agency that protects consumers’ financial rights. They offer resources and assistance with resolving issues related to student loans and other financial products.

- University Financial Aid Offices: Most universities offer financial aid counseling and workshops specifically for their students. Contact your university’s financial aid office to inquire about available services.

End of Discussion

Securing funding for graduate studies requires careful consideration of various loan options. By understanding the nuances of subsidized loans, including eligibility criteria, application procedures, and repayment strategies, graduate students can make informed choices that align with their financial goals. Remember to explore all available resources and seek professional advice to ensure a responsible and successful path toward completing your advanced degree.

Frequently Asked Questions

What is the difference between subsidized and unsubsidized graduate loans?

With subsidized loans, the government pays the interest while you’re in school (and sometimes during grace periods). Unsubsidized loans accrue interest from the time the loan is disbursed, increasing the total amount you owe.

Can I consolidate my graduate student loans?

Yes, loan consolidation combines multiple loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always lower your overall interest cost. Explore your options carefully.

What happens if I default on my graduate student loans?

Defaulting on your loans can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. It’s crucial to contact your loan servicer immediately if you anticipate difficulty making payments.

Are there income-driven repayment plans for graduate student loans?

Yes, several income-driven repayment (IDR) plans are available, adjusting your monthly payments based on your income and family size. These plans may extend your repayment period but could lower your monthly payments.