Navigating the world of student loans can feel overwhelming, especially when faced with the choice between subsidized and unsubsidized options. Understanding the nuances of each loan type is crucial for responsible financial planning and long-term success. This guide will illuminate the key differences, helping you make informed decisions about your educational financing.

This exploration will delve into interest rates, eligibility criteria, repayment options, and the long-term financial implications of each loan type. We’ll examine how these loans affect your credit score and explore strategies for responsible repayment. By the end, you’ll have a clearer understanding of which loan best suits your individual circumstances and financial goals.

Interest Rates and Repayment

Understanding the differences between subsidized and unsubsidized student loans involves carefully considering interest rates and repayment options. These factors significantly impact the overall cost of your education and your financial burden after graduation. Choosing wisely can save you thousands of dollars in the long run.

Subsidized and unsubsidized federal student loans differ primarily in how interest accrues. This difference, along with varying repayment plans, significantly impacts the total amount you ultimately repay. The interest rate you receive depends on the loan type, your lender, and the loan disbursement year.

Subsidized and Unsubsidized Loan Interest Rates

Generally, subsidized federal student loans have lower interest rates than unsubsidized loans. This is because the government subsidizes the interest while you’re in school, during grace periods, and sometimes during deferment. Unsubsidized loans, on the other hand, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. The exact interest rate for both loan types varies yearly and is set by the federal government.

Repayment Plan Differences

Both subsidized and unsubsidized loans offer various repayment plans to accommodate different financial situations. These plans vary in terms of monthly payment amounts, loan repayment periods, and total interest paid over the life of the loan. Common plans include Standard, Graduated, Extended, and Income-Driven Repayment plans. Choosing the right plan depends on your income, budget, and long-term financial goals.

Interest Accrual Differences

The key difference lies in interest accrual. With subsidized loans, the government pays the interest while you are enrolled at least half-time in school, during a grace period (typically six months after graduation or leaving school), and sometimes during deferment periods. This means your loan balance doesn’t increase during these periods. Unsubsidized loans, however, accrue interest from the moment they are disbursed. This interest is capitalized, meaning it’s added to your principal balance, increasing the total amount you owe. During repayment, interest accrues on the outstanding principal balance for both loan types.

For example, let’s say you have a $10,000 unsubsidized loan with a 5% annual interest rate. If you don’t make payments during your four years of college, the interest will accumulate. After four years, your loan balance could be significantly higher than $10,000. Conversely, a $10,000 subsidized loan with the same interest rate would only start accruing interest once repayment begins. This difference can result in thousands of dollars saved over the loan’s lifetime.

Sample Interest Rates and Repayment Terms

The following table provides a sample comparison. Note that actual rates vary by lender and year. These figures are illustrative and should not be considered definitive loan offers.

| Lender | Subsidized Rate (Example) | Unsubsidized Rate (Example) | Repayment Term Example (Standard Plan) |

|---|---|---|---|

| Federal Direct Loan Program | 4.5% | 6.0% | 10 years |

| Private Lender A | 5.0% | 7.5% | 12 years |

| Private Lender B | 6.0% | 8.0% | 15 years |

| Private Lender C | 4.0% | 6.5% | 10 years |

Eligibility Criteria

Understanding the eligibility requirements for subsidized and unsubsidized federal student loans is crucial for prospective borrowers. These loans differ significantly in their eligibility criteria, primarily revolving around demonstrated financial need. This section will detail the specific requirements for each loan type and highlight the role of parental income in the eligibility process.

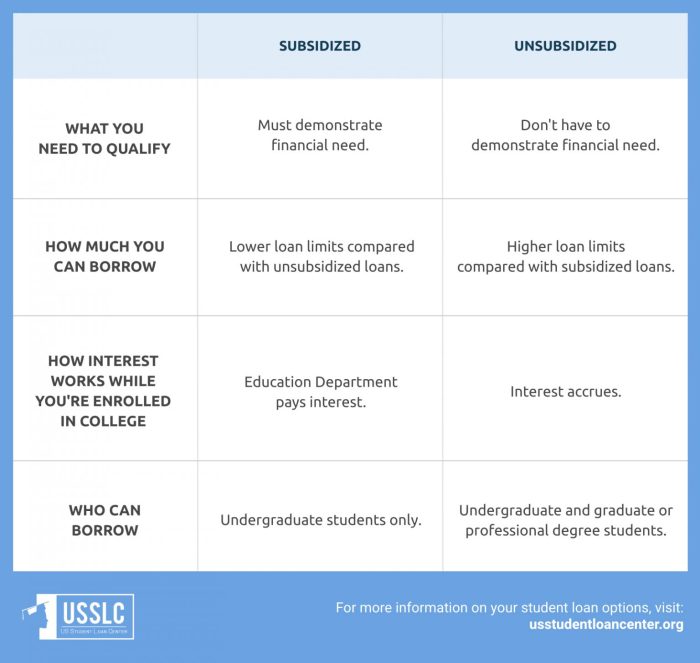

Subsidized Federal Student Loan Eligibility Requirements

To qualify for a subsidized federal student loan, a student must meet several key requirements. These requirements are designed to ensure that federal funds are allocated to students who truly need financial assistance to pursue higher education. The process involves demonstrating financial need through a thorough assessment of the student’s and (in most cases) their family’s financial situation.

Financial Need Assessment for Subsidized Loans

The financial need assessment for subsidized loans is conducted using the Free Application for Federal Student Aid (FAFSA). The FAFSA gathers detailed information about the student’s and their family’s income, assets, and other financial factors. This information is then used to calculate the student’s Expected Family Contribution (EFC). The EFC represents the amount the family is expected to contribute towards the student’s education. The difference between the student’s cost of attendance (tuition, fees, room, board, etc.) and their EFC determines their financial need. Only students with demonstrated financial need are eligible for subsidized loans. For example, a student with a high EFC might not qualify for subsidized loans, even if they have high tuition costs, while a student with a low EFC and high tuition might receive substantial subsidized loan amounts.

Comparison of Subsidized and Unsubsidized Loan Eligibility

While both subsidized and unsubsidized federal student loans are available to eligible students, a key difference lies in the financial need requirement. Subsidized loans require demonstrated financial need, as determined by the FAFSA. Unsubsidized loans, on the other hand, do not have a financial need requirement. Any student enrolled at least half-time in an eligible degree program can generally qualify for unsubsidized loans, regardless of their financial situation. Therefore, eligibility for subsidized loans is more restrictive than for unsubsidized loans.

Impact of Parental Income on Subsidized Loan Eligibility

Parental income plays a significant role in determining eligibility for subsidized federal student loans. The FAFSA uses parental income information (for dependent students) to calculate the student’s EFC. Higher parental income generally results in a higher EFC, thus reducing or eliminating the student’s demonstrated financial need. Conversely, lower parental income often leads to a lower EFC, increasing the likelihood of eligibility for subsidized loans. For independent students, parental income is not considered. This means that students who are independent due to factors like marriage, age, or military service, will have their eligibility determined solely based on their own financial circumstances, rather than their family’s income. This highlights the importance of understanding the FAFSA’s dependency status guidelines.

Loan Forgiveness and Deferment

Navigating student loan repayment can be complex, and understanding the options for loan forgiveness and deferment is crucial for responsible financial management. Both subsidized and unsubsidized federal student loans offer programs designed to provide temporary or permanent relief from repayment, depending on individual circumstances.

Loan forgiveness and deferment programs are distinct but equally important aspects of managing federal student loans. Loan forgiveness programs eliminate a portion or all of your loan balance under specific conditions, while deferment and forbearance temporarily postpone your payments. Understanding the nuances of each is key to making informed decisions about your repayment strategy.

Subsidized and Unsubsidized Loan Forgiveness Programs

Several federal loan forgiveness programs exist, applicable to both subsidized and unsubsidized loans. Eligibility requirements vary significantly depending on the specific program. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of your federal Direct Loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Other programs, such as the Teacher Loan Forgiveness program, target specific professions. It’s important to thoroughly research the various programs and their eligibility criteria to determine which, if any, might apply to your situation. Note that forgiveness programs often have strict requirements regarding the type of employment, the number of qualifying payments made, and the type of loan.

Deferment and Forbearance Options

Deferment and forbearance are temporary pauses in your student loan repayments. While similar, they differ in their eligibility requirements and the implications for interest accrual. With deferment, interest may or may not accrue depending on the loan type (subsidized loans typically have no interest accrual during periods of deferment, while unsubsidized loans do). Forbearance, on the other hand, usually results in interest accruing on both subsidized and unsubsidized loans. Both deferment and forbearance are typically granted for a limited period, and repeated use may be restricted.

Examples of When Deferment or Forbearance Might Be Beneficial

Deferment or forbearance can be beneficial in various situations. For instance, unemployment, severe medical emergencies, or a period of graduate study might justify a temporary pause in loan repayments. A recent graduate facing unexpected job loss could use deferment to alleviate immediate financial pressure. Someone facing a prolonged illness might seek forbearance to manage medical expenses. These options provide a safety net during times of financial hardship, preventing default and preserving your credit rating.

Applying for Loan Deferment: A Flowchart

The process for applying for loan deferment is largely similar for both subsidized and unsubsidized loans.

[Illustrative Flowchart Description:] The flowchart would begin with a box labeled “Need Deferment?”. A “Yes” branch would lead to a box asking “Meet Eligibility Requirements?”. A “Yes” branch would lead to “Complete Application,” which then branches to “Submit Application” and finally “Deferment Granted/Denied”. A “No” branch from “Meet Eligibility Requirements?” would lead to “Explore Alternative Options”. A “No” branch from the initial “Need Deferment?” would lead to “Continue Repayment”.

Impact on Credit History

Both subsidized and unsubsidized federal student loans impact your credit history, but the manner and timing differ slightly. Understanding these differences is crucial for responsible borrowing and maintaining a strong credit profile. Your creditworthiness, as reflected in your credit score, is significantly influenced by how you manage your student loan repayment.

Your student loan repayment activity is reported to the major credit bureaus (Equifax, Experian, and TransUnion). This reporting begins after your loans enter repayment, typically six months after graduation or leaving school. Whether the loan is subsidized or unsubsidized directly affects when this reporting starts and, indirectly, how it affects your credit score. Consistent on-time payments positively impact your score, while late or missed payments negatively affect it. This applies equally to both subsidized and unsubsidized loans.

Subsidized and Unsubsidized Loan Reporting to Credit Bureaus

The impact of subsidized and unsubsidized loans on your credit report is primarily determined by your repayment behavior, not the loan type itself. Both types of loans are reported to credit bureaus once repayment begins. However, subsidized loans differ in that the government pays the interest while you’re in school, during grace periods, and in deferment. This means that no interest accrues and is not reported to credit bureaus during these periods. Unsubsidized loans accrue interest from the time the loan is disbursed, and this interest is capitalized (added to the principal balance) at the end of grace periods and deferments. Therefore, the overall loan balance for unsubsidized loans may be higher at the start of repayment, impacting monthly payments and potential credit score effects if repayments are missed. For example, if a borrower consistently pays on time for both types of loans, their credit score will improve similarly. Conversely, if they consistently miss payments, their credit scores will suffer equally regardless of whether the loans are subsidized or unsubsidized.

Consequences of Defaulting on Student Loans

Defaulting on either subsidized or unsubsidized student loans has severe consequences. Default means you have failed to make payments for a specific period (usually 9 months or more). The repercussions include:

- Damage to your credit score: A default will significantly and negatively impact your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage garnishment: The government can garnish your wages to recover the defaulted loan amount.

- Tax refund offset: Your federal tax refund can be seized to repay the debt.

- Difficulty securing future loans: A default makes it significantly harder to qualify for future loans, including mortgages, auto loans, and other lines of credit.

- Collection agency involvement: Your debt may be sent to a collection agency, leading to additional fees and further damage to your credit report.

Maintaining a Good Credit Score While Repaying Student Loans

Responsible management of your student loan repayment is key to maintaining a good credit score. Here are some tips:

- Make on-time payments: The most important factor in your credit score is consistent on-time payments. Set up automatic payments to avoid missing deadlines.

- Understand your repayment options: Explore different repayment plans (standard, graduated, income-driven) to find one that fits your budget and financial circumstances. Contact your loan servicer to discuss your options.

- Monitor your credit report: Regularly check your credit report for errors or inconsistencies. Dispute any inaccuracies immediately.

- Budget effectively: Create a realistic budget that includes your student loan payments. Track your spending to ensure you can afford your payments.

- Consider loan consolidation: Consolidating your loans into a single payment can simplify repayment and potentially lower your monthly payments.

- Communicate with your loan servicer: If you anticipate difficulties making your payments, contact your loan servicer immediately. They may offer forbearance or deferment options to help you avoid default.

Long-Term Financial Implications

Choosing between subsidized and unsubsidized student loans has significant long-term financial consequences that extend far beyond the repayment period. Understanding these implications is crucial for making informed decisions that can positively impact your financial future. The key differences lie in interest accrual and the potential effect on your credit score and future borrowing capacity.

The primary difference between subsidized and unsubsidized loans lies in the accumulation of interest. Subsidized loans do not accrue interest while you are in school at least half-time, during grace periods, or in deferment. Unsubsidized loans, however, accrue interest from the moment they are disbursed, regardless of your enrollment status. This seemingly small difference can lead to a substantially larger debt burden over time. The longer you take to repay, the more interest compounds, potentially doubling or tripling your initial loan amount.

Impact on Future Borrowing Capacity

The total amount of debt you accumulate from student loans directly impacts your credit score and, consequently, your ability to borrow money in the future. High levels of student loan debt can lower your credit score, making it more difficult to qualify for mortgages, auto loans, or even credit cards with favorable interest rates. A lower credit score translates to higher interest rates on future loans, increasing the overall cost of borrowing and potentially hindering major life purchases like a home or a car. Conversely, responsible management of student loan debt, including timely payments and keeping debt levels manageable, can positively influence your credit score, leading to better borrowing opportunities in the future.

Examples of Debt Burden Differences

Consider two scenarios: Student A takes out $20,000 in subsidized loans and Student B takes out $20,000 in unsubsidized loans. Assuming a 5% interest rate and a standard 10-year repayment plan, Student A will pay significantly less in interest over the life of the loan compared to Student B because the interest on their subsidized loan doesn’t accrue while they are in school. Student B will begin accumulating interest immediately, leading to a higher total repayment amount. This difference can amount to thousands of dollars over the repayment period, significantly impacting their long-term financial stability.

Hypothetical Scenario: Subsidized vs. Unsubsidized Loan Repayment Over 10 Years

This example assumes a $20,000 loan with a 5% interest rate and a standard 10-year repayment plan. The actual figures will vary based on interest rates, loan amounts, and repayment plans.

| Year | Subsidized Loan Balance | Unsubsidized Loan Balance | Interest Paid Difference |

|---|---|---|---|

| 1 | $18,500 | $18,000 | $0 |

| 2 | $17,000 | $16,500 | $250 |

| 3 | $15,500 | $15,000 | $500 |

| 4 | $14,000 | $13,500 | $750 |

| 5 | $12,500 | $12,000 | $1000 |

| 6 | $11,000 | $10,500 | $1250 |

| 7 | $9,500 | $9,000 | $1500 |

| 8 | $8,000 | $7,500 | $1750 |

| 9 | $6,500 | $6,000 | $2000 |

| 10 | $5,000 | $4,500 | $2250 |

Understanding the Terms

Navigating the world of student loans requires a solid grasp of the terminology used. Understanding the nuances between subsidized and unsubsidized loans, along with key terms like grace periods and deferments, is crucial for responsible borrowing and repayment. This section clarifies these important concepts.

Subsidized and Unsubsidized Loans

Subsidized loans are awarded based on financial need. The government pays the interest on these loans while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, on the other hand, accrue interest from the moment the loan is disbursed, regardless of your enrollment status or repayment plan. This means you’ll owe more than the original loan amount when repayment begins if you don’t pay the accruing interest.

Grace Period, Deferment, and Forbearance

A grace period is a temporary period after graduation or leaving school (before you enter repayment) where you are not required to make loan payments. The length of the grace period varies depending on the loan type. Deferment is a postponement of loan payments granted under certain circumstances, such as returning to school at least half-time, experiencing unemployment, or facing economic hardship. During deferment, interest may or may not accrue depending on the loan type (subsidized loans typically don’t accrue interest during deferment). Forbearance, similar to deferment, allows for temporary suspension of loan payments, but it’s typically granted due to temporary financial difficulties and interest usually continues to accrue during this period.

Principal and Interest

When you repay a student loan, your payment consists of two parts: principal and interest. The principal is the original amount of money you borrowed. Interest is the cost of borrowing the money, calculated as a percentage of the principal. For example, if you borrowed $10,000 and your interest rate is 5%, you’ll pay interest on the outstanding principal balance each month. As you make payments, a portion goes towards paying down the principal, and the rest covers the interest. Early repayment strategies often focus on paying down the principal more aggressively to reduce the total interest paid over the life of the loan.

Glossary of Key Terms

Understanding the following terms is essential for effectively managing your student loans:

- Principal: The original amount of money borrowed.

- Interest: The cost of borrowing money, expressed as a percentage of the principal.

- Interest Rate: The percentage charged on the unpaid principal balance.

- Subsidized Loan: A loan where the government pays the interest while you are in school at least half-time, during grace periods, and during deferment.

- Unsubsidized Loan: A loan where interest accrues from the disbursement date, regardless of your enrollment status or repayment plan.

- Grace Period: A period after graduation or leaving school where loan repayment is not required.

- Deferment: A temporary postponement of loan payments granted under specific circumstances.

- Forbearance: A temporary suspension of loan payments, usually granted due to financial hardship; interest typically accrues.

- Capitalization: The process of adding unpaid interest to the principal balance of a loan, increasing the total amount owed.

- Loan Consolidation: Combining multiple student loans into a single loan with a new interest rate and repayment plan.

- Loan Forgiveness: Programs that may cancel or forgive a portion or all of a student loan balance under specific circumstances (e.g., public service loan forgiveness).

Final Review

Choosing between subsidized and unsubsidized student loans is a significant financial decision with lasting consequences. By carefully considering interest rates, eligibility requirements, repayment plans, and long-term financial implications, you can make an informed choice that aligns with your financial situation and future aspirations. Remember, proactive financial planning and responsible repayment are key to navigating student loan debt successfully.

Expert Answers

What happens if I don’t repay my student loans?

Defaulting on student loans can severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. It can also lead to wage garnishment and tax refund offset.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s important to compare offers from multiple lenders and understand the terms and conditions before refinancing.

What is a grace period?

A grace period is a temporary period after graduation or leaving school before loan repayment begins. The length of the grace period varies depending on the loan type.

What is the difference between deferment and forbearance?

Deferment temporarily suspends your loan payments, and under certain circumstances, interest may not accrue. Forbearance also temporarily suspends payments, but interest usually continues to accrue.