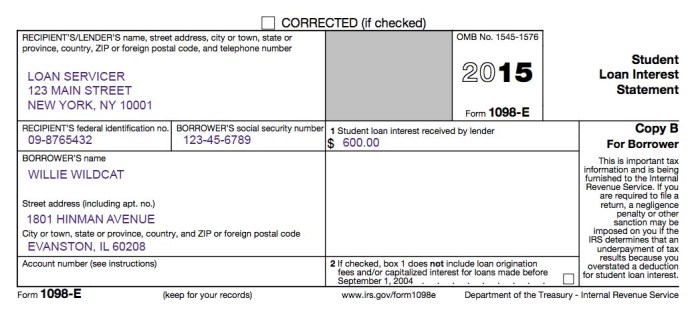

Navigating the complexities of student loan repayment can feel overwhelming, but understanding available tax benefits like the student loan interest deduction can significantly ease the financial burden. The 2024 student loan interest deduction offers a potential tax break for eligible borrowers, reducing their overall tax liability. This guide delves into the intricacies of this deduction, providing clarity on eligibility requirements, calculation methods, and essential record-keeping practices. This resource aims to empower you with the knowledge needed to confidently determine your eligibility and maximize your potential tax savings. We will explore the nuances of the deduction, comparing it to other relevant Read More …