Navigating the complexities of student loan debt while simultaneously planning for retirement can feel overwhelming. Many grapple with the question: should I tap into my 401(k) to alleviate student loan burdens? This guide explores the financial, legal, and emotional implications of using 401(k) funds for student loan repayment, presenting a balanced perspective to help you make informed decisions. We’ll delve into the potential tax penalties and long-term retirement consequences of early 401(k) withdrawals. We’ll also examine viable alternatives, such as income-driven repayment plans and refinancing options, providing a comprehensive overview of your choices. Ultimately, the goal is to empower you Read More …

Tag: 401k withdrawal

Pay Off Student Loans With 401k A Financial Analysis

The crushing weight of student loan debt often clashes with the long-term goals of retirement savings. Many find themselves grappling with the tempting, yet potentially risky, proposition of using their 401(k) funds to pay off student loans. This exploration delves into the complexities of this decision, weighing the immediate benefits of debt elimination against the potential long-term consequences for retirement security. We will analyze the financial implications, explore alternative strategies, and provide a framework for making an informed decision. Understanding the tax implications, penalties, and long-term financial impact is crucial before considering such a significant move. This analysis will provide Read More …

Can You Use 401k to Pay Student Loans Without Penalty?

The crushing weight of student loan debt often leads borrowers to explore unconventional repayment strategies. One such option, frequently pondered, is tapping into retirement savings, specifically a 401(k) plan. However, accessing these funds prematurely often comes with significant tax penalties and long-term financial repercussions. This exploration delves into the complexities of using 401(k) funds to pay off student loans, weighing the potential benefits against the substantial risks involved. We’ll examine the rules governing 401(k) withdrawals, explore alternative repayment strategies, and ultimately help you determine if this potentially risky move aligns with your financial goals. Understanding the intricacies of 401(k) withdrawal Read More …

Can You Use 401k to Pay Off Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for millions, often overshadowing other crucial financial goals. Many find themselves exploring unconventional avenues for relief, and one question frequently arises: can tapping into retirement savings, specifically a 401(k), offer a viable solution? This guide delves into the complexities of using your 401(k) to pay off student loans, weighing the potential benefits against the significant long-term financial ramifications. We’ll examine the intricate regulations surrounding early 401(k) withdrawals, the tax implications, and the various student loan repayment options available. Through detailed examples and comparisons, we aim to equip you with the Read More …

Can You Use Your 401k to Pay Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for many, leading some to explore unconventional solutions. One question frequently arises: can tapping into retirement savings, specifically a 401(k), alleviate this financial burden? This guide delves into the complexities of using your 401(k) to pay off student loans, weighing the potential short-term benefits against the significant long-term consequences for your retirement security. We’ll examine the intricate tax implications and penalties associated with early 401(k) withdrawals, contrasting them with alternative financing strategies such as refinancing and income-driven repayment plans. By understanding the potential financial ramifications, you can make an informed Read More …

Can You Use 401k to Pay Student Loans? A Comprehensive Guide

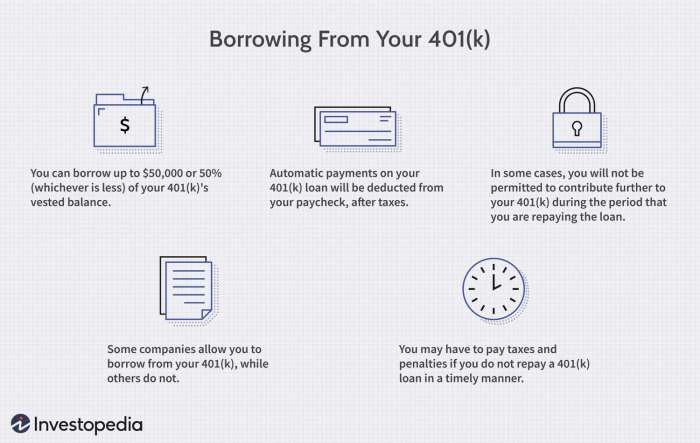

The crushing weight of student loan debt is a reality for millions, often forcing difficult financial choices. One question frequently arises: can tapping into retirement savings, specifically a 401(k), provide a solution? While seemingly appealing, this decision carries significant financial implications, demanding a careful consideration of both short-term relief and long-term retirement security. This guide explores the complexities of using 401(k) funds to pay student loans, examining the regulations, alternatives, and potential consequences to help you make an informed decision. Understanding the rules surrounding 401(k) withdrawals is paramount. Early withdrawals typically incur penalties and taxes, significantly reducing the amount you Read More …

Can You Use a 401k to Pay Off Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for millions, often overshadowing other crucial financial goals. Many find themselves grappling with the question: can tapping into their 401(k) for student loan repayment offer a viable solution? This guide explores the complexities of this decision, weighing the potential benefits against the significant financial implications, and ultimately helping you make an informed choice. We’ll delve into the intricacies of 401(k) withdrawal regulations, including tax implications and penalties for early withdrawals. We’ll also examine alternative student loan repayment strategies and compare the potential returns of your 401(k) investments against the interest Read More …

Should You Use Your 401k to Pay Student Loans? A Comprehensive Guide

The crushing weight of student loan debt is a reality for millions, often forcing difficult financial choices. One such choice, fraught with potential pitfalls and long-term consequences, is tapping into your 401(k) retirement savings to alleviate the burden. This guide explores the complexities of using your 401k to pay student loans, weighing the immediate relief against the potential sacrifices to your future financial security. We’ll delve into the financial implications, including tax penalties, the impact on retirement savings, and a comparison of interest rates. We’ll also examine alternative strategies for managing student loan debt, such as income-driven repayment plans and Read More …

Can I Use 401k to Pay Student Loans?

The crushing weight of student loan debt often clashes with the long-term financial security offered by 401(k) retirement plans. Many grapple with the tempting, yet potentially risky, idea of using their 401(k) savings to alleviate student loan burdens. This exploration delves into the complexities of this decision, weighing the immediate relief against the potential long-term financial consequences. We’ll examine the tax implications, penalties, and alternative strategies to help you make an informed choice. Understanding the rules governing 401(k) withdrawals is crucial. Early withdrawals, particularly before age 59 1/2, usually incur significant tax penalties and may severely impact your retirement savings. Read More …

Using My 401k to Pay Off Student Loans: A Comprehensive Guide

The crushing weight of student loan debt is a reality for many, prompting exploration of unconventional repayment strategies. One such strategy, often debated, involves tapping into retirement savings – specifically, your 401(k) – to accelerate loan repayment. This guide delves into the complexities of this decision, weighing the potential short-term benefits against the long-term implications for your retirement security. We’ll examine the financial ramifications, explore alternative approaches, and guide you toward making an informed decision. Understanding the potential consequences is paramount. Early withdrawal from your 401(k) incurs significant tax penalties and dramatically reduces the compounding power of your investment over Read More …