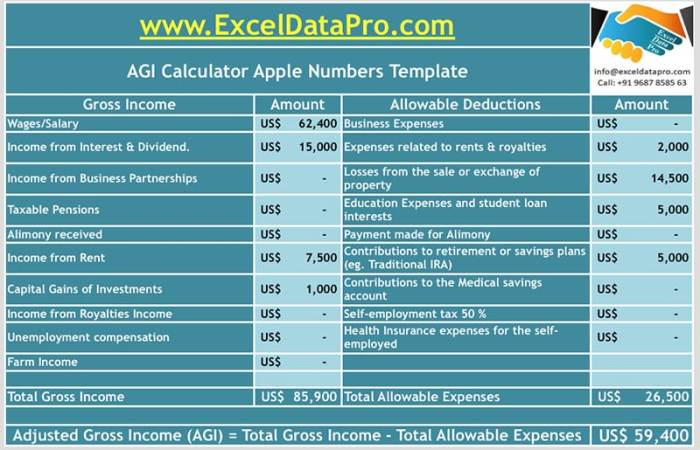

Navigating the world of student loans can feel overwhelming, especially when understanding how your income impacts your eligibility for repayment plans. A crucial factor in determining your repayment options is your Adjusted Gross Income (AGI). This guide demystifies the AGI calculation process specifically for students, providing a clear, step-by-step approach to understanding and calculating your AGI, ultimately empowering you to make informed decisions about your student loan journey. This comprehensive guide breaks down the complexities of calculating your Adjusted Gross Income (AGI) for student loan purposes. We’ll cover key income sources for students, relevant deductions, and a step-by-step calculation process Read More …