Navigating the complexities of student loan debt can feel overwhelming, especially when faced with a $10,000 balance. This guide offers a practical and insightful exploration of managing a $10,000 student loan, covering repayment strategies, budgeting techniques, and the long-term financial implications. We’ll delve into the impact on various educational paths and career choices, providing actionable advice to help you gain control of your financial future. Understanding the nuances of interest rates, repayment plans, and the psychological effects of debt are crucial aspects we will address. We aim to equip you with the knowledge and resources to make informed decisions, fostering Read More …

Tag: budgeting for students

How to Use Student Loans to Pay Rent

Navigating the complexities of student life often involves juggling finances, and the question of using student loans for rent frequently arises. This guide explores the legal, financial, and ethical implications of this decision, providing a balanced perspective on the potential benefits and significant risks involved. We’ll examine alternative solutions, budgeting strategies, and available resources to help students make informed choices about their housing and financial well-being. Understanding the terms of your student loan agreement is paramount. Misusing these funds can lead to serious consequences, including default, damaged credit, and future borrowing limitations. This guide aims to provide the necessary information Read More …

Student Loan for Housing A Comprehensive Guide

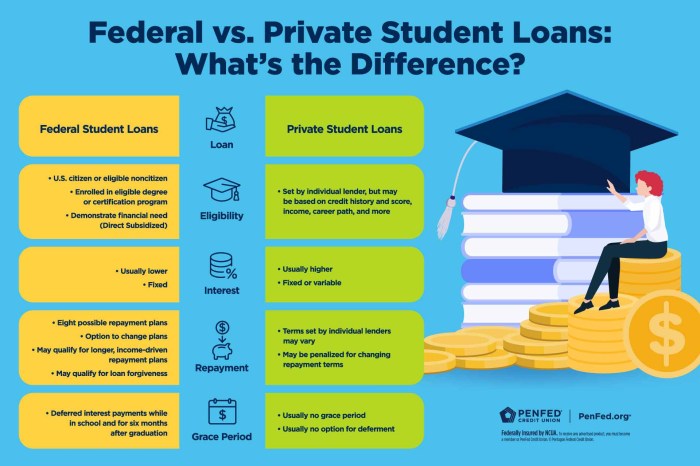

Securing suitable housing during your studies can be a significant hurdle, often complicated by financial constraints. This guide delves into the intricacies of student loans specifically designed for housing, offering a practical roadmap for navigating the process. We’ll explore eligibility criteria, loan types, budgeting strategies, and potential risks, empowering you to make informed decisions about your housing finances. From understanding the various types of loans available – federal versus private – to mastering budgeting techniques and exploring alternative housing options, we aim to provide a comprehensive resource that addresses the unique challenges students face when securing housing. Eligibility Criteria for Read More …

Navigating the Complexities: Using Student Loans to Pay Rent

The rising cost of living, coupled with the increasing burden of student loan debt, presents a significant challenge for many students. The question of using student loans to pay rent is a complex one, fraught with potential financial pitfalls and ethical considerations. This exploration delves into the practical, legal, and emotional implications of this decision, offering insights and guidance to help students make informed choices about their financial well-being. This discussion will examine the long-term financial consequences of diverting student loan funds towards rent, comparing the interest rates on these loans to the average rental costs in various regions. We Read More …

Discretionary Income Calculator Student Loans

Navigating the complexities of student loan repayment often leaves students questioning their financial freedom. Understanding discretionary income—the money left after essential expenses—is crucial for budgeting and long-term financial well-being. This guide explores how student loans impact discretionary income, the role of income-driven repayment plans, and the use of helpful calculators to manage finances effectively. We’ll examine budgeting strategies, highlight common pitfalls, and provide resources to empower students in their financial journey. From understanding the various factors influencing a student’s income, such as part-time jobs, scholarships, and living costs, to mastering the art of budgeting and prioritizing expenses, we’ll equip you Read More …

Navigating the Maze: Student Loans and Living Expenses

The pursuit of higher education is often intertwined with the realities of student loan debt and the often-overlooked challenge of managing living expenses. This exploration delves into the complexities of balancing these financial demands, providing insights into budgeting strategies, long-term financial planning, and the impact of financial burdens on students’ overall well-being and life choices. We will examine the average costs associated with student life across different geographical settings, explore various repayment plans, and offer practical advice for navigating this crucial period. From understanding the typical debt loads and repayment schedules to developing effective budgeting techniques and identifying available resources, Read More …

Mastering Discretionary Income for Student Loans: A Practical Guide

Navigating the complexities of student loan repayment can feel daunting, especially when juggling the demands of academics and part-time employment. Understanding your discretionary income – the money left after essential expenses – is crucial for effective loan management. This guide delves into the intricacies of discretionary income for students, exploring how to identify, budget, and utilize it to successfully repay your student loans while maintaining a reasonable standard of living. We’ll examine various income sources, explore different repayment plans, and offer practical budgeting strategies to help you navigate the financial challenges of student loan debt. We’ll also address the impact Read More …

Securing Your Future: A Guide to Student Loans That Go Directly To You

Navigating the world of student loans can feel overwhelming, especially when faced with the complexities of disbursement methods. Understanding how student loans are paid out directly to you is crucial for responsible financial management. This guide unravels the intricacies of direct student loan programs, offering a clear path towards securing your education without unnecessary financial stress. We’ll explore various loan types, application processes, and crucial budgeting strategies, empowering you to make informed decisions about your financial future. From federal loan programs like Direct Subsidized and Unsubsidized Loans to the diverse options offered by private lenders, the landscape of student financing Read More …

Navigating the Maze: A Guide to Part-Time Student Loans

Balancing work, studies, and finances is a tightrope walk for many part-time students. Securing the right funding is crucial, and understanding the intricacies of part-time student loans can significantly ease the burden. This guide delves into the specifics of eligibility, loan types, repayment options, and potential challenges, equipping you with the knowledge to make informed decisions about your educational journey. From understanding eligibility criteria and comparing federal versus private loans to mastering repayment strategies and navigating potential financial hurdles, we aim to provide a comprehensive overview. We’ll explore how part-time study impacts loan repayment and offer practical advice for effective Read More …