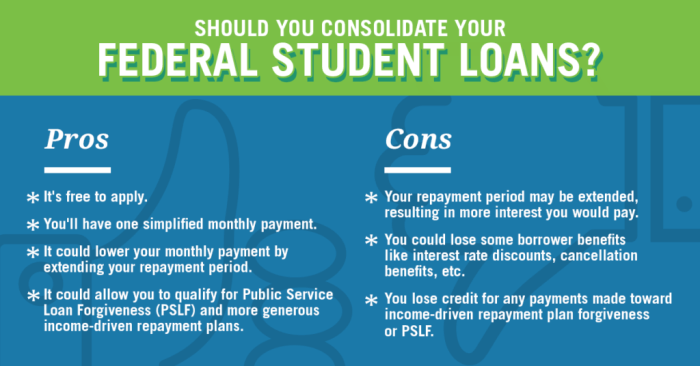

Navigating the complex world of student loans often involves more than just the student borrower. The question of parental liability is a crucial one, impacting not only the student’s financial future but also the parents’ financial well-being. Understanding the legal intricacies and potential consequences of co-signing or other forms of parental involvement is paramount for both parents and students seeking higher education. This exploration delves into federal and state laws, examining the nuances of parental responsibility for both federal and private student loans. We’ll analyze the implications of co-signing, explore strategies for parents to protect their financial interests, and detail Read More …

Tag: co-signer

Do You Need a Co-Signer for a Student Loan?

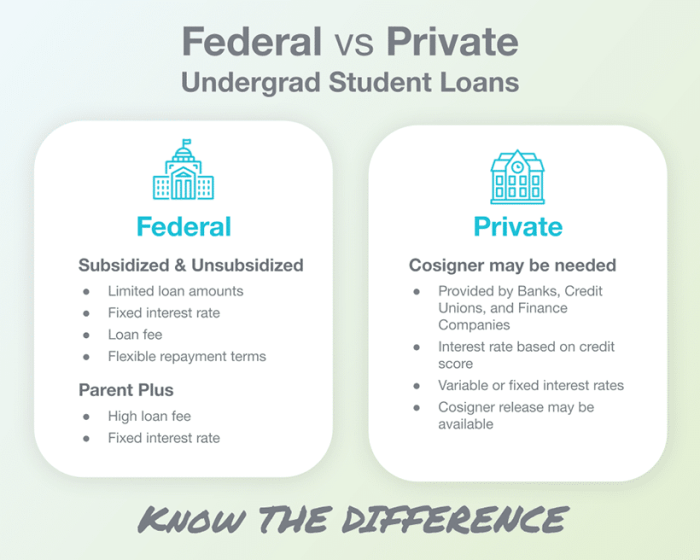

Navigating the world of student loans can be daunting, especially when considering the need for a co-signer. This crucial decision impacts your eligibility, interest rates, and long-term financial health. Understanding the factors influencing the need for a co-signer – your credit history, income, and debt – is paramount to making an informed choice. This guide will explore the benefits and drawbacks of securing a student loan with and without a co-signer, offering clarity on this important financial decision. We’ll delve into the eligibility criteria for loans with and without co-signers, examining both federal and private loan options. We’ll also discuss Read More …

Benefits of Private Student Loans A Comprehensive Guide

Navigating the complexities of higher education financing can feel overwhelming. While federal student loans offer a crucial pathway, private student loans present a valuable alternative, offering unique advantages for certain students. This guide explores the potential benefits of private student loans, examining their accessibility, repayment options, and overall impact on your educational journey. Understanding these benefits empowers you to make informed decisions about your financial future. We’ll delve into the intricacies of interest rates, loan amounts, and the crucial role of co-signers. We’ll also address potential drawbacks and provide practical advice on choosing the right lender. Ultimately, this exploration aims Read More …

Are Student Loans Based on Credit?

Securing funding for higher education is a significant undertaking for many students. The question of whether student loans hinge on creditworthiness is paramount, impacting both eligibility and the terms of repayment. This exploration delves into the intricacies of how credit history influences access to student loans, examining both federal and private loan options and offering strategies for navigating this crucial aspect of financing your education. We will dissect the relationship between credit scores and interest rates, the role of co-signers, and effective methods for building credit while in school. Furthermore, we’ll discuss alternative funding sources available to students who may Read More …

Why Do Most Student Loans Need a Co-Signer?

Securing a student loan can feel like navigating a complex maze, especially for those without established credit. The frequent requirement of a co-signer often leaves students and their families questioning the necessity. This exploration delves into the reasons behind this common practice, examining the perspectives of both lenders and borrowers. We will uncover the crucial role co-signers play in mitigating risk and securing favorable loan terms, while also exploring alternative options for students who lack a suitable co-signer. Understanding the dynamics between student loan eligibility, credit history, and the role of a co-signer is key to navigating the student loan Read More …

Navigating the Maze: A Guide to Private Student Loans for Students

The pursuit of higher education often involves a significant financial commitment. While federal student loans offer a well-established pathway, many students find themselves exploring the landscape of private student loans to bridge the funding gap. This guide delves into the intricacies of private student loans, providing a comprehensive overview to help students make informed decisions about financing their education. Understanding the various types of private loans, the application process, interest rates, repayment options, and potential risks is crucial for responsible borrowing. We’ll explore the advantages and disadvantages of private loans compared to other funding sources, empowering you to navigate the Read More …

Does Credit Score Affect Student Loans?

Securing student loans is a pivotal step for many pursuing higher education. However, the process isn’t always straightforward. A crucial factor often overlooked is the impact of your credit score. This exploration delves into the intricate relationship between your credit history and your ability to obtain favorable student loan terms, examining how a strong credit score can unlock better interest rates and loan amounts, while a weaker one might present significant hurdles. Understanding this connection is essential for navigating the complexities of student loan financing and making informed decisions about your financial future. We’ll examine how credit scores influence loan Read More …

Credit Score Needed for Student Loan: A Comprehensive Guide

Securing a student loan can be a pivotal step towards higher education, but the process isn’t always straightforward. A crucial factor often overlooked is your credit score. This guide delves into the intricate relationship between your creditworthiness and your ability to obtain student loan financing, exploring various loan types, lender requirements, and strategies to improve your chances of approval. We’ll examine how your credit score impacts interest rates, loan amounts, and even your eligibility for certain loan programs. We’ll also discuss alternative financing options for those with less-than-perfect credit scores and strategies for improving your credit score before applying. Ultimately, Read More …

Securing Private Student Loans: Navigating the No-Credit Landscape

The pursuit of higher education often hinges on securing adequate funding. For students lacking a credit history, the path to private student loans can seem daunting. This guide unravels the complexities of obtaining private student loans without a credit score, exploring eligibility criteria, co-signer options, interest rates, repayment plans, and alternative financing strategies. We’ll illuminate the process, empowering you to make informed decisions about your financial future. Understanding the unique challenges faced by students with no credit history is crucial. This involves not only navigating the application process but also comprehending the implications of interest rates, repayment terms, and the Read More …