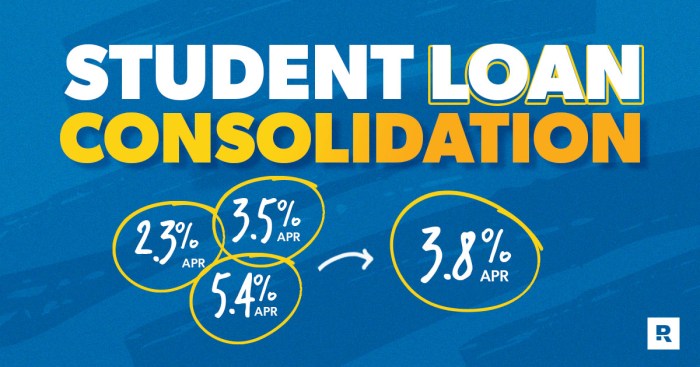

Navigating the complexities of higher education often involves the crucial decision of student loan financing. A well-informed approach to student loans can unlock significant opportunities, but it also requires careful planning and understanding of the potential long-term implications. This exploration delves into the advantages and disadvantages of student loans, providing insights into responsible borrowing and effective debt management strategies to empower students in their pursuit of higher education. We will examine the various types of student loans, comparing federal and private options, and analyzing their impact on career prospects and long-term financial stability. Furthermore, we’ll explore alternative funding sources and Read More …