Securing funding for higher education is a significant undertaking, and Aggieland Credit Union offers a range of student loan products designed to support students throughout their academic journey. Understanding the available options, application processes, and repayment strategies is crucial for responsible borrowing and successful financial management. This guide provides a comprehensive overview of Aggieland Credit Union’s student loan services, empowering students to make informed decisions and navigate the complexities of student financing. From exploring various loan types and interest rates to understanding eligibility requirements and navigating the application process, we aim to demystify the process. We’ll also delve into practical Read More …

Tag: college financing

StudentLoan.com A Comprehensive Review

Navigating the complex world of student loans can be daunting. StudentLoan.com aims to simplify this process, offering a range of services and resources to help students and borrowers manage their debt. This review delves into the website’s design, functionality, services, user feedback, and security measures, providing a comprehensive assessment of its effectiveness and value to users. We’ll explore the website’s strengths and weaknesses, comparing it to competitors and analyzing its marketing strategies. Our goal is to offer a balanced perspective, highlighting both positive and negative aspects to help potential users make informed decisions about utilizing StudentLoan.com for their financial needs. Read More …

Student Loan vs Parent Loan A Comprehensive Guide

Navigating the complex world of higher education financing can feel overwhelming, especially when faced with the decision between a student loan and a parent loan. Both options offer pathways to funding college, but they differ significantly in terms of interest rates, repayment terms, and long-term financial implications. Understanding these differences is crucial for making informed decisions that align with your family’s financial goals and risk tolerance. This guide will delve into the key aspects of each loan type, enabling you to choose the most suitable path for your educational journey. We will explore the intricacies of interest rates, repayment schedules, Read More …

Private Student Loans Best A Comprehensive Guide

Navigating the complex world of higher education financing can feel overwhelming, especially when considering private student loans. This guide provides a clear and concise overview of private student loan options, helping you understand the various types available, the application process, and potential risks involved. We’ll explore strategies for minimizing costs, comparing different lenders and repayment plans to empower you with the knowledge needed to make informed decisions. From understanding interest rates and fees to exploring alternative funding sources, we aim to demystify the process. Whether you’re a prospective student or a parent assisting with financing, this resource offers valuable insights Read More …

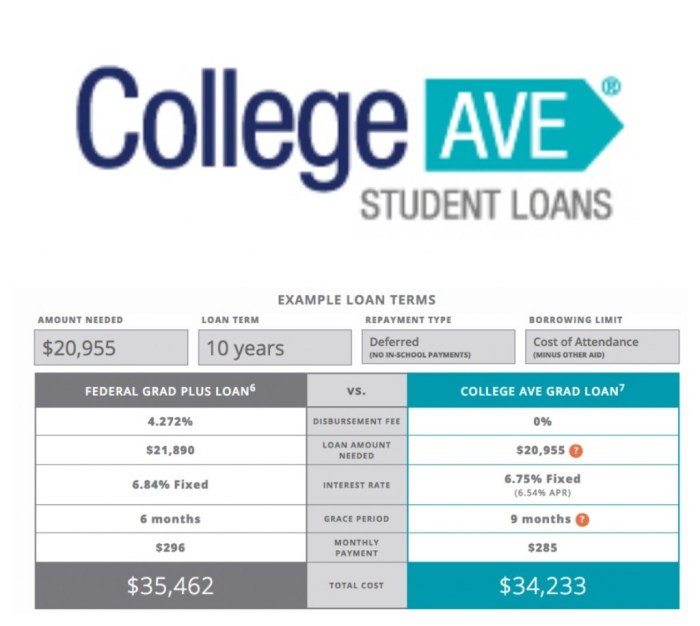

Decoding College Ave Student Loans: A Comprehensive Guide to Interest Rates

Navigating the world of student loans can feel like traversing a complex maze, especially when understanding interest rates is crucial for long-term financial health. This guide delves into the intricacies of College Ave student loan interest rates, providing a clear and concise overview of factors influencing your rate, comparison points to other lenders, and strategies to manage and potentially reduce your costs. We’ll explore the calculation process, the impact of various loan terms and credit scores, and the long-term implications of your interest rate choices. Understanding College Ave’s interest rate structure is paramount to making informed decisions about your education Read More …

University of Florida Student Loans A Comprehensive Guide

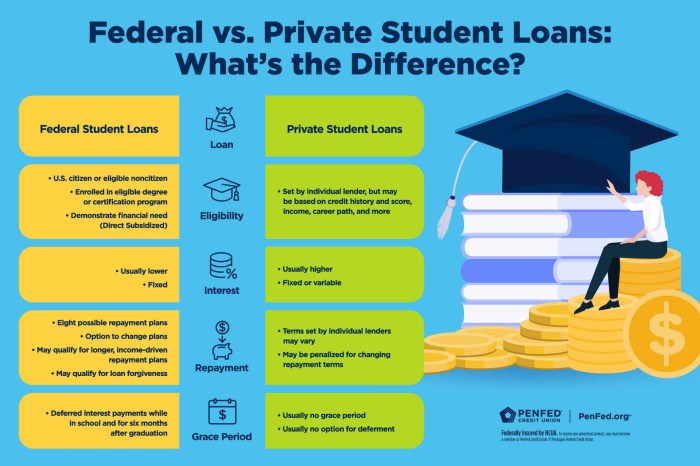

Navigating the complexities of financing a University of Florida education can feel overwhelming. The prospect of student loans, while necessary for many, often brings uncertainty about repayment, interest rates, and available options. This guide aims to demystify the process, providing a clear understanding of the various loan types available to UF students, the application procedures, and effective strategies for managing debt after graduation. We’ll explore both federal and private loan options, highlighting eligibility criteria and outlining the steps involved in securing financial assistance. From understanding interest rates and repayment plans to exploring financial aid and scholarship opportunities, we cover all Read More …

Best Private Student Loans 2024: A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, especially when considering private options. This guide provides a clear and concise overview of the best private student loans available in 2024, helping you make informed decisions for your educational financing needs. We’ll explore key factors to consider, leading lenders, and strategies for successful application and repayment, ensuring you’re well-equipped to manage your financial future. Understanding the differences between federal and private loans is crucial. Federal loans often offer more borrower protections and flexible repayment plans, while private loans may have higher interest rates and stricter eligibility requirements. This guide will Read More …

Student Loan Discovery A Comprehensive Guide

Navigating the complex world of student loans can feel overwhelming, especially for students facing the prospect of significant debt. This guide provides a clear and concise path to understanding the various loan options available, the application process, and effective repayment strategies. From understanding federal and private loans to utilizing online tools and resources, we’ll equip you with the knowledge to make informed decisions about your financial future. We will explore the current student loan landscape in the US, highlighting key features and challenges. We’ll delve into the specifics of different loan types, application procedures, and the importance of thoroughly understanding Read More …

Popular Private Student Loans A Comprehensive Guide

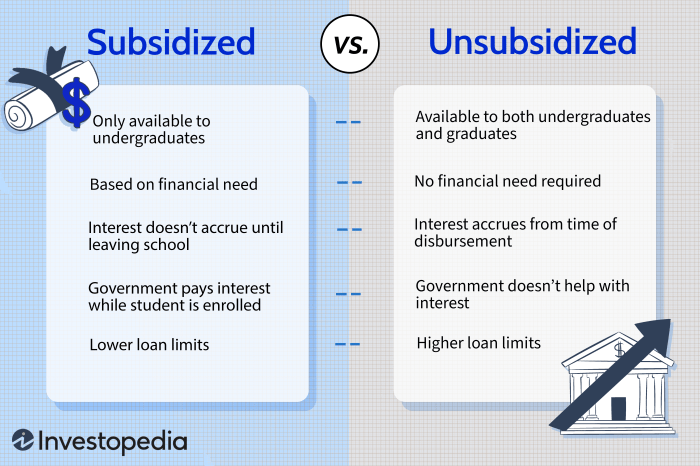

Navigating the complex world of higher education often requires financial assistance beyond the reach of federal student aid. Private student loans offer a potential solution, but understanding their nuances is crucial for responsible borrowing. This guide delves into the landscape of popular private student loans, exploring eligibility, application processes, repayment options, and potential risks, equipping you with the knowledge to make informed decisions. From understanding the diverse range of loan types and lenders to comparing interest rates and repayment plans, we aim to demystify the process. We’ll also contrast private loans with their federal counterparts, highlighting the key differences and Read More …

Personal Student Loans for Living Expenses

Navigating the complexities of higher education often requires financial assistance beyond tuition. Securing personal student loans for living expenses can significantly ease the burden, but understanding the various options, eligibility criteria, and potential risks is crucial for responsible borrowing. This guide provides a comprehensive overview to help students make informed decisions about financing their education. From federal loan programs to private lenders, the landscape of student loans is diverse. This exploration delves into the specifics of each, highlighting key differences in interest rates, repayment plans, and eligibility requirements. We’ll also examine alternative funding sources, such as scholarships and grants, to Read More …