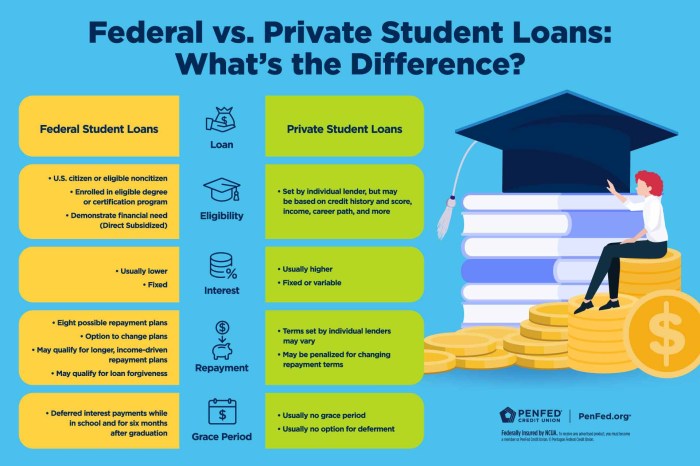

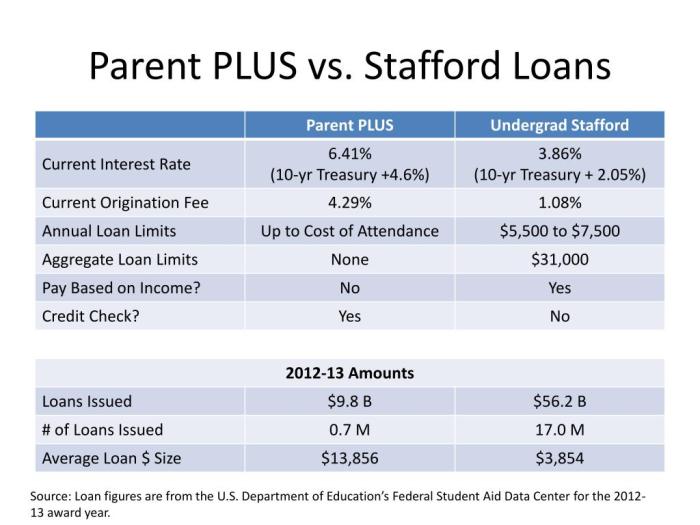

Navigating the complexities of higher education financing can feel overwhelming, especially when faced with the choice between Parent PLUS loans and student loans. Both offer pathways to funding college, but their implications differ significantly in terms of interest rates, eligibility criteria, repayment options, and long-term financial consequences. This guide aims to clarify these differences, empowering you to make an informed decision that aligns with your individual circumstances. Understanding the nuances of each loan type is crucial for responsible financial planning. Factors such as credit history, repayment schedules, and potential impacts on your credit score will be explored, providing a clear Read More …