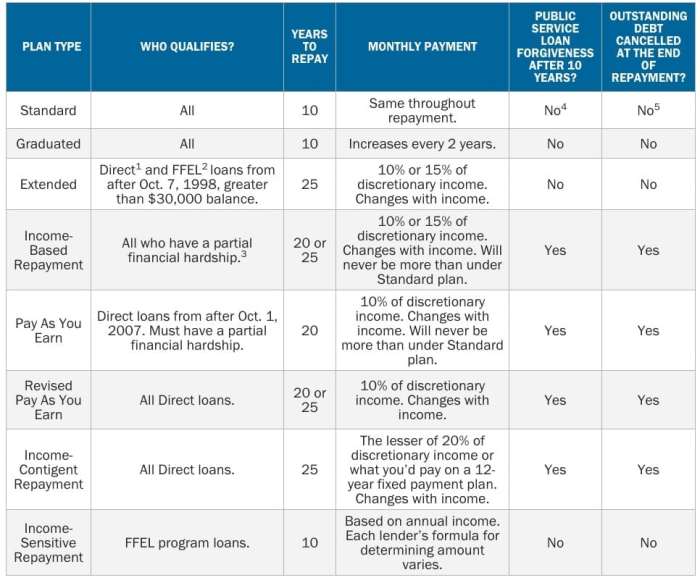

Securing funding for higher education is a crucial step for many aspiring students. The question, “When do you apply for student loans?”, is paramount, influencing not only the availability of funds but also the overall financial planning for your academic journey. This guide delves into the complexities of student loan applications, offering a clear understanding of timelines, deadlines, and the factors that shape the application process. From understanding the various types of student loans available – federal versus private – to navigating the FAFSA and comprehending the nuances of different repayment plans, we aim to equip you with the knowledge Read More …

Tag: college funding

PSU Student Loans A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, especially when considering the significant financial commitment involved. This guide delves into the specifics of Pennsylvania State University (PSU) student loans, providing a clear understanding of the various loan types, application processes, and debt management strategies. We aim to equip prospective and current PSU students with the knowledge necessary to make informed decisions and navigate their financial journey successfully. From understanding the differences between federal and private loans and their associated interest rates and repayment terms, to exploring effective budgeting techniques and debt management strategies, this guide offers a comprehensive overview. Read More …

Private Student Loans for Living Expenses

Navigating the complexities of higher education often requires financial assistance beyond tuition. Private student loans for living expenses provide a potential solution, but understanding the intricacies of interest rates, repayment plans, and associated fees is crucial. This exploration delves into the eligibility criteria, various lenders’ offerings, and alternative funding options, empowering students to make informed decisions about managing their finances responsibly. This guide aims to demystify the process of securing private student loans for living expenses. We will examine the advantages and disadvantages of this funding route, comparing it to federal loans and other financial aid sources. Understanding the potential Read More …

Private Loans for Students Without Cosigner

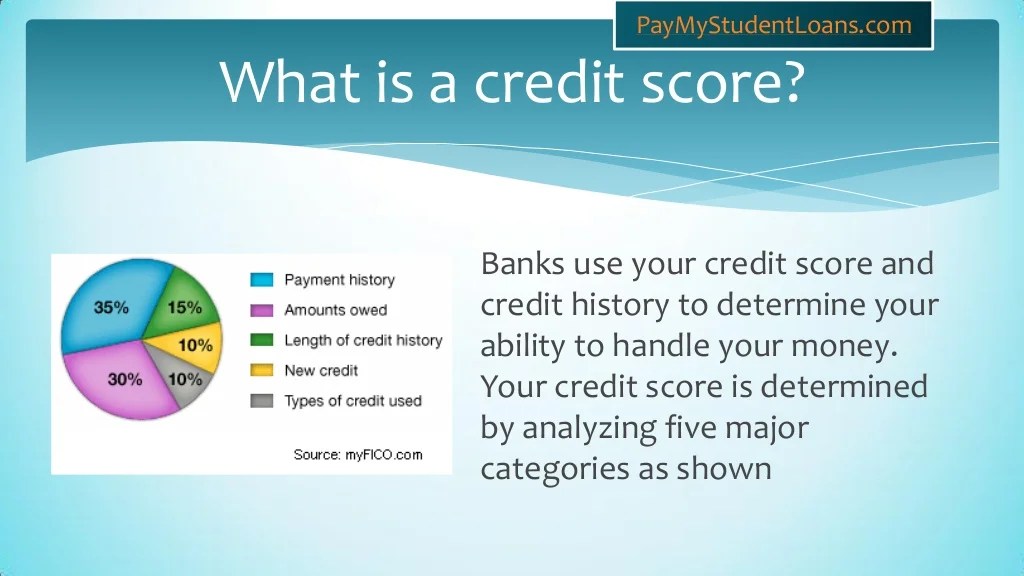

Navigating the world of higher education financing can be daunting, especially for students lacking a cosigner for private loans. Securing funds for tuition, fees, and living expenses without a cosigner requires careful planning and a thorough understanding of lender requirements. This guide explores the landscape of private student loans designed specifically for students who don’t have access to a cosigner, outlining eligibility criteria, loan types, interest rates, repayment options, and potential risks. Understanding the intricacies of cosigner-less student loans empowers students to make informed decisions about their financial future. We’ll delve into the specific factors lenders consider, comparing different loan Read More …

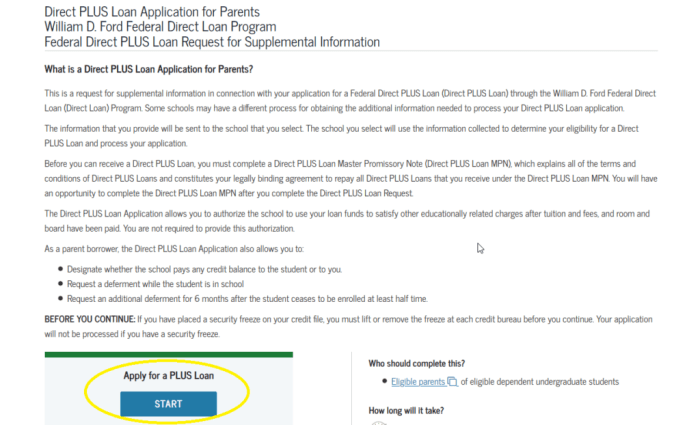

Parent Loans for Undergraduate Students

Navigating the complexities of higher education financing often involves considering parent loans as a crucial element. This comprehensive guide explores the various types of parent loans available for undergraduate students, offering a clear understanding of their benefits, drawbacks, and the application process. We’ll delve into the financial responsibilities involved, explore effective repayment strategies, and examine alternative funding options to help families make informed decisions about financing their child’s education. From understanding eligibility criteria and interest rates to managing repayment plans and avoiding potential pitfalls, this resource aims to empower parents with the knowledge needed to confidently navigate the landscape of Read More …

Parent PLUS Loan Federal Student Aid

Navigating the complexities of higher education funding often involves exploring various financial aid options. For many families, the Parent PLUS Loan becomes a crucial component of their college financing strategy. This loan program, offered by the federal government, allows parents to borrow money to help cover their child’s educational expenses. Understanding the intricacies of Parent PLUS Loans—from eligibility requirements to repayment options—is paramount to making informed financial decisions and avoiding potential pitfalls. This guide delves into the key aspects of Parent PLUS Loans, providing a comprehensive overview of the application process, interest rates, repayment plans, and potential long-term financial implications. Read More …

Need a Student Loan Funding Your Education

Navigating the complexities of higher education often necessitates exploring financing options. The decision to seek a student loan is a significant one, impacting not only immediate tuition costs but also long-term financial well-being. This guide provides a comprehensive overview of the student loan process, from understanding your needs and exploring available options to managing repayment and considering alternatives. From the initial anxieties of insufficient funds to the hope of a brighter future, the search for “need a student loan” reveals a spectrum of emotional states. This resource aims to alleviate some of that stress by offering clear, concise information and Read More …

Living Expenses Loan for Students A Comprehensive Guide

Navigating the complexities of higher education often involves the significant challenge of managing living expenses. For many students, securing a loan specifically designed to cover these costs is essential to pursuing their academic goals. This guide delves into the multifaceted world of student living expenses loans, providing a comprehensive overview of loan types, eligibility criteria, application processes, financial responsibility, and long-term financial planning implications. We aim to equip students with the knowledge and tools to make informed decisions about financing their education and future. From understanding different loan options and their associated interest rates and repayment terms to exploring alternative Read More …

Loan Limits for Federal Student Loans

Navigating the complexities of higher education often involves understanding the financial landscape. Federal student loans play a crucial role for many students, but knowing your borrowing limits is paramount to responsible financial planning. This guide unravels the intricacies of federal student loan limits, providing clarity on eligibility, annual and aggregate caps, and the impact of various factors on your borrowing potential. From understanding the different loan types – Direct Subsidized, Unsubsidized, and PLUS loans – to grasping the nuances of dependency status and enrollment levels, we aim to equip you with the knowledge needed to make informed decisions about financing Read More …

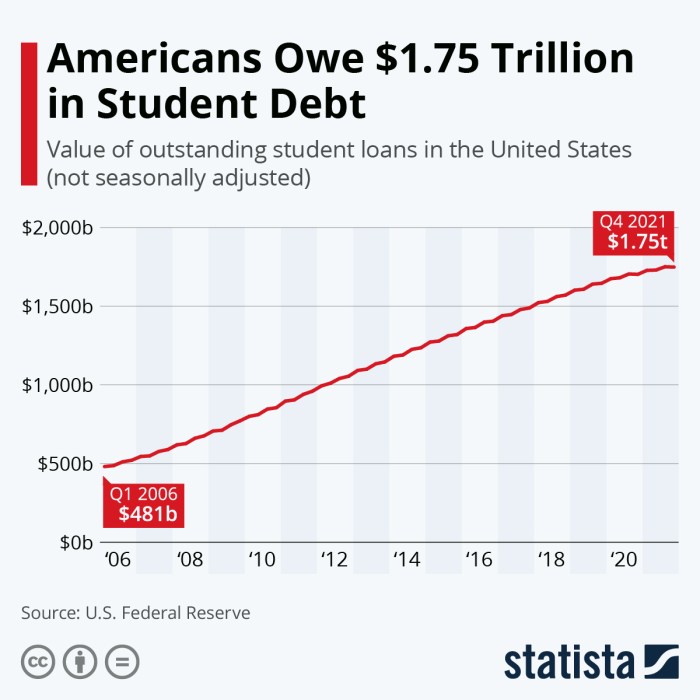

Navigating the Maze: Understanding Student Loan Limits and Their Impact

The pursuit of higher education often involves a complex financial landscape, with student loan limits playing a pivotal role in shaping students’ access to and experience with college. This exploration delves into the intricacies of federal and state student loan programs, examining the varying limits, eligibility criteria, and the overall impact on student debt. We will also consider alternative funding avenues and strategies for maximizing financial aid to mitigate the burden of borrowing. Understanding these limits is crucial for prospective and current students, as they directly influence borrowing decisions and long-term financial well-being. This guide aims to provide clarity and Read More …