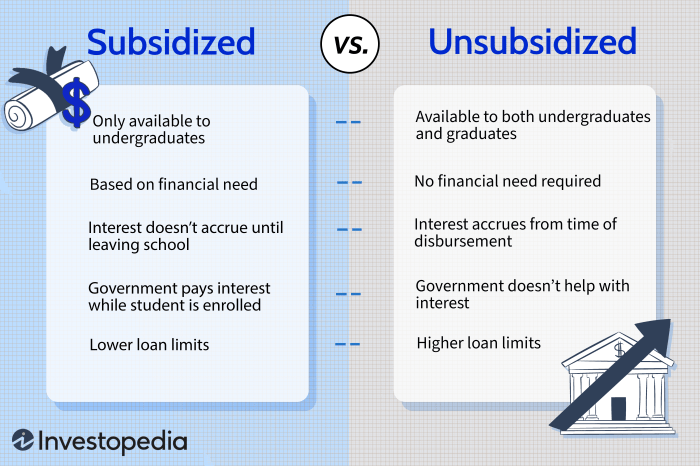

Navigating the world of student loans without a cosigner can feel daunting, but understanding your options and leveraging online resources like Reddit can significantly improve your chances of securing funding for your education. This guide explores the insights gleaned from Reddit discussions, comparing lenders, outlining alternative financing routes, and offering practical financial planning advice to help you succeed. Reddit provides a unique platform for prospective borrowers to share their experiences, both positive and negative, with various lenders. By analyzing this collective wisdom, we aim to illuminate the path toward securing a student loan without needing a cosigner, focusing on factors Read More …