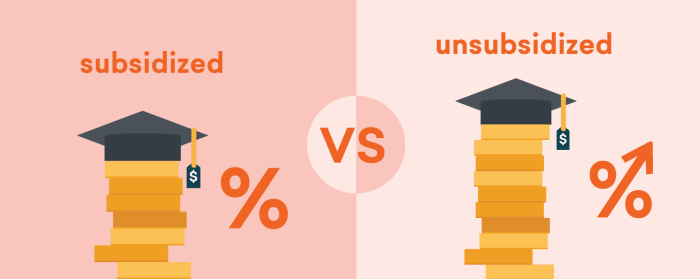

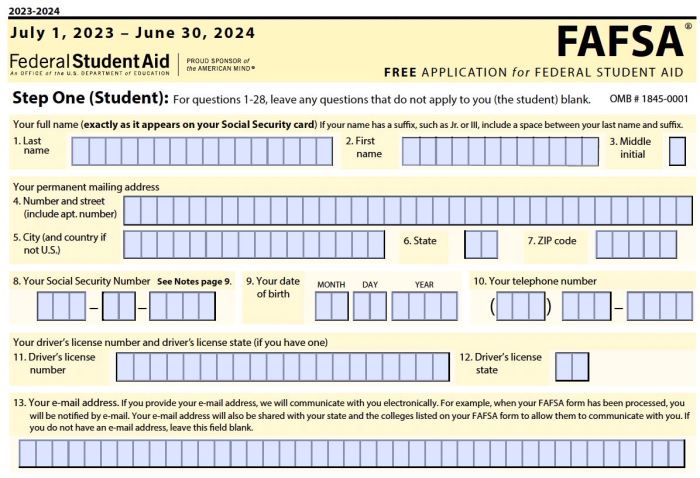

Securing financial aid for higher education can feel like navigating a complex maze. The Free Application for Federal Student Aid (FAFSA) is the key to unlocking various federal student loan programs and grants, significantly impacting college affordability. This guide serves as your roadmap, demystifying the FAFSA student loan application process and empowering you to make informed decisions about your financial future. From understanding eligibility criteria and exploring different loan types to managing debt responsibly and avoiding common pitfalls, we will cover all aspects of the FAFSA application. We’ll also provide valuable resources and tips to help you navigate this crucial Read More …