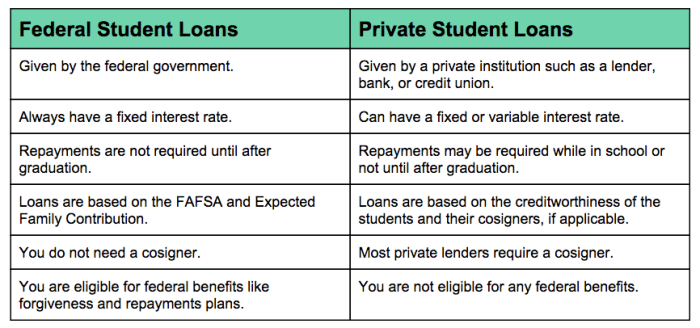

Navigating the complexities of higher education as an international student often involves securing funding. Private student loans represent a significant avenue for financing studies abroad, but understanding the intricacies of eligibility, application processes, and repayment options is crucial. This guide provides a comprehensive overview of private student loans specifically tailored to the needs and circumstances of international students, addressing key aspects from eligibility criteria to potential legal implications. Securing a private student loan as an international student requires careful planning and preparation. Unlike domestic students, international applicants often face unique challenges, including stricter eligibility requirements and the need for co-signers. Read More …