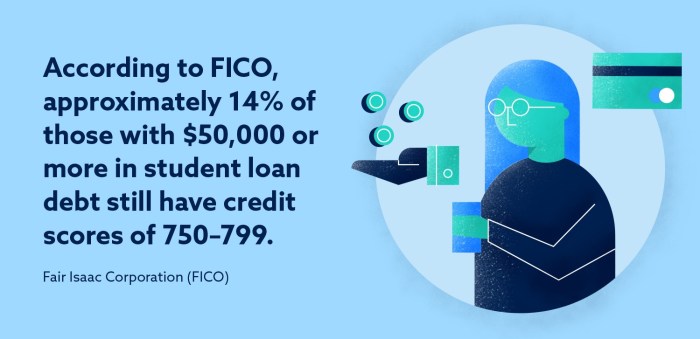

Navigating the world of student loans can be daunting, especially when a low credit score casts a shadow over your financial future. Many students find themselves in this situation, facing the challenge of securing the funding needed for their education while grappling with a less-than-ideal credit history. This often stems from limited credit history, past financial missteps, or simply the lack of established credit. The consequences can be significant, leading to higher interest rates, limited loan options, and added financial stress. This guide explores the complexities of obtaining student loans with a low credit score, offering practical strategies and solutions. Read More …