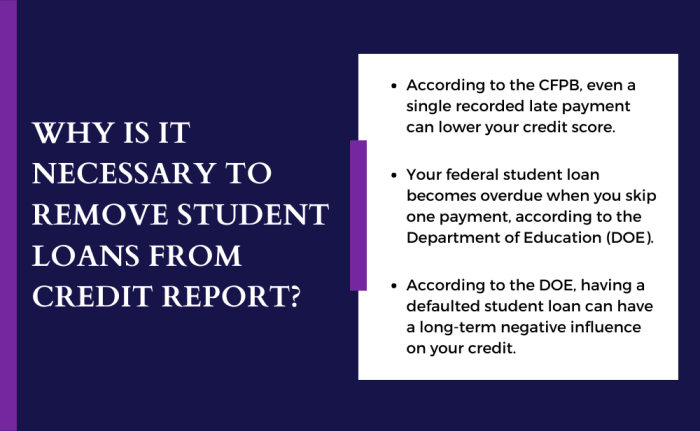

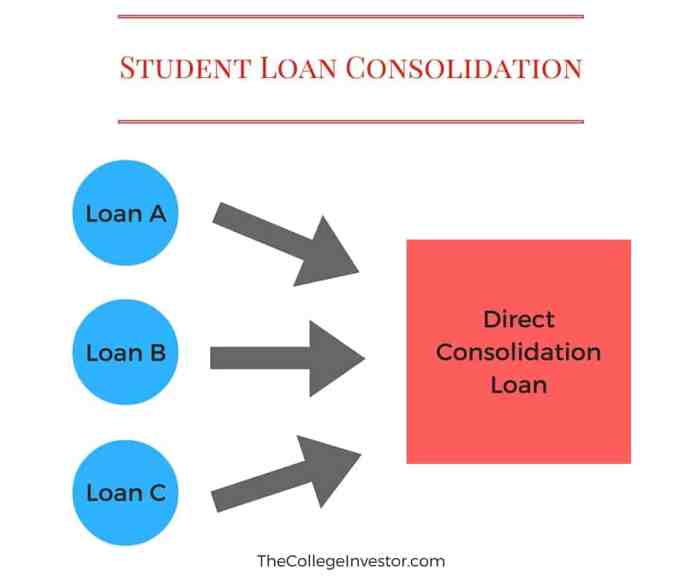

Navigating the complexities of student loan debt and its impact on your credit report can feel overwhelming. Understanding how student loans are reported, the potential consequences of late payments, and the strategies for effective debt management are crucial steps towards achieving financial health. This guide provides a clear path to understanding and improving your credit score in relation to your student loans, empowering you to take control of your financial future. From exploring different repayment plans and disputing inaccurate information to understanding the long-term effects of various repayment strategies and preventing future credit issues, we’ll equip you with the knowledge Read More …