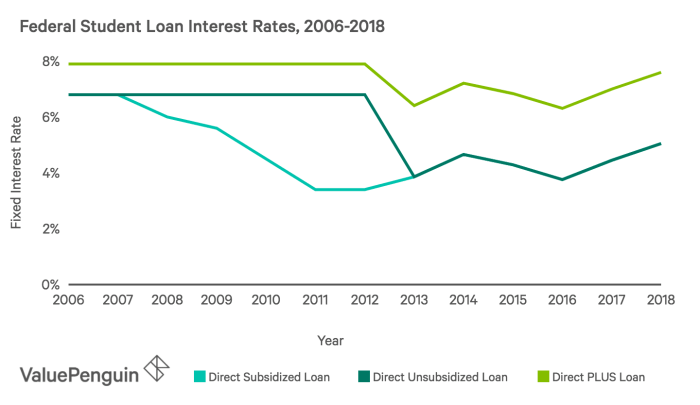

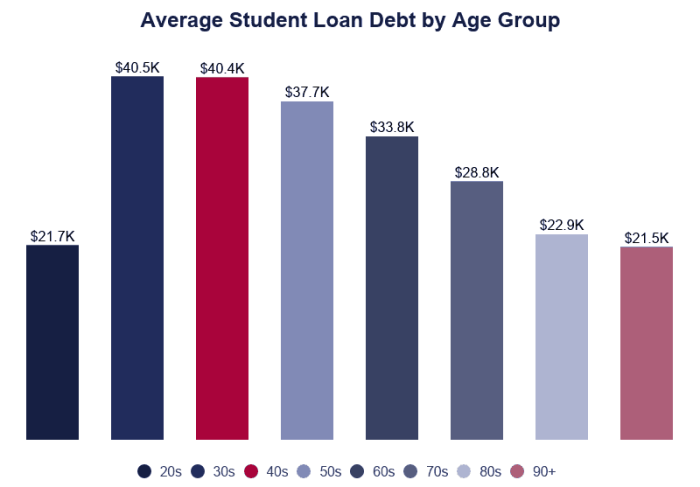

Navigating the complexities of student loan refinancing can feel overwhelming, especially with the fluctuating interest rates and diverse lender options. Understanding the average student loan refinance rate is crucial for making informed decisions and securing the best possible terms for your financial future. This guide provides a comprehensive overview of current market trends, crucial factors influencing rates, and a step-by-step process to help you successfully refinance your student loans. From exploring the relationship between credit scores and interest rates to comparing fixed versus variable options, we’ll demystify the process. We’ll also examine different lender types, eligibility criteria, and strategies for Read More …