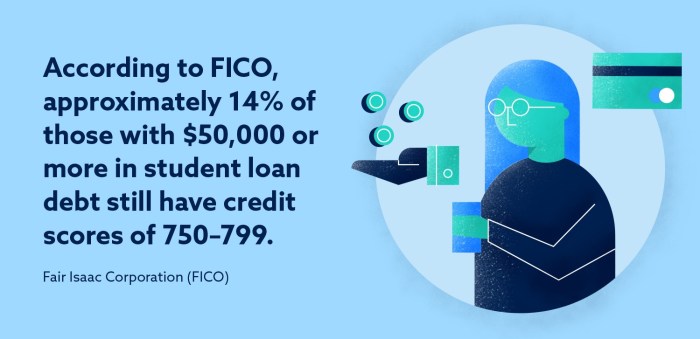

Navigating the complexities of student loan repayment while simultaneously safeguarding your credit score can feel daunting. The decisions you make regarding repayment plans, debt management, and credit utilization significantly impact your financial future. This guide provides a clear understanding of the intricate relationship between student loan repayment and your credit score, equipping you with the knowledge and strategies to navigate this crucial phase successfully. We’ll explore how different repayment strategies influence your credit report, the impact of high student loan debt on your credit utilization ratio, and practical steps to improve your credit score while diligently paying down your student Read More …