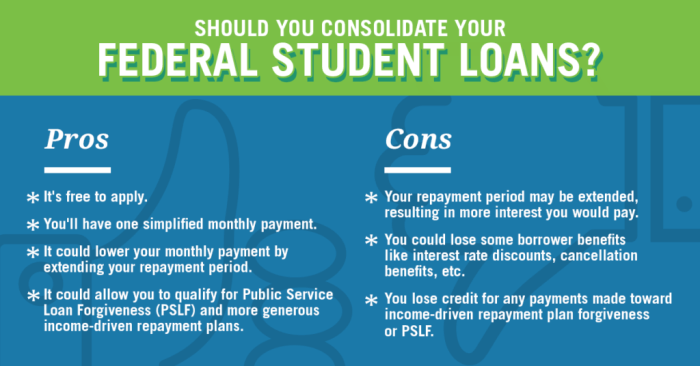

Securing funding for higher education is a significant undertaking for many students. The question of whether student loans hinge on creditworthiness is paramount, impacting both eligibility and the terms of repayment. This exploration delves into the intricacies of how credit history influences access to student loans, examining both federal and private loan options and offering strategies for navigating this crucial aspect of financing your education. We will dissect the relationship between credit scores and interest rates, the role of co-signers, and effective methods for building credit while in school. Furthermore, we’ll discuss alternative funding sources available to students who may Read More …