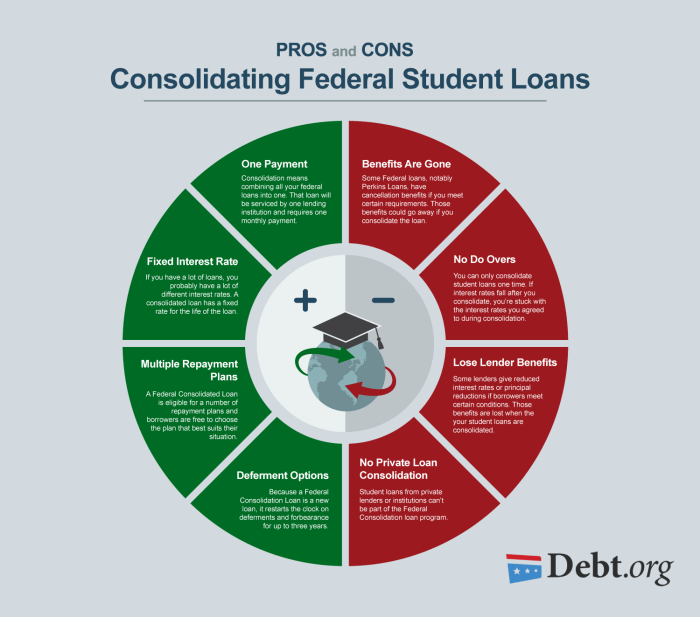

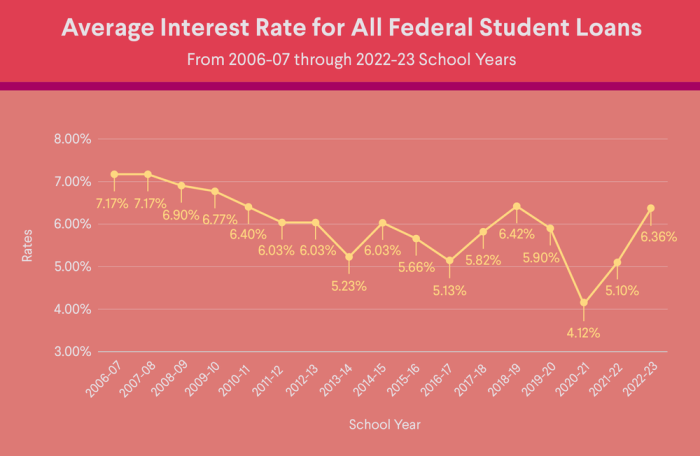

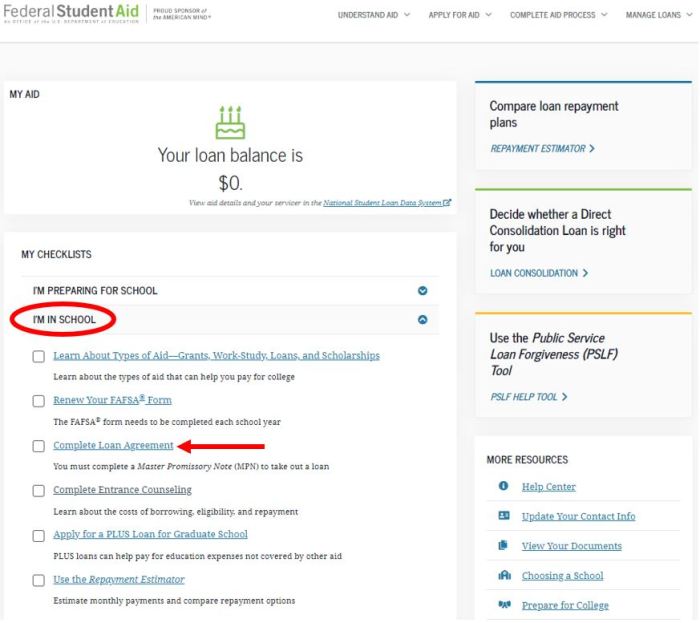

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the Master Promissory Note (MPN) is crucial for responsible borrowing. This guide provides a clear and concise overview of the MPN, from its initial signing to long-term repayment strategies and the impact on your credit score. We’ll demystify the process, equipping you with the knowledge to make informed decisions about your student loan debt. We will explore the various types of MPNs, the different repayment plans available, and the implications of defaulting on your loans. Furthermore, we will delve into loan forgiveness programs and how they interact with Read More …