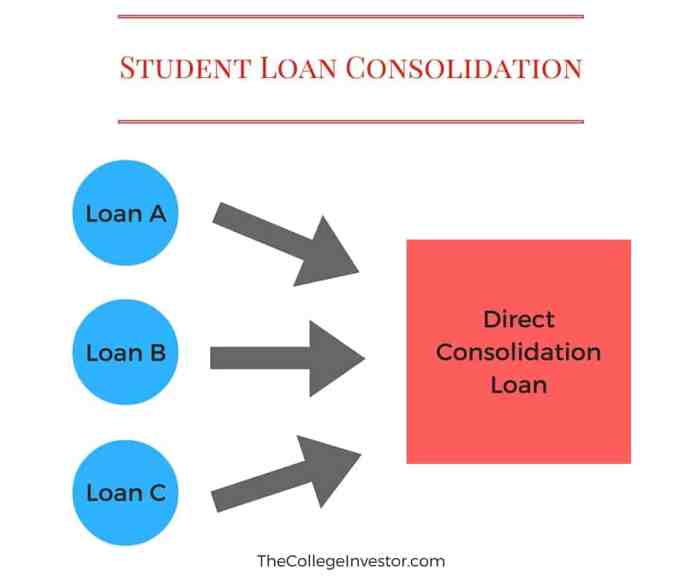

Navigating the complexities of student loan repayment can feel overwhelming, and the decision to consolidate your loans is a significant one. Many borrowers wonder about the potential impact on their credit scores, a crucial factor in future financial decisions. This exploration delves into the intricacies of student loan consolidation, examining both the immediate and long-term effects on your creditworthiness. Understanding how consolidation affects your credit score involves considering several key aspects. The age of your accounts, your payment history after consolidation, and even the type of loans you’re combining all play a role. This analysis will equip you with the Read More …