Navigating the complexities of student loan repayment and its impact on your credit score can feel daunting. Understanding how long these loans remain on your credit report is crucial for long-term financial planning. This information affects your ability to secure loans, rent an apartment, or even get a job in the future. This guide explores the factors influencing the duration student loans appear on your credit history, offering clarity and practical advice. From the initial loan disbursement to eventual repayment, the journey of a student loan’s presence on your credit report is a multifaceted process. This process is impacted by Read More …

Tag: credit score

How Can I Get Rid of My Student Loans?

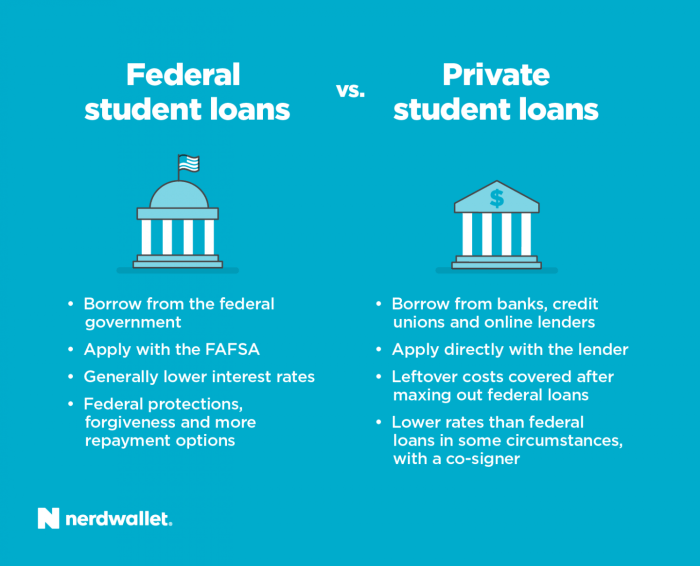

Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide explores various strategies, from exploring income-driven repayment plans to understanding loan forgiveness programs, empowering you to take control of your student loan debt. We’ll delve into the specifics of federal and private loans, outlining the differences in interest rates, repayment options, and forgiveness programs. We’ll also provide practical advice on budgeting, credit score improvement, and seeking professional help when needed, equipping you with the tools to make informed decisions and chart a path towards a debt-free future. Read More …

Good Personal Loans for Students A Comprehensive Guide

Navigating the world of student loans can feel overwhelming, especially when faced with the prospect of hefty tuition fees. Understanding the various types of personal loans available, their associated interest rates and repayment terms, is crucial for making informed financial decisions. This guide will equip you with the knowledge to confidently choose the best loan option to support your education and future. We’ll delve into the specifics of federal versus private student loans, exploring eligibility requirements, application processes, and the importance of responsible borrowing. We’ll also discuss alternative financing options and strategies for improving your credit score to secure the Read More …

How to Get Student Loans Off Your Credit Report: A Comprehensive Guide

Navigating the complexities of student loan debt and its impact on your credit report can feel overwhelming. Many students and graduates find themselves grappling with the ramifications of student loans, whether they’re managing payments successfully or facing challenges. This guide provides a clear and concise path to understanding how student loans appear on your credit report, strategies for managing them effectively, and steps to take if you need to dispute inaccurate information. We’ll explore proactive measures to maintain a healthy credit score, even while dealing with student loan debt. Understanding the reporting process, the various types of student loans, and Read More …

Federal Private Student Loan Consolidation Guide

Navigating the complexities of student loan debt can feel overwhelming. Federal private student loan consolidation offers a potential pathway to simplify repayment, but understanding its intricacies is crucial. This guide provides a clear and concise overview of the process, outlining eligibility requirements, the application procedure, and the potential benefits and drawbacks. We’ll explore different repayment plans, the impact on credit scores, and essential resources to help you make informed decisions. The process of consolidating federal private student loans involves combining multiple federal student loans into a single, new loan. This can simplify repayment by reducing the number of monthly payments Read More …

How Do Student Loans Affect Your Credit Score and Future Borrowing?

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering its significant impact on your creditworthiness. Understanding how student loans are reported to credit bureaus, the consequences of missed payments, and strategies for managing debt effectively are crucial for building a strong financial future. This guide provides a comprehensive overview of the relationship between student loans and your credit, equipping you with the knowledge to make informed decisions about your financial well-being. From the moment you take out your first student loan, its presence becomes intertwined with your credit history. This affects not only your credit score Read More …

Does Having Student Loans Affect Credit Score?

Navigating the complexities of student loan repayment and its impact on your credit score can feel daunting. The good news is, understanding how lenders report your payments and how various factors influence your score empowers you to make informed decisions about your financial future. This guide provides a clear overview of the relationship between student loans and your creditworthiness, offering practical strategies to manage your debt effectively and build a strong credit history. From the type of loan and repayment plan to your overall debt-to-income ratio, numerous elements interact to shape your credit profile. We’ll explore these factors in detail, Read More …

Does Claiming Bankruptcy Clear Student Loans?

Navigating the complexities of student loan debt can feel overwhelming, especially when considering drastic measures like bankruptcy. The question of whether bankruptcy can erase this significant financial burden is a critical one for many struggling borrowers. This exploration delves into the intricacies of bankruptcy law and its interaction with student loans, examining the various types of bankruptcy, eligibility requirements, and the crucial “undue hardship” exception. We will also consider the implications of bankruptcy on your credit score and future financial prospects, ultimately providing a clear understanding of the potential outcomes and alternative solutions. Understanding the nuances of federal versus private Read More …

Does Credit Score Affect Student Loans?

Securing student loans is a pivotal step for many pursuing higher education. However, the process isn’t always straightforward. A crucial factor often overlooked is the impact of your credit score. This exploration delves into the intricate relationship between your credit history and your ability to obtain favorable student loan terms, examining how a strong credit score can unlock better interest rates and loan amounts, while a weaker one might present significant hurdles. Understanding this connection is essential for navigating the complexities of student loan financing and making informed decisions about your financial future. We’ll examine how credit scores influence loan Read More …

Does a Parent Have to Cosign a Student Loan?

Navigating the complexities of student loan financing can be daunting, especially when considering the role of a cosigner. This exploration delves into the nuances of federal and private student loans, examining when a parent’s cosignature is required and the implications for both the student and the cosigner. We’ll unpack the factors influencing lender decisions, explore alternatives to cosigning, and illuminate the responsibilities and risks involved. Understanding the requirements for securing student loans is crucial for financial planning. This guide will provide clarity on the conditions under which a cosigner is necessary, the impact of credit scores, and the various options Read More …