Navigating the complexities of student loan repayment and its impact on your credit score can feel overwhelming. Many borrowers wonder if diligently paying off their student loans will translate into a tangible improvement in their creditworthiness. This exploration delves into the multifaceted relationship between student loan repayment and credit scores, examining key factors that influence the process. We’ll unpack how consistent on-time payments affect credit utilization ratios and payment history, the role of credit mix diversity, and the significance of the length of your credit history. By understanding these elements, you can develop a strategic approach to repayment that maximizes Read More …

Tag: credit utilization

How Much Does Student Loans Affect Credit?

Navigating the complex relationship between student loans and credit scores can feel overwhelming. The impact of student loan debt extends far beyond the monthly payment; it significantly influences your creditworthiness, impacting everything from securing a mortgage to obtaining a car loan. Understanding how your repayment habits, debt levels, and chosen repayment plans affect your credit report is crucial for long-term financial health. This guide will unravel the intricacies of student loan debt’s impact on your credit, offering practical strategies for responsible management. From the initial application process to long-term repayment strategies, the choices you make regarding student loans have profound Read More …

Will Paying Off Student Loans Increase My Credit Score?

The question of whether paying off student loans boosts your credit score is a common one among borrowers. The answer, however, isn’t a simple yes or no. While eliminating student loan debt can positively impact your credit score, the extent of the improvement depends on several interconnected factors. Understanding these factors – your credit utilization ratio, payment history, length of credit history, and the type of loan – is crucial to predicting the impact on your creditworthiness. This exploration delves into the intricate relationship between student loan repayment and credit scores, examining how various repayment strategies and loan types influence Read More …

Does Refinancing Your Student Loans Hurt Your Credit?

Navigating the complexities of student loan refinancing can feel daunting, especially when considering its potential impact on your credit score. The process involves a hard credit inquiry, which temporarily lowers your score, but the long-term effects depend on various factors beyond this initial dip. Understanding these factors – your debt-to-income ratio, payment history, credit utilization, and the type of refinancing – is crucial for making informed decisions and minimizing potential negative consequences. This guide explores the intricate relationship between student loan refinancing and your creditworthiness, offering insights into how each aspect of the process influences your credit score and providing Read More …

Paying Off Student Loans and Protecting Your Credit Score: A Comprehensive Guide

Navigating the complexities of student loan repayment while simultaneously safeguarding your credit score can feel daunting. The decisions you make regarding repayment plans, debt management, and credit utilization significantly impact your financial future. This guide provides a clear understanding of the intricate relationship between student loan repayment and your credit score, equipping you with the knowledge and strategies to navigate this crucial phase successfully. We’ll explore how different repayment strategies influence your credit report, the impact of high student loan debt on your credit utilization ratio, and practical steps to improve your credit score while diligently paying down your student Read More …

How Much Do Student Loans Affect Your Credit Score? A Comprehensive Guide

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering its impact on your creditworthiness. The weight of student loan debt often looms large, but understanding how your repayment habits influence your credit score empowers you to make informed financial decisions. This guide delves into the intricate relationship between student loans and your credit, providing insights and strategies to help you manage your debt effectively and build a strong credit history. From the effect of on-time payments to the consequences of delinquency, we’ll explore the various factors that contribute to your credit score in the context of Read More …

Does Paying Off Student Loans Increase Credit Score?

Navigating the complexities of student loan repayment and its impact on credit scores can feel overwhelming. Many borrowers wonder if diligently paying down their student loans will translate into a higher credit score, a crucial factor in securing future financial opportunities like mortgages or car loans. This exploration delves into the multifaceted relationship between student loan repayment and creditworthiness, examining how various repayment strategies, payment history, and the length of credit history all contribute to the overall credit score. We will investigate how factors like credit utilization, consistent on-time payments, and the age of your accounts influence your credit score. Read More …

Does Paying Off Student Loans Increase Credit Score?

The question of whether paying off student loans boosts your credit score is a common one among borrowers striving for financial health. While the answer isn’t a simple yes or no, understanding the intricate relationship between student loan repayment and credit score improvement is crucial for effective financial planning. This exploration delves into the mechanics of credit scoring, examining how various repayment strategies and other contributing factors influence your overall creditworthiness. We will investigate the impact of reducing your credit utilization ratio through student loan payoff, the significance of consistent on-time payments, and the role of other factors like credit Read More …

Does Student Loan Debt Affect My Credit Score? A Comprehensive Guide

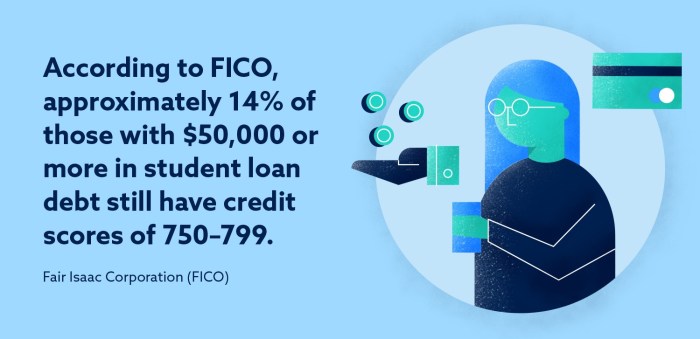

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering its impact on your credit score. Understanding how your student loan payments—or lack thereof—influence your creditworthiness is crucial for long-term financial health. This guide delves into the intricacies of student loan reporting, highlighting the significance of consistent payments and offering strategies for maintaining a positive credit profile even with substantial student loan debt. From the moment you begin repayment, your student loan activity is meticulously tracked and reported to credit bureaus, shaping your credit history. This report details loan type, lender, outstanding balance, and crucially, your payment Read More …

Does Student Loans Affect Your Credit Score? A Comprehensive Guide

Navigating the complexities of student loan repayment can feel overwhelming, especially when considering its impact on your financial future. Understanding how student loans affect your credit score is crucial for long-term financial health. This guide delves into the intricate relationship between student loan debt and your creditworthiness, providing practical strategies to manage your debt effectively and maintain a strong credit profile. From the moment you begin repayment, your student loan activity is meticulously recorded, influencing your credit report and, consequently, your credit score. This guide explores the various facets of this relationship, examining the impact of different loan types, payment Read More …