Facing unexpected deductions from your bank account? You might be entangled in the Treasury Offset Program (TOP) for student loan debt. This program, designed to recover outstanding federal student loan balances, can significantly impact your finances. Understanding how TOP functions, your eligibility, and available protections is crucial to navigating this complex process effectively. This guide provides a detailed overview of the Treasury Offset Program as it pertains to student loans, exploring the process from eligibility criteria and offset amounts to legal protections and alternative debt resolution strategies. We’ll demystify the complexities of TOP, empowering you to understand your rights and Read More …

Tag: debt collection

Private Student Loans in Collections A Guide

Navigating the complexities of private student loan collections can feel overwhelming. This guide offers a comprehensive overview of the process, from initial delinquency to potential legal ramifications. We’ll explore the actions of collection agencies, discuss legal protections available to borrowers, and provide practical strategies for managing debt and protecting your credit. Understanding the intricacies of private student loan debt is crucial for borrowers facing financial hardship. This guide aims to demystify the process, providing clear explanations and actionable advice to help borrowers regain control of their financial situation and navigate the challenges effectively. We’ll cover everything from communication strategies with Read More …

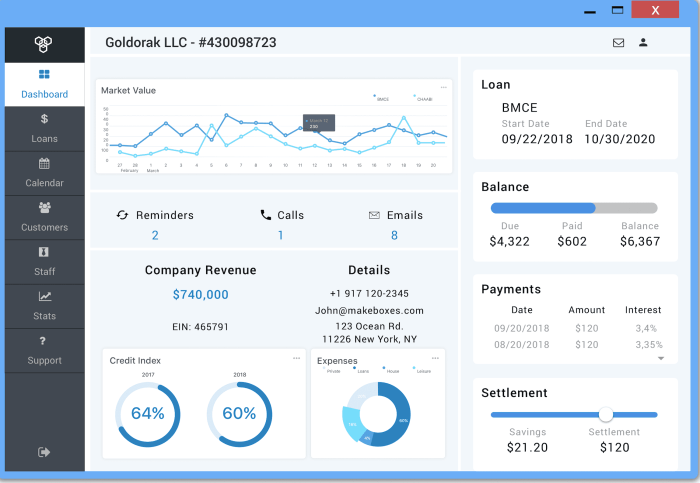

Debt Management and Collections System Student Loan

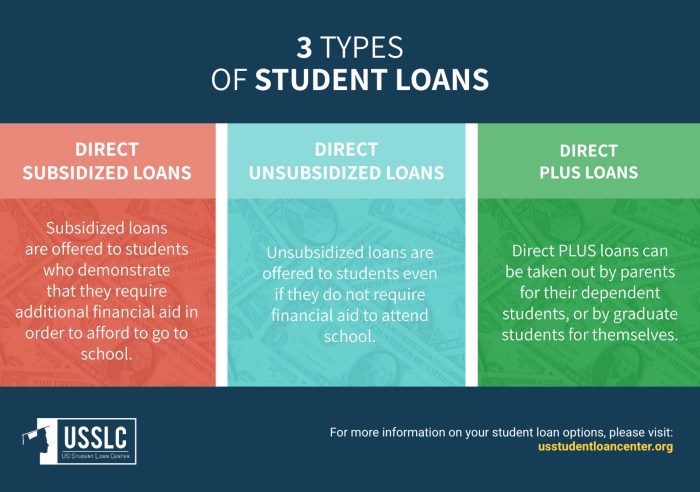

Navigating the complexities of student loan debt can feel overwhelming, especially given the diverse repayment options and potential involvement of collection agencies. This exploration delves into the intricacies of student loan debt management, offering insights into effective strategies for repayment, understanding your rights when dealing with collection agencies, and leveraging technology to streamline the process. We’ll examine various debt management systems, government programs, and the crucial role of financial literacy in achieving long-term financial well-being. From understanding the different types of federal and private loans to exploring income-driven repayment plans and loan consolidation, this guide provides a comprehensive overview of Read More …

What Happens If You Dont Pay Private Student Loans?

Navigating the complexities of student loan repayment can be daunting, especially with private loans. Understanding the potential consequences of non-payment is crucial for responsible financial management. This guide explores the immediate and long-term ramifications of neglecting your private student loan obligations, from impacting your credit score to facing legal action. We’ll also delve into strategies for addressing delinquent loans and mitigating potential damage to your financial future. Failing to repay private student loans can trigger a cascade of negative consequences, significantly affecting your creditworthiness and overall financial well-being. From hefty late fees and potential wage garnishment to the long-term challenges Read More …

Can Wages Be Garnished for Private Student Loans? A Comprehensive Guide

The weight of student loan debt is a significant concern for many Americans. While federal student loans have specific protections, the landscape surrounding private student loans and wage garnishment is considerably more complex. This guide navigates the intricacies of private student loan debt collection, exploring the legal pathways lenders can take to garnish wages and the options available to borrowers facing this challenging situation. Understanding the nuances of state laws, court proceedings, and available alternatives is crucial for borrowers to protect their financial well-being. This exploration delves into the key differences between federal and private loan garnishment processes, highlighting the Read More …

Private Student Loan Collection Agencies

Navigating the complexities of private student loan debt can be daunting, especially when dealing with collection agencies. Understanding the legal framework governing these agencies, their collection tactics, and your consumer rights is crucial to avoiding financial hardship. This guide provides a comprehensive overview of private student loan collection agencies, empowering borrowers to navigate this challenging landscape effectively. From understanding the differences between private and federal loan collections to negotiating repayment plans and knowing your rights under the Fair Debt Collection Practices Act (FDCPA), this resource equips you with the knowledge and tools to manage your debt responsibly. We’ll explore the Read More …

What Happens When You Dont Pay Your Student Loans: A Comprehensive Guide

Student loan debt is a significant financial commitment for millions. Understanding the repercussions of defaulting on these loans is crucial for responsible financial planning. This guide explores the immediate and long-term consequences of non-payment, from the impact on your credit score to potential legal actions. We’ll also examine available solutions and repayment options to help you navigate financial hardship and avoid the pitfalls of default. Failing to meet your student loan obligations can trigger a cascade of negative events, affecting your creditworthiness, financial stability, and future opportunities. This detailed overview will equip you with the knowledge to make informed decisions Read More …

Do Student Loans Go to Collections?

Navigating the complexities of student loan repayment can feel overwhelming, especially when facing financial hardship. Understanding the process of loan delinquency and potential collection actions is crucial for borrowers to protect their credit and financial future. This exploration delves into the journey a student loan takes from missed payments to potential collection, examining the roles of loan servicers, credit bureaus, and debt collection agencies. We’ll uncover the factors influencing whether a loan ends up in collections, including loan type, income, and the borrower’s legal protections. We will also highlight available resources and programs designed to help borrowers avoid or resolve Read More …

Can Student Loans Be Garnished From Your Paycheck? A Comprehensive Guide

The looming threat of wage garnishment for student loan debt is a significant concern for many borrowers. Understanding the nuances of this process, particularly the differences between federal and private loans, is crucial for navigating financial stability. This guide delves into the complexities of student loan garnishment, offering clarity on procedures, exemptions, and strategies for mitigation. From the mechanics of federal garnishment and the legal considerations surrounding private loans to exploring available exemptions and negotiating with loan servicers, we aim to provide a comprehensive resource for borrowers facing this challenging situation. We’ll examine the potential long-term consequences of wage garnishment Read More …

Can Private Student Loans Garnish Wages? A Comprehensive Guide

The weight of student loan debt can feel overwhelming, especially when facing potential wage garnishment. Understanding the nuances of private student loan collection is crucial for borrowers navigating this complex financial landscape. This guide delves into the legal framework surrounding wage garnishment for private student loans, exploring the differences between federal and private loan collection practices, and offering strategies for protecting yourself from this potentially devastating outcome. We’ll examine the legal basis for wage garnishment, the factors lenders consider before taking action, and the potential consequences of such actions. Ultimately, our goal is to empower you with the knowledge necessary Read More …