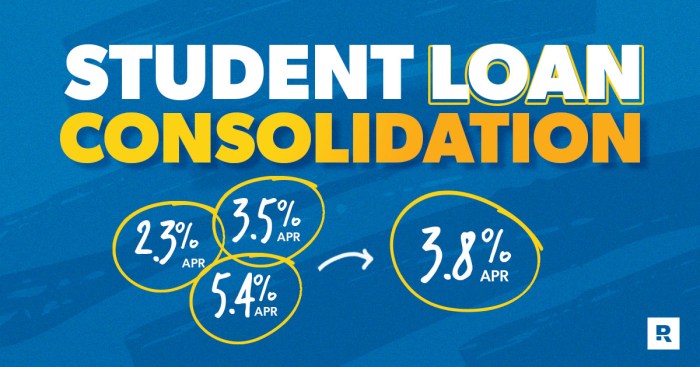

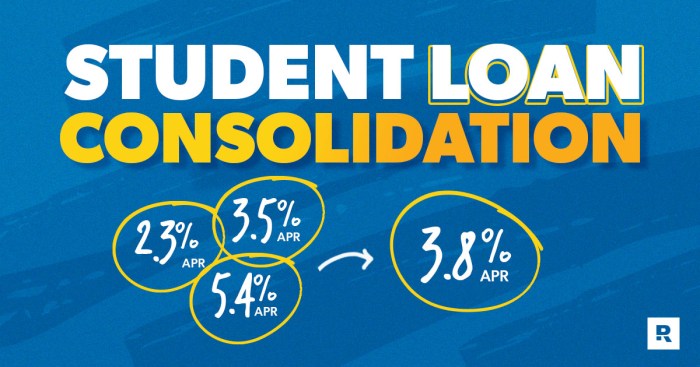

Navigating the complex world of student loan debt can feel overwhelming, especially when juggling both private and federal loans. The prospect of simplifying this financial burden through consolidation is attractive, promising reduced monthly payments and easier management. However, this path isn’t without potential pitfalls. Understanding the intricacies of consolidation, including eligibility requirements, the application process, and potential long-term financial implications, is crucial for making an informed decision. This guide delves into the benefits and drawbacks of consolidating private and federal student loans, providing a comprehensive overview of the process and offering insights to help you determine if consolidation aligns with Read More …