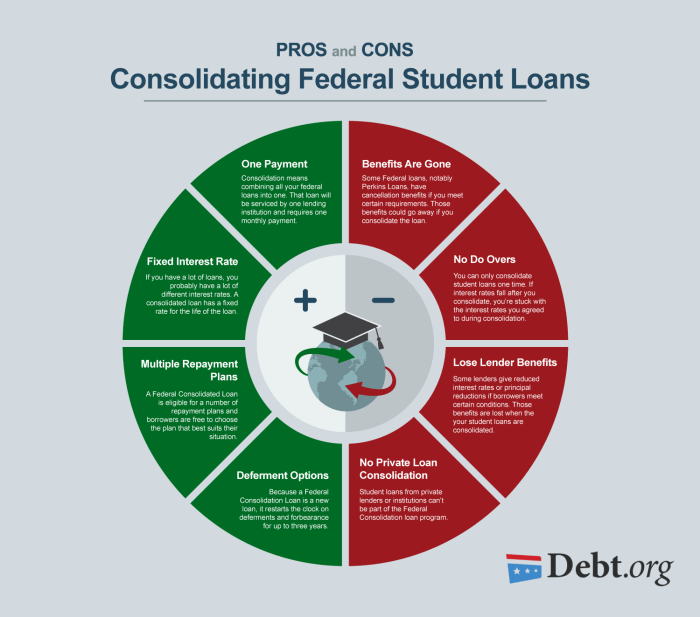

Navigating the complexities of student loan debt can feel overwhelming, especially when dealing with multiple private loans. The question of whether or not these loans can be consolidated is a crucial one for many borrowers seeking to simplify their repayment journey. This exploration delves into the intricacies of private student loan consolidation, examining its potential benefits and drawbacks, and guiding you through the process. Understanding the eligibility requirements, the various lenders and their offered programs, and the potential impact on your credit score are all essential steps in making an informed decision. This guide aims to provide clarity and empower Read More …