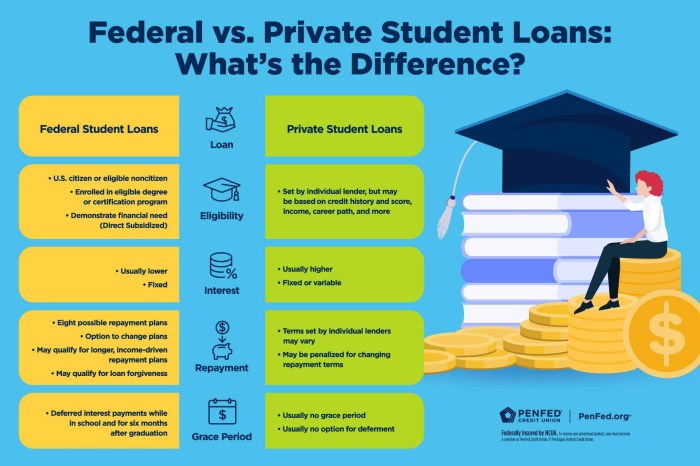

Navigating the complexities of student loan debt can feel overwhelming, especially when dealing with private loans. Many borrowers wonder if it’s possible to refinance their private student loans into federal loans, potentially accessing lower interest rates and more flexible repayment options. This comprehensive guide explores the intricacies of this process, examining eligibility requirements, potential benefits and drawbacks, and alternative strategies for managing private student loan debt. We’ll delve into the specifics of federal refinancing programs, including eligibility criteria such as income levels and credit scores. We’ll also compare different private loan types and their suitability for refinancing, detailing the step-by-step Read More …