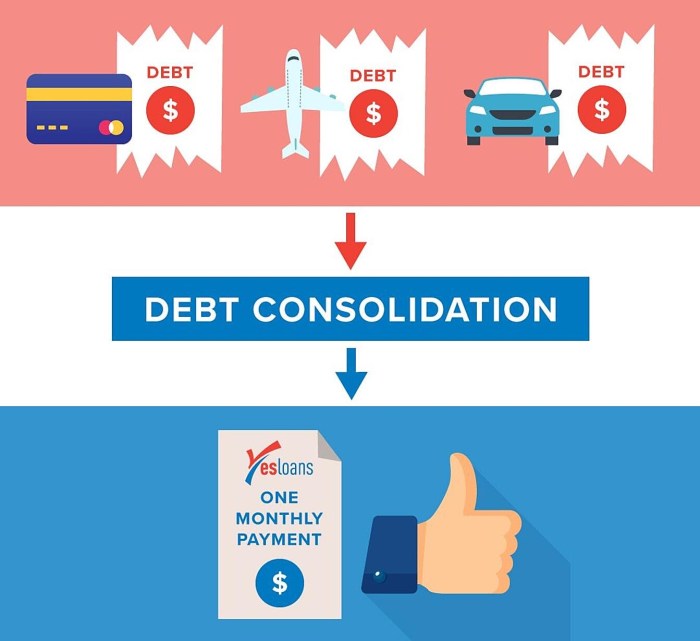

Navigating the complexities of student loan debt can feel overwhelming, but understanding student loan consolidation rates is a crucial step towards financial freedom. Consolidation offers the potential to simplify repayment by combining multiple loans into a single, manageable payment. However, the process involves careful consideration of interest rates, repayment terms, and the long-term financial implications. This guide will equip you with the knowledge to make informed decisions about consolidating your student loans and achieving a more sustainable repayment plan. We’ll explore the various factors that influence consolidation rates, including your credit score, the types of loans you’re consolidating, and the Read More …