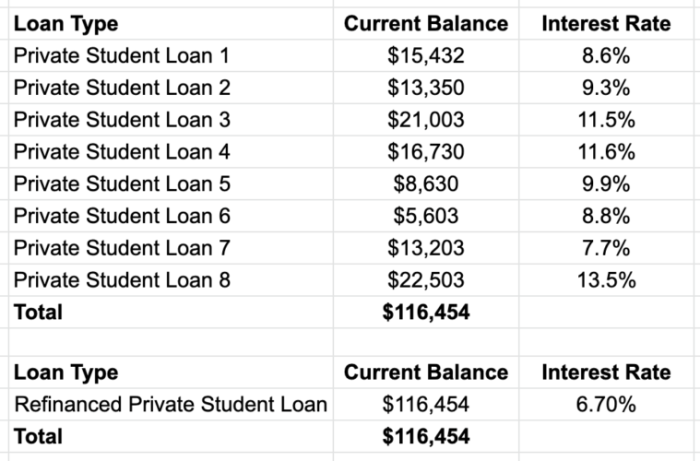

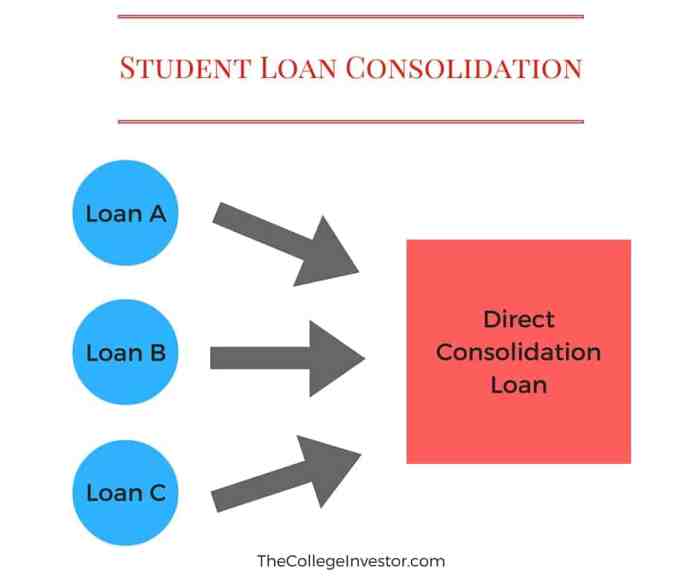

Navigating the complexities of student loan debt can feel overwhelming, and refinancing often emerges as a potential solution. This process involves replacing your existing student loans with a new loan, potentially offering a lower interest rate, a more manageable monthly payment, or a shorter repayment term. However, the decision to refinance isn’t always straightforward. It requires careful consideration of your current financial situation, long-term goals, and a thorough understanding of the various refinancing options available. This comprehensive guide will delve into the key factors to consider before making such a significant financial decision. We’ll explore current interest rate trends, analyze Read More …