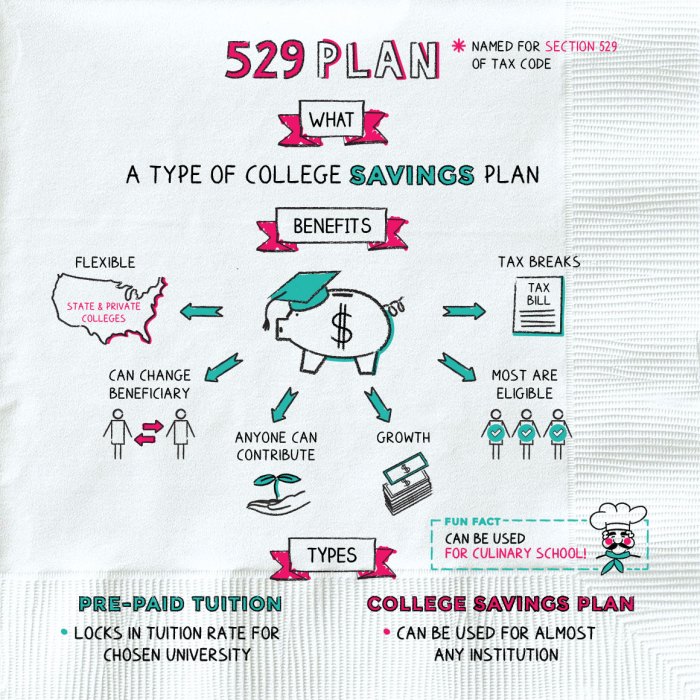

Navigating the complexities of student loan debt often feels like an uphill battle. While traditional repayment strategies exist, exploring alternative options can significantly impact your financial future. This exploration delves into the potential of utilizing 529 plans, typically associated with college savings, as a tool to manage and potentially reduce student loan burdens. We’ll examine the tax implications, legal considerations, and financial planning strategies involved in this unconventional approach. This guide provides a comprehensive overview of using 529 plans for student loan repayment, covering the advantages and disadvantages, along with practical steps to determine its suitability for your individual circumstances. Read More …