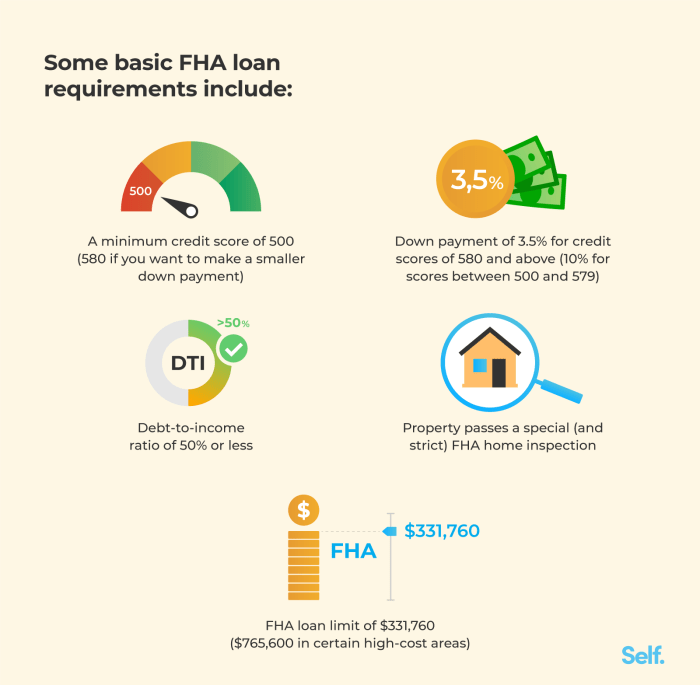

The dream of homeownership often clashes with the reality of student loan debt. Many aspiring homeowners wonder if their student loans will derail their plans. The truth is more nuanced than a simple yes or no. Successfully navigating the mortgage application process with existing student loan debt requires careful planning, strategic financial management, and a thorough understanding of your options. This guide explores the key factors influencing your ability to buy a home while managing student loan repayments. From understanding how lenders assess your creditworthiness and debt-to-income ratio (DTI) to exploring different mortgage types and strategies for improving your financial Read More …